- Business Growth & Optimisation

7 Reasons Your Business Shouldn’t Be Cash-Only

Making the decision to run your business cash-only is costly.

While it is legal to operate a cash-only business in Australia, it's a poor strategy for business growth. Beyond the accounting headache, choosing to only accept cash payments will eventually limit your sales capacity. Cash is increasingly giving way to more convenient digital payment methods.

For some merchants, the small cost of transaction fees is enough to keep them operating their business as cash-only. Yet the perceived benefits of avoiding digital payments also come at the expense of useful, real-time insights you can use to help your business grow. Ultimately, it is a decision that will cost you time, customers, and growth opportunities.

Considering running a cash-only business? Here are 7 reasons why you shouldn’t.

It’s a waste of momentum

Sometimes, when a business is just getting set up, it makes sense to temporarily operate as cash-only. If you’re simply testing out the market, setting up the processes involved with digital payments and purchasing an EFTPOS machine can seem like unnecessary admin. However, as soon as your business is established, it’s doing your business more harm than good to reject other forms of currency — especially in your first few months of operation.

Turning away potential customers in the launch phase (when you should be gaining traction in the market) is bad business. If someone wants to support your new business, but can’t because you don’t accept the most common forms of payment, they are unlikely to return. Using an EFTPOS terminal to accept payment for your newly-launched product or service also lends legitimacy to the transaction, as the transaction is traceable and a receipt of purchase can be provided.

Accounting is a headache

No one likes bookkeeping, but it’s important to get it right. Running a cash-only business can be an accounting nightmare.

Keeping track of cash is challenging. It can get lost easily, or mixed up with personal funds. Most important of all, it will cost you time. Reconciling your accounts with cash quickly becomes a time-consuming effort, as you’ll need to input all your cash transactions manually to your accounting software in order to understand your margins and report your income.

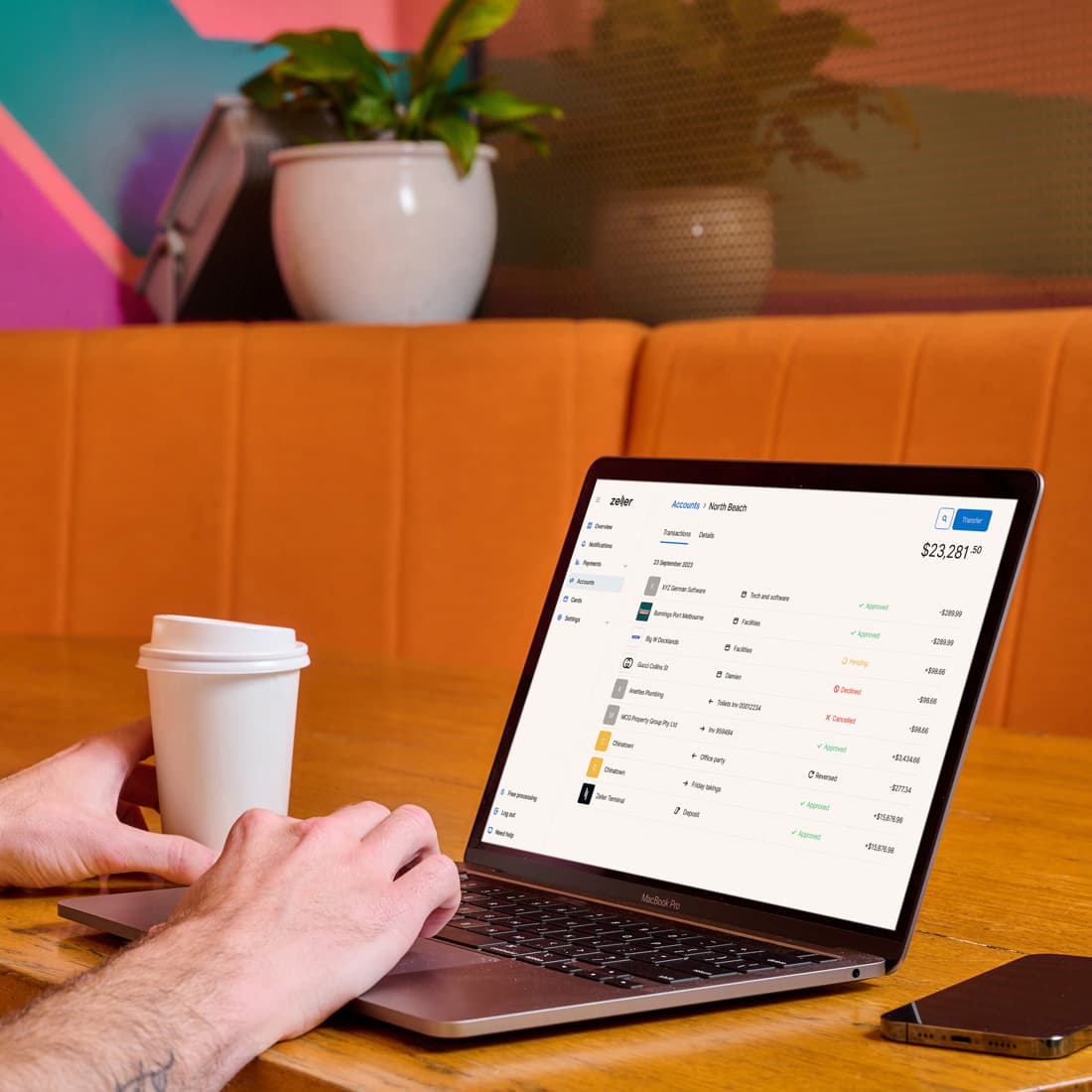

With online payments, you can integrate your payment processors with your accounting software so all your transactions are inputted automatically, saving time and considerably minimising the risk of human error.

Cash is no longer king for your customers

Cash use has been in steep decline for over a decade, and Australian Banking Association data shows the outbreak of the pandemic has sped up the pace of that downward trend. Data collected over the last 14 years shows that ATM cash withdrawals have more than halved since 2008. Monthly ATM withdrawals in Australia dove from $13.5 billion per month to just $6.2 billion during the height of the pandemic in 2020. This trend is expected to continue, as people who once carried cash fall out of the habit — whether due to the inconvenience of fewer ATMs, or because of the increased risk of contracting the virus compared to contactless methods.

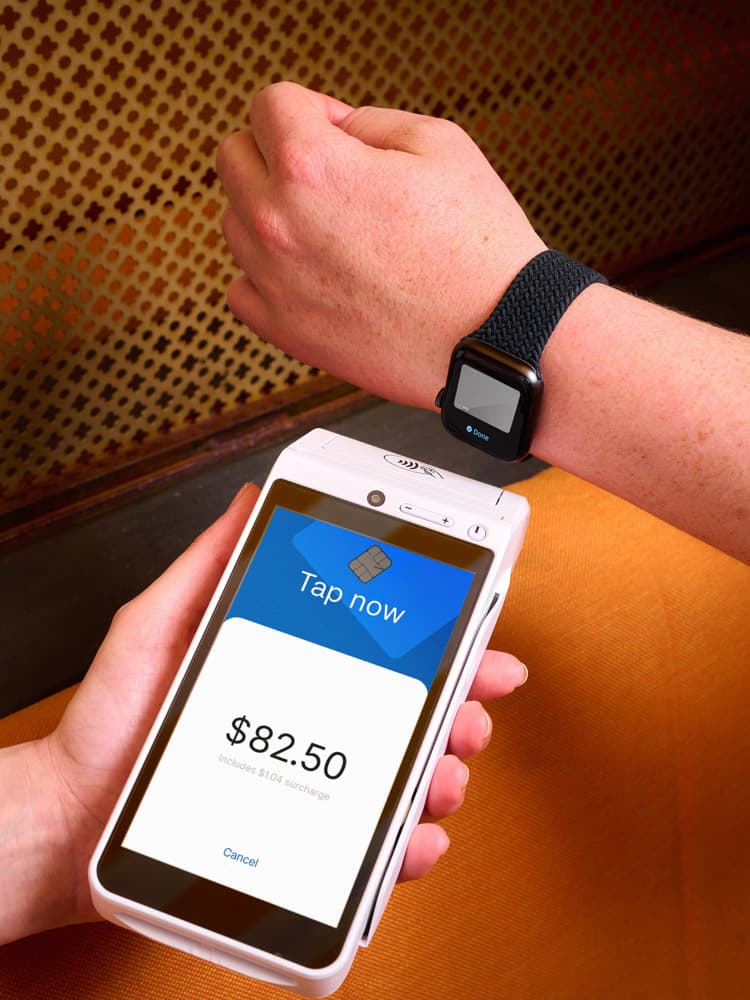

The reality is, very few people walk around with a wad of cash in their pocket anymore. Habits are changing. Instead, consumers are embracing new payment methods, with 71% of smartphone users now using their digital wallets weekly. People can now spend and track with the touch of a widget on their phone — something that isn't possible with cash. By making the decision to accept digital payments, you’ll be able to serve the large pool of consumers that don’t use cash to pay for their purchases anymore.

You’re wasting time

Time is a precious, and limited, resource.

While being cash-only may sound like a simpler option, removing the need to find the right EFTPOS terminal, you’re probably wasting a lot more time than you think. Between trips to the bank to deposit your takings and time spent manually tracking profits and losses, you’ll have less time to spend developing strategies to grow your business.

Finding and getting set up with a financial services provider doesn’t have to take weeks, or require a trip to a physical bank branch. Most businesses can sign up for Zeller in under 5 minutes, which means you can focus on more important parts of your business.

Ready to get started with Zeller?

Cash is risky business

Being a cash-only business puts you at increased risk of burglary, robbery, or counterfeit currency. It’s important to mitigate those risks, for both your business and your customers. The simplest way to do that is by encouraging and accepting digital transactions — where payment is taken from the customers’ bank account, and sent to yours.

Of course, keeping your money and your customers’ card details safe is an important part of doing business. If the threat of credit card fraud or online security breaches is a scary thought, make sure to speak with your payment services provider to learn how they keep your funds secure.

Zeller Security, for example, monitors every transaction, 24 hours, 7 days a week to prevent fraud before it happens. Backed up by intelligent machine monitoring, our team works to identify and respond to fraudulent attacks in real-time.

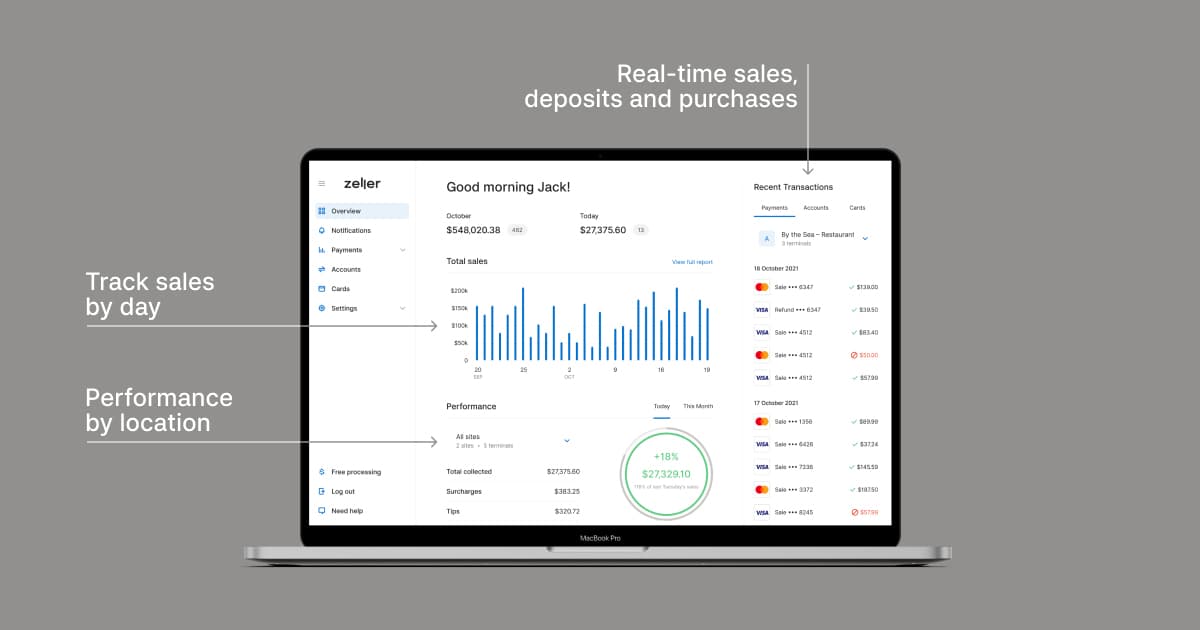

Cash doesn’t give you data insights on demand

Growing your business requires insight and intelligence about how your sales are tracking, and how you can better capitalise on new opportunities. While you can crunch the numbers on cash sales, it will take a lot of time to generate data that will give you actionable insights to grow your business.

The beauty of digital payments is that transactions can be tracked and analysed in real-time, enabling you to make quick decisions.

With cash, paying bills is harder

While you might be running a cash-only business, most Australian businesses use electronic payments. Try paying your phone or electricity bill with cash – it’s not easy.

That’s not to say that cash is dead, yet. However as society continues to transition away from cash in favour of more modern contactless options, you may find it gets harder to spend your money (and spend time manually tracking business expenses).

Choosing a cash-only business model can seem like an easy option when you’re just getting started, but with fewer consumers carrying cash than ever — the data shows you’re doing yourself a disservice. If you're operating your business solely with cash, you’re likely leaving money on the table.

There are numerous benefits to operating your business with a combination of both electronic payments and cash, while a small number of consumers continue to use it. Could it be time to re-evaluate?