- Business Growth & Optimisation

4 Ways to Stop Long Lines Forming at Your Next Event

Reduce wait times to keep attendees happy and spending.

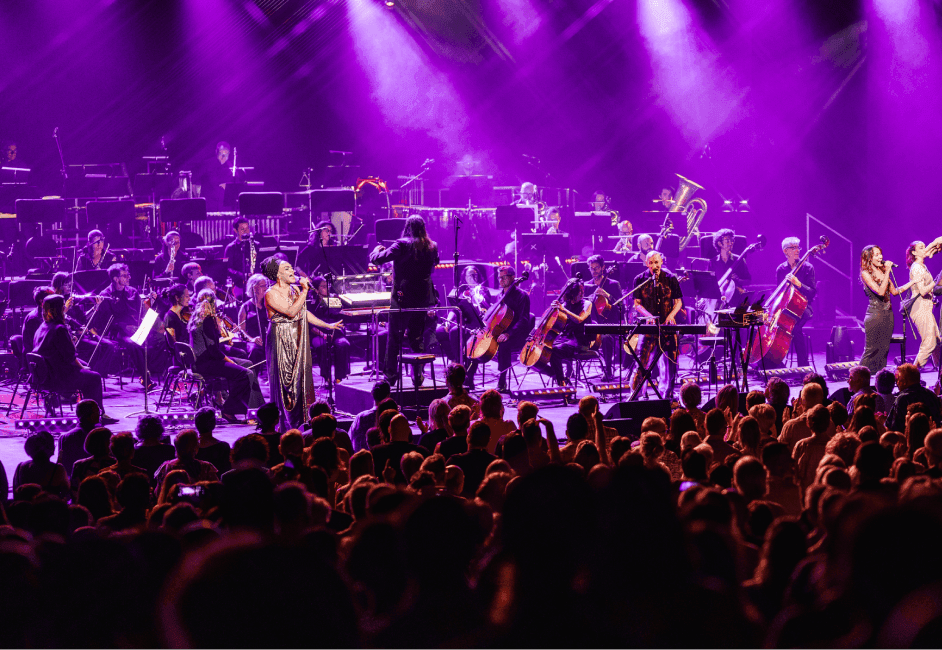

Long queues are one of the most visible hiccups onsite. Regardless of how good your lineup is, sentiment can quickly go south if attendees are forced to spend too long in queues.

It’s no secret that people dislike waiting, and it can be difficult to break up lines once they form. However, what’s rarely discussed is the impact that having attendees waiting in long queues has on your bottom line.

How much are lines costing you?

After the events of recent years, Australians have never been hungrier for rich experiences: for delicious food, vibrant music, eclectic market shopping, and other in-person experiences. Yet there’s one thing you can guarantee no event attendee will have missed: queues.

The impact of queuing goes beyond lost sales — your event’s brand sentiment could be damaged. If attendees need to wait in line for more than a few minutes, their impression of the entire event can become soured by that single experience.

On the other hand, short lines keep customers happy, give them more time to browse, increase the likelihood of repeat purchases, and boost their overall satisfaction.

Fortunately, there are ways to reduce the likelihood of long lines forming. Keep reading to discover some small changes you can make to efficiently move attendees through your event, and reap the benefit of more sales, repeat purchases, happy customers and good reviews.

Tips to avoid queues forming at your event

1. Go cashless

One of the easiest ways to reduce long lines at your event is to remove the option for customers to pay in cash. There will be less time spent at the point of sale counting out change, and no time wasted balancing cash drawers. The decreased security risk is an added benefit.

Running a cashless event will also ensure your staff are never caught without enough change to complete a transaction, in turn forcing customers to wait for the till to be refilled. Your staff also won’t need to waste time at the end of the day recounting cash as a result of human error. Better yet, you’ll remove ATM queues altogether.

If the potential for reduced tips is a concern, rest assured that Zeller Terminal can nudge your customer to leave a tip during the payment flow — either a percentage of the sales total, or a custom amount. For the most efficient payment experience, give your attendees the option to leave an amount equal to a percentage of the sales total so they can leave a tip with the touch of a finger.

2. Understand your bottlenecks

Realistically, some lines are bound to be longer than others. Knowing which facilities or stalls will be in the highest demand will help you plan ahead to minimise waiting time.

For example, the ticketing and merchandise stall at a live music event is likely to be busiest in the lead-up to the headline act. Once activity has picked up, attendees are likely to have worked up a thirst and make their way to the bar. This forecasted demand could be addressed with additional staff and mobile EFTPOS terminals positioned in the right place at the right time, facilitating a higher rate of purchase and reducing waiting times.

You may also find that demand fluctuates, depending on a number of circumstances. Hosting a food market? The mobile pizza oven may see the biggest lines between 6:00pm and 8:00pm, while the ice cream truck may be in hot demand after 9:00pm. On a cold, rainy night, the hot chocolate cart could see an unprecedented swell of foot traffic. This is where mobile EFTPOS terminals can be shared between sites, allowing you to minimise queues without footing the bill for additional terminals at every stall.

Not sure which sites are the busiest? Zeller Dashboard provides real-time data and insights that reveal exactly which sites are processing the most transactions, providing you with the insight to optimise your staff and payment terminals accordingly.

3. Get the restroom ratio right

Long bathroom lines are a common customer gripe at events. Unfortunately, they are also a far too common occurrence. A good rule of thumb is to have one toilet per 100 patrons. Increase that by at least 15% if you’re hosting an event with a focus on beverages.

Quantity, however, should be far from your only focus. The location and quality of your facilities will influence the time spent using them, and a customer’s perception of convenience. Portaloos with automatic lights will reduce the need for patrons to fish around in their bags for a phone torch, while strategic placement near drink stalls will reduce time spent looking for restrooms.

Importantly, make sure you’re well stocked on supplies.

4. Make sure you have a Plan B for connectivity

Large crowds gathered in a single location can put pressure on internet networks, ultimately leading to connectivity problems. This has the potential to affect your ability to process transactions swiftly. If every transaction takes even five seconds longer than it should, it’s costing your business money.

To avoid situations where slow payment processes lead to long queues, ensure your EFTPOS terminals can be connected to the internet via a number of different means. If the Wi-Fi is interrupted, having the option to connect via hotspot or SIM card means you’ll always be in a position to process transactions with ease, mitigating any unnecessary bottlenecks.

Looking for a reliable fleet of EFTPOS terminals for your next event? The Zeller Event Rental Program enables event organisers to rent an all-in-one event payments kit, combining a Zeller EFTPOS Terminal, SIM Card and Charging Dock. Each kit is available for one low daily rate, with no lock-in contracts — so you can rent as many (or as few) as you need. Funds are settled direct to your nominated account as fast as the same day, giving you the fast access to your takings so you can pay suppliers and staff quickly.

Looking to cash in on more valuable insights and tips to streamline your next event? Sign up to the Business Blog.

Let us help streamline your event.

We can build a rent or purchase events package that suits your needs. Tell us about your event, and we'll get in touch to learn more and build a competitive quote.

By sharing your details with us, we may contact you from time to time. We promise we won’t bug you — and you can unsubscribe from communications at any time.