- Business Growth & Optimisation

10 Reasons Why You Should Switch to a Zeller Transaction Account

Gone are the days when managing your money was synonymous with paperwork, bank tellers, and hidden fees. Enter the new age of business finance with Zeller.

In the same way that video streaming platforms replaced movie rental shops, online-only financial service solutions are rapidly becoming the preferred alternative to traditional, outdated business banks. While the idea of perusing aisles of dusty DVDs may fill us with a warm nostalgia, no one is mourning the loss of queuing at the bank. Zeller is one such digital financial institution tailored to Australian businesses. From securely storing and saving your funds to paying employees, invoices and bills, Zeller’s free Transaction Account has everything you’ve come to expect from a traditional bank account, but with less fuss, and more features designed with the unique needs of business owners in mind. If you’re tired of inefficient processes, paperwork, and complex fee schedules, here’s ten reasons why you should make the switch to a Zeller Transaction Account today.

1. It takes less than 6 minutes to sign up.

If you’re 18 years or older, have an active Australian Business Number (ABN) or are a Sole Trader, you’ll be able to sign up in a matter of minutes. The process to sign up for a Zeller Account is simple, and done entirely online. All you’ll need is a current passport or Australian drivers’ licence. Once your identity has been verified, you’ll be able to create your own Zeller Transaction Account – with a BSB and account number – as well as your Zeller Dashboard, where you can access and manage all other Zeller services. For more complex business types such as a trust or company, our team may reach out to you to request some additional information.

2. It’s free.

Once your Transaction Account is up and running, there are no monthly fees, and no lock-in contracts. You will only ever pay a fee if you choose to start accepting payments via Zeller EFTPOS Terminal (1.4% per in-person payment, or 1.7% for over-the-phone payments) and/or Zeller Invoices (1.7% + $0.25 per transaction). What’s the catch? There isn’t one. Read more about our transparent pricing here.

3. Create unlimited debit cards and sub-accounts.

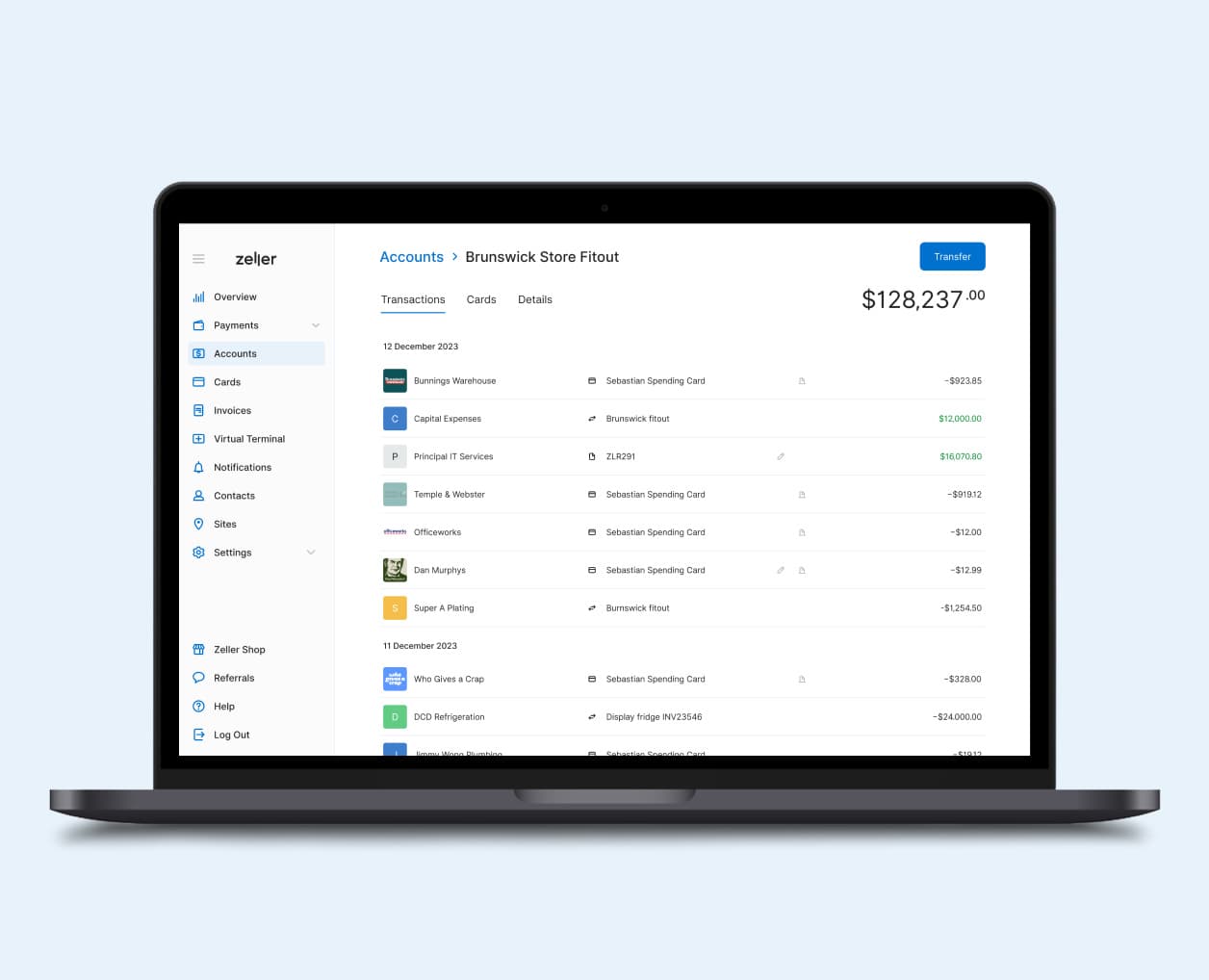

Zeller Transaction Account is designed to be configured to your unique business needs. You can create as many sub-accounts and Zeller Debit Cards as you like, at no additional cost. You may choose to open one sub-account for storing operating funds, one for tax savings, and one for profits for example. Or, if your team has to regularly pay for expenses, you might create sub-accounts for each member of staff, and then give them each a Zeller Debit Card.

Rather than dealing with petty cash or expense claims, Zeller Debit Cards – which can be physical or virtual – take the hassle out of team expenses, while also giving you complete control. Unlike with traditional banks, Zeller cardholders are not required to be signatories on the account, which means only you, as the business owner, will have admin access to your Zeller Transaction Account.

4. See your cash position at a glance with visual charts and quick-access insights.

From your Zeller Dashboard, you can access a real-time, single-page overview of your business financial position. A simple chart tracks your end-of-day balance over the last 90 days, allowing you to quickly identify spending patterns and make informed business decisions such as rostering, inventory orders or the best time to push marketing. On the same page, you will find a preview of your most recent transactions, as well as the cash position of all your sub-accounts and debit cards.

5. Pay bills with BPAY.

BPAY is an easy and secure way to manage and pay bills online. From your Zeller Transaction Account, you can assign contacts to bills paid with BPAY to track expenses over time, as well as reconcile bill payments with BPAY through Zeller and Xero Bank Feeds. Unlike many banks and other financial institutions, BPAY with Zeller is entirely free to use. Plus you benefit from the combined security of BPAY and Zeller to give you extra peace of mind.

6. Attach invoices, receipts and notes to transactions.

Get the full picture when it comes time to do your taxes, reconcile your expenses, or find proof of purchase, thanks to Zeller’s handy feature that lets you attach invoices, receipts or notes to your transactions. Rather than storing payment records or important information relating to transactions in a folder somewhere, store them right alongside the transactions themselves where they can be accessed from anywhere you have an internet connection. It will keep you organised, reduce paper (better for the environment!), and save you time in the long run.

7. Assign contacts and customers to each transaction.

Zeller Contact Directory lets you store business and personal details, and assign them to relevant transactions. Whether you’re transferring money, taking a payment, searching for a previous transaction or comparing how much you spend at various businesses, Zeller makes it easy to identify payers or payees. Simply select a contact to view your shared transaction history or direct a transfer.

8. Send invoices and receive online payments.

Every Transaction Account holder has access to Zeller’s all-in-one invoicing solution. From Zeller Dashboard, you can choose to create or import a library of items, build customised invoices and send them immediately or at a later scheduled date via email or SMS. Your customers can then pay you securely via an online link using their debit or credit card – no need for bank details means you get paid faster. You can then track and report the payment status of your invoices or send automated reminders to make sure nothing goes unpaid.

9. Streamline your accounting with Xero.

Whether you use Xero for invoicing, bookkeeping or both, Zeller’s integration with Xero keeps things simple. By connecting Zeller online payments to your Xero invoices, customers can pay in a click and you can receive your funds directly into your Zeller Transaction Account. Plus, you can sync your Zeller transaction and settlement data with Xero Bank Feeds making end-of-month reconciliation a breeze.

10. Access your business finances on the go with Zeller App.

Access your business finances from a tablet or smartphone with Zeller’s top-rated app. From tracking sales and expenses to creating new accounts, issuing cards, and configuring account settings, Zeller’s full suite of tools and features is available from the palm of your hand. We understand that business owners are time-poor, which is exactly why we’ve carefully designed this app to allow you to manage all your finances on the go, simply and securely.

Ready to try Zeller for yourself?

Sign up freeIf you’re an existing Zeller customer, simply log into your Zeller Account to create a new, free Transaction Account today. If you are not yet using Zeller, sign up for free here and start growing your business with Zeller’s suite of financial tools.