- Banking

Best Business Debit Cards in Australia for 2026

Business spending and tracking should be simple, yet many traditional banks’ business debit cards lack important features while also having unnecessary fees and restrictions.

In this article we compare the best business debit cards in Australia for 2026, including those issued by the big-4 banks, and the Zeller Debit Card – our smarter, modern alternative that’s designed to help you better manage your business spending.

Compare Zeller Debit Card to the big-4 banks.

Say goodbye to monthly debit card fees

Traditional banks may charge account fees of up to $10 per month, just for the benefit of managing your own money the way you want. With Zeller, there are no hidden fees attached to our transaction accounts or business debit cards – just seamless spending online and in-store with a fully featured, cost-free business debit card.

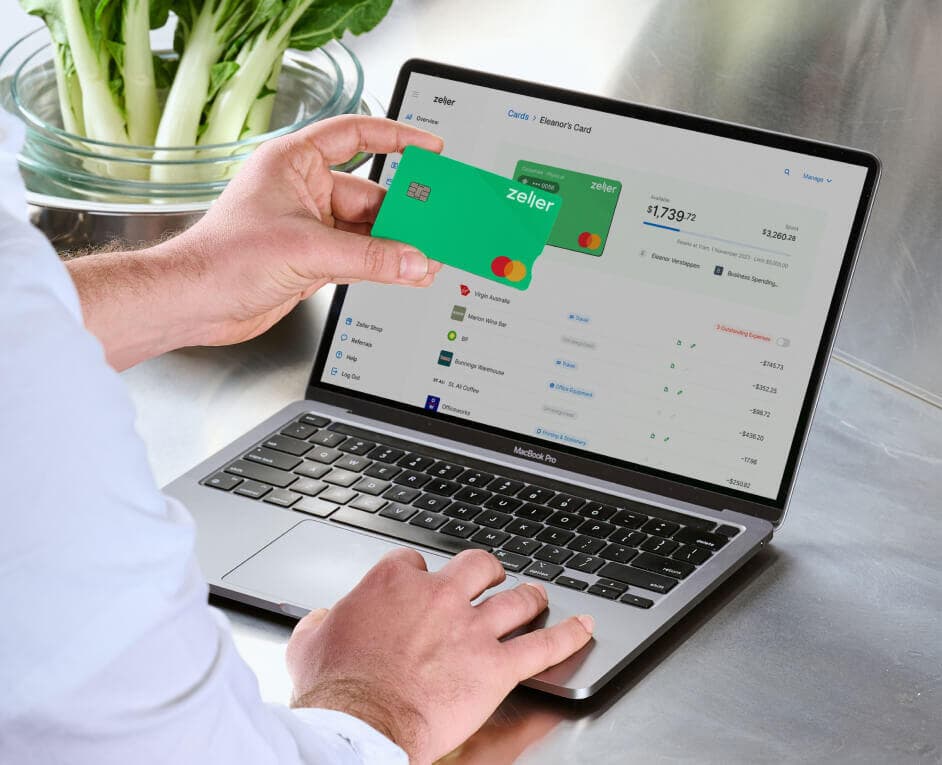

Effortless money management via Zeller Dashboard and Zeller App

Unlike traditional banking apps which can be clunky and outdated, Zeller’s intuitive dashboard and app give you full control over your spending. View and manage cards, check balances, track purchases, lock cards and manage security, and set spending limits across multiple Zeller accounts in real-time with ease from either Zeller Dashboard or Zeller App.

Powerful reporting and analytics

Unlike traditional banks that provide only basic transaction summaries, Zeller lets you delve deep into your business debit card spending for useful insights into your cash flow. Get an overview across all your cards and filter or export transactions by date, amount, category, vendor, transaction status, and more, giving you a clear financial picture to plan ahead for your business.

Advanced security and fraud protection

With scams on the rise, you can put your mind at ease knowing that Zeller Debit Card transactions are processed with multiple layers of secure encryption and authorisation, including multi-factor authentication. Instantly lock or report lost or stolen cards via the Zeller Dashboard or Zeller App, ensuring your funds remain secure.

Transaction tracking and reconciliation made easy.

Business expenses vary, from buying the essentials like office supplies to recurring payments to suppliers and more. With Zeller, you can attach customer, supplier or vendor profiles to transactions, build a contact directory, attach receipts, and streamline your bookkeeping with direct integration to Xero Bank Feeds, eliminating the need to manually import transaction details.

The Zeller Debit Card in the box being activated instantly is a great feature. Linking the account statements to Xero was a breeze - everything just works. Very happy.

Peter Green, Arafura Connect

Instantly issue unlimited business debit cards.

Many traditional banks limit the number of business debit cards you can have per account or have restrictive requirements when you’re ordering additional cards. With Zeller, you can issue unlimited physical and virtual business debit cards instantly from the Zeller Dashboard or Zeller App. This is perfect for businesses looking to streamline expense management, empower employees with controlled spending, and ensure fast access to funds without needing reimbursements or petty cash.

Customise your cards with your brand logo.

You can also personalise your Zeller Debit Cards with your brand logo, which is a simple way to reinforce your identity every time you use the card. Whether you order for team members, contractors or different branches, uploading your logo makes each card visibly yours. It adds professionalism, makes your cards easier to spot and reduces mix-ups between personal and business spending.

Virtual business debit cards for modern businesses.

Once you’ve ordered a new virtual card, you can add it to your Apple or Google Wallet and start spending online or in-store immediately. Using virtual cards adds another level of financial protection because the technology disguises sensitive card data and ensures that your actual card information cannot be used or stored by the payment processor.

Managing a large team? Try Zeller Corporate Cards.

For businesses with multiple employees, Zeller Corporate Cards provide a streamlined way to manage spending. Issue individual or project-based cards, set custom spending limits, and automate budgets. No manual staff reimbursements, just real-time cash flow tracking. Try it free for 60 days, then it’s just $9 per active card per month thereafter.

How to get a Zeller Debit Card.

Issuing Zeller Debit Cards and opening a Zeller Transaction Account is free, fast and can be completed online in minutes – no need to wait in line at a bank or fill out lengthy paperwork. You'll just need your ID documents (e.g. driver's licence, passport) and ABN/ACN.

Plus, Zeller’s 24/7 support team is always available if you ever need some extra help. Say goodbye to your outdated business bank debit card and hello to cost savings and powerful features the big-4 banks simply can’t match.

Switch to a Zeller Debit Card today

Say goodbye to lengthy applications that come with traditional business debit cards. With Zeller, you can issue physical or virtual cards in seconds to take control of team spending, monthly bills, and subscription payments.