- Product Updates

What’s New at Zeller this December

Discover the latest tools and features powering Zeller.

We’re always looking for ways to make the financial side of your business simpler, and build even more power into the Zeller platform. The feedback you provide, coupled with advancements in technology and new developments in the payments industry, mean we’re constantly developing new functionality and tools.

In the last few weeks, we’ve delivered new functionality that enables you to:

further customise your receipts

download lists of transactions and settlements for analysis

easily see why a transaction was declined or cancelled, from within the payment flow

and much more.

Here’s a wrap-up to ensure you’re getting the benefit of the latest features and tools available in your Zeller Dashboard and on your Zeller Terminal.

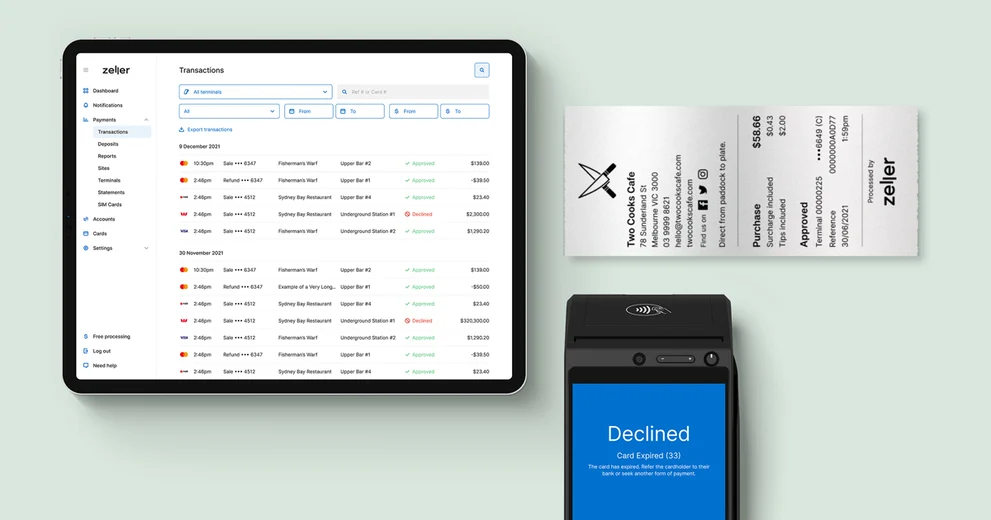

1. More opportunity to customise your receipts

Most customers like to pocket a receipt after making a purchase — especially for larger-value purchases. Why not use it to your advantage?

Your business’s receipt is another opportunity to reinforce your brand and remind customers of their interaction with your business, as well as communicate important customer information (such as your returns policy). The more information you include, the better for your business.

The latest Zeller enhancements include even more receipt customisation options, including the ability to add social media icons to your printed receipts, and social media links to your digital receipts. Adding your business’s Instagram, Facebook and Twitter handles makes it easier for you to grow your following, and for customers to keep up to date with what’s going on at your business.

You can customise your Zeller receipts from both Zeller Terminal and Zeller Dashboard by following the steps below.

From the Sites tab, select a Site to update its Terminal settings.

Navigate to the Receipt tab.

From here, you have the option to toggle on Always print store copy, Print company logo, Print social media links, and Print notes.

Click Save.

When you set up your Zeller Account, you were prompted to enter your business details — including your website and social media handles. These details will appear in the Receipt tab. If these details require updating, simply type your updated details and click Save.

2. Download your list of transactions and settlements

We’ve also enabled you to export your business’s transaction and settlement histories, providing the opportunity for easier analysis of key business information — as well as better data retention.

You can now:

download a list of transactions processed through Zeller Terminal, and

download a list of settlements made to your Zeller Transaction Account, or any external third party bank account.

We know every merchant runs their business in their own unique way, so you have the option to download these histories as a CSV, PDF or Excel (XLS) file — whatever works for your business. What’s more is that you have the ability to apply a number of different filters to drill down into your histories and learn more about your business’s finances.

How to use your transaction histories

Follow the below steps to download your transaction history.

Expand the Payments menu, then click Transactions.

Set the appropriate filters. You have the option to filter by the Zeller Terminal through which the transactions were processed, status of the transaction, date range, and transaction amount.

Click Export transactions, and choose a file format. Then click Download.

When you download a list of your transactions, you will be able to easily work out:

the number of declined transactions

what type of cards your customers most commonly use

the average transaction amount

how much GST you must pay

the total amount of surcharges you have passed onto your customers

the tips your business has received

for any given period of time, and much more.

This functionality will be particularly handy after the busy Christmas season; download your list of December transactions and file it away for when you’re ordering stock for Christmas 2022, for example.

How to use your settlement histories

Settlements are the funds paid to your chosen account, from your daily sales. Having the ability to export a list of your settlements enables you to easily track progress towards business goals.

To export your settlements, follow the below steps.

Expand the Payments menu, then click Settlements.

Set the appropriate filters. You have the option to filter by date range and settlement amount.

Click Export settlements, and choose a file format. Then click Download.

You can use your settlement history to see:

the total amount collected through Zeller Terminal

all merchant fees payable

any outstanding payment amount

and more, for the chosen date range.

3. Automatic payments for Zeller SIM Card

Having the ability to accept payment from every customer is critical. No matter where you are — in a rural town, at the top of a ski field, or jumping from market to market — Zeller ZIM Card enables you to run your business without relying on WiFi or a personal hotspot.

Powered by Optus, which covers 98.5% of the population of Australia, Zeller SIM Card is a reliable solution for any business that wants to be able to transact even when faced with poor internet connectivity and service disruptions.

Previously, you needed to remember to log in to Zeller Dashboard and pay your monthly SIM Card fee. With this update, Zeller SIM Card is now paid via a subscription model. For those businesses that use Zeller SIM Card, the monthly fee of $15 will be deducted from your nominated Zeller Transaction Account, or any external third party bank account. This change is automatic and applies to all Zeller merchants with a Zeller SIM Card from 1 December 2021.

If a payment is missed for any reason, you will immediately be advised and prompted to make a payment so that you can continue to operate your Zeller Terminal using Zeller SIM Card with the least amount of disruption to your business.

Visit the Zeller Shop to purchase yours today, or read more about the benefits of Zeller SIM Card on the blog.

4. Identify why a transaction was declined or cancelled

A customer’s card may be declined for any number of reasons. When that happens, your goal is simple: try to progress the transaction and make the sale.

A few months ago, we developed functionality that enables you (and your staff) to view the reason for a declined transaction on both Zeller Terminal and Zeller Dashboard. Now, it’s even easier to identify the issue and quickly loop the customer in.

When a customer’s payment is declined, the reason for the decline will now automatically appear on Zeller Terminal — no need to navigate to another screen. Simply read the reason for the decline out to the customer.

If you have any questions, reach out on Facebook or call our Support team on 1800 935 537. Or, email feedback@myzeller.com to provide any product feedback or feature ideas to our team directly.