- Business Growth & Optimisation

Shop Local: How You Can Benefit From This Growing Trend

Australians are showing their values with their wallets, and ramping up local spending.

From buying produce at the farmer’s market to splurging on the local high street, consumers are becoming increasingly community-conscious when it comes to their spending.

In fact, 73% of Australians say they are making a conscious effort to spend with local brands and businesses to help them recover from the financial blow dealt by the pandemic, according to a Mastercard survey. This is great news for business owners: a local customer is more likely to become a regular, and refer other locals your way.

But how can you attract more conscious consumers? Keep reading to discover more about this trend, as well as five tips to attract more local customers.

Shop Local is here to stay

While the impact of the various lockdowns cannot be understated, one unexpected silver lining has emerged: a resurgence of local shopping areas. With fewer consumers traveling to large shopping centres, whether due to restrictions or an unwillingness to visit potential exposure sites, many smaller shopping hubs have seen an uptick in sales.

Even as restrictions on movement are lifted, it’s unlikely we’ll see a shift back to the way things were. The Shop Local trend is part of a drastic evolution of consumer spending habits, and clear proof of a shift towards more conscious consumerism.

Ben Lazzaro, Chief Executive of the not-for-profit Australian Made Campaign Ltd (AMCL), believes the COVID-19 pandemic has changed consumer perspectives.

“The pandemic very quickly highlighted our over-reliance on imported product and provided an impetus to address that imbalance,” he says. “I think it brought it home to a lot of us that the way we choose to spend our money can have an impact on Australia’s self-sufficiency as well as our economic future.”

How to cash in on the trend

People want to spend locally, whether that means purchasing craft beer at the local brewery or a birthday present at a neighbourhood retailer. However, in order to spend money at your business, consumers need to discover it.

Here are five tips to attract more local customers to your business.

1. Make your business more discoverable on Google

A recent study by Facebook found that the majority of today’s shoppers are searching the internet to plan their store visits in advance, which means it’s crucial that potential customers are able to find your business online. Understand the tools, websites and channels your target customers are using, and ensure your business has a strong presence in those areas.

You’re probably already using Facebook or Instagram to promote your business, but what about Google? Add or claim your Google My Business listing, then populate your profile with your business’s contact details, store hours and other important information. Add photos of your store and products, and encourage customers to rate and review your business.

2. Accept more payment methods

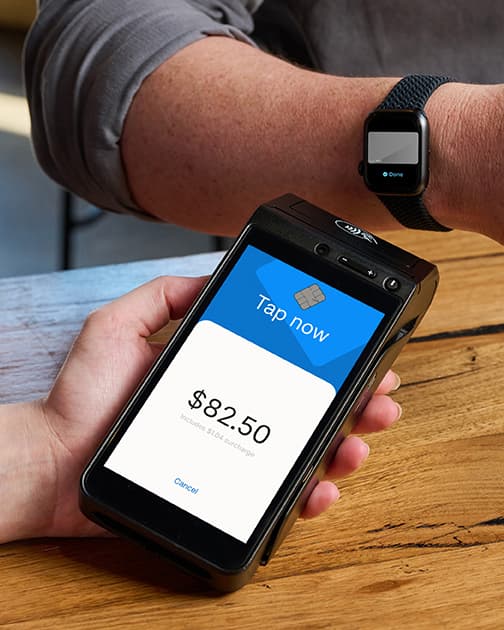

Offering more ways to pay isn’t just a convenience win for customers — it can also help you increase profits. According to the latest Mastercard New Payments Index, offering more payment customers can also help increase consumer spending.

74% of consumers would spend at small businesses more often if additional payment options were offered.

Since the outbreak of the pandemic, contactless payment methods have been put front and centre as the ideal, hygienic way to pay. For those operating on a cash-only basis, it’s critical to understand the impact this operational decision is having on your bottom line. Not only is the cost of running a cash-only business higher than most people think, it also costs businesses customers.

Getting more local customers in-store is only half the battle. Enable your staff to accept every payment from every customer by looking for a provider that supports payment via digital wallets, such as ApplePay and GooglePay, and QR codes such as Alipay.

3. Run a localised advertising campaign

Geo-targeting allows you to run online campaigns targeted to potential customers in a specific area. Targeting your local area can help find the right customers for your business.

Both the Google Display Network and Facebook allow you to target your ads to a particular country, state, city as well as postcode, however we recommend using the specific radius address. You tell the platform where your business is located, and it will target ads to people within a specific radius of that location.

To help your ads stand out, localise your messaging. Do your research — if you’re the only local retailer that stocks a particular brand, or you have the lowest prices in your area, make it a focus of your ad text.

4. Offer curbside pickup

To meet social distancing protocols and provide consumers peace of mind, consider setting up curbside pickup. It’s a convenience measure your customers will appreciate, allowing them to get items on the same day without stepping into the store or paying for rush shipping costs.

For an even smoother customer experience, take your EFTPOS terminal to the curb so you can exchange goods for payment as seamlessly as possible.

Ready to get started with Zeller?

Sign up for free5. Set up an online destination

If there are other businesses within walking distance, consider setting up an online community. Show consumers that they can come to your business for a birthday card, then get a bottle of wine next door, and flowers from across the road. The impact is twofold: you’re helping to keep dollars in your hometown, and showing your community that you care for it and are willing to invest in it. “If communities do well, your business does well. That’s just how it works,” says Sandy Chong, CEO of the Australian Hairdressing Council.

Many local shopping areas have recently undertaken such a community initiative, tapping into the power of the internet to connect with more locals. For example, the Chapel Street precinct has its own website (and independent destination marketing association), informing readers where to eat, drink and shop in an effort to drive more foot traffic into the area.

Many shopping centres have an Instagram account that highlights sales and special events — send the account holiday a direct message to discover who’s running it, and provide them with content. Or, reach out to other business owners in your area and create your own online community.

Attitudes towards supporting local economies have strengthened since the outbreak of the pandemic, creating a huge opportunity for small businesses to grow their customer base and increase profits. For more tips on growing your business, sign up to our Business Blog.