- Business Growth & Optimisation

5 Trends Shaping Business In 2021-22

COVID-19 has drastically changed consumer behaviour. Here's what you need to know.

Australian business owners have shown incredible resilience throughout 2020, and the first half of 2021. Faced with lockdowns, capacity restrictions, and a constant sense of uncertainty, many have had their hands full simply trying to keep out of the red. Yet while it’s clear the 2021-22 financial year will be another year of transition, there is light at the end of the tunnel.

A number of business trends have emerged over the past few months, shaped by fast real-time consumer preferences and behaviour. While we cannot know with total certainty what the next financial year holds, you can be prepared to embrace the changes. Understanding how the economic environment has shifted is key to navigating your business through the pandemic, and beyond.

In this article, we deep dive into five of the emerging business trends identified by the world’s biggest consulting firms. Each of these trends will have a ripple effect across the small to medium business sector. Keep reading to discover how you can capitalise on these trends and implement practices that will benefit your bottom line.

1. Revenge spending

As consumer confidence returns, so too will spending.

“Revenge spending” has emerged as a new term for a post-lockdown cash splash. The term, first used to describe the increase in retail spending in China last April, is defined by the Collins Dictionary as: “Spending excessively after a period when one has had limited opportunities to spend.”

It makes sense; consumers have spent the last eighteen months saving a disproportionate amount of their income. Now, after more than a year of lockdowns, quarantines, business closures, and restrictions, those same consumers have a pent-up desire to spend.

41% of Australians saved more than usual in 2020.

This trend isn’t new — economists have reported an increase in spending after every financial crisis. The difference, however, is that this particular economic downturn particularly affected the services industries.

Unlike other periods of financial crisis in history, those involved in the running of a services-based business have been restricted from carrying out their jobs. A service cannot be purchased online, ordered through click-and-collect, or delivered via UberEats. Government restrictions have prevented plumbers, electricians and other trades from entering people’s homes, effectively putting a stop to business.

For this reason, it’s likely we’ll see revenge spending across all industries for the first time — as consumers spend big on dining, retail, entertainment, home improvements and more.

Tim Finocchiaro, Managing Director of Pavers Plus — one of Victoria’s largest independent paving and landscape suppliers — has already noticed a shift in where Australians are spending their money, and it’s close to home.

After more than a year of border restrictions, Australians are choosing to spend big on home improvements.

“Last Spring was pretty tough, with Victoria's lockdowns, and Spring is usually our busiest period. But the Australian life is an outdoor life, and now with programs like The Block people are being exposed to all sorts of new designs. We’re seeing a lot of demand for pool tiles at the moment – people are thinking, ‘If I can’t spend money on an overseas holiday, I’ll spend it on a pool’,” Tim says.

"We're expecting to see the economic benefits this financial year, as Australians reinvest in their homes.”

How businesses can benefit

To cash in on consumers’ willingness to spend big, consider which elements of life your customers have missed most throughout lockdown and how your business can adapt to provide those things.

The most obvious example is communal experiences. To meet this need, book stores could invite an author to read in-store. A games retailer could put on a magic show, or host an in-person chess competition. Restaurants and cafes could offer group packages such as high tea, or themed dinners with entertainment.

Of course, with group bookings comes the headache of bill-splitting. This is where having the right tools for the job can save a lot of time, and help to provide an exceptional customer experience that leaves a great taste in diners’ mouths.

Sign up for free today

Sign up for free2. Conscious consumerism

Conscious consumerism — sometimes referred to as ethical consumerism, green consumerism, or sustainable consumerism — is a commitment to making purchasing decisions that have positive social, economic, and environmental impact. These terms are no longer buzzwords; conscious consumerism is an effective (and arguably necessary) business strategy.

We know with certainty that younger generations are actively spending at businesses that share their own values. The public shunning of fast fashion producers and the growth in demand for farm-to-table hospitality are examples of this shift, albeit from opposite ends of the spectrum. In fact, a recent survey found that nine in ten Australian consumers are more likely to purchase products that are ethically or sustainably produced. And they’re not just settling for “eco-friendly” labels — 87% want to see greater transparency around what makes a business’s products sustainable.

But it’s not just a trend we’re seeing on our own home soil — sustainable business is an international phenomenon. A global study by Oxford Economics reported that 82% of SMEs who introduced ethical and sustainable practices saw a 15% increase in financial performance the following year. People spend more with conscious businesses.

How businesses can benefit

Consumers are more environmentally and socially conscious than ever before, and expect the brands they buy from or use to take responsibility for their impact. It’s no longer enough to not know where your products come from, or the conditions under which they’re made. Consumers are looking for greener alternatives and transparent supply chains.

Now is the time for every business to rethink its operations and environmental impact. First, read our blog to discover five ways to make your business more sustainable, work out where you can make changes and — if it makes good business sense — implement them publicly. With the significant supply chain disruptions brought about by COVID-19, it’s an ideal time to hit the reset button and make changes to run your business more sustainably.

3. Local love

The silver lining of physically restricting consumers to within a few kilometers of their homes is that local businesses have been put in the spotlight.

In 2020, consumers saw the effect of the pandemic on their local barbershop, fruit market, gift shop, and more. The shift to remote work kept (and continues to keep) many workers in suburbs and regional areas, providing more opportunity to discover local shops, cafes, restaurants and other businesses. Now, with many shuttered still, consumers say they will be taking action to support homegrown businesses.

More consumers are turning away from department stores and chains in favour of local businesses.

A recent survey by CouriersPlease found that 4 out of 5 Australian shoppers — an overwhelmingly large proportion — say they would be proactively supporting small and local businesses over big, global brands throughout 2021. It’s clear the “shop local” trend is likely to continue in 2021-22 and beyond.

How businesses can benefit

This shift presents challenges for larger brands, such as department stores. However, small businesses can capitalise on this by reminding consumers that spending locally doesn’t have to mean more money, or less convenience. It could be something as simple as showing support for other local businesses, or sympathy for those doing it tough. If you’re in a position to, it could be an extended returns policy or offering a payment plan.

Depending on the type of business you run, joining forces with other local business owners might be beneficial. For example:

A cafe shop could invite the local florist to place a few arrangements for sale by the register, and in exchange the florist might keep some of the cafe’s business cards at the front counter.

A local grocer and gift store could team up to create and sell hampers, with an emphasis on local produce and products.

A homewares store could invite the local coffee cart to sell coffees at its EOFY sale event.

Read our blog, Shop Local: How You Can Benefit From This Growing Trend, for five easy-to-implement tips to attract more local customers to your business.

4. Authenticity on social media

These days, it’s not just e-commerce businesses that need to be active online; bricks and mortar businesses need to have a social media presence. However, consumers’ increasing reliance on social media does not necessarily mean that it’s any easier for businesses to connect in a meaningful way.

For the last 18 months, social media has been a lifeline for many — providing people with the means to connect with one another, and businesses with a platform to reach their target audience. Yet countless studies show that a growing reliance on technology rather than face to face interaction is causing an overwhelmingly large proportion of people to feel isolated, disconnected and lonely. In fact, the problem is so pervasive that at least one scientist is working on a pill to try and alleviate it. As a result, businesses need to think outside the curated box and utilise social media in a way that makes their audiences feel connected.

In 2020-21, a number of brands saw the opportunity to strengthen community ties through an authentic social media presence, purposefully designed to connect with and engage their audience. There were giveaways, collaborations, behind-the-scenes content, live videos and more. This authentic content helps forge a deeper connection with customers, which in turn encourages brand loyalty.

As communities continue to be affected by lockdowns, this type of marketing should be an important part of any businesses social media strategy in 2021-22.

How businesses can benefit

Being authentic means being real and genuine. An authentic brand is one that understands its audience and their values, and aligns itself accordingly. This is especially important for businesses operating in a saturated marketplace; consumers will often choose to spend money with the brand they feel most connected to.

One of the most important steps to creating an authentic brand is deciding its values. Decide what your business stands for, then audit your website, social media presence and in-store experience for any discrepancies.

When it comes to social media, imperfect content, live content, and user-generated content should be prioritised over overly photoshopped or curated content. One of the most authentic pieces of content you can create is a peek behind the scenes, introducing the people that make your business what it is— whether that’s the chef, the jeweler, the barista, the locals, or even their dogs. Whatever you choose to post, it must reflect the ethos of your business’s brand in an authentic way.

5. Business model innovation

Crisis typically spark a wave of innovation, and the COVID-19 pandemic has proved no different. 2020 was a year of business model innovation. This financial year, the focus will be on refinement.

In the face of lockdowns and restrictions, many businesses were forced to adapt their strategy in order to stay afloat. Hospitality and events-based businesses were especially affected. The businesses that thrived were those that were able to react quickly to the changed environment. For example, restaurants that pivoted to enable finish-at-home experiences through the likes of Providoor, or in-person events that shifted to online.

Bill Spathis, co-owner of Melbourne-based Decoy Cafe Coffee Roasters, was quick to adapt when the city came out of lockdown. With fewer office workers dropping by for their morning brew, Decoy Cafe's menu shifted to align with its new clientele.

“We usually operate à la carte, but we’ve had to change our business model because our customer base is different now. People aren’t coming back to the city for work just yet — but they’re building a hotel across the road, so there are lots of tradies,” Bill said.

“We’ve installed a bain marie for dim sims, fries and the like — and that’s what’s saved us. Without the tradies, we’d be closed.”

Decoy Cafe will keep its bain marie until office workers return to Melbourne's city centre.

Although businesses have always had to think about how the market is changing and what that means for their product or service, business model innovation will be more important in 2021-22 than ever before. The key to success this financial year will be refining the strategies that allow your business to continue generating revenue even when consumers cannot physically visit your business, or engage your services.

How businesses can benefit

Every business should have a crisis plan by now. In fact, it should be a part of every business plan; no one can say, with complete certainty, what this financial year or the next holds. Businesses need to plan in advance how they will adapt in the face of a lockdown.

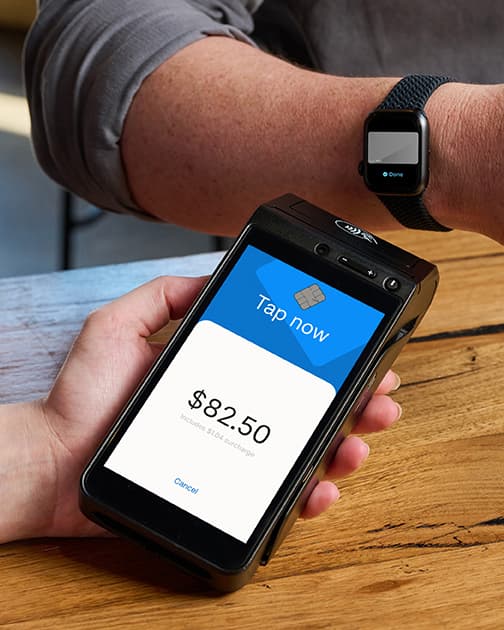

Retailers should know how a lockdown will affect their returns policy, and trades businesses ought to have a communications strategy in place to reschedule appointments, for example. Every business should invest in an EFTPOS terminal that allows them to accept payment, even when customers cannot come to the store. This will help ensure business can continue as normal, as much as possible. However, the businesses that continue to grow in these times are those that innovate their business model.

Gift cards, online tutorials and take-home packs are all examples of monitisable, COVID-safe strategies. If these changed business models make sense – customers enjoy the changed offering, and it’s a profitable direction for the business – there’s no reason to go back to the way things were. Business owners should always look for opportunities to drive revenue and generate new opportunities as the economy recovers.

Embrace the opportunity

The COVID-19 pandemic has changed the business landscape, however life beyond the pandemic holds promise. Overall, the 2021-22 financial year looks like it will be a year of optimism, recovery and opportunity for business owners.

As the months roll on, additional trends will emerge that further shape the business landscape. It’s up to business owners to decide how to adjust their tactics in response.

To stay up-to-date with the latest small business marketing trends, learn about new payment methods and more, sign up to our Business Blog.