- Payments & Point of Sale Solutions

Add Custom Notes to Transactions via Zeller Terminal

Add custom notes directly to transactions using Zeller Terminal.

Notes help track specific orders, services, or customer requests easily.

Improve record-keeping accuracy for accounting and reconciliation processes.

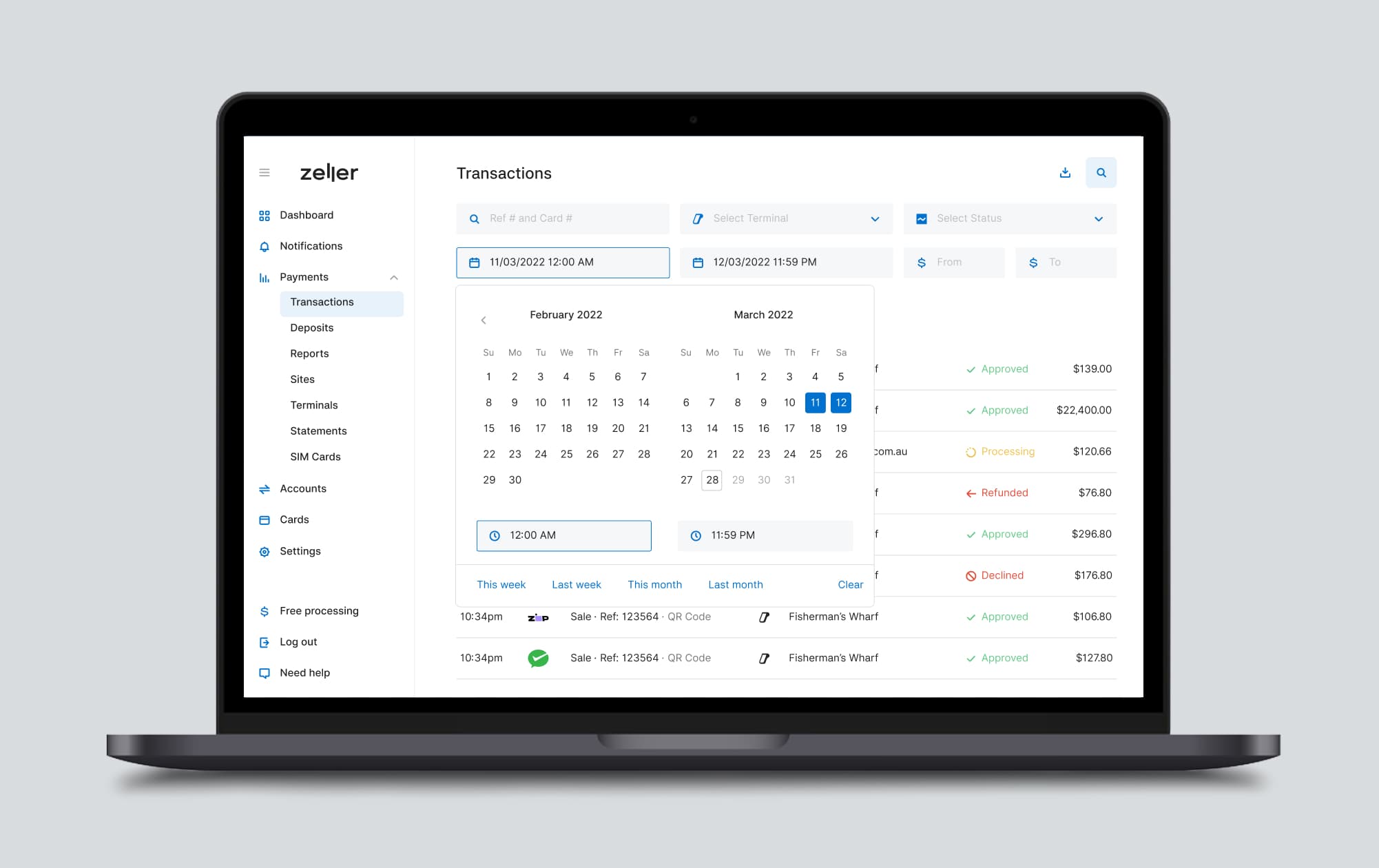

Access transaction notes later through Zeller Dashboard for reporting clarity.

Custom notes streamline communication between staff and simplify internal processes.

Add, edit and view critical information for every transaction with ease.

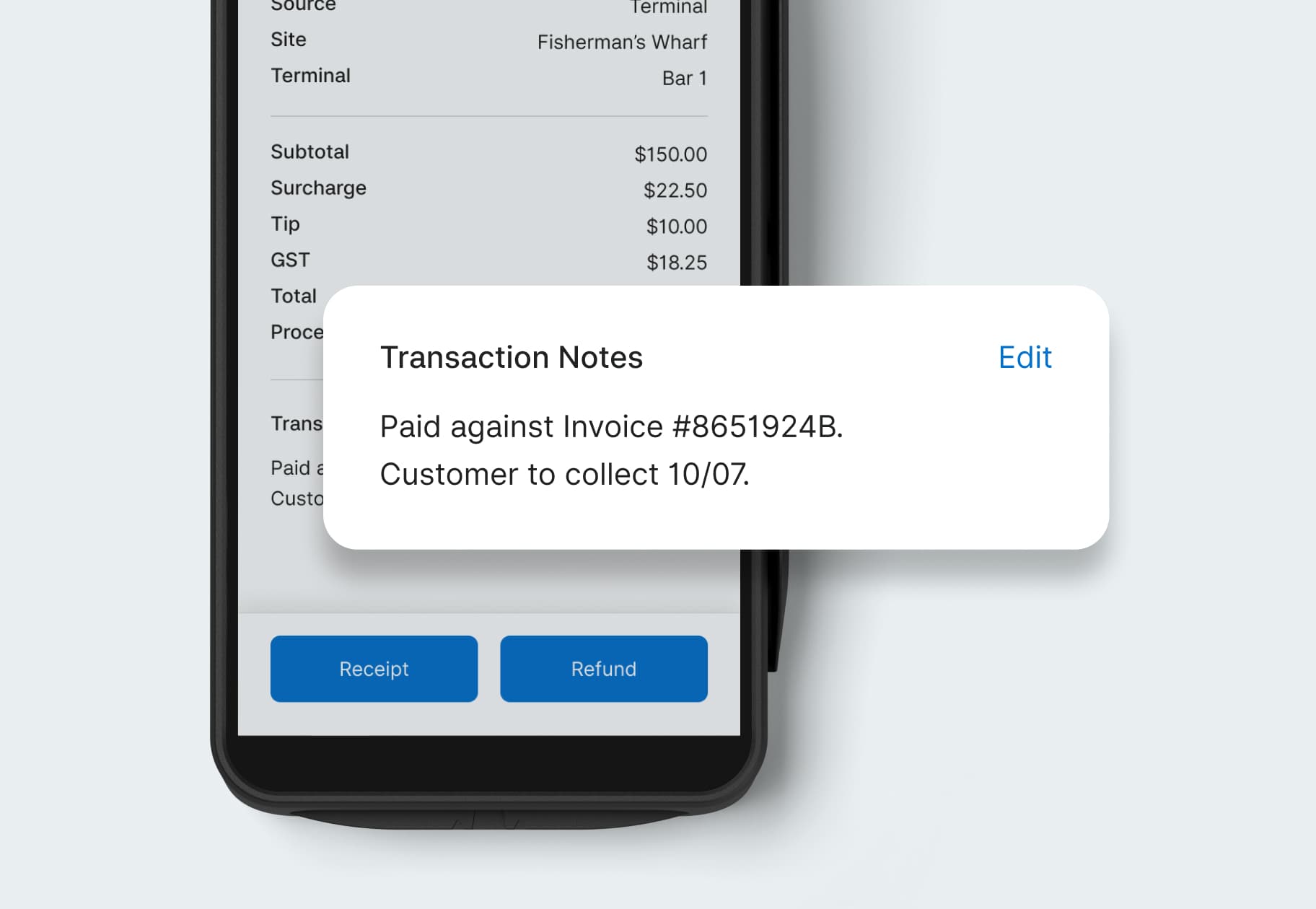

Notes are a powerful way to store and access additional information about transactions accepted via Zeller Terminal. Invoice or other important reference numbers, customer information, collection details and more — the information you choose to record is up to you. With Zeller’s note functionality, you’ve got 1,000 characters to play with.

Having the ability to add a note directly from Zeller Terminal means important information can be captured and stored in seconds. Incorporating transaction notes into your business processes will reduce double handling of information, leaving less room for human errors, and enable you to quickly access important information from both Zeller Terminal and Zeller Dashboard.

Using transaction notes in your business

A note can be quickly and easily added to a transaction at the point of sale, or after the transaction has taken place.

There are many ways to use this flexible functionality in your business. For most Zeller merchants, a transaction note will be the ideal place to record reference information such as invoice numbers.

Here are some more ideas to get you started thinking about all the ways transaction notes could be used in your business.

Store a customer's name and contact details, such as phone number

If the customer is coming back to the store to collect a purchase, add the collection date and any deposit details

For refunded transactions, keep track of the reason for the refund

Add general notes about the sale

However you choose to use notes in your business, having the ability to access pertinent transaction information in seconds will streamline everyday tasks and enable you and your staff to provide an elevated customer experience.

Adding a custom note at the point of sale

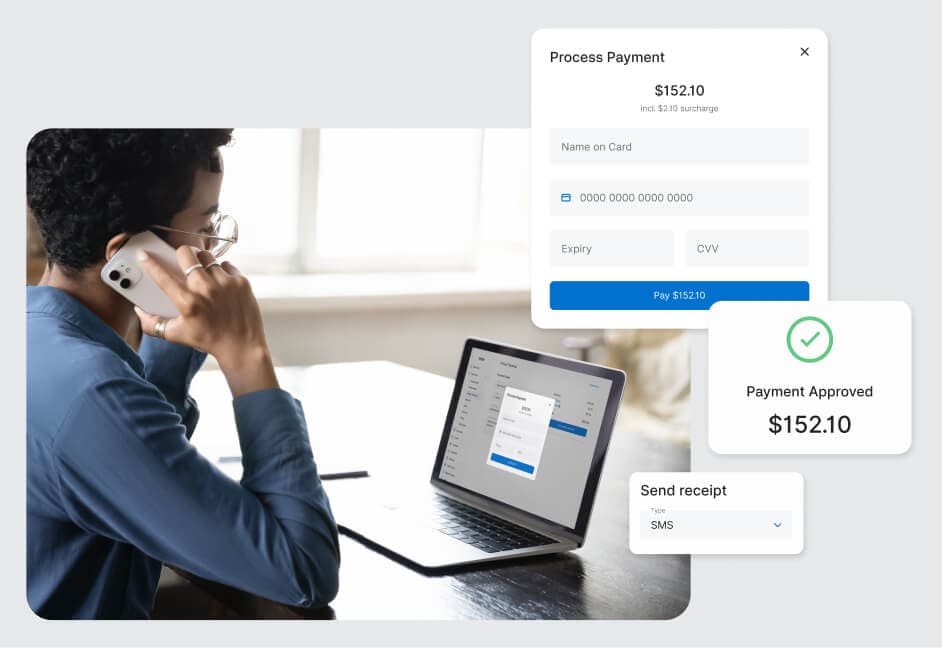

When a customer taps, dips or swipes their card or other device to Zeller Terminal, the transaction is instantly processed. The Approved screen appears, signalling to both the customer and staff that the transaction has been successfully processed.

From this screen, you can:

print a receipt

send a customer their digital receipt

process a new sale

and now, add a note to the transaction.

To add a note to the transaction, simply tap Notes and a custom field will appear. Type the note directly onto Zeller Terminal and tap Save. Zeller Terminal will store the transaction note against the relevant transaction and return you to the Approved screen.

In the event a transaction is declined or fails, follow the same process to add a note to the transaction.

Adding a note via the transaction list

Notes can also be added to transactions that have already occurred. Depending on the type and length of information you want to store against transactions, you may wish to type the note after a customer has left your store.

Simply navigate to the transaction list on Zeller Terminal, open the relevant transaction, and tap Add a note. The custom note field will appear. Type your note, tap Save, and your note will be stored against the transaction — readily accessible on Zeller Terminal and in Zeller Dashboard.

Zeller gives you a clear view of every transaction

When you take payment via Zeller Terminal, critical transaction information is just a few taps away. Each transaction record contains thorough details, including:

time and date the transaction was processed

status of the transaction

which Terminal and Site the transaction was processed through

sales totals, including surcharge, tip and GST

a transaction note.

The ability to see all of this information in one spot reduces the number of steps you need to take in reconciling your accounts, and enables you to put that information to use to improve business processes.

Switch to a smarter EFTPOS machine today

Join the thousands of Australian businesses using Zeller Terminal to accept payments. With one low, flat fee, no lock-in contracts, and smarter features, Zeller gives you back time and money.