- Payments & Point of Sale Solutions

Understanding Merchant Fees in Australia

Merchant fees are charges businesses pay to process electronic card payments.

Fees consist of interchange, card scheme, and merchant services components.

Pricing models (flat-rate, interchange-plus, tiered) affect fee predictability and transparency.

Debit card transactions generally cost less to process than credit card payments.

Regularly review fees and choose a provider with transparent pricing to reduce merchant fee costs.

Skip ahead

What are merchant fees?What makes up a merchant fee?How are merchant fees calculated?Compare merchant fees in AustraliaDebit vs credit card fees: what's the difference?Should your business accept American Express?How to reduce your merchant feesMerchant fees are a necessary part of accepting card payments — but without a clear understanding of how they work, they can quietly eat into your margins.

This guide explains what merchant fees are, how they’re calculated, and the practical steps Australian businesses can take to reduce them, without compromising customer experience.

What are merchant fees?

Merchant fees are the charges a business pays to process card payments. Each time a customer taps, inserts, or pays online, several parties are involved in completing that transaction — and each takes a small fee for their role.

While these fees are usually charged as a percentage of the transaction value, the exact amount can vary depending on the card type, payment method, and pricing model used by your payment provider.

What makes up a merchant fee?

A typical merchant fee is made up of three main components:

Interchange fees: Paid to the customer’s card‑issuing bank. These fees vary based on factors such as card type (debit, credit, premium — read more about this below), transaction method (in‑person or online), and whether the card is domestic or international.

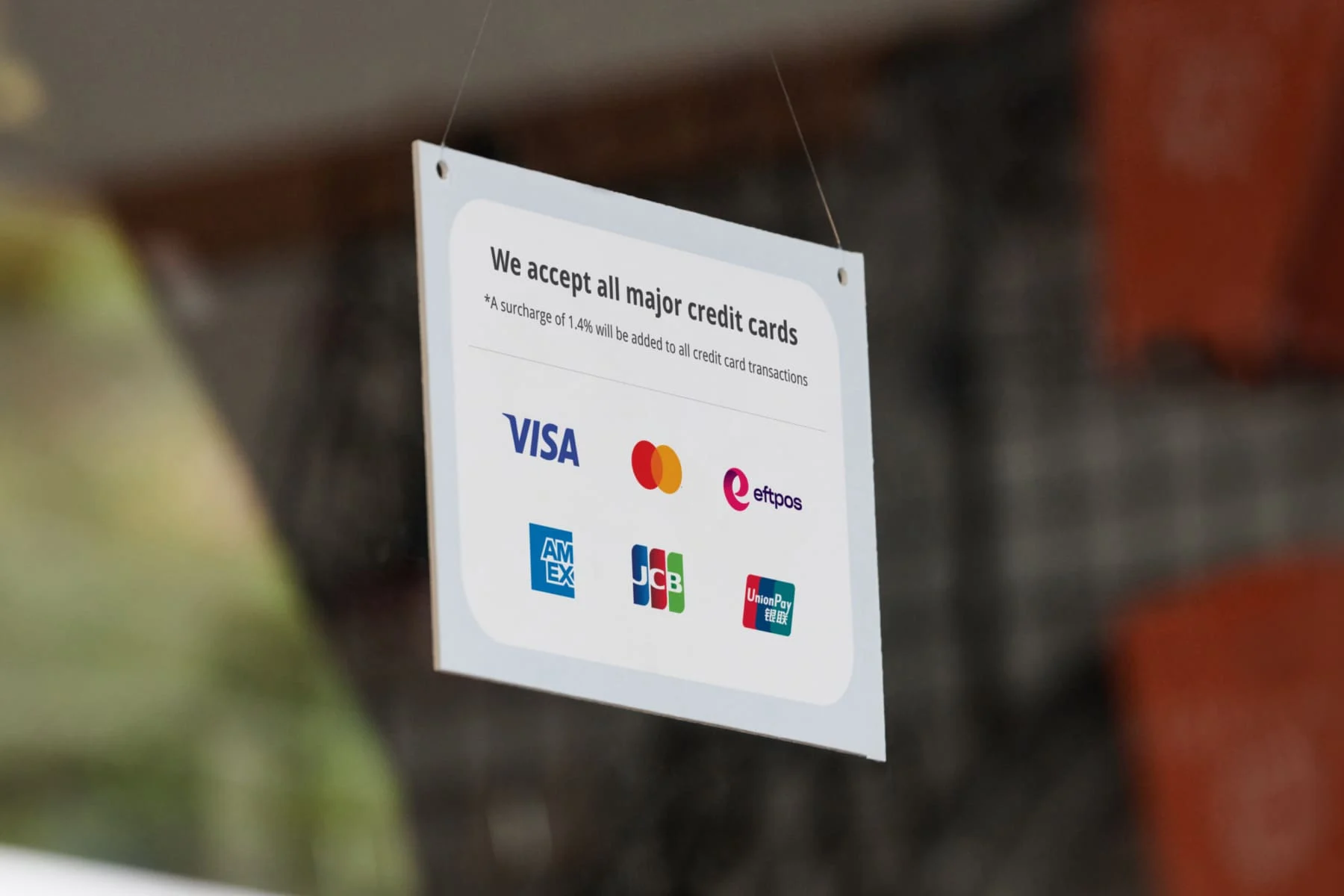

Card scheme fees: Charged by card networks such as Visa, Mastercard, and American Express. These cover the cost of maintaining payment infrastructure and network security.

Merchant services fees: Charged by your payment provider for processing the transaction and providing hardware, software, reporting, and support.

Understanding how these components fit together makes it easier to compare providers and spot hidden costs.

How are merchant fees calculated?

The way your fees are calculated depends on the pricing model used by your payment provider. Common models include:

Flat‑rate pricing

You pay a single, fixed percentage for each transaction, regardless of card type. This model offers predictability and simplicity, making it easier to forecast costs.

Interchange‑plus pricing

You pay the true interchange fee for each transaction, plus a fixed margin charged by your provider. With this model, fees can vary widely month to month, making it very hard to predict and budget accordingly.

Tiered pricing

Transactions are grouped into tiers (e.g. qualified, mid‑qualified, non‑qualified), each with different rates. This model is often less transparent and harder to predict.

Merchant fees can also vary based on whether a transaction is card‑present or online, and whether the card is domestic or international.

Compare merchant fees in Australia

Compare merchant fees for Square, Zeller, Sumup and Tyro.

Debit vs credit card fees: what’s the difference?

Debit cards generally attract lower interchange fees than credit cards, as funds are drawn directly from a customer’s bank account. Credit cards — particularly premium or rewards cards — tend to cost more to process due to higher interchange rates.

Understanding this difference can help businesses make informed decisions about surcharging, minimum spend policies, or payment acceptance strategies.

Should your business accept American Express?

American Express is often associated with higher‑spending customers, making it an attractive payment option for many businesses. While AMEX has traditionally carried higher fees, modern payment platforms, like Zeller, can simplify pricing and reduce complexity.

Accepting American Express can:

Increase average transaction values

Improve customer convenience and satisfaction

Help capture spend from domestic and international customers who prefer AMEX

With transparent, flat‑rate pricing, accepting American Express no longer needs to come with administrative overhead or unpredictable costs.

Do merchant fees have GST?

In Australia, merchant fees are generally subject to GST when they are charged as part of a payment provider’s processing or service fee. This means the merchant services component of your fees will usually include 10% GST, which GST-registered businesses can typically claim back as an input tax credit on their BAS. However, some elements of card payments — particularly those considered “financial supplies”, such as interchange fees paid to banks — may be treated differently and not attract GST. Because fees are often bundled, it’s a good idea to check your provider’s invoice or statement to understand how GST is applied in your specific case.

How to reduce your merchant fees

While some costs are unavoidable, there are several practical ways businesses can reduce the overall cost of accepting payments.

1. Understand what you’re being charged

Review your merchant statements regularly and make sure you understand how your fees are structured. If pricing isn’t clear, ask your provider for a full breakdown.

2. Choose transparent pricing

Simple, flat‑rate pricing can help avoid bill shock and make it easier to compare providers. Be wary of pricing models that obscure how fees are calculated.

3. Avoid long‑term contracts

Some providers lock businesses into lengthy contracts with high exit fees. Flexible, no‑lock‑in agreements make it easier to switch if your needs change.

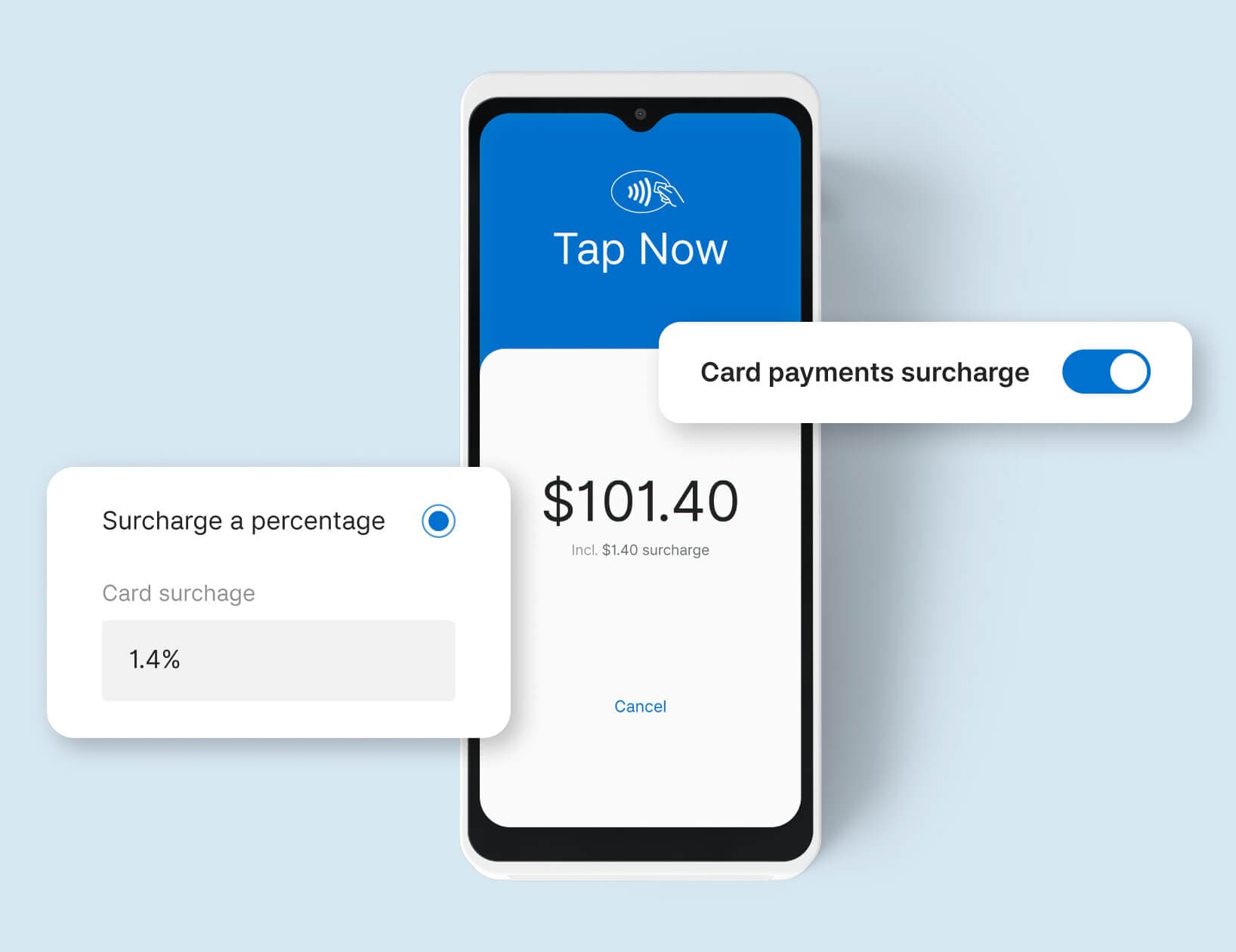

4. Consider surcharging or zero‑cost EFTPOS

Surcharging allows businesses to pass on part or all of the cost of card payments, where permitted by law. Zero‑cost EFTPOS options can help offset transaction fees without increasing base prices. Read our blog to find out whether surcharging is right for your business.

5. Reduce chargebacks and disputes

Clear refund policies, accurate transaction descriptors, and good customer service can help prevent disputes — saving time and money. Learn how to safeguard your business against chargebacks.

6. Choose the right payments partner

Look for a provider that offers transparent pricing, modern terminals, local support, and tools that help you manage payments efficiently.

Pay one low, flat fee of 1.4% with Zeller

• Simple, transparent pricing for all cards, including Amex

• No hidden contracts or lengthy paperwork

• Reliable, modern hardware

• 24/7 customer support via phone, email, and SMS

• Real-time reporting from desktop or mobile app