- Banking

How To Open Your First Business Transaction Account

Opening a business account separates finances and makes bookkeeping easier at tax time.

You’ll need ID documents, business details, an ABN and proof your business exists.

Traditional banks often require visiting a branch, while Zeller’s process is fully online.

Business accounts give professional credibility and clearer financial visibility for your company.

Choose an account with low fees, a simple setup, and features that suit your needs.

What is necessary to open a business account?

To open a business transaction account, you’ll need to provide:

certified copies of identification documents, such as a passport or driver’s licence

details of your business

proof your business exists, such as a website and social media profiles

Additional documents may be required if your business operates under a particular structure. For example, if your business operates under a trust, documents identifying the beneficiaries of that trust may be required for account verification. Further, traditional banks often require you to visit a bank branch in person in order to set up a business account.

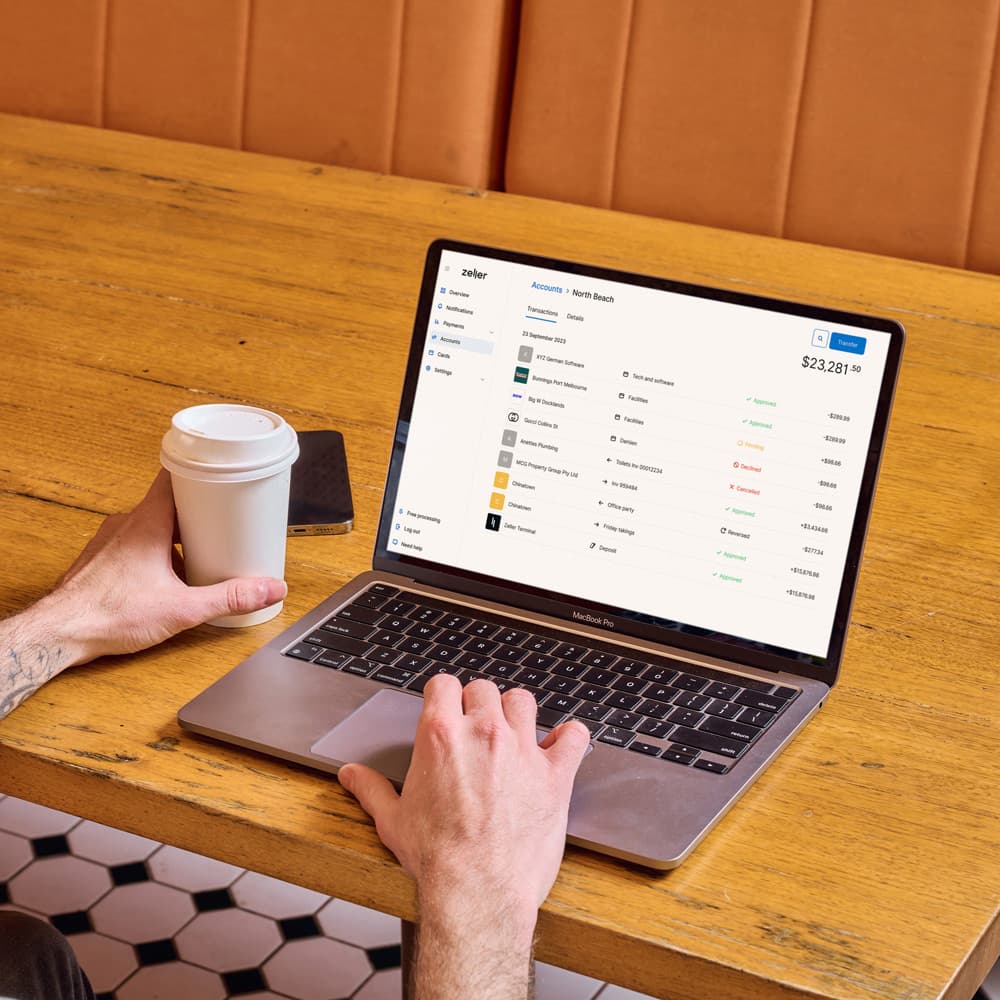

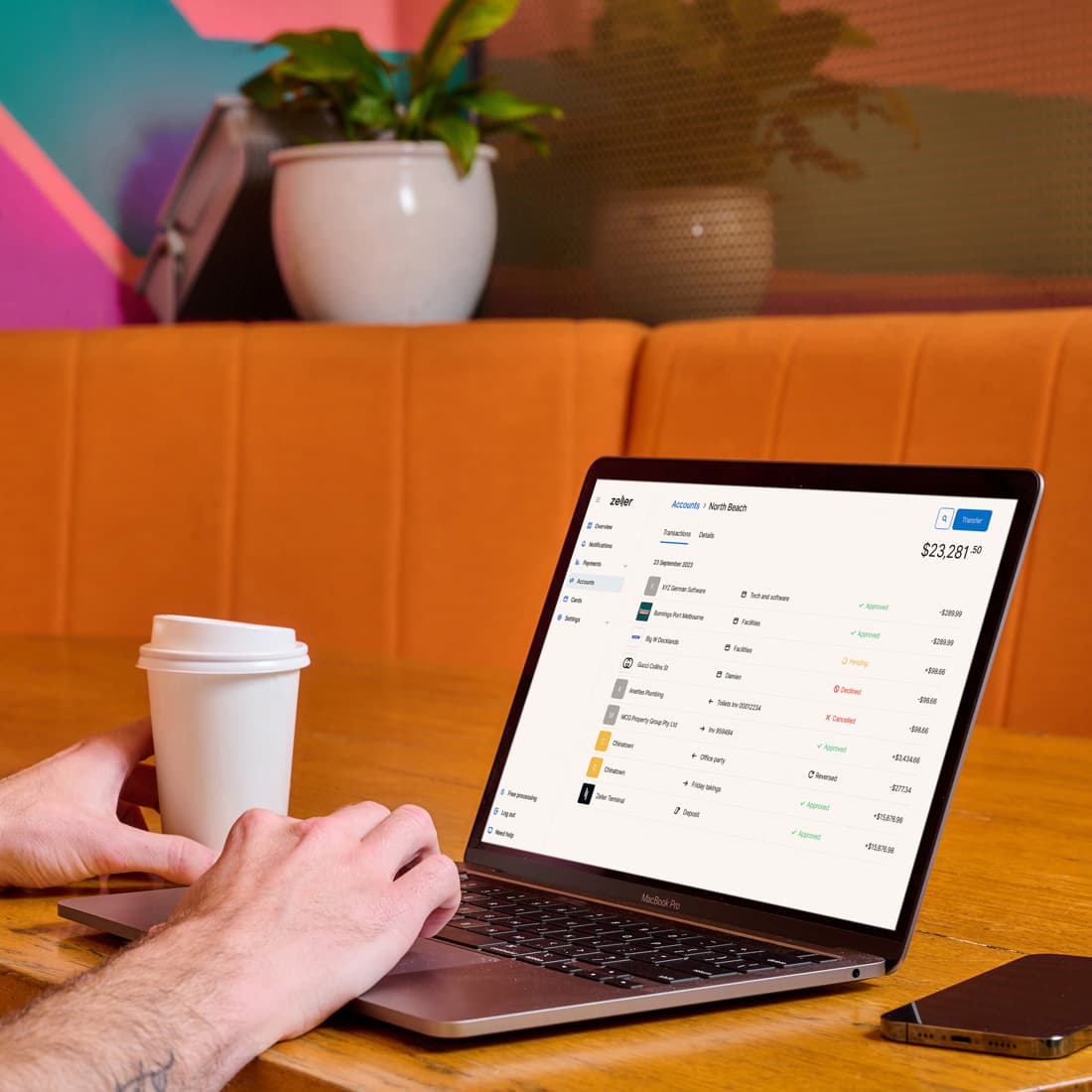

Wondering how to set up a business account, or how to open a transaction account online? The easiest way is to sign up for Zeller. In just 5 minutes, most businesses can be up and running with a free Zeller Transaction Account. Once set up, you can create as many accounts as you like to separate business funds — and link each to a Zeller Debit Card for simple, trackable spending.

Ready to get started with Zeller?

Sign up for freeLet’s dive deeper into the details, so that you can make an informed decision about the best account for your business.

What is a business account?

A business account is an account traditionally offered by incumbent banks. In recent years, digital banks and neobanks have introduced similar offerings. Business bank accounts offer a single place to accept deposits and make payments, while keeping your business and personal finances separate. A transaction account enables you to do the same.

A business account itself is pretty straightforward. Different banks and alternative providers offer additional features and services, on top of the base offering, which usually come with extra costs. Fees including, but not limited to, monthly account fees and minimum deposit fees are important to keep in mind. Focus on finding an account that aligns with your specific needs in order to keep fees to a minimum.

It's important to keep business and personal expenses separate.

Why open a business account?

There are a multitude of benefits that come with opening a separate account for business purposes. For one, setting up a business account can make bookkeeping less of a headache — especially at tax time.

A business account also helps you stay in line with the relevant government rules and regulations. The Australian Taxation Office stipulates that ventures operating as a company, partnership or trust must have a business account for tax compliance. And, while sole traders don’t face the same requirement, a business account provides the same benefit of keeping personal and professional transactions separate. Once your business account is set up, you’ll have a clear path to sharing important information with your accountant or handling your tax obligations yourself.

Business accounts also give you a clear view of your business finances.

All of the relevant transactions are tracked in one place, making it straightforward to look at recent activity and identify any potential areas for concern.

Opening a business account also helps your company appear more mature and professional. While customers won’t notice the difference at the point of sale, they will likely see it when reviewing their monthly statement. The legitimacy a business account offers can also encourage suppliers and vendors to form a relationship with you.

When you hear the term “business bank account”, it’s usually in reference to a transaction account. This type of account is used to make and receive business payments on a daily basis. A business savings account is another type of business bank account, very similar to a personal savings account. These types of accounts serve as a place to deposit and hold money for longer periods of time.

Who can open a business account?

Banks and other providers of financial services have a number of rules and security measures in place to make sure anyone attempting to open a business account is doing so in good faith — and is eligible to receive one in the first place.

The requirements for opening a business account are strictly defined but straightforward, at least as far as the highly regulated world of banking is concerned. You may be asked to provide a variety of documents and information to prove your business is legitimate and eligible for an account. This mostly involves things you likely have on hand right now or can quickly access, such as your company’s full name, Australian Business Number, and tax file number. The physical and registered address of a business are also commonly requested.

You will also need to identify key parties, including both company directors and any employees who will access the account. You, your partners, and potentially your staff may need to produce passports or a certified copy of drivers licences.

When should I open a business account?

Opening a business bank account makes everything from tax time to accepting customer payments easier. As Australians increasingly move to using debit and credit cards for everyday purchases, this will only become more important. A business account is foundational for smoothly processing card and online payments and keeping track of your business’s finances.

You should be looking to set up a business account as soon as you’ve set your business in motion. You’ll need to set aside some time to gather the needed documents and information, but accounts that offer online registration will save you precious hours (and, in some cases, days). You’ll also need to give some thought to the impact any fees will have on your budget. To save on fees, look for providers who are upfront about the costs of using their platform.

How can I open a business account?

Understanding how to open a business transaction account and set it up correctly is crucial. It streamlines day-to-day management of your finances and makes your business appear more professional. And, in many cases, a business account isn’t just a smart idea — it’s a requirement.

You have plenty of choices when it comes to choosing a business account. There are traditional banks, of course, but their offerings don’t always align with the needs of modern business owners. High fees, excessive paperwork, and long application processes can sap your energy, turning what should be a basic task into a drawn-out process. These are just some of the reasons why Australian Businesses aren’t satisfied with the Big 4 banks — and why we built Zeller.

We’re reimagining business banking for Australian merchants. With Zeller, you can sign up in minutes and begin taking payment. Discover how our fee-free Zeller Transaction Account, used in conjunction with Zeller Terminal and Zeller Debit Card, can help accelerate your cash flow and grow your business.