- EFTPOS & Point of Sale Solutions

Paying the Way Forward: The Next Trends in Australian Payments

Zeller’s Head of Product, James Vatiliotis shares his insights on the innovation we can expect to see in payment technology over the next 12 months.

In the past year, Australia’s payment sector has been transformed by the launch of Tap to Pay technology. Untethering payments from the traditional EFTPOS terminal and putting them in the hands of any individual with a smartphone has revolutionised what we’ve come to expect of the payment experience. Now with the rapid expansion of AI and machine learning, the pressure of security breaches, and the growing obsolescence of cash and printed receipts: there’s more innovation coming in the payments space.

More customers choosing a bank alternative.

The shift away from cash has accelerated significantly, with cash representing less than 14% of total transactions today according to the Reserve Bank of Australia (RBA). For businesses, this means the choice of financial services and payments provider has never been more important. With the incumbent banks no longer dominating the market with one generic offering, businesses have the choice of a growing number of digital banking alternatives, enabling them to shop around for a solution that offers greater flexibility, affordability, and functionality.

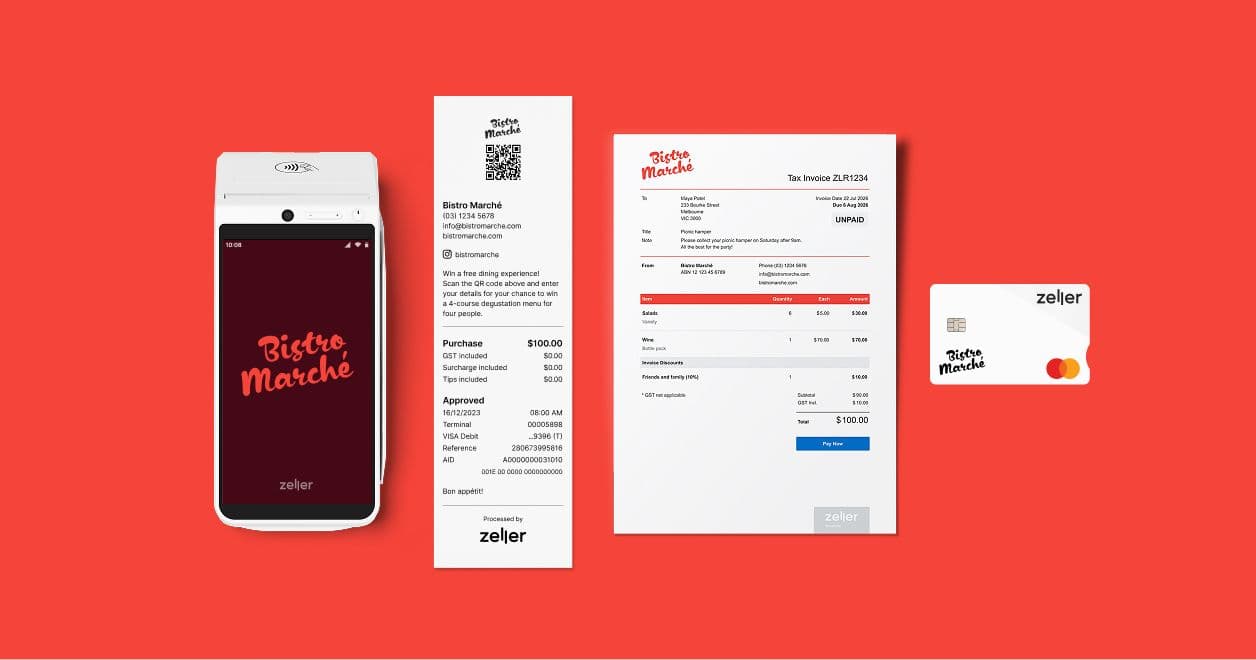

From the pricing of payments technology to how it integrates with other systems, how it mitigates security risks, and what features it offers (think surcharging, bill-splitting, tipping, customisable screensavers, digital receipts, and more), there is no longer a one-size-fits all solution when it comes to business banking. Additionally, with very few customers nowadays carrying cash as a back-up payment option, the reliability of the payments hardware and the quality of your provider’s customer support have become paramount. Over the next year, we anticipate more businesses will shift from traditional banks to newer digital solutions, which will continue to drive innovation and differentiation in an increasingly competitive market.

Payment security enhanced with AI capabilities.

Across the world, we are seeing rapid adoption of AI in SaaS and financial services companies, to increase speed and accuracy when analysing documents and information; this trend will also accelerate in Australia in the coming years. The Australian Bureau of Statistics (ABS) recently reported that an estimated 8.7 per cent of Australians – 1.8 million people – were victims of card fraud in the 2022-2023 financial year. To combat this, payment providers are harnessing the power of AI to improve fraud detection.

AI already plays a crucial role in a number of our security processes at Zeller. It is enhancing the accuracy and speed with which we can run biometrics, by matching a merchant’s likeness against their identification documents. It is being used to help verify the authenticity of documents supplied, and is continually improving transaction monitoring systems by enabling fraudulent transactions to be identified even faster.

AI-enabled insights give decision makers more data.

On top of its applications in security, there’s also huge potential for AI to help business owners make more informed, data-driven decisions. Companies like Shopify have already announced AI sidekicks to help questions around business operations such as, “Why have I had a drop in sales between March and now?” We’re especially excited to see the application of a similar framework being introduced into a platform like Zeller which benefits from a 360-degree view of your entire business and finances (via EFTPOS terminals, invoicing, debit cards, expenses, transfers and more).

It will allow AI to go beyond answering questions, to instead provide proactive business insights, such as, “In three months, you will have a cash flow shortfall; here are ways you can mitigate this” or, “We noticed a group of customers who shopped with you last month haven’t this month; here’s how to bring them back”. In certain cases, AI will even be able to help implement these suggestions, with prompts such as, “You could earn a better return on your money by transferring funds into a savings account each evening; Would you like us to do this for you?” These types of real-time insights and tips will prove critical in helping businesses make informed, strategic decisions when it comes to managing their finances.

The disappearance of printed receipts.

Recent research by the University of Technology Sydney (UTS) revealed that Australia produces an astonishing 10.6 billion paper receipts annually, and because most are coated with toxic chemicals, they can't be recycled. With consumers and businesses becoming more and more conscious of their environmental footprint, many are choosing digital receipts as a convenient and sustainable alternative.

By offering SMS and email receipts, Zeller Terminal users have saved enough paper to wrap the MCG 142 times. In addition to the environmental benefits, digital receipts also provide business owners the convenience of accessing receipts when they need them again in the future. We foresee a future where EFTPOS terminals may no longer need printers at all, embracing an entirely digital receipt system.

Tap to Pay integration to third-party hardware.

Since it was launched last year, Tap to Pay with Zeller App has enabled businesses to accept contactless payments using their own iOS and Android smartphones. This technology has proven greatly successful, with tens of thousands of businesses adopting it within the first months. It’s now set to expand to enable other devices to accept contactless payments using Tap to Pay technology; including apps, point-of-sale, and more.

By providing other technology companies access to Zeller’s Tap to Pay technology, we expect to see this become the new norm for various applications. Kiosks, point-of-sale (POS) systems, vending machines, and more will be able to integrate Tap to Pay into their hardware, doing away with the need for traditional card readers. If you’re interested in incorporating Zeller’s Tap to Pay solution into your own technology, email us at partnerships@myzeller.com.

Want to stay up to date?

At Zeller we are constantly enhancing our features in line with the very latest technology. Stay abreast of all the newest developments by signing up to our newsletter and checking in on the Zeller Business Blog, where you will find helpful resources, inspiring stories, and handy business tips updated on a weekly basis.