- Banking

5 Reasons to Separate Personal From Business Banking

It pays to open a separate account for your business.

When you run a business, keeping accurate financial records is essential. One of the easiest things you can do to simplify your life is to choose the right set-up for your accounts from the outset — especially if you have plans to grow your business in future.

Depending on your business structure, you may be required to have a separate account to hold business funds. If your business has been set up as a partnership, company or a trust, you are legally obligated to have a separate account for tax purposes. Sole traders aren’t legally required by the ATO to have a separate account, but there are many reasons why keeping your personal finances distinct from business funds is a good idea.

Read on to discover the top reasons for opening a business account, and how to choose the right small business account for your circumstances.

What is the difference between a business transaction account and a personal account?

Business accounts are designed for business transactions and financial management, commonly allowing for multiple users, higher transaction limits, detailed reporting, and access to additional services like business loans or invoicing. In contrast, personal accounts are for managing individual finances, and generally have lower fees, but do not offer any specialised services.

5 reasons why you should open a business account

1. Better visibility of the financial health of your business

One of the biggest challenges for small businesses is the ability to manage cash flow. Accurate monitoring of spending is vital for cash planning, however managing this can become more difficult when business spending and personal spending are intertwined in the one account.

As a sole trader, there’s no legal reason why you can’t use your personal bank account to receive and make payments for your business. Yet when it comes to reconciling your business transactions at the end of each month, you may find that trawling through your personal expenses is a tedious task. If you choose to store business and personal funds in one account, you will need to be extra careful in reconciling your financials. Getting it wrong could land your business in trouble, come tax time.

By keeping your business transactions separate, sorting out your legitimate business expenses from your personal spending becomes far simpler. To streamline your bookkeeping even further, you can link your business account to your business accounting software and automate the process of inputting your expenses. The ATO requires you to maintain your business records for five years; having a dedicated business transaction account will make it much easier to manage in the event you are audited.

2. Separated funds ready for tax time

Meeting your tax obligations is one of the less enjoyable, yet necessary, elements of running a business. Maintaining a separate business transaction account means that you can keep track of your business income, and better manage your obligations when tax time rolls around.

A popular approach for ensuring that there are no surprises at the end of the financial year is to have three business accounts: one for everyday transactions, one for holding your GST and PAYG instalments, and one for storing profit. This way, you won’t be tempted to spend more money than you should, and you’ll have better control over your cash flow.

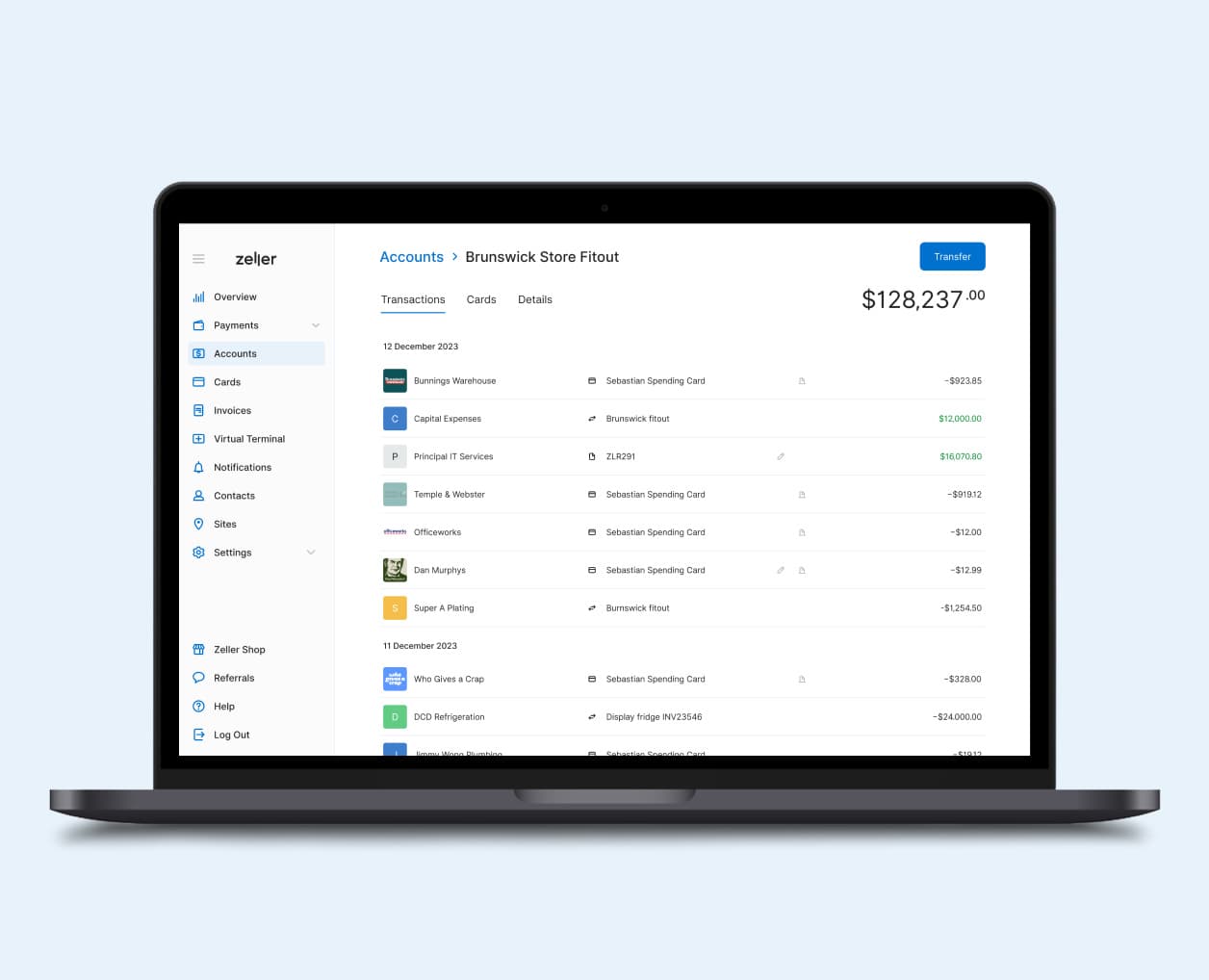

With Zeller, you can open multiple Zeller Transaction Accounts – with different cards attached to each for simple, trackable expense management and you can open a Zeller Savings Account to earn interest on your profit.

3. Easier accounting

When tax time rolls around, you’ll want to make sure you don’t miss any legitimate business deductions. Keeping your personal and business transactions separate will not only make this easier, but will also help to avoid mistakenly claiming a personal expense as a business expense.

You’ll also likely minimise your accountant’s fee, as they won’t have to sift through your personal expenses in order to complete your tax return. Instead, you could ask them to spend time on meaningful tasks that will help to grow your business. The true value of an accountant is in helping you to identify longer-term savings and strategies to grow your business — not identifying which coffees were for a business meeting, and which were for brunch with friends.

Haven’t got one? Read How to Find an Accountant for Your Small Business.

4. Simpler and faster money management

Most financial service businesses take the hassle out of making and receiving payments by offering 24-hour online access to accounts. However, by shopping around, you will be able to find smarter solutions that offer far more than round-the-clock access to your funds.

Depending on which provider you choose, your business could also benefit from the ability to track things like:

the total value of sales on any given day, or month

business performance by location

the amount of tax payable on your takings, at any point in time.

Zeller Transaction Account offers real-time visibility of all of the above, and much more. Most businesses can sign up in under 5 minutes. Take the time to research the features and compare business bank accounts to discover which meet your needs — not only now, but as your business grows.

5. A more professional image

If you want your business to be taken seriously, opening a business account is an important first step. Making and receiving payments into a business account helps to create a more professional, trustworthy perception.

When you have a separate account for storing business funds, your business name will appear on any invoices and payment paperwork, rather than your personal name. This will help both suppliers and customers to become more familiar with your business' name.

Choosing the best transaction account for small business

Before opening a new business account, it’s important to take a moment to consider your needs. Your business' operating rhythm, as well as the time it takes to get set up, are two of the most important considerations. Thanks to decades of technological advancements, there are new alternatives to traditional big-4 banking which don’t require you to carve time out of your busy work day to visit a branch, and rely on outdated communications methods — such as fax.

Aside from ease of setup, there are a number of other considerations. These include:

transaction limits

whether you require additional features, such as cheque books

availability of merchant facilities, such as EFTPOS terminals

fees, including account-keeping and transaction fees

how quickly you need access to your funds.

If you’re not sure which business account is right for you, consider seeking advice from your accountant or tax agent. They may be able to help you decide what will work best for your financial reporting requirements.

The easiest way to set up a business transaction account

Zeller has developed a fee-free option specifically for small and medium sized Australian businesses. Our all-in-one solution includes a free business transaction account, linked to your Zeller Terminal. There are no hidden fees, or lock-in contracts.

Payments accepted via your Zeller EFTPOS machine are settled into your Zeller Transaction Account at the end of every day, and funds are available for spending via your Zeller Debit Card the next day — which means there’s no waiting for your money. You can pay staff, suppliers, and yourself immediately. However, if you prefer to store your funds elsewhere, your Zeller Terminal can be linked to any third party bank account. Funds will be transferred the very next business day.

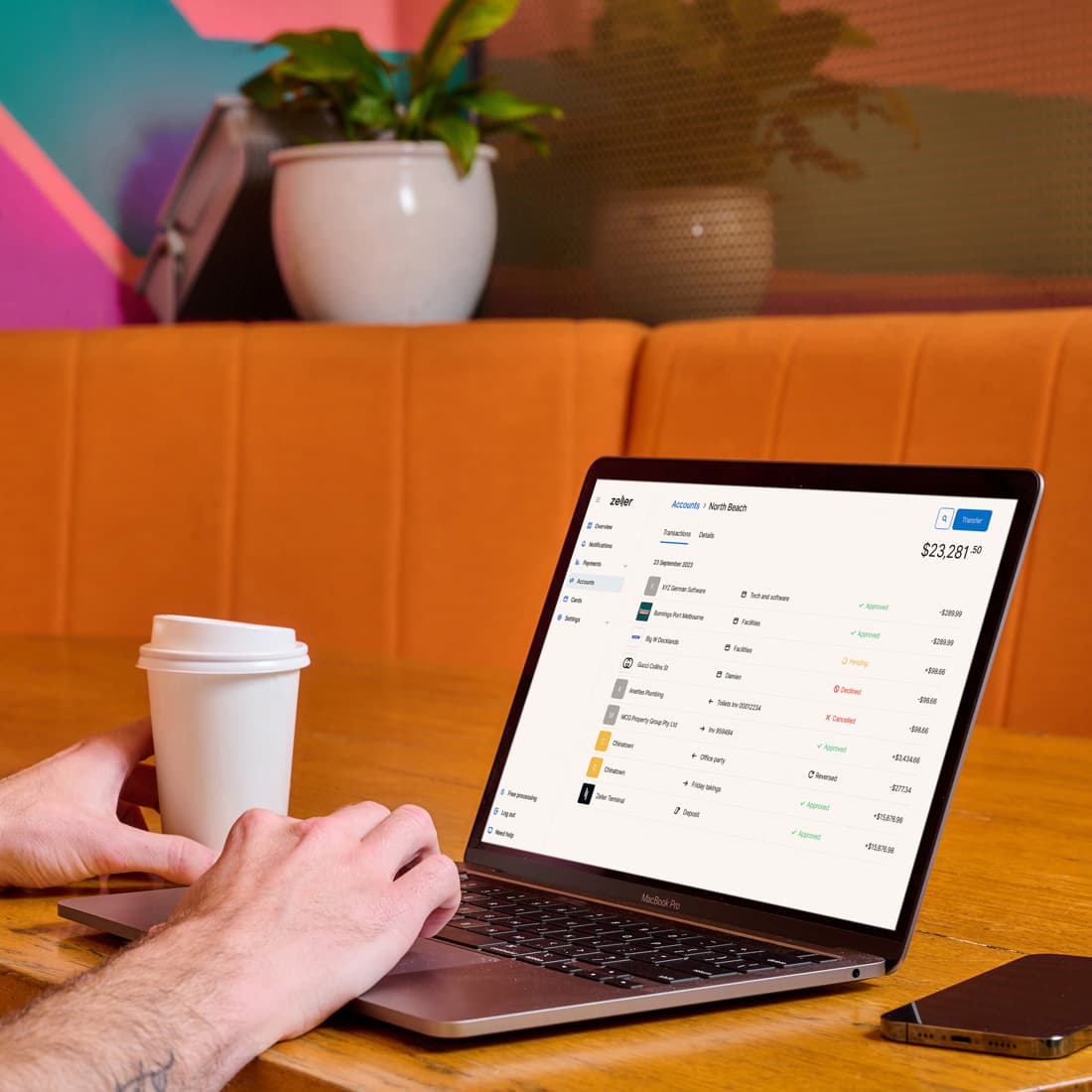

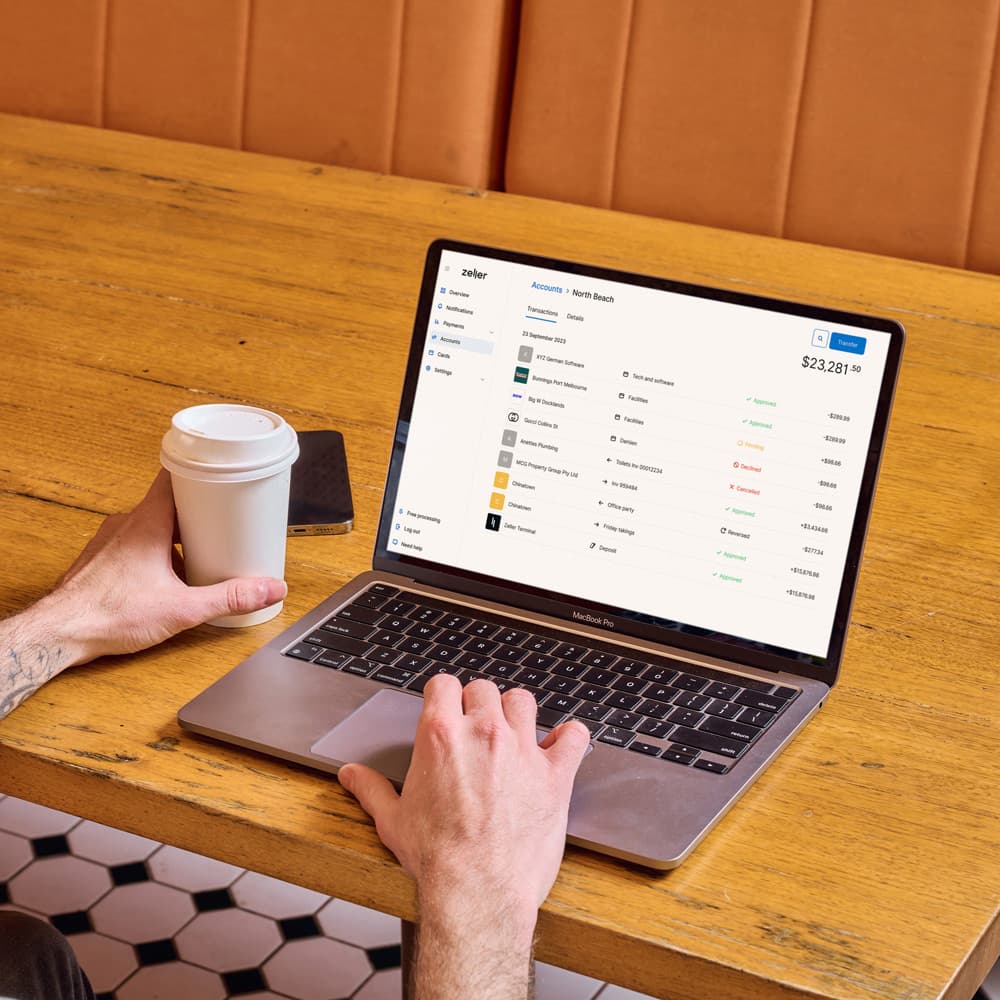

The Zeller system has been designed to streamline the entire payments side of your business, and provide visibility over your incomings and outgoings at a glance. Zeller Dashboard provides a real-time overview of the money flowing into your transaction account, earning interest in your savings account, and being spent via your business debit card, as well as how your current cash flow compares to previous periods.

Still not sure which is the right option for your business? Read up on Best Business Bank Accounts in Australia.

Open a Zeller Transaction Account today

See all your incomings and outgoings in real-time. There are no account-keeping fees, hidden charges or lock-in contracts.