- Business Growth & Optimisation

How to Write a Business Plan: A Step-by-Step Guide

A business plan is critical to achieving your growth goals.

Whether you’re getting your brilliant business idea off the ground or looking to scale an already established venture, the best way to be prepared is to develop and stick to a business plan.

Business planning can be a long and complicated process, if you don’t know the appropriate scope or level of context to explore. Keep reading to learn how a business plan is going to help your business succeed. Then, follow the steps in our business plan template as you put pen to paper and write your own blueprint for success.

Why business plans are necessary

A business’s success relies on a laundry list of items that require considerable attention, including rigorous market research, effective strategies and finance. An effective business plan requires a business owner to consider all of these things.

A business plan isn’t just an outline for what an entrepreneur imagines their business becoming. It’s documentation of each and every step to achieving both short and long-term goals — providing accountability, direction, and valuable information that business owners can reflect back on throughout the different stages of running their business.

An effective business plan serves a number of purposes.

Business plans highlight business risks

Starting and scaling a business is inherently risky. Expanding too quickly or in the wrong market, failing to undertake a suitably specific market analysis, or ignoring gaps in the existing market can have significant ramifications.

In Australia, 50% of businesses fail within their first three years. Of the businesses that don’t make it, many fail due to poor financial planning, preemptive expansions, and overall lack of experience and knowledge from leaders — however, the overwhelmingly common reason for business failure is lack of cash flow.

One of the most important steps in creating a business plan is working out how cash will flow in and out of your business. The faster you can access your takings, the faster you grow your business. The right EFTPOS machine can help speed up the process.

Business plans help to secure funding

The average Australian business takes around a year and a half to become fully funded. Some new business owners dip into their personal savings or turn to friends and family members for startup costs — but this isn’t an option for every new business owner. Sometimes, funding from external sources will be necessary.

Your best bet for securing funding from investors or financial institutions is compiling a detailed and strategic business plan.

However, not all businesses will require a loan. The Australian Government has prepared a guide to help entrepreneurs determine what their funding needs are. It’s worthwhile doing the maths to figure out if your business can grow without the additional expense of loan interest.

Business plans help identify unique selling propositions

To succeed, businesses need to offer something that customers can’t get anywhere else — whether the product or service itself is unique, or it is delivered in the best or most affordable way. These factors are called unique selling propositions (USPs).

In the beginning stages of developing a business plan, when the vision and objectives are explored, these USPs should become clear. They will become critical to marketing your business.

Business plans create accountability

Building a business from the ground up requires a business owner to take on many responsibilities and constantly complete complex tasks. It can be easy for a new business owner to get lost in their many responsibilities and forget their initial vision. A business plan will serve as a blueprint for what was envisioned.

The same goes for scaling an established business. Many business owners hold off on hiring additional staff before it’s certain that the business is growing at the speed anticipated, meaning there’s often a period of understaffing. A business plan will help to ensure everyone involved understands the direction of business growth, and is on a clear path to success.

Now you understand the importance of writing a business plan, it’s time to consider six essential steps you'll need to complete before putting pen to paper.

6 steps to writing a successful business plan

A business plan should be a succinct document, outlining everything from your growth goals, to your marketing budget, to business risks and plans for mitigation.

Consider the below steps as preparation work necessary to create an effective business plan that you can use to keep yourself and your business partners aligned for years to come.

1. Determine your vision and objectives

The very first step of writing a business plan is solidifying the motivation behind the business itself. That means establishing a purpose, mission statement and vision statement. These three things must be aligned.

Purpose

When someone comes up with a business idea, the purpose is likely the first thing they think of. It’s the whole reason for starting the business in the first place. Whether the business’s objective is to make unique, delicious food, or provide a valuable service that the community lacks, the purpose is the driving force behind the innovation. This is also where a business’s USPs begin to emerge.

When a business owner decides to grow their business, the purpose outlined in their business plan may stay the same — but on a bigger scale — or it may shift the direction of the business to keep up with a change in market conditions, for example.

Mission statement

A mission statement is what business owners will show lenders and investors when trying to secure funding. It establishes how the business will meet its goals. There are four questions business owners should ask themselves when drafting a mission statement.

They are:

What industry is the business in?

What are the business’s goals?

What key terms describe the business and what it offers?

How can the business’s objectives best be described?

Many businesses choose to publish their mission statement on their website, to give customers some context as to why they should support the business. Depending on your particular circumstances, this might be a good idea — considering the propensity of Gen Z to support businesses that align with their values.

Vision statement

A business’s mission statement is rooted in what the business can accomplish in the present, and how its day-to-day actions will uphold its values — whereas a vision statement is focussed on the future.

A vision statement looks 5 to 10 years into the future and provides the context for setting long-term goals. How will strategies change as the business grows? What is the correlation between short-term growth goals and objectives and long-term business health?

If the mission statement is the blueprint for today, think of the vision statement as the plan for tomorrow.

2. Solidify your structure

Every business has a legal structure that determines rights, responsibilities and more. The legal structure is sometimes decided for the business owner based on the size and the type of business, as well as goals and plans for growth. However, there is often room for flexibility — so it’s up to a business owner to choose the right structure for their venture.

The most common legal structures are:

Sole trader: A sole trader is someone who owns a business independently. No partners are involved, so the business owner makes all decisions, bears all of the responsibility and accountability, and is the sole beneficiary of the profits.

Partnership: A partnership forms when two or more people go into business together. They share the responsibilities as well as the profit.

Trust: A trust is a person or group of people who own and manage a business for the benefit of others. The owners bear all of the responsibility and liability, but the beneficiaries receive the income.

Company: A company is its own entity, separate from the people who own and operate it. This means that the shareholders of the company are less liable if and when the organisation is sued or incurs debt, and it also means that they have less control over company decisions.

Incorporated association: Like a company, an incorporated association is a legal entity. It is generally established for social, community or charitable purposes, yet it has the same rights as a company.

A business plan will need to include an overview of the business’s structure, including a “who’s who”, so it’s important to understand the implications that come with your chosen structure.

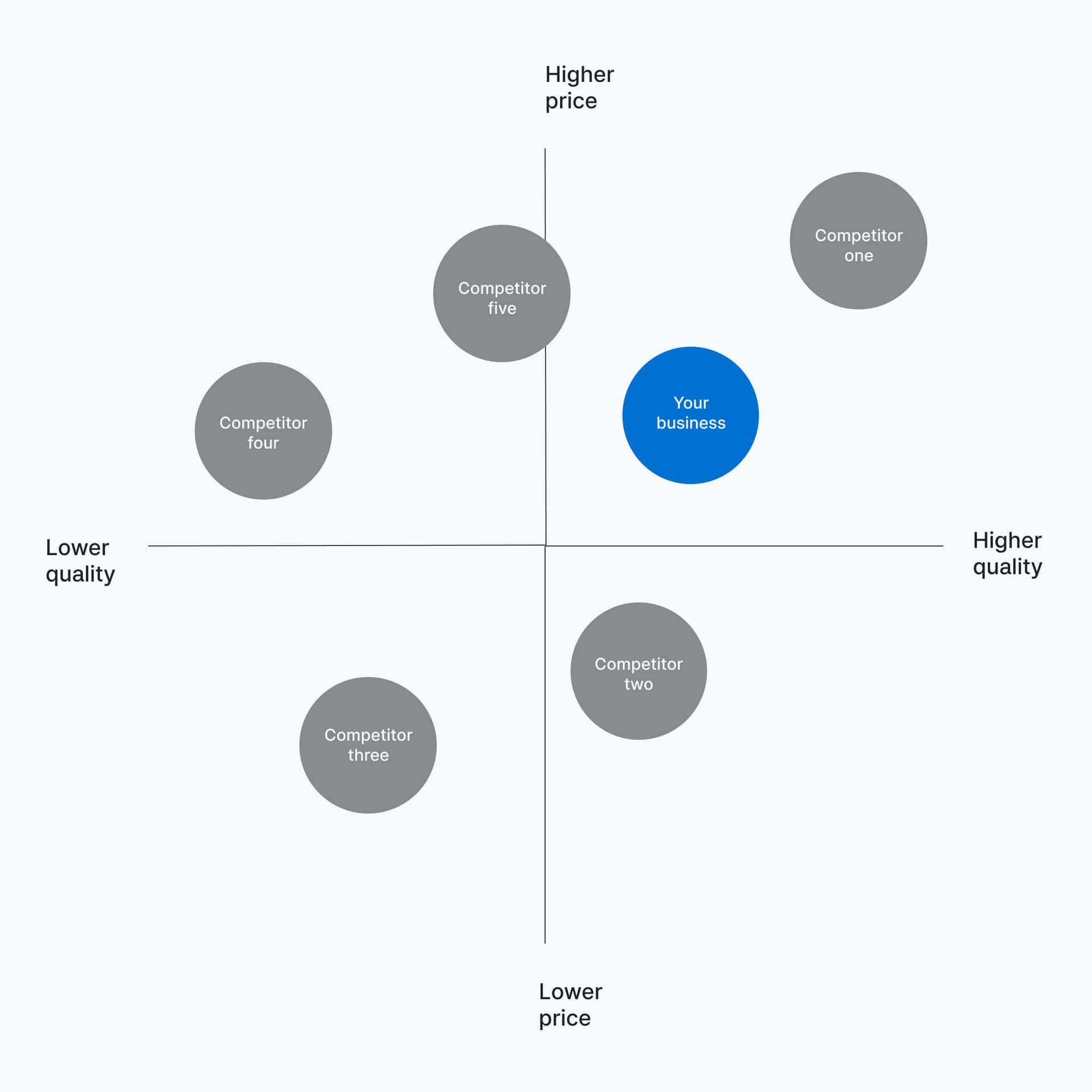

3. Conducting market research

It’s essential to conduct a market analysis before diving too deep into a business plan. Market research provides important context on the industry, including how necessary a business’s product or service is, who the target market will be, and who the business’s competitors are.

There are many directions to go in market analysis. Some effective ways to obtain information on the industry and target audiences include:

Taking advantage of available statistics. IBISWorld has information and statistics on various industries and is frequently updated to keep up with changing trends. Business owners should also check business indicators through the Australian Bureau of Statistics.

Connecting with the public. Use free online survey services to gather consumer information. Business owners can ask about consumer preferences on particular products, customer service, delivery channels and more. There are many free options out there — Wordstream, an online advertising organisation, has compiled a list of what of the 10 best survey services.

Utilising available software. Google Trends is a free online service that can help business owners understand changing trends within their target market. Keep track of keywords relevant to the industry your business operates in, and see if search volume is growing over time.

Testing competitors. Business owners should buy from their competitors to get a sense of the quality of their products or service, as well as their customer service. Retail store owners should shop from other stores that sell similar products and test them for themselves. Restaurant owners should dine at other restaurants that serve similar food, and owners of service-based organisations should book their competitors.

Use this insight to determine how your offering compares to your direct competitors'.

The market research stage can be a great opportunity for business owners to connect with potential customers for the first time — perhaps through market research or survey groups. By connecting with potential customers, you’ll learn more about who your target audience is, and how they spend their money, while also generating brand awareness for your business.

4. Devising a marketing plan

The next step towards documenting a business plan is to devise a marketing plan, which is heavily informed by the market analysis — as well as the particular growth goals of the business. Your marketing plan will help to refine your budget and provide the structure for upcoming marketing activities.

When creating a marketing plan, keep the 7 P’s in mind.

Product (or service). Business owners should consider how they can use their product or service to their advantage. Is it something that can be packaged in an exciting way? Does it photograph well, meaning it would be easy to advertise on Instagram or other social media platforms? Business leaders should leverage these unique opportunities.

Price: Businesses frequently use pricing as a differentiating factor. In general, the price should be high enough that customers know it’s of good quality — yet low enough that it competes with similar businesses.

Place: Where a business is physically located can often impact whether or not a customer shops there. Convenience is a key factor for most consumers, and something businesses should seek to advertise where possible.

Promotion: No matter the product or service, it will need promotion in one form or another. Established businesses may be able to rely on word of mouth, but for a new businesses promotion is critical. The marketing rule of seven states that customers must come into contact with a brand name seven times before they decide to make a purchase from that brand. This could be through Facebook ads, printed flyers, a blog — it really depends on the business and its target market.

People: People are the backbone of any business. Hiring a friendly, knowledgeable and hardworking staff is key to attracting and retaining customers.

Process: The ease with which a customer can purchase a product or book a service may be an element you choose to advertise, for example. A straightforward purchasing process, simple returns process, and speedy customer service are beneficial to both businesses and customers.

Physical environment: It’s not enough for a product or service to be of a high quality — the physical environment of a business needs to be pleasant and inviting. That means comfortable chairs in a restaurant or visually appealing decór in a store.

5. Write a shopping list

The equipment a business needs to operate will depend largely on the type of business it is. Equipment can fall under two categories: tangible and intangible.

Tangible equipment

Tangible equipment means physical items.

Some types of tangible equipment are universal to most, if not all, businesses. For example, all businesses with in-person locations need a payment processor — otherwise, they would be restricted to operate as a cash-only business, which is often unappealing to customers. In fact, 50% of Australians find cash-only businesses inconvenient.

Businesses can take convenience to the next level — for their customers, employees and business owners — by opting for a mobile electronic funds transfer at point of sale (EFTPOS), such as Zeller Terminal. Read more about the benefits of this type of payment processor on the blog.

Other types of equipment may be required, depending on the industry the business operates in. For example, a restaurant may need a walk-in fridge while a trades provider may need a concrete mixer.

Equipment can be expensive, so equipment financing or leasing might be the best route for some business owners. Money.com has a tool for finding equipment financing options.

Intangible equipment

Intangible equipment includes things like a website and accounting software, which are essentials for most businesses regardless of the industry in which they operate.

Businesses typically need a website to get their name out there and provide convenience for customers — whether that’s through e-commerce, or providing a mechanism through which to book a service.

The cost of tangible and intangible equipment will need to be taken into account when creating a budget and financial projections. This is why determining the types of equipment necessary, as well as their costs, early on is important in drafting a business plan.

6. Make a plan to manage finances

Your budget is one of the most important elements in your business plan. You need to understand how much you are able to spend to grow your business, and whether you will be able to generate an income from the business. Fixed costs, such as rent or mortgage, salaries, business insurance and possible equipment leases or equipment financing should all be taken into account — as should variable costs, such as hourly wages, utilities, products, materials, and more.

At a minimum, you will need to create a cash flow plan and establish a balance sheet. These track the money coming in and going out of the business, which is critical to manage in order to ensure your business survives long term.

Once set up, business owners can assess their monthly spending and earnings by analysing their merchant statement at the end of each month, which they will receive if they open a business account. These accounts are essential for long-term business health because they keep business owners organised and provide crucial information on cash flow.

Start writing your business plan

The meticulous research and planning involved in developing a comprehensive business plan can help business owners avoid some of the problems most commonly faced when building or scaling a business.

Once you’ve followed the above preparatory steps, follow our business plan blueprint. Use it to hold yourself to account and make sure business remains on track. Make sure to revisit your business plan at least every year, and make any changes as necessary.