- Banking

What Are Digital Banks and Neobanks?

Studies show the majority of Australian business owners are open to using neobanks in the near future, but many still don’t know what they are.

These days, the thought of visiting a physical bank branch in person feels archaic. However, not too long ago, it was something business owners needed to do frequently.

To open a business banking account, multiple forms of personal identification as well as lengthy business documents had to be handed over to a banking representative, who would complete a number of verification checks before escalating the request to another department. Fast forward a couple of weeks, and the business owner would receive a letter or fax containing next steps.

One set up, business owners would then frequently need to go back to their bank branch to deposit cheques and cash, apply for business loans or make administrative changes to their accounts, among other things.

Digital banking changed all of this — then neobanking came along and revolutionised banking even further.

The days of brick and mortar banks, with expensive overhead costs, are over. Digital banks provide an affordable, efficient alternative.

What is digital banking?

Digital banking is exactly what it sounds like: banking done digitally. It’s a hugely convenient (and popular) way to bank; 52% of Australians do their banking online. For business owners, the ability to manage finances without being tied to a physical bank branch means more time to run their business.

Instead of needing to take time out of their own business day to visit a brick and mortar bank during business hours, account holders can use their mobile phone or computer to do many things, including:

transferring money

managing accounts and loans

paying bills

applying for credit cards, loans, and other services

Although it’s now the norm for traditional banks to have an app, these are simply digital systems applied to legacy banking systems – which themselves are slow to update. These legacy systems have often been built upon over a number of years, if not decades, by multiple people both inside and outside the organisation. That makes both maintenance and upgrades difficult, and costly.

As was noted at the Bank Governance Leadership Network,

“Financial institutions are museums of technology dating back to the 1960s.”

Because of this, there is nothing revolutionary about digital banking apps. The real change that has come about in recent years is neobanking.

What are neobanks?

A neobank is a type of digital bank that offers something completely different to the traditional banking model.

Instead of using legacy systems housed in physical locations, neobanks exist solely in the online world. Not to be confused with the likes of ING and ME Bank – which don’t have physical branches, yet still use legacy banking infrastructure – neobanks offer a completely digital experience.

Financial commentators do not yet have an agreed-upon definition of a neobank. However, the basic concept of neobanks is that they are financial institutions similar to banks, with a few key differences. Namely, neobanks are designed and built with the end user (i.e. the account holder) in mind. That means workflows are optimised to reduce friction and allow account holders to bank with ease. Leveraging technology, neobanks are able to provide a highly personal experience – and some can even shorten the process of being approved for a loan.

In today’s digital world, it’s no surprise that 60% of Australians are open to using a neobank in the near future.

Neobanks and the future of Australian business banking

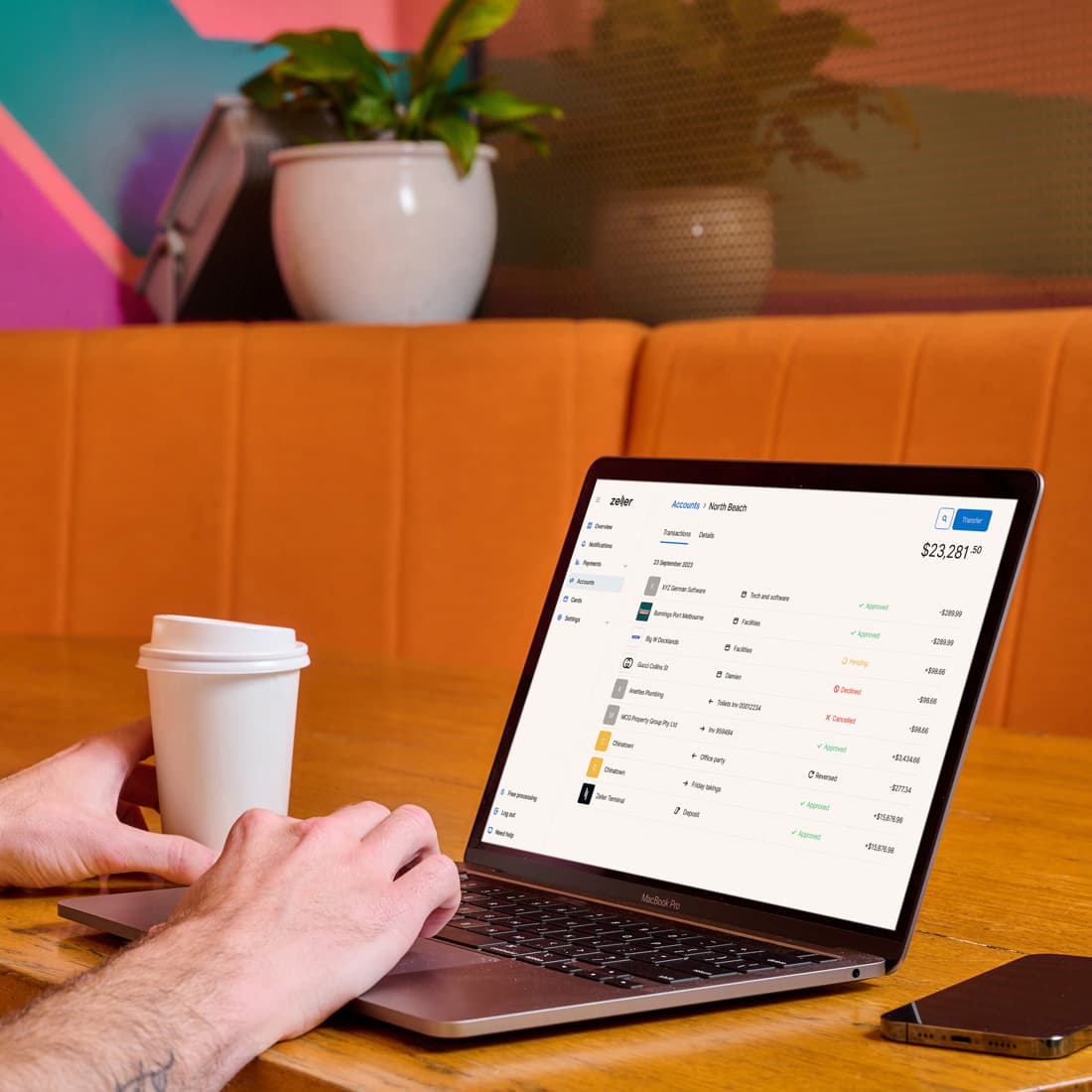

Most people love digital banking for its convenience. With a smartphone, computer or tablet, you can use a neobank from anywhere. As a business owner, that presents some huge efficiency gains.

Because they operate solely online, neobanks have less overhead compared to their traditional counterparts. There are no in-person locations, which saves the company money on rent, employees, electricity and the upkeep of traditional systems. In many instances, neobanks can pass these cost savings on to their customers by charging much lower fees than physical banks — which need to account for rental payments, cleaning fees, staffing costs, electricity and more — as well as those digital banks that rely on legacy systems.

Since neobanks are entirely online and run by tech-savvy operators, processing times are often much faster than they are at traditional banks. Neobank customers can set up accounts, request assistance, apply for loans, and initiate transfers at the click of a button.

Of course, without a physical location, account holders aren’t able to make an appointment to talk with a bank representative face to face. However, there are more efficient customer service options available — phone calls, email and live chat, for example.

It’s no secret that Australians are dissatisfied with traditional banks, and studies show that dissatisfaction is growing. Our research shows 61% of businesses are looking to switch from traditional banks due to high costs, expensive fees, slow deposits and lack of access to local support. The right bank account for your business will give you more time and money to spend where it truly matters: on growing your revenue and improving your customers’ experience.

We built Zeller to enable Australian businesses to get fast access to their funds. Learn more about Zeller Transaction Account, and how it can give you quick access to payments accepted via your Zeller Terminal.