- Payments & Point of Sale Solutions

Accepting Credit Cards is Critical for Business

What was once the go-to option for making purchases is fast becoming a thing of the past.

Cash is no longer king. The most recent Consumer Payments Survey, conducted by the Reserve Bank of Australia (RBA) every three years, paints a bleak picture for the future of physical currency — and poses a problem for cash-only businesses.

In 2019, 32 per cent of all in-person payments were made using cash. However, those purchases accounted for just 19 per cent of all in-person purchases. Three years prior, in 2016, 43 per cent of in-person payments were made using cash, accounting for 30 per cent of purchases. It’s a steep rate of decline that’s hard to ignore.

As cash use continues to fall, and electronic payment methods become the go-to option for consumers, it becomes obvious that it’s not just a good idea to accept credit card payments for your small business — it’s vital for long-term success. Luckily, it’s surprisingly easy to start accepting credit card payments in Australia. Keep reading to learn more about the shift away from cash, why this change of preference impacts your business, and how to keep your customers happy by providing credit card payments as an option.

Some businesses are limiting their ability to grow by only accepting cash payments.

Why do some businesses still operate as cash-only?

A surprising number of businesses remain cash-only, despite the obvious benefits of accepting credit card payments. Among these are often food trucks and other street vendors, nail salons and some restaurants and coffee shops.

Reasons for cash-only

The decision to remain cash-only could be for a number of reasons; it could be due to something as simple as preference towards cash and resistance against change, or lack of a stable internet connection, or tax avoidance, or something else entirely. The most commonly cited reasons for not making the switch to accept more modern forms of payment are:

no credit card processing fees

no waiting for payments to clear

more straightforward accounting

However, none of these reasons make it a more affordable option for business. In fact, not accepting credit cards could be costing a business in more ways than one.

Perceived benefits don't outweigh the costs

Providing no other option but to pay with cash can be a frustrating experience for a customer. It might even cost you their business. Research undertaken by the Australian Tax Office shows Australians are twice as likely to consider a cash-only payment experience as negative, rather than positive. That means operating as cash-only can have an impact on business reputation. That’s just one reason why knowing how to accept credit card payments in Australia is essential.

The ATO has also done the maths to figure out whether accepting cash payments makes sense, from a financial standpoint, and discovered that processing a cash payment actually costs businesses nine cents more than processing a tap-and-go payment — while also taking about twice as long.

Operating a cash-only business can cost you customers.

Cash: kept on hand but not put to use

Paper currency and coins will continue to play a role in payments well into the future. There’s no reason to think you won’t have at least the occasional customer who wants to pay for a purchase, especially a small one, with hard currency instead of a card. However, it’s becoming less and less common.

The RBA has tracked a consistently downward trend in coin and currency payments since at least 2007, and the demographical data strongly suggests this trend will continue. Although older generations are still hanging on to their cash, just four per cent of 18 to 29 year olds make payments using cash on a frequent basis. Over time, that means this move away from cash will only become more noticeable.

While it’s true that there was an injection of $11 billion worth of physical currency into circulation throughout the coronavirus crisis in 2020, the RBA has reported that this cash was stockpiled — not spent — suggesting a lack of confidence in the economy. Australians are keeping more coins and cash on hand, but you won’t necessarily see it flow into your business. Instead, your customers are continuing to turn to payment options beyond currency.

Options for accepting credit card payments for small businesses

All this talk of broad economic trends and data has an incredibly relevant point: your customers want to pay with a credit card and, as a business owner, your goal is to bring in revenue. So, how can you start accepting credit card payments at your business?

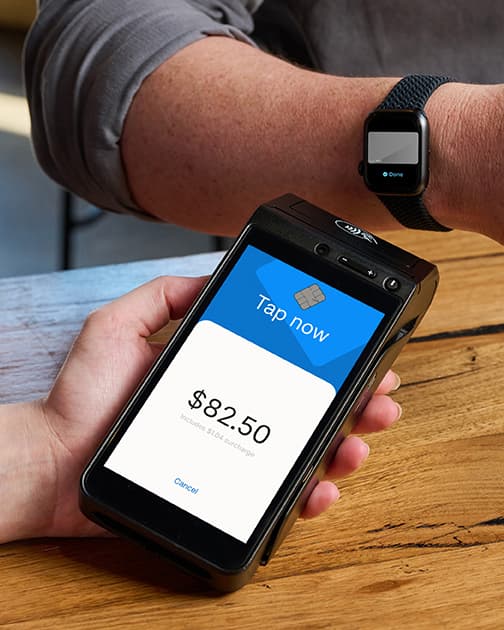

The short answer is you need the right tools in place to accept credit card payments at your business. An Electronic Funds Transfer at Point Of Sale (EFTPOS) machine and a business account are the foundation of your business’s ability to process credit cards. This combination allows you to accept payment by processing cards in person, and then access your funds.

There are plenty of options available to your business. An EFTPOS machine linked to a merchant account provided by a Big 4 bank is the most traditional. However, the process of applying for a business account and then ordering and setting up a payment terminal is often slow and time-consuming. A bank’s standards may even box out some smaller companies and new businesses without credit history or operating history.

This route also isn’t typically the cheapest way to accept credit card payments in Australia, and it can take a number of business days for funds to reach your merchant account. That means your merchant account can actually be a bottleneck to your cash flow.

An online merchant gateway, like PayPal or Stripe, is one option for e-commerce ventures. However, accepting in-person payments using an online gateway is often clunky and requires a number of workarounds; you’re effectively entering your customer’s details as if you were them. This is likely to leave your customers less than thrilled about the experience — and you and your staff consistently spending extra time on an everyday task.

SME-focused alternatives

Pairing a modern EFTPOS payment terminal with a banking alternative to the Big 4, such as a neobank, is an option many business owners are now considering. Frustrated with the lack of support traditional banks provide to large enterprises, small and business sized business owners are looking beyond the incumbents and setting their sights on more forward-thinking providers.

When you take payment via Zeller Terminal, funds are settled into your Zeller Transaction Account on the same day — giving you fast access to your funds. Spend the money you make using your Zeller Mastercard as soon as funds clear. It’s the quickest way to speed up your cash flow and grow your business.