- Business Growth & Optimisation

Understanding ABNs: A Comprehensive Guide for Soon-to-Be Business Owners

What is an ABN?

An ABN (Australian Business Number) is an 11-digit number issued by the Australian Business Register that identifies your business to the government. It 's used for tax and other business purposes, and it can also be used by the general public to find your business on the ABN Lookup website.

Who needs an ABN?

Anyone who is running or starting a business or enterprise in Australia needs an ABN. If you’re not sure if your activity is regarded as a business, ask yourself the following questions:

Will it involve commercial sales of products or services?

Is the activity more than just a hobby? Ie. Do you intend to make a profit from it?

Will you be repeating the activity?

Will you keep records of the activity in a business-like way?

If you answered ‘yes’ to the above questions, you will almost certainly require an ABN.

An ABN is essential for various reasons. It allows businesses to register for GST if their annual turnover exceeds $75,000, enabling them to claim GST credits and comply with tax obligations. Having an ABN also ensures you can issue valid tax invoices, making it easier to manage transactions and maintain professionalism with clients. Additionally, an ABN is often required to work with other businesses, apply for government grants, or secure financial assistance.

Other situations may also require creating ABN, such as acting as the trustee of a deceased estate, super fund or a Self-Managed Superannuation Fund (SMSF), operating a charity, or leasing an investment property.

Why do you need an ABN?

When running a business in Australia, there will be many instances where you will be required to provide an ABN. These may include (but are not limited to) the following:

Applying for a business bank account: banks or financial services providers often request an ABN as part of the documentation needed to open a business bank account as it helps them verify the legitimacy of the business.

Business tax deductions: to claim tax deductions on business-related expenses, the ATO generally requires that your business have an ABN. Similarly, businesses that want to claim fuel tax credits for fuel used in business activities need to have an ABN.

Identifying your business: when invoicing or placing orders, many clients and suppliers may require your ABN to help them verify your business's legitimacy and ensure smooth and transparent dealings.

To get an Australian domain name: to register for a web address that ends in “.au”, you must be able to prove eligibility in Australia and it’s recommended that you have an ABN to do so.

Registration as a charity: charities and non-profit organisations seeking registration with the Australian Charities and Not-for-profits Commission (ACNC) generally require an ABN.

Government contracts: businesses engaging in contracts with the Australian government or its agencies usually need an ABN.

Claim GST credits: to claim money back on GST that you’ve been charged on business supplies and expenses, the ATO will require that you have an ABN.

Employer obligations: if you have employees, you need an ABN to meet your employer obligations, such as withholding taxes from employee wages.

When do you need to register for an ABN?

You need to register for an ABN prior to incurring income or expenses relating to the business. When you fill out the application form, you will be asked for the date that you expect to start your business. This date, however, cannot be more than six months in the future when you apply.

Prior to applying for an ABN number you will need to have undertaken some relevant ‘commencement activities’ to prove that you are serious about setting up your business. These activities could be as simple as setting up a social media account or website, or purchasing business cards and stationery, or they could be more substantial steps such as purchasing a business; leasing a premises; obtaining insurance, equipment or stock; or applying for finance.

It’s not essential to have undertaken all these activities prior to applying for an ABN number, but a certain number will be necessary to prove the legitimacy of the business.

One thing you do need to do before applying for an ABN however, is to decide on the right structure for your business, for example, a sole trader, partnership, or trust. Read our article on how to structure a new business here.

What documents are required to apply for an ABN?

To apply for an ABN you will require the following documents:

A tax file number (TFN) and the TFNs of any associates – for example, partners, directors, and trustees

The date your ABN is required (the date you expect to start any business activities)

An entity legal name, which will appear on all official documents or legal papers

Business contact details including an address, postal address, email address and phone number

The business’ physical location(s)

Depending on your circumstances, there may be additional documents that you need to provide:

If you are using the services of a professional advisor, you will need to provide their Australian Financial Services licence number

If you are using a registered agent for your tax or BAS preparation you will need to provide their registered agent number. If they are authorised to make changes or update information on behalf of the entity, you will also need to provide their contact details

If you have previously held an ABN, Australian company number (ACN) or Australian registered body number (ARBN) you will need to provide these.

What’s the difference between an ABN and an ACN?

Unlike an ABN, which is legally required for all Australian businesses, an Australian Company Number (ACN) is only required if your business is registered as a company.

If this is the case (read our article on structuring a business here), then you'll need both an ABN and an ACN. This unique nine-digit number is issued by ASIC and must be displayed on all company documents. Click here to learn more about registering a company.

How much does an ABN cost?

Registering for an ABN through the Australian Government’s Business Registration Service is completely free.

Of course if you choose to use a tax practitioner or another service then that may involve fees, but the process is actually very straightforward, so it's worth having a look yourself before asking for help.

How do you apply for an ABN?

There are two ways to register for an ABN:

Via the online application form on the Australian Business Register website

Via the online application form on the Business Registration Service’s (BRS) website.

The advantage to applying through the BRS is that you can register a business name at the same time as your ABN application. If you don’t, you’ll need to go back to the Business Registration Service to register your business name.

How long does it take to receive an ABN?

If you have provided all the relevant information, and your application is successful, you will receive your 11-digit ABN immediately.

If, after applying, you receive a reference number it means that the ABR may require additional details or information. Applications are usually received within 20 business days and they will contact you if further information is needed.

How do you update your ABN details?

To update your ABN details, including your business addresses, contact details, and business activities, simply log in to the Australian Business Register (ABR) online services. Once logged in, select 'Update ABN record' and follow the prompts. Changes made online take effect immediately.

If online access isn't available, you can update your details by contacting the ABR directly, consulting your registered tax professional, or completing and mailing the appropriate form. It's important to update your ABN details within 28 days of any changes to your business.

What if I forget to update my ABN details?

Everyone makes mistakes every now and again, but it really is best to do your best to keep your ABN details up to date.

If you forget, the Australian Taxation Office (ATO) could impose a fine ranging from $220 to $4,400, depending on the severity and frequency of the oversight. Also, outdated ABN information can hinder your access to government assistance, especially during emergencies. Government agencies rely on current ABN details, so inaccurate information may result in missed opportunities for support.

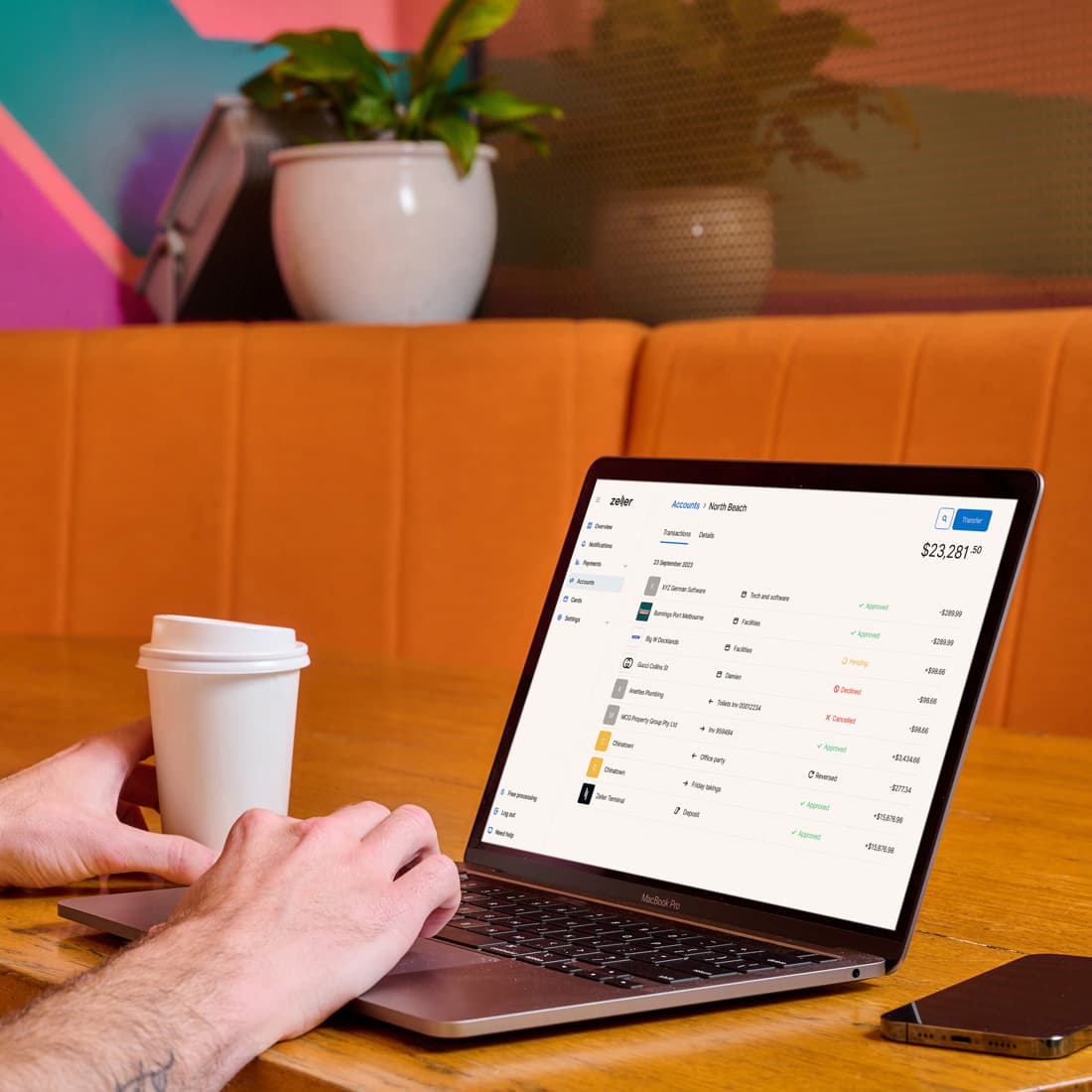

Starting a business? Zeller has your finances covered.

We know you’ve got a lot on your to-do list, but thanks to Zeller you can cross off ‘open a business transaction account’ in as little as six minutes. Plus, with a suite of tools to help you accept payments, manage your expenses and track your cash flow, Zeller will ensure you start your business on solid financial footing.

Open a free Zeller Account today and you’ll gain access to:

Zeller Transaction Account: a free account to store your funds.

Zeller EFTPOS Terminal: the smart way to accept in-person payments.

Zeller Debit Card: an expense card that helps you stay on top of business spending.

Zeller Invoices: a platform for sending unlimited invoices and getting paid online.

Tap to Pay with Zeller App: the easiest way to take payments with no hardware required.

Zeller Virtual Terminal: a simple solution for taking payments from a web browser.

Zeller App: one convenient app for managing all your business finances from anywhere.

And there’s more! We’re constantly updating our tools and features, so stay up to date by signing up to our newsletter. You'll get all the latest Zeller news and updates straight to your inbox.