- Business Growth & Optimisation

Does the Cost of Acceptance Outweigh the Price of Rejection?

While the added expense of card processing fees may paint cash-only business as an appealing option, in the scheme of things, the cost of acceptance is a small price to pay.

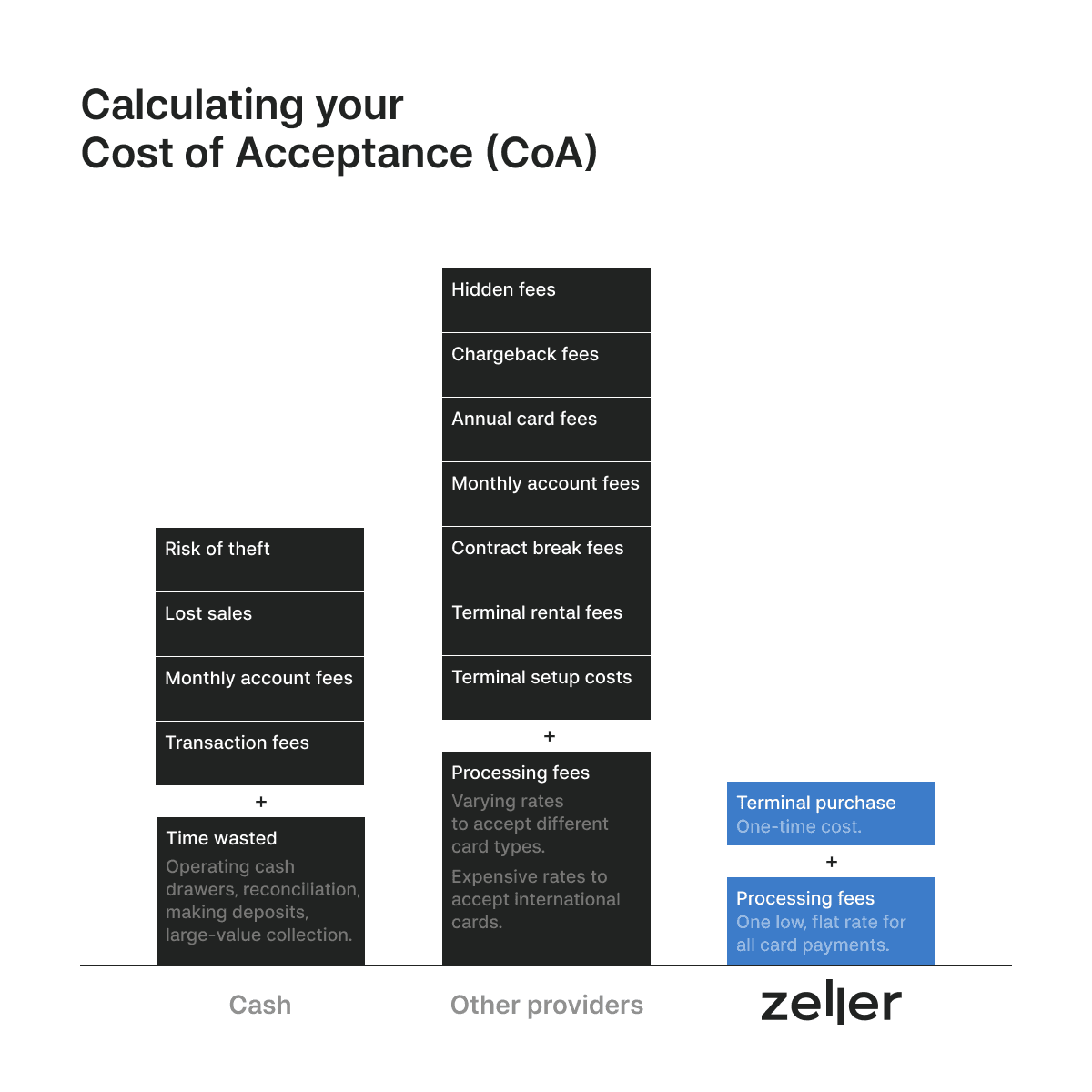

There’s a common misconception in the business world that restricting your business to cash-only exchanges comes with significant financial savings. This comes down to the belief that equipment costs and processing fees far outweigh the extra revenue presented by card payments.

While this belief may have held true a number of decades ago, when only a small percent of customers would reach for their debit or credit cards, this simply isn’t the case today. In fact, you might be surprised to learn that the cost of only accepting cash is surprisingly high (we’ve even gone as far as to say it’s detrimental to business).

So, with debit and credit cards now the payment method of choice, it’s important to understand the true cost of acceptance for card payments, and how it compares to the cost of cash-only business.

Discovering what you're really paying to accept payments isn't as straightforward as we believe it should be.

Calculating cost of acceptance for credit and debit cards

One perceived advantage of accepting card payments is the ability to work out exactly how much it’s costing you. In an ideal world, you’d be able to glean this cost by simply reading the Cost of Acceptance (CoA) Statement provided by your bank. This document identifies the fee you’ve been charged for accepting credit and debit card payments. Both your bank and other third parties must provide you with a CoA Statement in June of each year. In addition, the RBA has made it a requirement to issue statements that clearly set out the average cost of acceptance for each card scheme.

However, this document doesn’t take into consideration other fees some merchant services providers charge, such as terminal rental and gateway fees. Many merchant services providers also charge varying rates for accepting different card types, adding an additional layer of complexity. These fees will need to be derived from your merchant statement — which can be a confusing document to interpret.

If Zeller is not your chosen merchant services provider, you might need to do a bit of digging to work out your true Cost of Acceptance. However, if you know how to uncover any hidden fees in your CoA Statement and merchant statement, you should be able to work out how much it's costing your business to accept credit and debit cards.

Calculating the Cost of Accepting Cash

On the other hand, calculating the cost of acceptance for cash is a more complex and volatile equation.

While card transactions incur a fixed fee, cash transaction fees increase in proportion to the value of the transaction. So as soon as your customers are spending more than loose change on a purchase, you’re actually paying a higher fee for the transaction than you would a card payment.

That being said, the cost of acceptance isn’t as simple as the sum total of your transaction fees. It also includes a number of other factors that aren’t immediately obvious.

These include:

logistical costs, such as opening and closing cash drawers, performing change requests, large-value collection, and on-site theft (something you’re much more susceptible to if cash is your only payment method).

back of store processes, such as counting drawers, making deposits, contracting with cash-in-transit companies, and associated bank fees.

loss of sales, which can result from slower checkout lines— negatively affecting both customer patience as well as your own ability to conduct a higher volume of transactions.

While the issue of lost income is serious, the reality of lost time is even more concerning.

On average, Australian businesses waste 216 hours a year handling, counting, and banking cash.

That's a lot of precious time that could otherwise be spent invested in optimising business functions, organising stock, building your professional network, exploring a new market, or simply making extra sales.

On top of these factors is the added cost (and risk) of counterfeit currency. While there are a number of ways you can safeguard against card fraud it's significantly harder to detect 'fake money' in live transactions, particularly when there's no record of the customer's details other than a receipt of purchase.

Can Your Business Afford the Cost?

Needless to say, the costs of running a cardless business are neither straightforward nor small. While on the surface it may seem as though you've avoided expenses like card transaction fees and equipment hire, in the long-term you've likely forfeited more time and money by rejecting card payments.

The reality is that accepting modern forms of payment opens your business up to opportunities that far outweigh the costs of cash-only operations. This is especially the case if you’re able to bundle all of your hardware and software in one complete package, like Zeller, further minimising costs and creating a more seamless purchase experience for both your business and customers.

Discover your current Cost of Acceptance

As a cash-only business, it can be difficult to know where to begin when it comes to accepting card payments. A good starting point would be to learn about how EFTPOS payments work.

If you're already accepting card payments at your business and would like to understand how Zeller can help save you money, contact our Sales Team.

.png&w=1920&q=75)

Switch to fee-free EFTPOS

Keep more money in your business with flexible, fee-free EFTPOS card payments. Pass your cost of acceptance on to customers with the toggle of a switch.