What to Look for When Choosing a Free Business Account

Learn how Zeller Transaction Account compares to traditional business banks in Australia.

Keeping accurate financial records is essential to running a business, and it all starts with a business bank account. However, navigating the muddy waters of bank jargon and fee structures is no easy task. To help make the decision easier for small business owners, we’ve compared the best business banking accounts in Australia, and weighed them up against Zeller, a smarter and more affordable non-bank alternative to your traditional business bank.

Read on to discover why you need to open a business bank account, what factors you need to consider, and why an alternative financial services solution like Zeller could be the better choice for your small business.

Bank accounts for Australian small businesses

Every bank and financial services provider has its own approach to offering business transaction accounts and structuring the fees that come with them.

Some have a wide range of add-on services that can be very valuable to the right business, but come at an additional cost. Others require fees simply for continued access and use, without any added benefits. Identifying what’s relevant and useful to your particular business will not only keep costs low, but ensure you are getting the maximum value from the service.

Business bank account comparison table

To help you find your way through the weeds, we’ve aggregated the fee structures and features of business bank accounts from six major Australian banks — Westpac, CommBank, NAB, ANZ, Suncorp and Bendigo Bank — and compared them to the Zeller Transaction Account in one simple comparison table. Simply select the two banks you would like to compare from the drop-down menu, and scroll down to compare all the different criteria you should consider when choosing a business bank account.

What is a business bank account?

A business bank account is a specialised bank account designed specifically for the needs of businesses. It is used to manage the financial transactions of a company, such as paying bills, receiving payments from customers, and managing payroll.

Business bank accounts can be opened at most banks and financial institutions, and are typically offered in a variety of account types to suit the different needs of both large and small businesses.

Why do you need a business bank account?

Whether you’re planning a medium-sized enterprise or starting out as a sole trader, any business venture requires separating your personal and business finances.

For businesses structured as a partnership, company or a trust, having a business bank account is a legal requirement for tax purposes;

For sole traders, a business bank account is not required under Australian law, but is strongly recommended.

Separating business from pleasure in your bank accounts makes reconciliation for bookkeeping and tax considerably easier, professional and legitimate. Additional benefits include:

Clear cash flow

Centralising business revenue and expenses with one institution gives you a clear view of your cash flow, to ensue the financial health of your business.

Loan documentation

Lenders often require documentation that proves the business is operational, and a business bank account statement can help provide that proof.

Brand perception

Your business name will appear on invoices and payment paperwork, helping to create a more professional, trustworthy perception with your customers.

Is there an alternative to a traditional bank?

Yes, business owners nowadays can access a wide range of non-bank financial services solutions, as an alternative to their traditional business bank.

Additionally, you should also re-consider the value you can get from an alternative to the traditional business bank — rather than just an account to store money in, many new providers offer an array of powerful business banking features. When comparing business banks, look for solutions that include features such as instant sub-account creation, the ability to issue virtual and physical business debit cards in a click, real-time fund transfers, a dedicated business banking mobile app, transaction tagging and reporting, integrations with your accounting software, customer-level tagging and relationship management reports, and more.

If you’re considering a non-bank alternative to your traditional provider, sign up for a free Zeller Transaction Account to review all of the features and functionality included that you may never get from a regular business bank.

Zeller's financial solution

Zeller is a popular Australian alternative to the traditional, outdated business bank, that offers business owners a complete financial services solution with free Transaction Accounts, Business Debit Cards, an EFTPOS Machine, invoicing software, and more, all available from one convenient and free account.

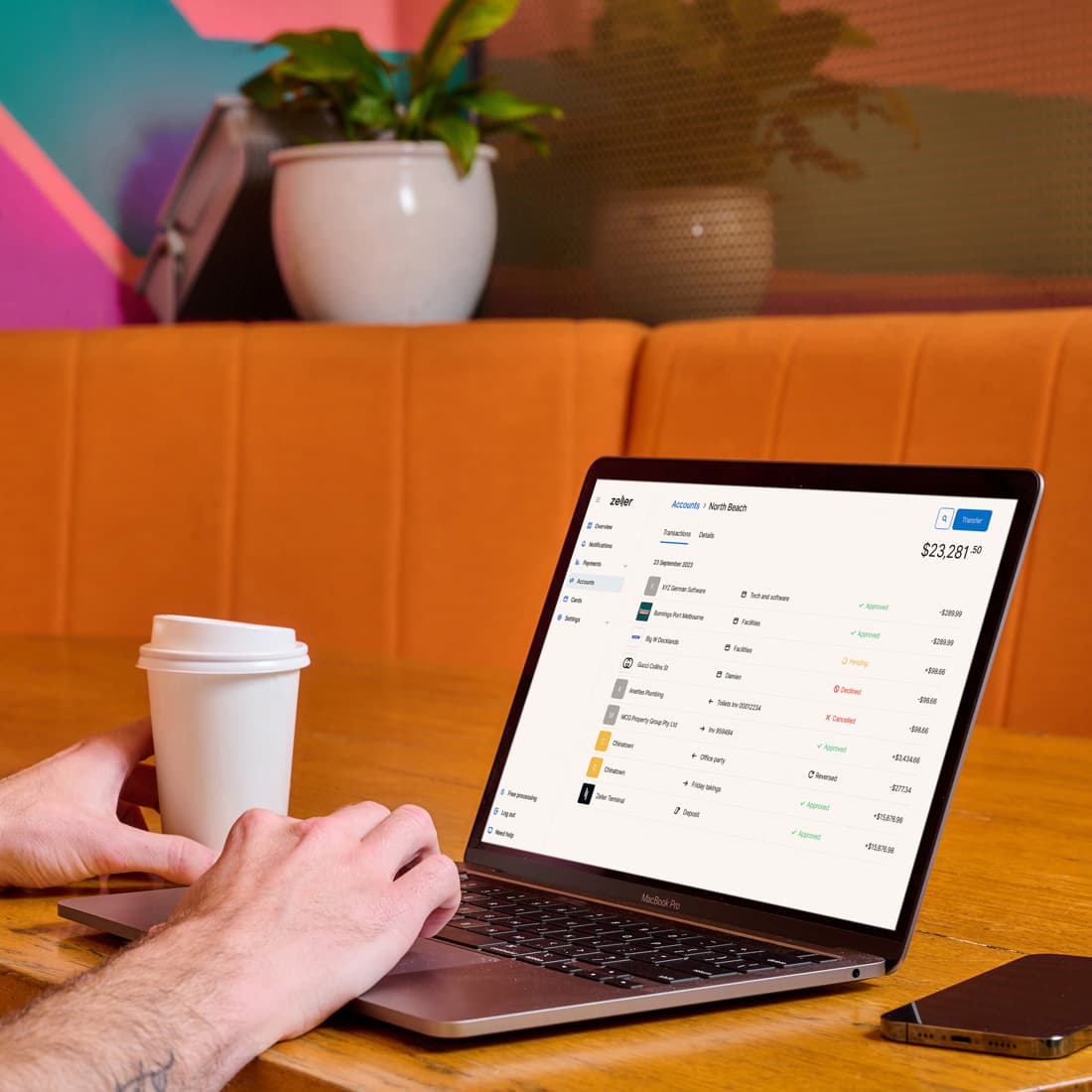

If you require a way to store, manage and spend your business funds, and accept electronic payments, but have no need to visit a bank branch, a non-bank such as Zeller is a very compelling choice. With Zeller:

Whether you’re paid by card or funds transfer, access to your funds is generally quicker than traditional banks, which often use legacy technology and complex internal processes.

You can create multiple accounts and debit cards at the click of a button. Fund transfers are made in real-time.

A powerful web portal and leading edge mobile app allow you to send and receive funds transfers, and work with your transaction accounts, debit cards, and real-time card sales.

Contacts can be assigned to transactions, and you can add notes and images to transactions, to simplify reconciliation.

Everything is consolidated in one, easy-to-use platform: from your EFTPOS payments to transfers, settlements and expenses. You can even write, send and track invoices in your Zeller account.

Your Transaction Account can be synced with Xero’s Bank Feeds Integration, for seamless bookkeeping reconciliation

A fee-free small business account with no paperwork, no need to visit a branch, and the ability to open sub-accounts and issue debit cards with a click: Zeller is the smarter non-bank alternative to your traditional business bank.

Sign up for a free Transaction Account.

Your fee-free merchant account is ready to use in minutes — no lengthy paperwork required.

How do you open a business bank account?

With the major banks, opening a business bank account will depend largely on what kind of business you are running and whether or not you are already a business customer. Depending on what camp you sit in will determine whether you can open an account online or whether you’ll need to go into a branch.

As Zeller is an entirely online financial services provider, all customers — no matter the business structure — can open an account online in a matter of minutes.

Whichever institution you choose, opening an account will require you to provide:

A business name

A primary business address

An Australian Business Number (if applicable)

An industry type

Certified identification documents (such as passport or driver’s licence) for all owners or partners

Additional documents may be required if your business operates under a particular structure such as a trust, cooperative or association

To see specific requirements of each bank, check the comparison table and scroll down to “How to Apply” or visit the bank’s website. Or, if you're looking for a smarter, faster non-bank alternative, follow the prompts to sign up to Zeller for free here.

Five things to consider when finding the best business bank account for your small business.

1. Fees, Transaction Limits & Staff-Assisted Transactions

Depending on the option you choose, you could be spending as little as $0 or as much as $264 a year on business bank account fees.

Beyond the account fee, be sure you understand all the fees associated with using your account – some of which can be hidden in the fine print. Certain accounts from ANZ and Bendigo Bank, for example, only offer a limited number of free electronic transactions per month, while staff-assisted transactions are capped at 20 to 30 per month for nearly all the major banks’ no fee business bank accounts.

If you’re not careful, seemingly inexpensive plans can actually end up costing you more to use. To help you decide what you need, let’s break down some terminology:

Electronic transactions are any type of transaction that is conducted with your computer, smartphone or other digital device. This could include transferring money between accounts, paying bills, shopping online, or using a debit card or mobile payment app, such as Apple Pay.

Staff-assisted transactions are those that require you to go into a bank branch and speak with a teller; to deposit cash or collect change, for example.

If you’re going to be making several electronic transactions each day, it’s worth doing the maths: two transactions per day at $0.40 per transaction (as is the case with Bendigo Bank’s no fee business bank account) will end up costing you $24 a month.

Staff-assisted transactions can be as much as $3 each, when not included in your plan. If you need to collect change once a week, at a rate of $3 per transaction you’ll be paying $12 a month — more than the monthly fee for most accounts that offer this service for free.

2. Debit Cards

All the best business accounts will include a debit card as part of their offer. This is the bare minimum requirement when opening a business account, and all of the options we compare in the table above do indeed provide one. Each will have slightly different features associated with it.

While all banks will have maximum daily transaction and cash withdrawal limits for security purposes, most will allow you to increase these limits if you need to. If you’re likely to be withdrawing cash frequently from ATMs or making significant purchases, it’s important to note how much you can increase these limits by.

Similarly, if you’re planning on using your business account to manage staff expenses, check the requirements for ordering additional debit cards.

The big four banks — Westpac, Commbank, NAB and ANZ — all require that each additional cardholder is an account signatory. This is a potential deal breaker for any small business owner who just wants to give their staff members a card to purchase everyday items, without also giving them the authority to access and manage the whole bank account.

Flexibility provided by Zeller Debit Card

This is where Zeller has a much more flexible alternative to the traditional business banks. Within your Zeller Account, you can create as many Debit Cards as you like — one for each staff member, for example, which can each draw from a different Zeller Transaction Account.

With Zeller’s no fee small business account, Debit Cards are free to create and can be virtual and instant, with the option of plastic cards.

3. Mobile Business Banking Apps

How you use and interact with your business bank account will either be a seamless experience or an endless source of frustration. Rather than finding out the hard way, do a little research upfront to make sure the banking app and online platform are going to work for you. A great place to start is by looking at the reviews on the Apple App Store, at the time of writing*, the Zeller App on the App Store was rated the highest with 4.8 stars, while the CommBank Small Business app was the lowest with 2.1 stars.

Most banks use the same app for both business and personal banking. Zeller, on the other hand, is a financial services provider solely for business, therefore the app is entirely tailored to what small business owners need.

From the Zeller App you can create and manage accounts, issue new cards, build and review payment reports and transaction insights, and manage expenses — all with real-time business data.

*Customer ratings on the Apple App Store as of 17 May 2023.

4. Reporting & Analytics Tools

One of the most important ways of measuring the financial health of your business is to track your cash flow. When considering what business bank account to choose for your operation, you need to look into what tools and reporting the bank will offer you, because ultimately, these will inform important business decisions, such as:

Committing to capital purchases such as a new coffee machine or vehicle

When and at what level to roster staff on, and when to take a break

If recent marketing has brought in more sales

For owner-operators who are short on time, being able to gain these financial insights at a glance is essential. In this domain, the Zeller Business Transaction Account is second to none. From the dashboard on desktop or from the Zeller App, business owners can:

Visualise their cash flow with real-time reports in a user-friendly interface

Break down incoming and outgoing transfers

Categorise and filter transactions by type, contact, date, amount and spend category

Assign contacts and attach receipts or notes to transactions to know exactly where the money’s going and why.

Your browser does not support the video tag.

5. Customer Support & Service

A final and very important consideration when choosing a business bank account is the customer experience. Whether this is over the phone, on a mobile app, or in person at a physical branch, it’s important to choose a provider that is suited to your needs.

If you’re leaning towards a bank and need the option of speaking to someone face-to-face, then make sure to look up where your closest branches are before signing up. If you prefer to manage all your finances online, make sure you like the user experience provided on the website or mobile app of your chosen provider.

For day-to-day support, have a look at how robust their customer service platforms are including contact channels, customer assistance directories, and support articles — some will be much more comprehensive and easier to navigate than others.

Where Zeller offers a considerable advantage over traditional business banking counterparts is its phone, SMS or email customer support (available 9AM to 1AM AET, 7 days a week) as well as 24 / 7 debit cardholder support.

So, what’s the best business bank account?

There’s no one-size-fits-all solution: every business is structured differently and every owner will prioritise different features. However, if you’re embracing the inevitable shift towards cashless transactions, Zeller’s financial ecosystem is very hard to beat on cost and functionality.

Zeller is a non-bank alternative that has been designed for businesses, therefore every feature is tailored to the needs of business owners.

To come to a final decision, weigh up all the considerations outlined in this article, consult the comparison table above, do your own research, contact the banks if you require even more detail, and sign up for your free Zeller Account today to give it a try.

.jpg&w=1920&q=75)

Sign up for a free Business Account.

Your fee-free merchant account is ready to use in minutes — no lengthy paperwork required.