- Banking

Business Credit, Debit & Expense Cards Explained

Credit cards let businesses borrow money, while debit cards use available funds.

Business credit cards offer rewards but require credit checks and personal guarantees.

Corporate/business debit cards link to bank accounts, limiting spending to account balance.

Prepaid/expense cards control spending by loading fixed funds for employee costs.

Zeller Corporate Cards offer easy setup, spend limits, and real‑time expense control.

Issuing payment cards to employees for business-related spending is a great way of simplifying expense management in the workplace.

What’s less simple, however, is understanding the different card types available to businesses. From corporate credit cards to business debit cards, prepaid cards, and expense cards, there’s a bit to get your head around. Below we explain the difference between the most common card types and provide a list of pros and cons for each.

A note on debit vs. credit.

Before we get started, it’s important to remember the following. Credit cards let you borrow money. Debit cards let you spend money you already have.

Business Credit Cards.

Business credit cards are designed for businesses to cover work-related expenses with funds borrowed from an issuing bank. They often provide rewards such as cash rebates or a points program and are available to businesses of all sizes, typically without any minimum annual revenue or spending threshold requirements. They do, however, require a credit check and often a personal guarantee, meaning the business owner is liable for all debt. Because of the risk of misuse, business credit cards are usually only held by business owners, or authorised personnel, not employees.

Corporate Debit Cards & Business Debit Cards.

A corporate debit card, or business debit card is linked to a business’s transaction account. When a transaction is made, funds are deducted from the available balance of the company’s bank account. When a business owner opens a business bank account, they will receive a business debit card. Unlike credit cards, they are not linked to a line of credit, and spending is limited to what is available within the account. Most debit card issuers don’t offer the ability to easily modify spend limits on individual cards, meaning that whoever has access to the debit card, can access all the funds on it.

Prepaid Cards & Expense Cards.

A corporate prepaid card, otherwise known as a business expense card, or employee expense card is a payment card that has been preloaded with funds, allowing businesses to control employee spending. These cards are typically very easy to get, with no paperwork or application process required. Prepaid cards are managed by the finance team or CFO, topped up as necessary, and assigned to employees to give them access to company funds.

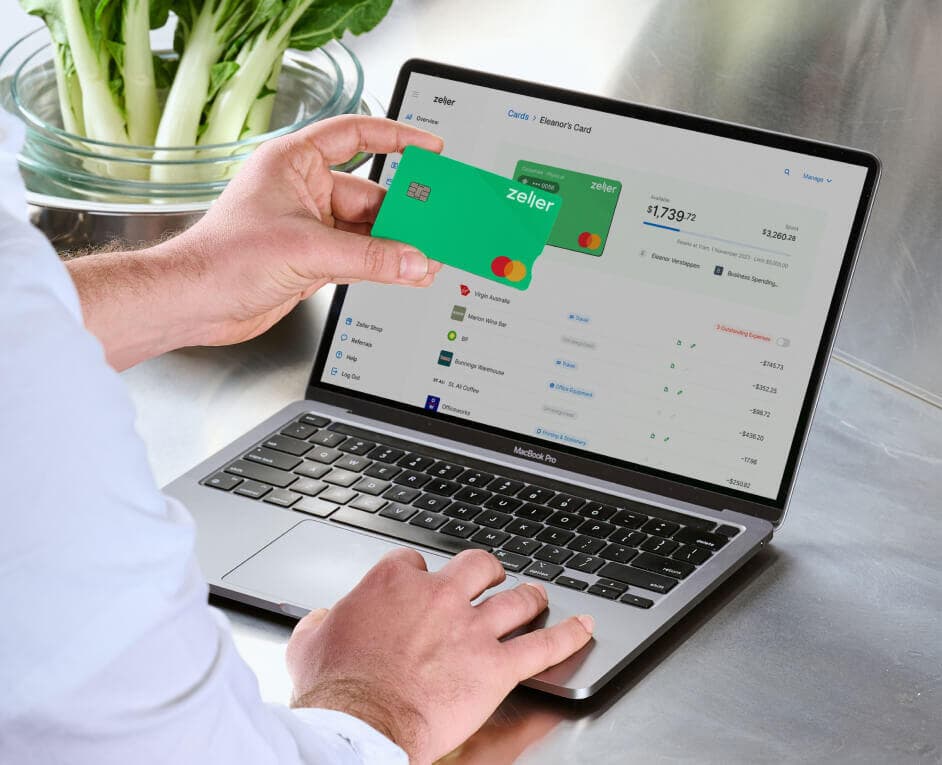

Zeller Corporate Cards.

Similar to prepaid cards, Zeller Corporate Cards are designed for businesses as a convenient way to track and regulate spending while providing employees with a secure and flexible payment method. These cards are linked to your Zeller Transaction Accounts, and are managed by the finance team or CFO who can set maximum spend limits per transaction and per day, week, fortnight, month, or quarter. Additional cards are very easy to issue (virtual cards can be issued instantly from Zeller Dashboard, or Zeller App), and can be assigned to employees as necessary.

Zeller Corporate Cards:

Do not require a credit check to qualify

Can be set up in minutes

Allow you to set spend limits and recurring budgets, reducing admin time

Provide a layer of security if cards are lost or stolen

Are accepted anywhere Mastercard is accepted

Do not need to be topped up with funds – cards draw funds directly from the transaction account, but only within the card's pre-defined limits.

Learn more about the benefits of Zeller Corporate Cards here

What card types are best for managing team spending?

Although it’s common practice for businesses to share one business credit or debit card, and to pass it around to employees as they need it, this is not recommended. Not only do you run a greater risk of losing the card, but also, company money could be used irresponsibly. When choosing a card type for managing work-related expenses for your team, it’s important to choose one that has been designed for that purpose.

Corporate credit cards are a good option, however, given their strict eligibility requirements, they remain largely inaccessible to many businesses. The best option for managing team spending is either prepaid or expense cards, or even better: Zeller Corporate Cards. These options give your employees the flexibility to pay for work-related expenses without the risk. You remain entirely in control of how much your employees have access to. With Zeller Corporate Cards, you will benefit from robust expense management features, which allow employees to easily upload receipts against their transactions, and employers to control spending limits and reconcile expenses from their desktop or Zeller's mobile app. Additional cards are easy to order, and Zeller supports virtual cards, which employees can add to their mobile wallets.