- Payments & Point of Sale Solutions

How to Accept Contactless Card Payments on Your Smartphone

Did you know you can now easily take contactless payments with just your smartphone? Read on for an in-depth guide to the new technology that turns your mobile phone into a card reader.

Can you take contactless payments with just your mobile phone?What is it called when you take a card payment on your mobile phone?Can you use any smartphone as an EFTPOS terminal?What Android phones can be used to take contactless payments?What iPhones can be used to take contactless payments?What app lets you take EFTPOS payments on your mobile phone?Is it safe to take EFTPOS payments on your mobile phone?How much does it cost to take contactless card payments on your mobile phone?I need to take contactless card payments immediately, what should I do?What are the advantages of accepting contactless card payments on your mobile phone?Are there any other hardware-free payment options?Can you take contactless card payments with just your mobile phone?

Yes! Until 2024, accepting contactless card payments on your phone required you to have a mobile credit card reader either plugged into your phone or connected via Bluetooth. Now, thanks to the latest smartphone technology, you don’t need any extra hardware, all you need is a mobile app that's enabled with Tap to Pay technology.

What is it called when you take contactless card payments on your mobile phone?

The process of accepting a contactless payment on your phone (using its inbuilt technology, not a mobile card reader) is known as ‘Tap to Pay’. This term applies to both iPhone and Android devices that are using a financial services app – such as Zeller App – to accept contactless credit and debit cards and digital wallets.

1. Download Zeller App

With Zeller App you’ll be able to accept payments and manage your business finances from anywhere.

2. Create your free Zeller Account

Follow the prompts to open your account then complete the verification process.

3. Enable Tap to Pay

Select ‘Tap to Pay’ from the left hand side menu and follow the prompts to set it up.

4. Start accepting payments

Once Tap to Pay is set up, simply enter the payment amount and let your customer tap their card, phone, or wearable against your smartphone to complete the transaction.

Can you use any smartphone as an EFTPOS terminal?

Only selected iPhone and Android smartphones, with built-in NFC technology will support Tap to Pay.

What Android phones can be used to take card payments?

Android 10 or later versions with NFC technology will support Tap to Pay on Android.

What iPhones can be used to take card payments?

Currently, the feature is available to all users with an iPhone XS or later, using iOS 16.4 or later. It’s important to note that in order to use Tap to Pay on iPhone, users must be signed in to their iPhone with an Apple ID.

What app lets you take EFTPOS payments on your phone?

There are a number of different payment apps that can be downloaded from the App Store or Google Play Store that support Tap to Pay. Zeller App is a great option for Australian businesses looking for a simple, affordable, and scalable platform to accept EFTPOS payments and manage their finances as they grow. Merchants wishing to take payments on their phone will simply need to download their selected app, and follow the steps to configure their device. Once configured, they can then start accepting EFTPOS payments immediately.

Accepting contactless payments on Zeller App is easy and instant.

Is it safe to take EFTPOS payments on your mobile phone?

Taking contactless payments on your mobile phone relies on ‘Near Field Communication’, or NFC – the same technology that is used for making payments with a mobile wallet. Account information is transmitted from a customer’s card or mobile wallet to the payment processor via radio waves within a very close range, and once received, the processor uses the information to complete the transaction. By virtue of the fact that NFC only works within a couple of centimetres, it makes it incredibly difficult for a potential fraudster to intercept the transaction and steal sensitive information.

Tap to Pay on both Android and iPhone via the Zeller App offers highly secure contactless payments that adhere to global security standards. Both platforms support various card types, regularly verify device security, include secure PIN processes and use advanced technology to ensure every transaction is not only convenient but also protected, maintaining the privacy and safety of user information. Additionally, Tap to Pay on iPhone ensures secure transactions through Apple's unique features, such as issuing decryption keys after thorough validation and leveraging the iPhone's built-in security element.

I’d already spent thousands of dollars on setting up my business, I didn’t want to have to pay for an EFTPOS terminal. I’d rather spend that money on cleaning products.

Sebastian Fernández Mackenzie, Seb's Mobile Car Wash

How much does it cost to take contactless card payment on your mobile phone?

Tap to Pay technology is facilitated by payment apps, each of which have their own pricing structures. The cost of taking card payments on your phone will therefore depend on which app you choose to process these payments. Zeller, for example, offers one low flat transaction fee of 1.4% for all cards, including American Express. The advantage of Zeller is that it is one of the few payment apps that also lets you pass the transaction fee onto your customer through surcharging. If you choose to surcharge, you will incur no fee whatsoever for accepting contactless payments on your phone.

I need to take contactless card payments immediately, what should I do?

If you want to be able to use your phone like an EFTPOS terminal within a few hours, it’s important that you choose a payment app that has a simple, online sign-up process. All the payment apps will require you to have an account with them first, and in the case of the banks, this will mean opening a business bank account which may take several days and an in-person branch visit. With Zeller, you can open an account online (or directly via the app), within a matter of minutes – no paperwork required. Once your Zeller Account is up and running, you simply need to download Zeller App, enable Tap to Pay on your device, and you’re ready to start taking card payments on your smartphone.

What are the advantages of accepting contactless card payments on your mobile phone?

It’s affordable

Not all businesses can justify the upfront cost of an EFTPOS terminal, especially if they are not processing a large volume of in-person payments. Being able to use hardware that you already own is therefore a much more cost-effective solution. It allows new businesses or very small businesses to get up and running without the outlay of having to purchase an EFTPOS terminal.

It’s mobile

For mobile businesses that take in-person payments, having to carry a bulky EFTPOS machine around with you is inconvenient. Using your mobile phone as a payment terminal means you can keep it in your pocket and enjoy being hands-free.

It’s great for emergencies

For businesses that use a traditional EFTPOS machine, having an app installed and configured to take payments on your phone means that if there’s ever a day when your terminal lets you down or when you have a surge in customers, you won’t miss a beat. In the case of an outage or damaged EFTPOS machine, rather than having to revert to cash-only payments – which will almost certainly lead to lost sales in this day and age – you can keep trading as per usual by simply using your phone.

Are there any other hardware-free payment options?

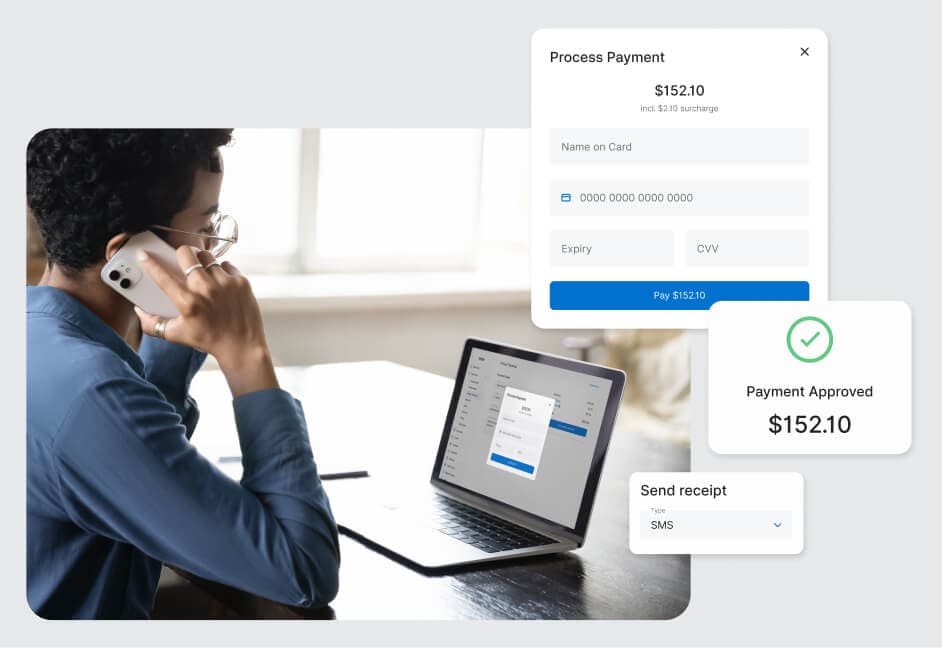

In addition to Tap to Pay, there’s another simple solution for taking card payments instantly with no hardware required: Virtual Terminal. If you need a way to charge customers, but in-person payments aren’t possible, this is a great alternative. Zeller Virtual Terminal is a web-based tool that lets you take payments over the phone (as well as mail order, fax, or email) by manually entering a customer’s card details into your browser. Alternatively, merchants have the option of sending customers a secure payment link via email or SMS, where they can enter their card details themselves from their own device.

Meet Zeller: an all-in-one financial services provider.

When you sign up for a free Zeller Account today, not only will you be able to start taking card payments on your phone, you will also gain access to a suite of financial services, from a Zeller Transaction Account to debit cards, invoicing, virtual terminal and more. It only takes a few minutes to sign up, and it’s all done online – no paperwork or branch-visits required.