- EFTPOS & Point of Sale Solutions

Zeller for Events: How to Rent an EFTPOS Machine

No matter how soon, big, or complex your event is, Zeller takes the pain out of processing payments.

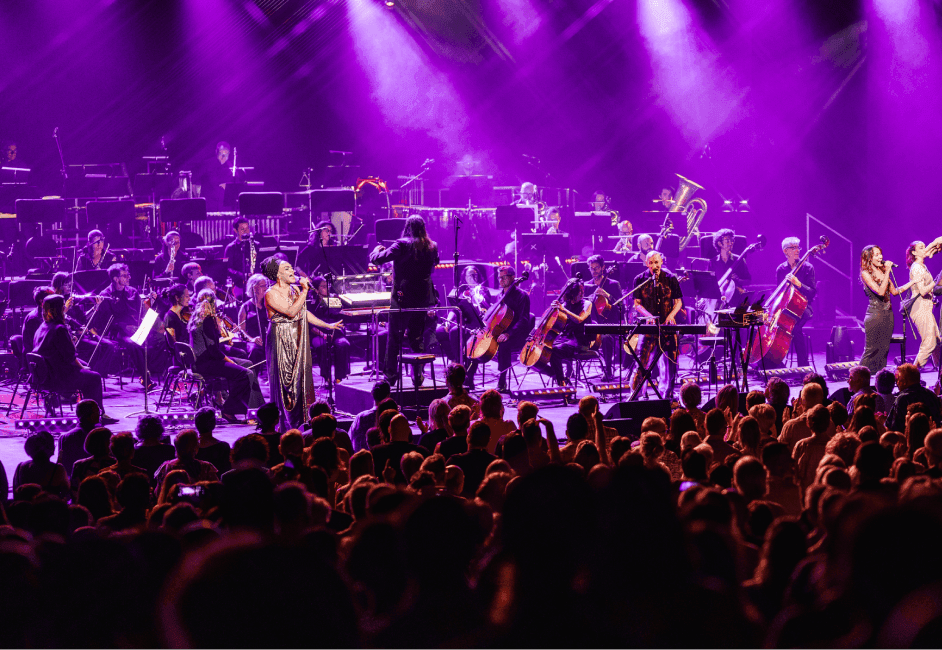

Whether you're planning a music festival, farmers market, or charity event: the Zeller Event Rental Program provides event organisers with access to payments technology — without the lengthy paperwork. With no monthly rental fees, and no lock-in contracts, you won’t need to pay for a service you’re not using – Zeller will customise a quote for you and offer you local support for the duration of your event. Keep reading to discover why event payment processing is easier with Zeller.

Get set up fast.

We understand that, often, with events, decisions need to be made fast – and sometimes at the last minute. How many EFTPOS machines you need might depend on how many attendees you are expecting, and it’s likely that you won’t know this until you’ve started selling tickets or receiving RSVPs. Having a merchant facility that can be flexible and agile is essential but increasingly difficult to find, with many banks and payment providers offering only 12-month rentals with lock-in contracts. Signing up with Zeller takes a matter of minutes, and a local team member will help you get set up with the EFTPOS terminal rental package you need.

To have that support and to have that super speedy turnaround was just great. It saved us.

Prue Miels, Adelaide Festival Administration & Payroll Officer

Reduce queues with faster payment acceptance.

Whether you’re selling tickets at the door, running a merchandise stall, or operating a food and beverage site, customers expect to be able to pay for their purchase quickly. With Zeller, transactions are processed in seconds — meaning you can keep queues moving. After all, long lines can prevent customers from coming back for merchandise, or another drink (or even from joining the queue in the first place). Plus, with Zeller Terminal you can accept Visa, Mastercard, eftpos, American Express and JCB cards, as well as mobile wallets. Having the ability to accept every payment from every customer means no one needs to wait in line, only to be sent to the nearest ATM.

Enjoy peace of mind with local support.

When events are planned year-round, but their window for generating revenue is limited to the few days or weeks that the event runs, organisers simply cannot run the risk of losing sales to unexpected issues. When you sign up to Zeller’s Event Rental Program, you will be assigned a dedicated account manager who will assist you in setting up your account, and tailoring a payment solution to your event. Additionally, our support team is available from 9AM to 1AM, Australian Eastern Time, and you can find the answers to standard queries in the Zeller Support Centre.

It’s just so nice that Zeller is Australian and that there’s a person you can talk to… It was amazing customer service.

Prue Miels, Adelaide Festival Administration & Payroll Officer

Never lose a sale with WiFi, SIM, and Ethernet connectivity.

Zeller offers a streamlined attendee experience with fast, secure, and reliable payment solutions integrated across your entire site. Zeller Terminal connects to the internet via Wi-Fi, mobile hotspot, SIM card, and Ethernet — safeguarding your business against unforeseeable service interruptions, or internet speed issues that often plague large-scale events. And, because it’s wireless, you can accept payment from wherever is convenient across your site.

Keep costs down with low transaction fees and simple surcharging.

Events are expensive, and increasingly so. It’s essential to find cost-saving solutions wherever possible. When you accept payments with Zeller, you will only ever pay one low 1.4% transaction fee – there are no minimum requirements or hidden charges. What’s more, surcharging is made simple: you can toggle the feature on or off, or you can choose only a partial amount to surcharge your customers. By passing on the transaction fee, the only cost you will pay is the price of renting the hardware.

Paying EFTPOS rental fees every month for a machine that gets used for two weeks of the year doesn't make any sense. Then I found Zeller. It seemed too good to be true. The service has been amazing.

Prue Miels, Adelaide Festival Administration & Payroll Officer

Get fast access to your takings.

Unlike traditional businesses, events-based businesses experience significant fluctuations in revenue. Organising events typically requires substantial upfront investments in venues, equipment, marketing, and staffing, and these costs must be incurred well before any revenue from ticket sales or sponsorships is realised. This potential cash flow gap means it's especially important to be able to access your funds, as quickly as possible. Depending on which payment services provider you choose, you could access your takings the same day — or you could be waiting upwards of three business days. When payment is accepted via Zeller Terminal, funds are settled to your Zeller Transaction Account that same day. Or, funds can be swept to any other bank account and settled the next business day.

Tap to Pay with Zeller App: a fast, scalable solution.

If your event requires an even more flexible and mobile payment solution – perhaps you have a large group of volunteers needing to take donations, or maybe you need a card reader that you can slip in your back pocket – Tap to Pay with Zeller App is a great option. With nothing but a smartphone required, this payment solution can be set up in minutes. Simply create a Zeller Account, download the Zeller App onto an Android or iPhone mobile device, and start taking contactless card payments directly from your smartphone. If you are an exhibitor at a market or if you only need to take payments sporadically throughout the year, Tap to Pay is an excellent solution as it gives you flexibility without the added cost of renting hardware. What’s more, you will only pay one low transaction fee of 1.4%, or you can pass on the cost of acceptance by toggling the surcharging function on.

Track what you’re selling and when and where you’re selling it.

If you choose to rent Zeller Terminal 2, this model comes with a built-in point-of-sale system – Zeller POS Lite – enabling you to manage your inventory and track your sales at your event. With this POS, you can easily upload a library of items and deploy it to all your terminals at once. You can add item details and a photo to make products easier to identify and add variants such as size, colour, or style as well as modifiers like add-ons, toppings, or special requests. To help keep the queues moving fast, you can also design the terminal home screen to give you quick and easy access to the top-selling products. Detailed transaction reports will tell you what you're selling and when you're selling it, so you can make informed decisions about ordering more products or adding on more staff.

We had our 20 volunteers using their phones to accept payments with Tap to Pay. The ability to scale it up really quickly was fantastic.

Ben Stammer, Co-Founder, ReLove

Rent an EFTPOS machine with Zeller for your next event.

Interested in renting a Zeller Terminal for your next event? Contact the Zeller Events team to discuss your rental requirements. No matter how big or small your event, we can find a solution that meets your needs and budget. Plus, it’s the perfect way to trial Zeller as your long-term solution. Every Zeller Terminal rental kit comes with your choice of Zeller Terminal 1 or Terminal 2, Zeller SIM Card, a Zeller Charging Dock, and a roll of receipt paper — everything you need to accept payments at your event.

The Zeller Event Rental Program supports:

Farmers markets

Community events

Food and beverage tastings

Cultural events

Seasonal pop-ups

Fundraisers and galas

Sporting events

Conventions and trade shows

Music festivals

Arena shows

Event venues

Sports stadiums

And more!

Speak to the Zeller Events team.

Tell us about your event, and we'll get in touch to learn more and present a competitive proposal.

Phone 1800 935 537

Monday to Friday

9am to 5pm Australian Eastern Time