Introducing Zeller for Startups.

Don’t waste time assembling disparate tools or waiting in line at a bank. Zeller for Startups is an all-in-one financial solution for founders, by founders.

Don’t waste time assembling disparate tools or waiting in line at a bank. Zeller for Startups is an all-in-one financial solution for founders, by founders.

Speak to our expert team about your in-store payments, and we’ll personalise a solution to your business and budget.

Enjoy a free, built-in POS system with the new Zeller Terminal 2. Order today with free express shipping nationally.

Starting a new business? Enjoy a free, built-in POS system with the new Zeller Terminal 2.

Strategies to help you navigate an economic downturn: Learn which strategies publicans are using to weather the financial storm — some tried-and-tested, some new and innovative.

Tools you can use to identify opportunities for growth: From tools that improve the customer experience to tools that help you crunch the numbers, learn how successful pubs are using technology to grow revenue.

Trends gaining momentum in the hospitality industry in 2022: Learn how both new and experienced publicans can discover and capitalise on emerging trends.

Publicans are a diverse bunch, and many of the skills it takes to own and run a successful pub are learned on the job. These business owners are thinkers, movers and shakers — unblocking a toilet and appeasing rowdy patrons one day, then creating a menu and analysing profit margins the next.

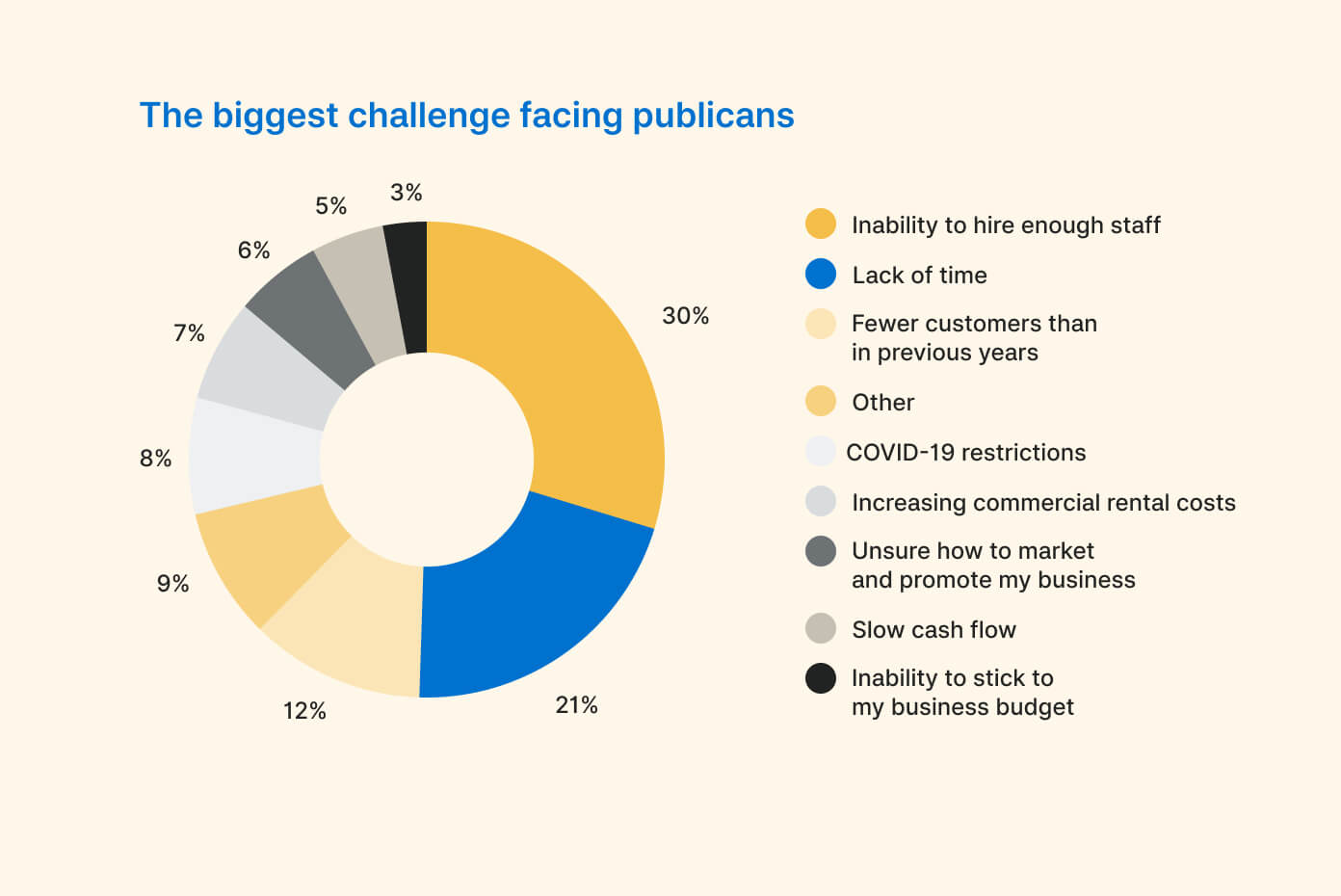

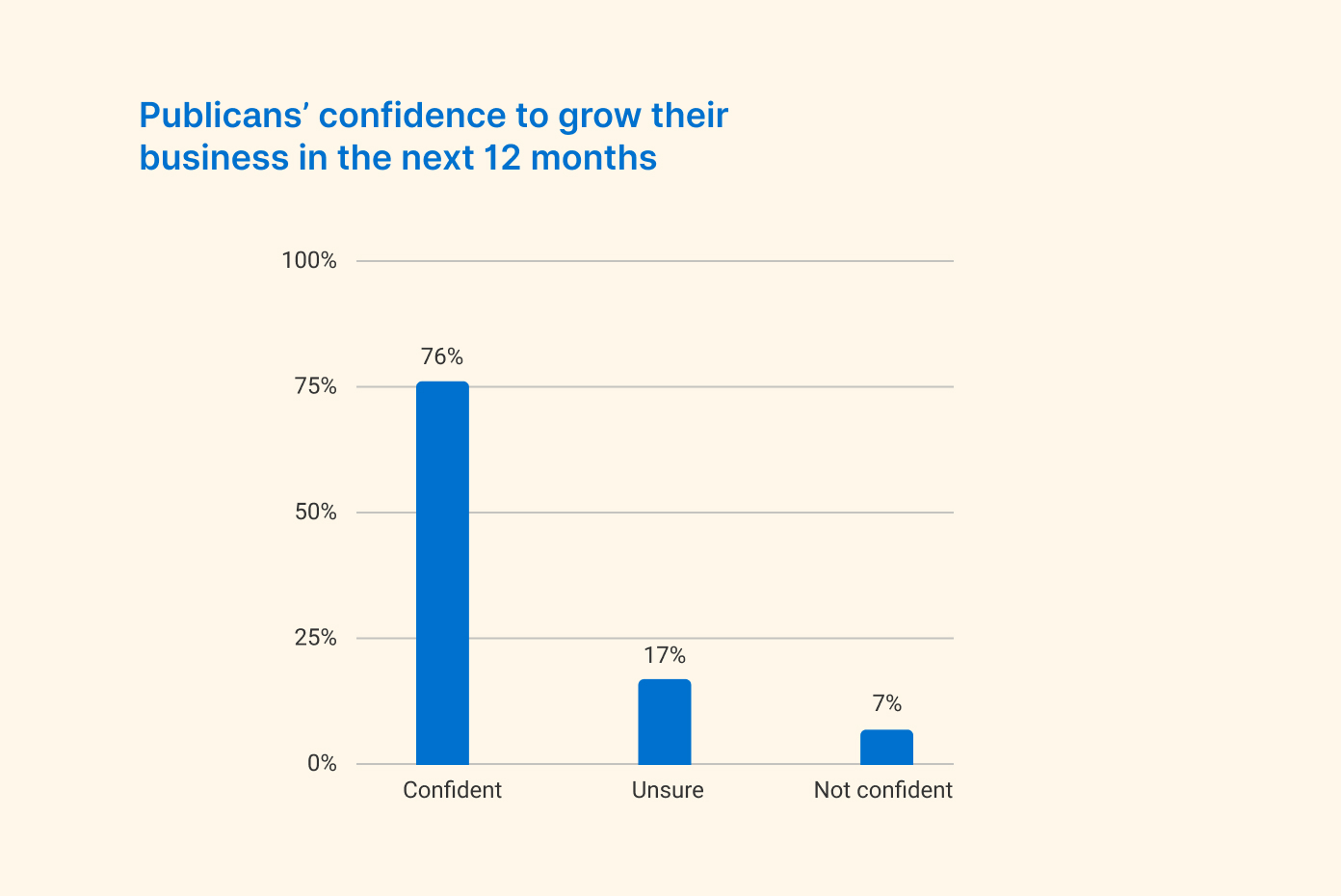

After a difficult two years of trade, merchants are now being hit with rising interest rates, fluctuating produce costs, lack of staff and new patron expectations — but it’s not all bad news. Zeller’s recent research shows that, despite these hurdles, Australian publicans feel up to the challenge. 76% of publicans are confident that they can grow their business over the next 12 months, despite a challenging economic environment.

To understand the reality of running a pub in 2022, we sat down with the brains behind three of Melbourne’s favourite pubs: Andrew Gilbert (co-owner of The Peacock Hotel), Bradley Olsson and Nicholas Schultze (managing partners of Ascot Vale Hotel), and Glenn Perriam (co-owner of Union Club Hotel).

“Hospitality has developed into something completely different over the last 40 years. You’ve got to adapt to change and jump on board.”

“I know everyone talks about prices going up, but if you make your prices and your offerings approachable, it promotes a return customer.”

“Pubs are a space where people feel really welcome and invited and comfortable. We want everybody that comes into the place to feel that.”

A community’s local watering hole is the go-to destination for a quick feed, a cold pint and a yarn. Yet the quintessential Aussie pub has faced numerous challenges in recent years — from staffing, to cash flow, to a lack of customers — and publicans have been forced to adapt.

Although the vast majority of publicans remain confident about their venues’ beloved place in the local community, the industry is going through a period of undeniable change.

It’s not yet known how the cost of living crunch will impact consumer spending, however Zeller data shows 77% of publicans are worried about rising interest rates and a recession. Forward-thinking merchants have already begun making changes to their operations to best position their businesses for growth, despite the potential downturn. “The head spend may change, but there’s no reason why you can’t still grow your business,” says Andrew Gilbert, co-owner of The Peacock Hotel.

Keep reading to learn how publicans across Australia are growing their business, and discover tactics that business owners — both old and new — can use to grow their revenue.

One way many publicans are growing their business, despite the downturn, is by adopting a tech-first mentality. When leveraged correctly, technology streamlines processes and surfaces powerful insights that can be used to effect positive change in every type of business.

Nicholas and Bradley, managing partners of the Ascot Vale Hotel, are 30 and 25 respectively. Together, they also oversee the management of Mona Castle Hotel — an impressive portfolio for two young publicans. As Nicholas explains, the new generation of publicans has a significant advantage.

“Being tech savvy definitely helps us to streamline processes a lot easier. We have a lot of trust in technology these days, and if something is going to make our job easier, then of course we’re going to look at it seriously,” he says.

“Zeller, for example, lets us serve 6, 7 or 8 people at once. The transactions just flow. You’re not worried about running the till out of change, or any of that stuff. Technology makes the whole process smoother, and if anything ever happens we can go straight to the back-of-house and fix it.”

It’s an approach the pair believe will set them in good stead to grow the business for years to come.

“Whether it be a new dish on the menu, a new wine on the board or anything else, being open minded helps grow the business, identify trends, and understand what people want faster. I definitely think having that mindset will help us grow our pubs quicker and easier.”

A tech-first approach enables you to know your numbers. Andrew Gilbert, co-owner of The Peacock Hotel, is keeping a close eye on which areas of the pub are bringing in the most revenue using Zeller Dashboard. He’s applying these insights to make strategic business decisions with broad impact.

“Without the tools, you don’t have any actual figures. Ten years ago, when we were working with cash, you didn’t know what the trends were. What time of the day the money’s coming in,” he explains.

Andrew Gilbert, co-owner of The Peacock Hotel

However, with 3 in 5 pub merchants using at least two pieces of software to run the payments side of their business, having an integrated system is key. Without a streamlined payments system, important data cannot be put to use.

Over time, many traditional locals’ pubs have evolved into family-friendly dining venues. For publicans, this presents an opportunity for business growth — something the team behind Ascot Vale Hotel know all about.

When the original site of the Ascot Vale Hotel, a public bar with a rich history, was up for sale, locals worried it might be bought by a developer. Instead, the new owners revitalised the interior back to its former glory and broadened its appeal.

“We wanted to hang onto all of the old fellows as much as we can, because they're the ones that tick the wheels over and make up what a pub is. We never wanted to come in and scrap the existing audience. You’ve got to find that happy medium. Now we have young families sitting next to people who have been coming here for 30 years,” says managing partner Bradley.

Ascot Vale Hotel, Victoria

To boost customer spending, the Ascot Vale team has dialled up its happy hour specials — giving locals more incentive to visit the pub, even on quiet days. “Having access to all of our financial information makes it a lot easier to make decisions, like moving happy hour from just one day to Monday through Friday,” says Bradley.

Some publicans have found similar success by introducing live music and trivia nights. For others, it’s offering an extended menu, with appropriately-sized kids’ portions. By using technology to sense-check these ideas, publicans remove a lot of the risk of implementing changes.

“For our business to work, we need to stick with our margins. You need to have a really clear understanding of what you're actually selling, and how much money you’re making from each product to create the revenue and the profit that you require for the business to work,” says Andrew.

It’s becoming increasingly expensive to run a business, and across the globe merchants of all types are tightening their belts.

While some business costs simply cannot be cut, there are opportunities to protect your profit margins. When it comes to ingredients — one of the biggest operating expenses, whether you offer à la carte fine dining or traditional pub fare — publicans have three options.

The latter is an option more experienced publicans have the confidence to take, as Glenn (co-owner of Union Club Hotel) explains. “We haven’t had to pass on huge increases, as I know some places have, because we’ve questioned pricing and explored where we can do a better deal for our customers.”

It is, he admits, a time-consuming task. “But, at the end of the day, if we don’t we will be passing the increase on in full.”

Glenn Perriam, co-owner of Union Club Hotel

While publicans are taking a mixed approach to getting ahead of rising costs, other strategies — such as surcharging — are being more uniformly implemented. An increasing number of Australian merchants are opting to pass the cost of transactions on to customers and keep more money in their business. Zeller data shows the number of purchases with a surcharge attached has tripled in the last 12 months

“With the jump from 60% of customers paying cash to almost 90% using cards now, it makes more sense to relay the surcharge onto the customer. The customer gets their credit card rewards, and we’re all happy,” says Andrew.

Zeller merchants have the option to toggle surcharging on or off and pass transaction costs on to the purchasing customer, in full or in part, whenever it suits them. As the data shows, a growing number of business owners across all industries are using this strategy to reduce operational costs by thousands of dollars every year.

When it comes to changing suppliers, publicans are also looking beyond the big banks for their financial services needs. Fewer than one in five publicans say they are tied to their bank. The vast majority of publicans recognise the opportunities technology affords their business, and the efficiencies that can be gained from partnering with forward-thinking providers.

One of the most frustrating realities of relying on incumbent banks is that settlement can take multiple business days, stifling cash flow and making publicans’ jobs that much more difficult. “You work with pretty tight margins in hospitality, and not having access to funds that you know are coming is really challenging. Getting faster access to those funds with Zeller means you can pay bills and buy produce,” explains Andrew.

By looking beyond the traditional incumbent banks, publicans can benefit from:

and much more. Backed by a financial services provider that truly understands their business, publicans have the opportunity to grow their revenue in new and impactful ways.

Union Club Hotel, Victoria

Marketing during a recession is always going to be difficult. This is especially true for new merchants, who are 3 times more likely to report marketing and promoting the business as their biggest concern. As we enter a challenging economic period, this uncertainty threatens to stifle new hospitality business growth.

Union Club Hotel has found an opportunity for business growth through locals’ revitalised appetite for socialising post-lockdown — optimising their group dining experience, and utilising their various spaces to create unique spaces for larger groups. After two years of capacity limits and contract tracing, patrons have a renewed passion for group get-togethers. As Glenn puts it, “You’ve got to listen to what people want.”

Ascot Vale Hotel, Victoria

Making it easier for bigger groups to book in, order and pay is all key to optimising the dining experience and attracting larger transactions for larger bills. However, with the swift shift from cash to digital payments, patrons expect a convenient payment experience — even when dining in large groups.

Gone are the days where each patron could pass a handful of notes to the leader of the group. These days, each patron expects to be able to tap, dip or swipe their chosen card or smart device. Making smarter decisions about EFTPOS technology by keeping in mind features like broad card acceptance and back-up connectivity, so you can swiftly process payments throughout the venue, can help to reduce load on staff while improving the customer experience.

Staffing is a perennial issue for hospitality merchants. “Staffing has always been hard, and COVID amplified the situation. It's the hardest part of the job,” says Andrew. “For us to improve the business or work on the business or do the things that we want to be doing, we need staff.”

While always on the lookout for an extra set of hands, The Peacock Hotel has come up with a way to optimise their current staff using insights from Zeller.

“I look at the trends in Zeller Dashboard and work out exactly when we need a certain amount of staff. You can see the busy periods, and know how many people you need for that shift. In quiet periods, you can keep your wage costs low so you can improve your profitability.”

The Ascot Vale Hotel managing staff are using the Dashboard to make decisions about their operating hours. Opening a pub on a public holiday can be particularly expensive, especially if all the locals decide to head out of town.

“We track how busy the pub gets on public holidays, and use that to decide if we’re going to open or close on the next. Zeller lets us keep track of how each day goes, when people are coming in, and different data points we’d never get using our previous bank terminals,” says Bradley.

ad on staff, while improving the customer experience.

Zeller was built to give Australian businesses an integrated, powerful and centralised alternative to outdated business banking. Since launching in May 2021, thousands of publicans, bars, restaurants, and venue owners have made the switch to Zeller and grown their business using functionality like in-built surcharging, contact management, real-time reporting and more.

To discover how Zeller can help your pub or hospitality business grow, contact our local Sales team today.