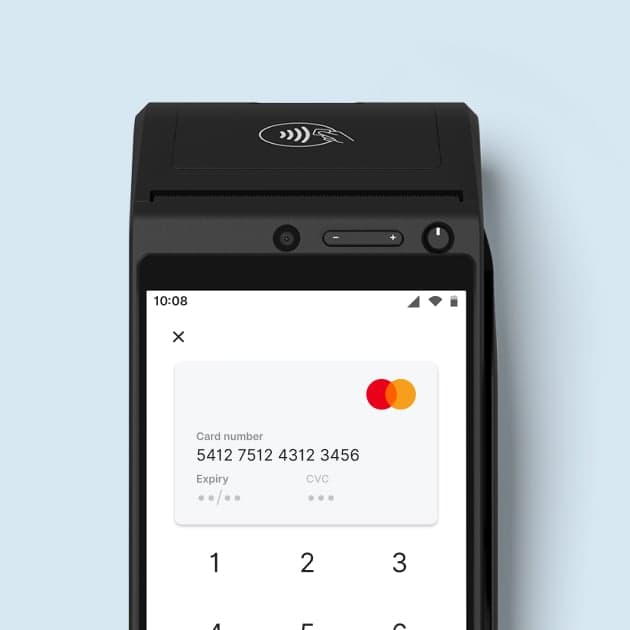

EFTPOS & POS Solutions

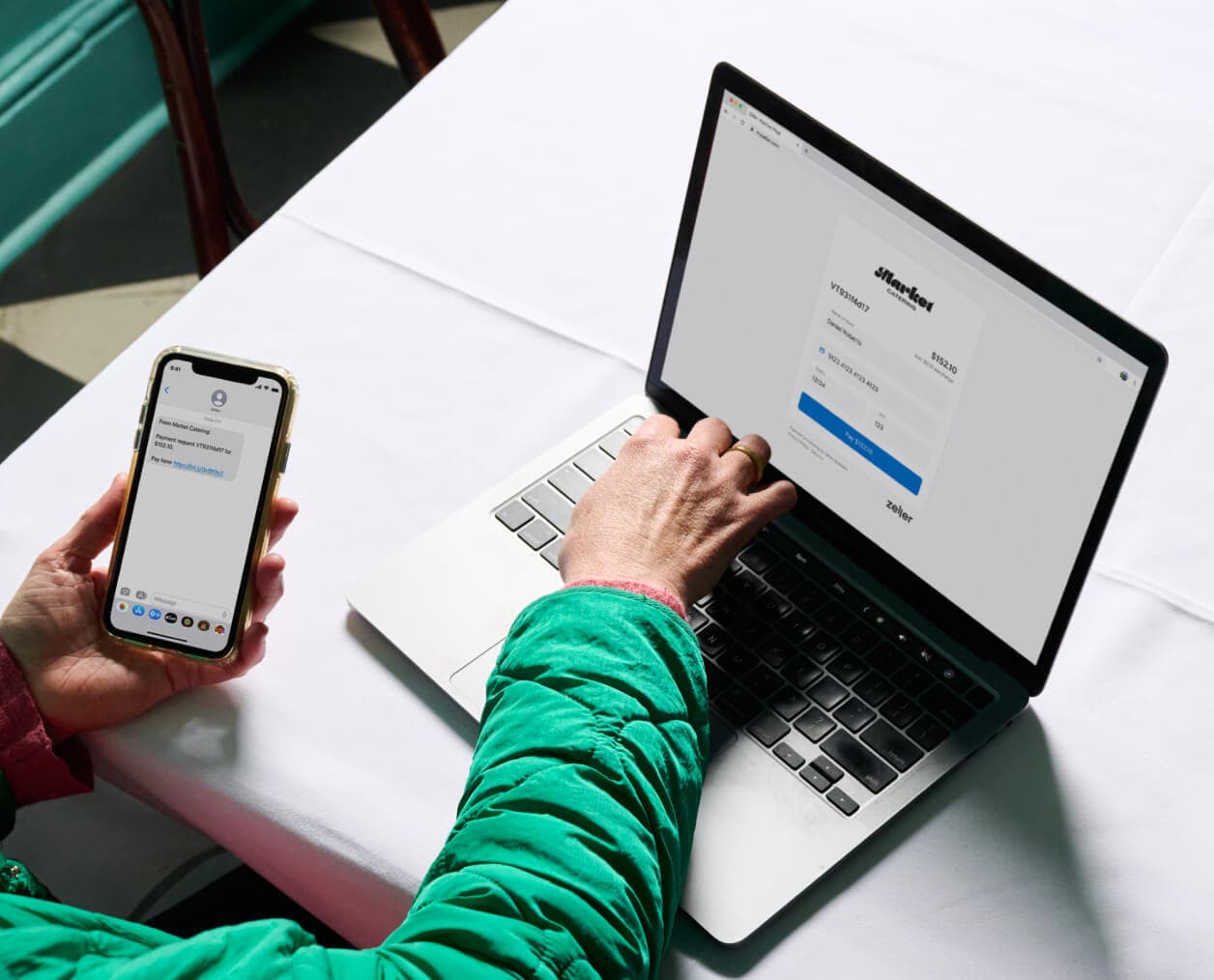

Let Zeller help you grow your business.

Curated news and content designed for small business owners, delivered to your inbox.

Let Zeller help you grow your business.

Curated news and content designed for small business owners, delivered to your inbox.