- EFTPOS & Point of Sale Solutions

Introducing Tap to Pay on iPhone with Zeller App

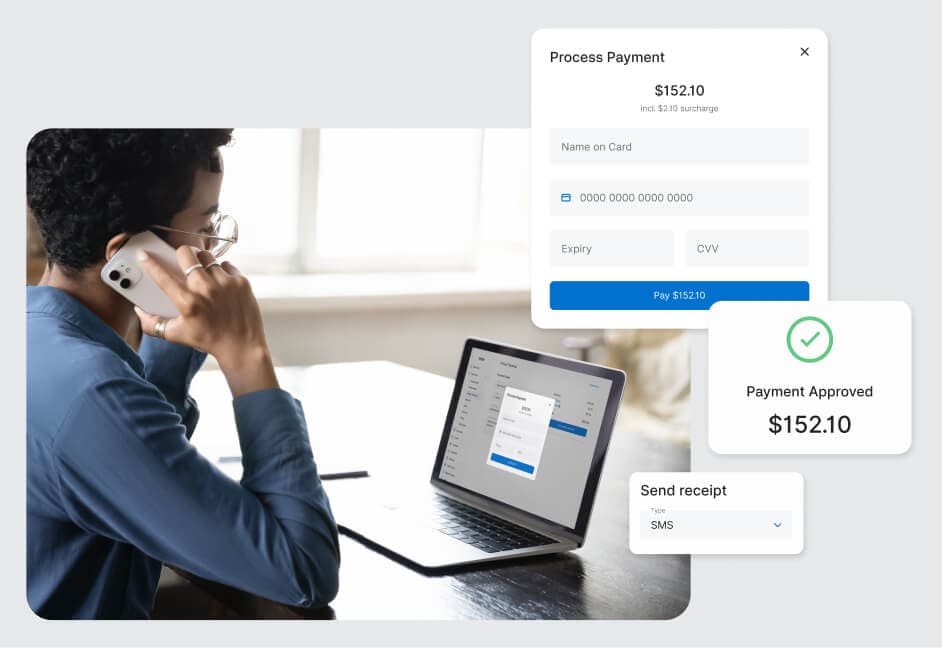

No EFTPOS machine? No problem. All you need is your iPhone and Zeller App.

Welcome to the future, where transactions can be made instantly, contactlessly, securely, and now without any additional hardware. Whether you’re a sole trader or a fast-paced business looking for a flexible back-up solution, Tap to Pay on iPhone, which is now enabled in your Zeller App, lets customers pay you easily on your iPhone. To learn more about how to enable Tap to Pay on iPhone click here.

Powered by Zeller’s industry-leading smartphone app, this new solution to accept contactless payments includes all the Zeller functionality you know and love, including tipping, surcharging, transaction notes, digital receipts, sales tracking and more. With a straightforward set-up process and one low, flat transaction fee for all cards, Tap to Pay on iPhone and Zeller App does away with complex paperwork, branch visits and fee schedules, instead affording you the ability to take payments quickly and simply. Read on to discover everything you need to know about this cutting-edge tool and how you can get up and running in a matter of minutes.

Not an iPhone user? Learn about Tap to Pay on Android here.

What is it?

Tap to Pay on iPhone is a payments feature, now available on the Zeller App, that lets you accept contactless payments on your iPhone, without the need to invest in an EFTPOS terminal. Customers can simply tap their credit or debit card, Apple Pay, or digital wallet to your iPhone, and/or enter their card PIN number, just like they would do on a regular EFTPOS machine. In this case, the transaction is accepted using EMV Contactless technology.

How does it work?

Once you’ve signed up online for your free Zeller Account, downloaded the Zeller App to your iPhone, and set up Tap to Pay on your device (see below) accepting contactless payments is a breeze. Simply tap on ‘Tap to Pay’ in the sidebar, key in an amount, present your iPhone to your customer who can pay using a physical card or digital wallet, and wait for the transaction to be approved. It’s as simple as that.

Do all iPhones have Tap to Pay?

Currently, the feature is available to all users with an iPhone XS or later, using iOS 16.4 or later. It’s important to note that in order to use Tap to Pay on iPhone, users must be signed in to their iPhone with an Apple ID.

How much does it cost?

Zeller charges one low, flat fee of 1.4% per transaction, for all card types — including American Express. However, businesses have the option of passing on this fee to their customers through surcharging. Businesses can choose to toggle surcharging on or off via the Zeller App or Dashboard.

Who is it designed for?

Tap to Pay on iPhone and Zeller App is a flexible solution that can be used by all types of businesses, but is especially suited to those whose payment processing requirements don’t justify a full-scale fleet of EFTPOS terminals or advanced features such as Integrated EFTPOS, Pay at Table or printed receipts. What solution you choose will largely depend on your volume of customers and your specific business needs.

If you run a busy bar, having a hard-wearing EFTPOS machine on the counter is naturally a better choice. However, for sole traders on the move or smaller businesses such as market stalls, boutiques or clinics with a need for only one or two payment terminals, Tap to Pay on iPhone and Zeller App is an ideal solution.

Regardless of your business size, having the Tap to Pay on iPhone feature set up can give you peace of mind, knowing that you’ve got a quick and easy backup option if you ever need one.

What about receipts, refunds, and tipping?

Tap to Pay on iPhone with Zeller App does not compromise on functionality. Digital receipts can be sent to your customers via text or email; the tipping option can be toggled on, which automatically presents your customers with the option to leave a tip; and users will be able to process refunds directly from Zeller App. What’s more, transactions can be assigned to a contact and notes can be left, making reconciliation a breeze later on.

What cards are accepted?

Tap to Pay on iPhone and Zeller App accepts contactless payments for all major cards including Mastercard, Visa, American Express, Apple Pay, and a range of other digital wallets including Samsung Pay and Google Pay.

Is Tap to Pay safe?

Tap to Pay on iPhone uses the built-in features of iPhone to help keep your business and customer data private and secure. When a payment is processed, Apple doesn’t store card numbers on the device or on Apple servers so combined with Zeller’s industry-leading security, you can rest assured knowing your business and customer data is protected.

Is Tap to Pay available on Android?

Yes it is! Click here to learn how Tap to Pay works on Android.

Get started.

If you’re not yet using Zeller, you will need to create your free account first. This can be done on a desktop or mobile device in a few minutes. Then, simply download the Zeller App.

If you already have a Zeller Account, log in to the Zeller App.

Once on the app, follow the prompts to begin your set up and start taking payments in minutes.