- Banking

Credit Where It’s Due: Credit and Debit Card Processing Fees Explained for Merchants.

Skip ahead

What are card processing fees?How are card fees calculated?Common pricing models for payment processing?How to minimise credit card processing fees?How Zeller comparesCard processing fees are costs paid by merchants on credit and debit card sales. In most instances, card processing fees cover things like interchange fees, scheme or network fees, chargebacks and other charges related to accepting credit and debit card payments quickly and securely.

Most people who don’t run their own business rarely think about credit card processing fees. When it comes time to pay for things, they just tap, insert, or swipe their card and assume the money will leave their bank account and go straight into the merchant's – but it’s definitely not that simple.

In reality, when a cardholder uses their debit or credit card to make a payment, a huge number of microtransactions and computations take place between varying financial institutions.

This complicated cascade of transactions includes processes for authorising, clearing, and settlement between the financial institution processing the card transaction on behalf of the merchant and the financial institution that provided the card to the cardholder, across card payment networks.

Below we’ll cover the basics of card processing fees to help you understand a bit more about what goes on behind the scenes.

What are credit and debit card processing fees?

Whenever a customer makes a card payment, a series of financial institutions work to instantly and securely process the transaction. This process incurs fees to the various parties, including:

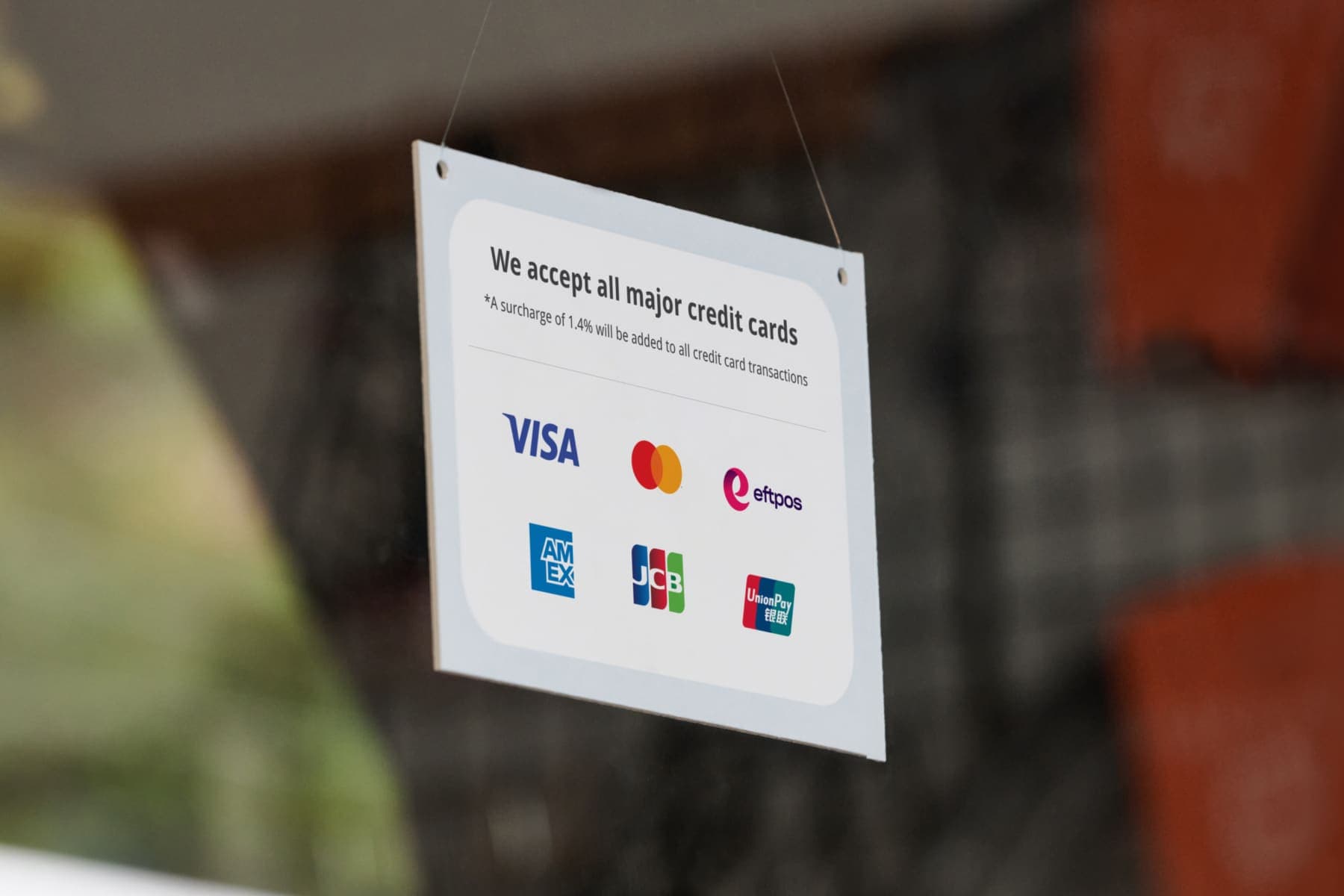

• Interchange fees: These are typically set by the operators of card payment networks or card schemes, such as EFTPOS, American Express, JCB, Visa or Mastercard. They can vary based on factors like the type of card, and whether it’s an online or in-person transaction. The variable nature of these fees makes for a lack of predictability, and merchants who opt for ‘cost plus’ pricing are subject to card processing fees that vary month by month based upon the types of cards that come across the counter. At Zeller, interchange fees are included in the low, flat rates we offer as part of our service.

• Scheme or network fees: Also charged by the card networks, scheme fees are added on top of interchange fees and cover the cost of maintaining card payment infrastructure operations. At Zeller, we also include scheme fees in our flat-rate transaction fees.

• Chargeback fees: In rare events where a customer disputes a transaction on their card, chargeback fees are sometimes imposed on merchants to cover the costs associated with managing the chargeback process. Zeller does not impose any additional fees to manage the chargeback process, regardless of the outcome for merchants.

• Additional or hidden fees: Some payment providers charge a flat fee per transaction in addition to percentage-based fees, as well as monthly fees, contract termination fees, terminal rental fees, and account setup fees. Zeller does not charge any of these additional fees. Instead, we make it simple for merchants to sign up for and access our services at any time, without the need to be handcuffed into long-term contracts or worry about punitive exit fees.

• Merchant services fees: A fee charged by the payment provider for processing each card transaction in the form of a fixed amount, percentage-based fee, or a combination of both. In Zeller’s case, that fee is a flat 1.4% for card-present transactions across all supported card networks, including American Express, and it covers all the costs mentioned above. This means we take care of everything from interchange fees to chargeback resolution for our merchants, and it’s all covered by our industry-leading fees.

How are card fees calculated?

Card processing fees are typically calculated as a percentage of the transaction amount, and some providers may charge you an additional fixed fee per transaction. The final cost can depend on several factors, including:

• The type of card used: For example, cards which grant cardholders additional benefits like points or rewards may have a higher interchange fee, which is then passed on to the merchant at the point of purchase.

• Card origin: Whether the transaction is being processed with a domestically or internationally issued card.

• The payment method: In-person transactions using card tap or chip generally have lower fees than manual card entry or online payments.

With Zeller, you never have to worry about complicated fee structures, because we've kept it simple, predictable and affordable. Learn more about Zeller’s industry-leading card processing fees here.

Payment processing pricing models

Understanding your payment provider’s pricing structure can help you estimate and manage costs. In Australia, the various pricing models include:

• Flat-rate pricing: A single fixed percentage fee applies to relevant transaction types, making your card processing costs predictable. This is the pricing model Zeller uses, and it's very popular in Australia for the simplicity, affordability, and ease of understanding it offers both merchants and customers.

• Cost plus pricing: The interchange fee is passed through, with an additional margin from the payment provider charged on top. This results in unpredictable card processing fees for merchants.

• Tiered pricing: Transactions are grouped into categories, each with different fees. This model can be complex and less transparent.

How to minimise your credit and debit card processing fees.

While card processing fees are a necessary cost of doing business, there are ways to reduce their impact:

• Choose the right payment provider for your business: Thoroughly compare payment providers, focusing on fees, pricing structures, and value-added services. At Zeller, we’re known for our transparent, flat-rate pricing of 1.4% per card-present transaction, including for American Express.

• Negotiate your merchant fees: Depending on transaction volume, some providers may offer better rates. At Zeller, merchants who process over $250K annually in card payments can speak with our team about the potential for a custom rate.

• Consider if surcharging is right for your business: In Australia, merchants can choose to legally pass on the cost of card processing to customers, provided the surcharge reflects the actual processing cost. To surcharge, merchants must clearly display the surcharge amount at the point of sale. Learn more about surcharging here.

• Proactively reduce chargebacks to minimise fees: Chargebacks can result in additional fees and lost revenue. Implementing fraud prevention measures, such as verifying customer identity and using secure payment technologies, helps to avoid these fees. Learn more about chargebacks and how to prevent them here.

See how Zeller compares.

While credit and card processing fees are an inevitable part of accepting payments, understanding how they work can help you make more informed decisions and manage your costs effectively.

By choosing the right provider and negotiating your fees based on your card processing volume, you can help ensure your business is operating efficiently while providing your customers with convenient payment options.

Looking for a more affordable card processing solution?

Speak to the Zeller Sales team about how we can help with a simpler, more cost effective payment solution.