Try Zeller Corporate Cards free. Pay $0 for your first 60 days.

Terms applyCreate cards instantly

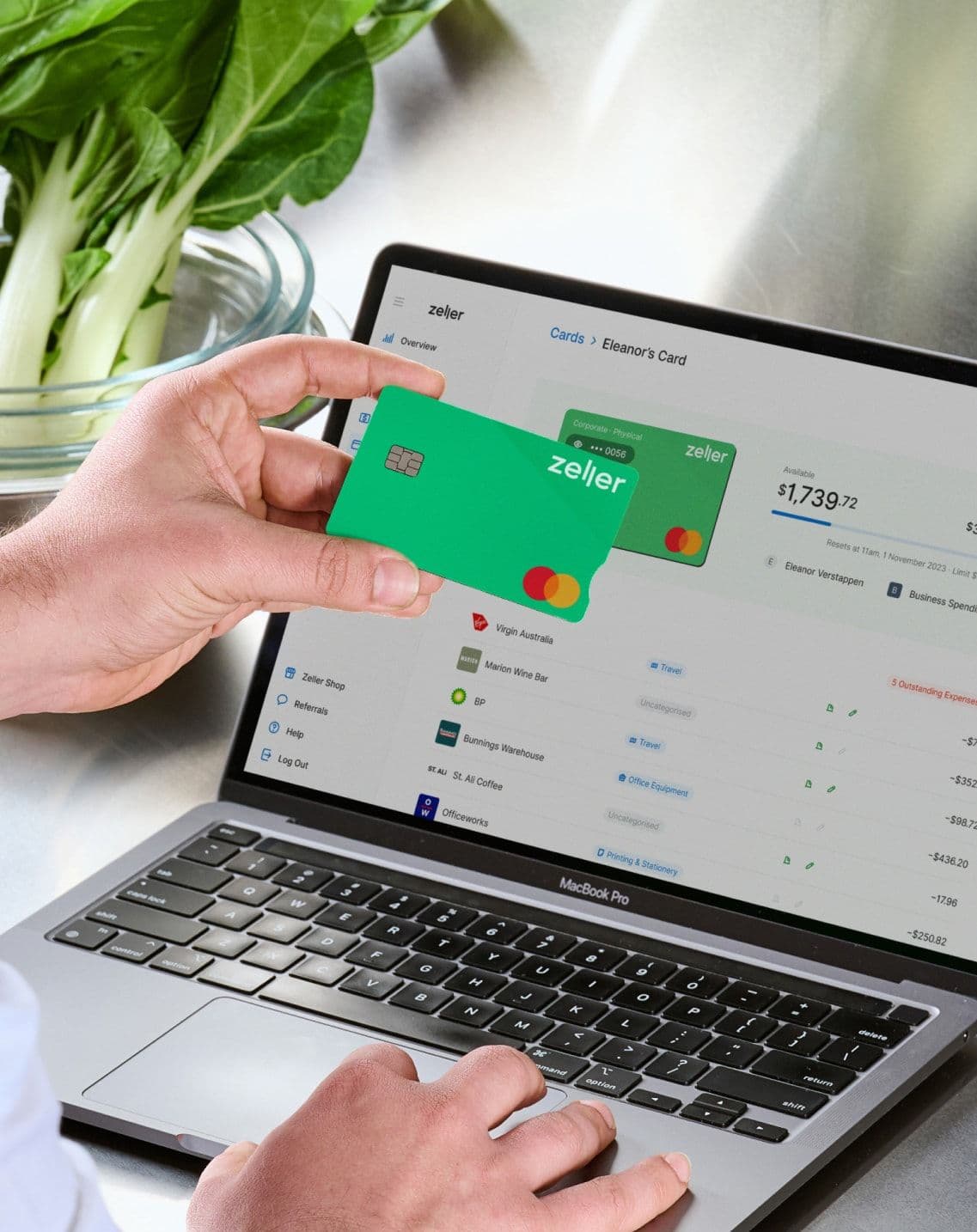

Issue virtual corporate cards instantly, or order physical cards.

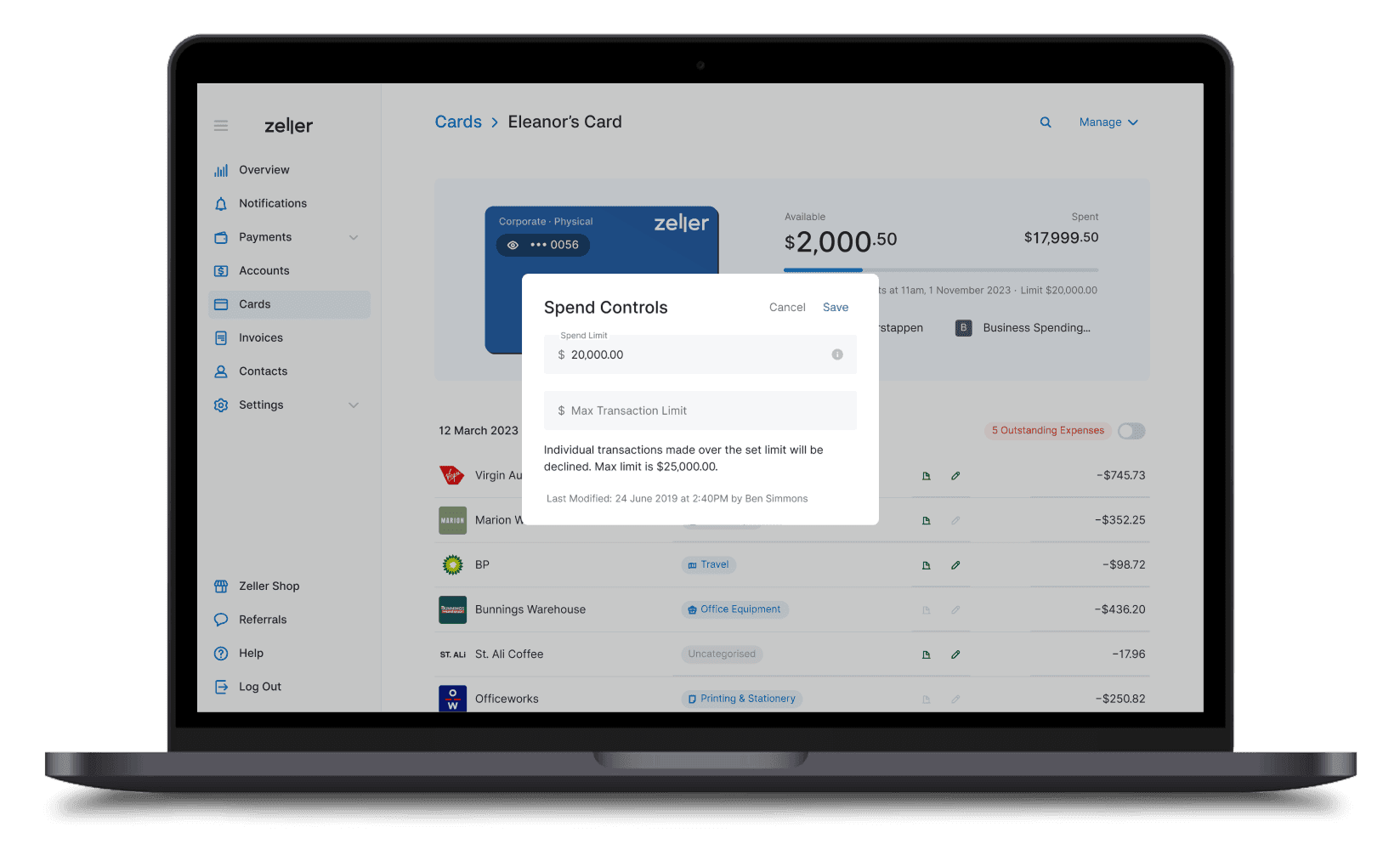

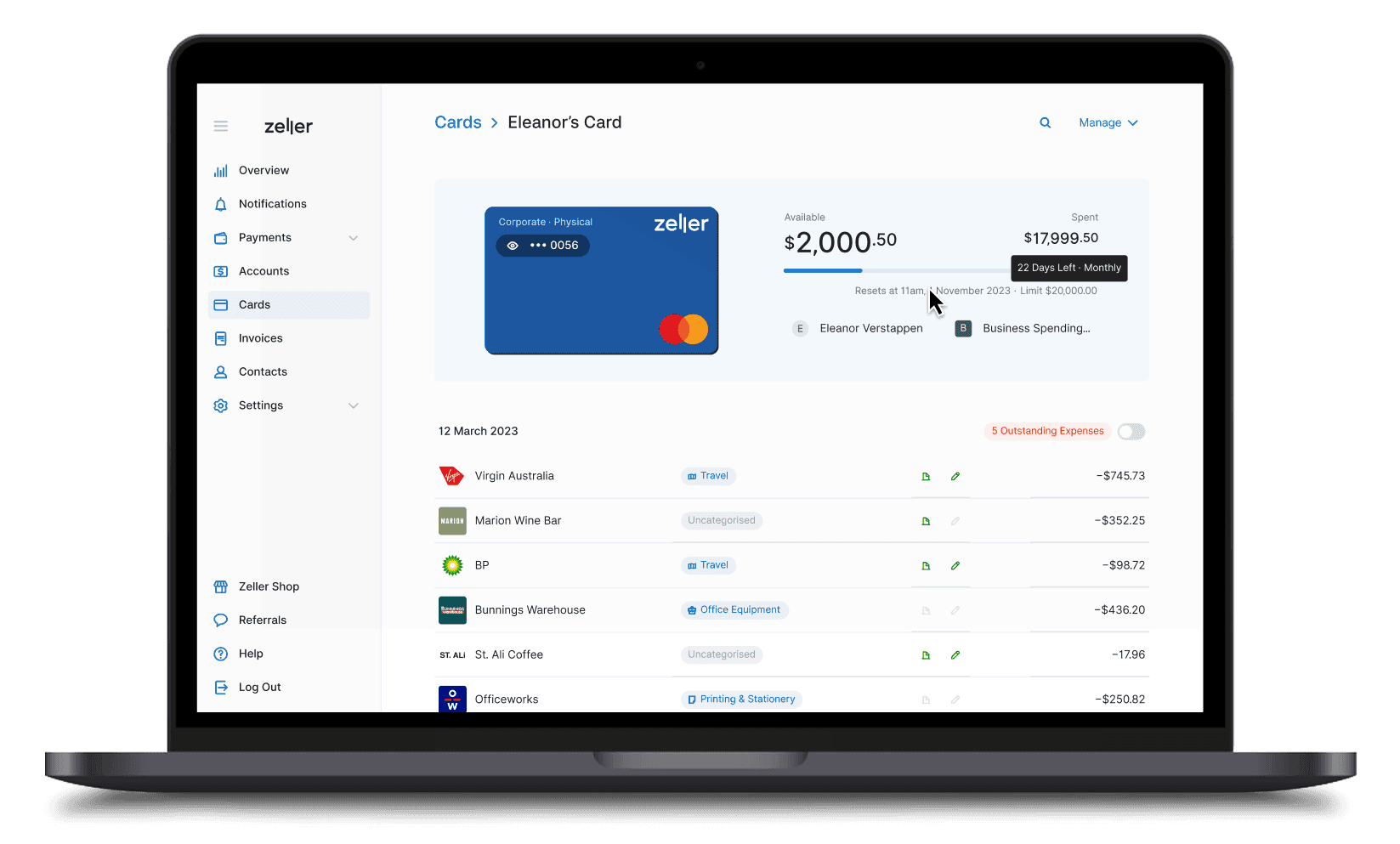

Set recurring budgets

Automate budgets to reset daily, weekly, fortnightly, monthly, or quarterly.

Easy expense reconciliation

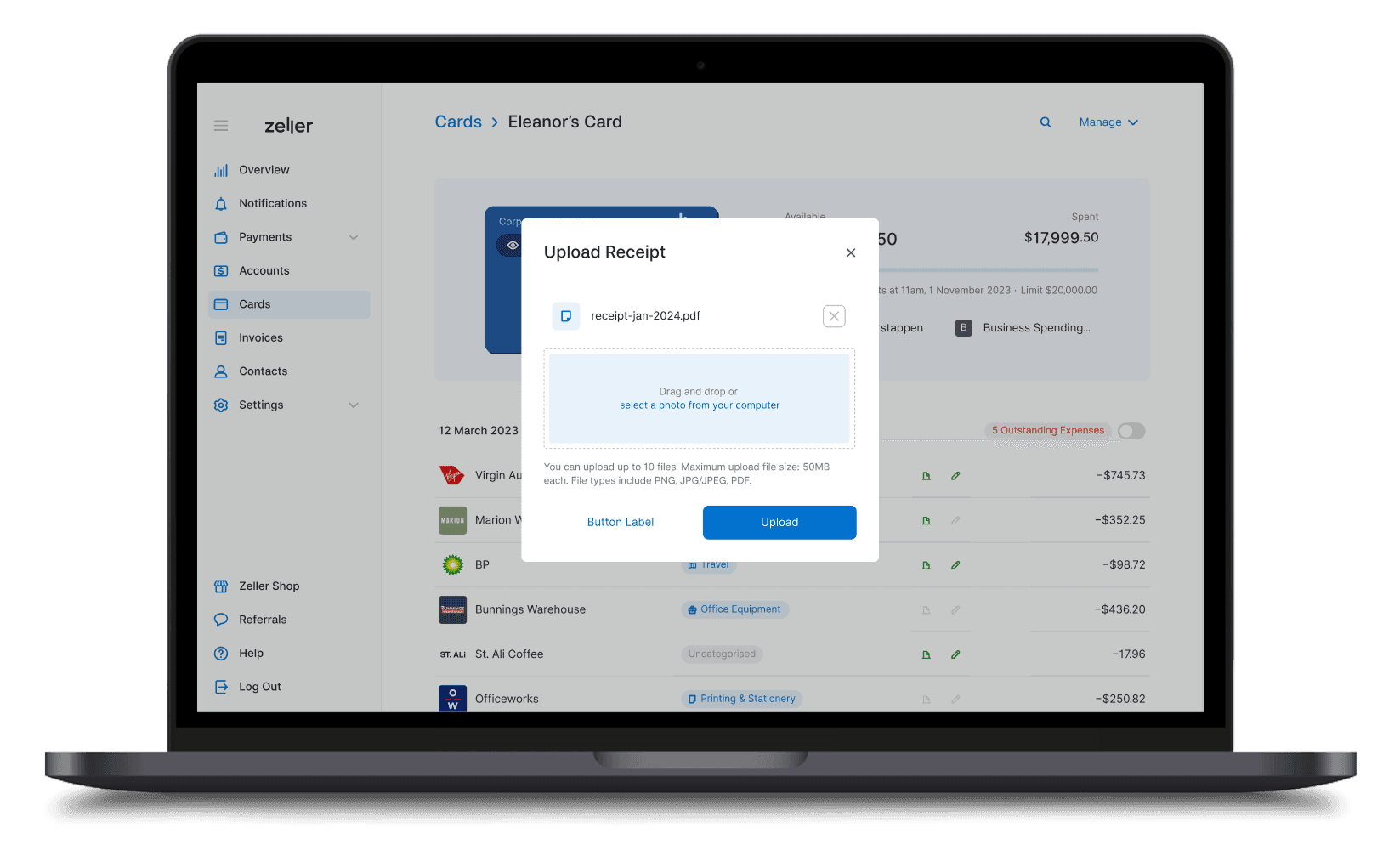

Employees can upload receipts, invoices, or attach notes to expenses.

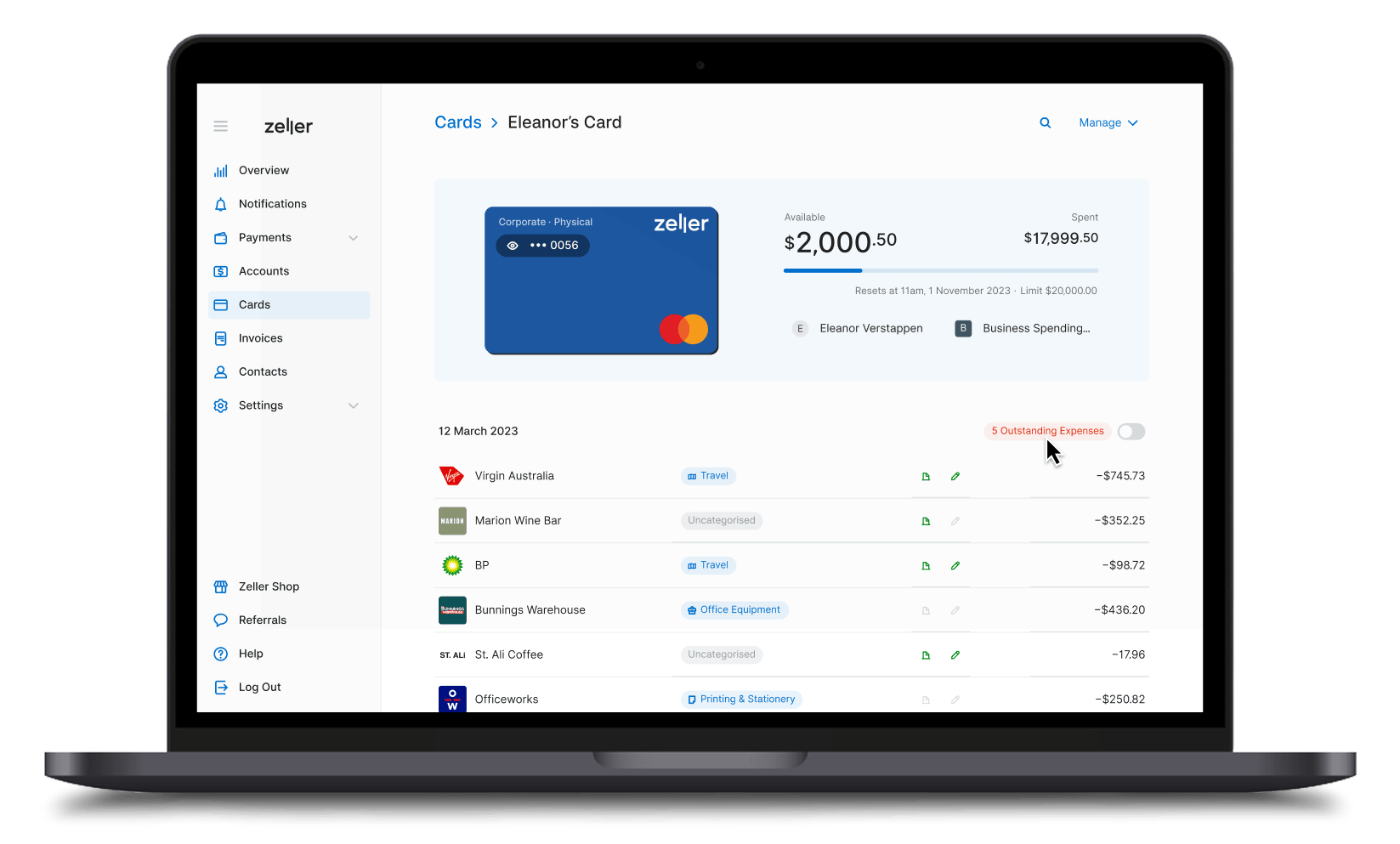

Complete finance view

With access to real-time spend data, you'll never encounter surprise expenses.

How to use Zeller Corporate Cards.

Your card. Your brand.

You’ve invested in your brand, so why shouldn’t your banking look just as good? Personalise Zeller Corporate Cards by adding your business logo, and naming cards by team or purpose.

Better expense management.

Zeller Corporate Cards give finance teams greater flexibility and control over business expenses.

Centralise expense tracking to eliminate manual reimbursements.

Sync expenses using the Xero Bank Feeds integration. More

Automate reminders for team members to upload receipt details (coming soon).

Manage projects and teams.

Assign corporate cards to individual employees, or to team members working on joint projects.

Issue corporate cards to individual employees with their own budget.

Assign corporate cards to teams to manage project expenses.

Automatically categorise project expenses to simplify finance reconciliation.

Virtual or physical corporate cards? You decide.

Choose to issue a virtual corporate card instantly, or order a physical card.

Employees can add virtual corporate cards to a mobile wallet.

Order a physical Zeller Corporate Card for in-person spending.

Zeller Corporate Cards are available in 4 colours.

Mobile expense management.

Create and manage corporate cards directly from your smartphone with Zeller App.

Issue cards to staff members and add card nicknames.

Set spend limits and budget controls with automated reset periods.

Attach receipts to transactions for faster reconciliation.

Plus, enjoy all the regular benefits of Zeller.

Try Zeller Corporate Cards free for 60 days.

Monthly Card Fee

$9

Try Zeller Corporate Cards free for 60 days from first card activation.

Transaction Fees

$0

Just a low FX margin on international purchases.

Software Fees

$0

No costly monthly expense management software fees.

Report Download Fees

$0

Access spend reports from Zeller App or Dashboard.

Get started in minutes.

Create a Zeller Account.

Signing up takes minutes for most businesses, and it’s free.

Add an opening balance

Transfer funds to your account to create an opening balance.

Issue a Zeller Corporate Card.

Create a virtual or physical corporate card for an employee.