- Payments & Point of Sale Solutions

Unwrap 3 More Ways To Get Paid This Holiday Season

Extend your trading hours and promote extended hours to attract late shoppers.

Offer express or discounted shipping to guarantee Christmas delivery cutoff.

Provide gift-wrapping services to save customers time and add value.

Ensure extra staff are available to handle increased seasonal foot traffic.

Stock essential last-minute items and bundle gift sets for convenience.

It’s beginning to look a lot like Christmas, with streetscapes around the country adorned by oversized candy canes, inflatable Santas, and enough tinsel to tickle a reindeer’s nose. Naturally, all this fun, festive frivolity comes with increased consumer spending, and businesses can sometimes experience payment bottlenecks if they’re not prepared.

At Zeller, we’re constantly dreaming up new ways to help our merchants get paid in more ways than just over the counter. On top of our industry-leading mobile EFTPOS terminals, here are three other clever ways Zeller can help you accept payments this Christmas.

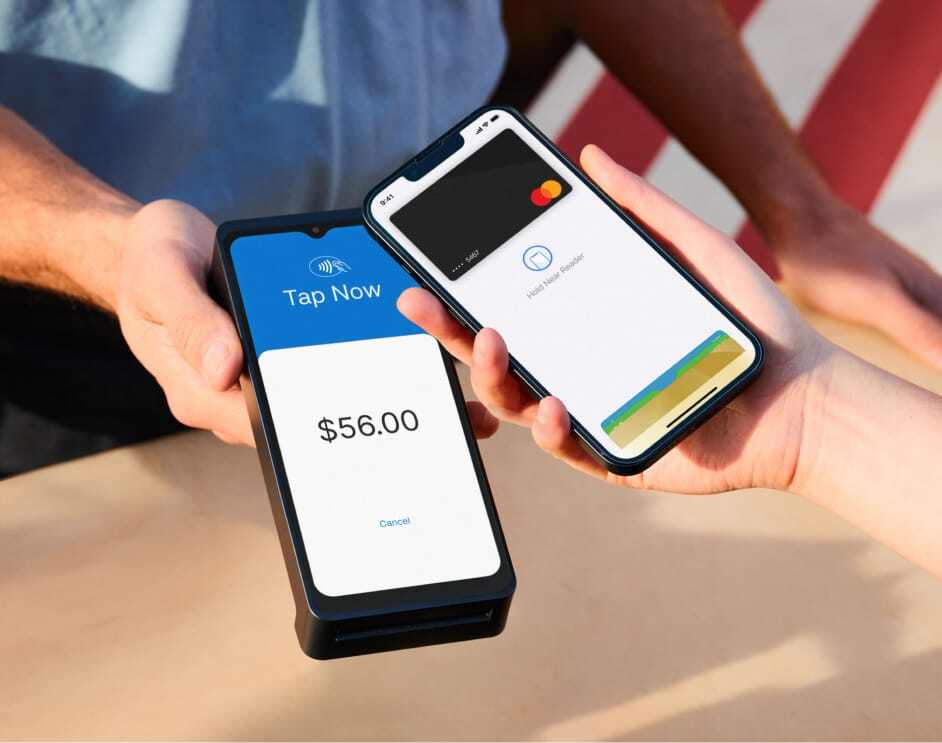

1. Take payments down the queue with Tap to Pay.

Got a smartphone? Great, you’ve got a mobile POS terminal. Simply open up the Zeller App on your smartphone, hit the hamburger in the top left corner (the three stacked lines), enable ‘Tap to Pay’, follow the prompts, and you’re ready to accept contactless payments.

Tap to Pay with Zeller App can be handy in so many scenarios. For example, if you’re running a one-off stall selling Christmas hampers at your local farmers market, you can accept payments directly on your phone. No EFTPOS terminal needed — it’s that easy..

Another example could be a fishmonger with a steadily growing queue of people lining up to buy fresh seafood for Christmas Day. While one staff member takes orders and accepts payments at the counter using Zeller Terminal, another can walk down the line using Tap to Pay with Zeller App on a smartphone as a secondary POS. By reducing customer wait time, you’re helping to ensure fish-fans don’t get salty and move on to a quieter nearby competitor.

2. Lock in bookings or large orders with Zeller Invoices.

Sending professional invoices has never been easier. Let’s say you run a restaurant and have just received a booking request for a large Christmas party. To accept a deposit payment to secure the booking, you’d open Zeller Dashboard, whip up an invoice in a few clicks (including detailing the payment terms), create a new contact, and send the invoice for the client to arrange pre-payment quickly and securely with their credit card.

Or perhaps you’re a bakery taking Christmas pudding orders. You can fire off the invoice in a few clicks, and then be automatically notified when your customer completes their order payment. And if your customer was slow to pay, they’d automatically receive reminder emails to prompt them. We’re proud to say that 75% businesses using Zeller Invoices get paid in under 24 hours.

3. Take card payments over the phone and send payment links with Virtual Terminal.

Zeller Virtual Terminal allows you to manually enter a customer’s card details they’ve given you over the phone, or send them a secure payment link via email or SMS, right from Zeller Dashboard.

But what if you don’t have their email address or phone number? What if you’ve been communicating with your customer purely on social media? No worries, Virtual Terminal can handle that too.

Let’s say you’re a handmade jewellery creator crafting cute Christmas-themed earrings for customers on Instagram and Facebook Marketplace. You would take an order via your DMs, add the payment details into Zeller Virtual Terminal in a few taps, click ‘Copy Link’ and shoot your customer the payment link back via DM. Quick, easy and efficient, the way it should be.

So whether you’re a sole trader, a medium sized business or even running a bigger operation, hopefully this article has given you some fresh ideas on taking payments this Christmas and beyond.

If you have any questions on any of these additional payment options available to you, log in to your Zeller Dashboard to try them out, or give our local team a call on 1800 935 537 and we’ll step you through the process.