The Best Time to Grow Your Business

Thinking of scaling up? Give your business the best chance of success by timing it right.

You run a business. You’ve got customers, and your product or service keeps them coming back. At this stage of your business journey, your challenge shifts. Where once you were striving to make your business viable, you are now working towards making it profitable and sustainable. This next phase of growth is both exciting and risky, so it’s important not to rush into it. Read on to learn the six signs you’re ready to take the next step.

1. You have positive cash flow.

Cash flow is the make or break of any business. It’s what ultimately determines whether a business can grow sustainably, or whether it is destined to fail. Ensuring there is more money flowing in than is flowing out, is the number one most important thing you can do before deciding to expand your business. Healthy cash flow is intrinsic to growth for a number of reasons.

Expanding your business inherently involves risk – whether it’s through hiring more employees, investing in a large piece of equipment or machinery, or opening a new premises – having healthy cash flow will help mitigate this risk. It will give you a financial buffer that can help you absorb any setbacks or unexpected costs associated with your expansion plans. Similarly, having positive cash flow will give you the ability to take advantage of opportunities when they arise. If a lucrative client contacts you for an ongoing partnership or requests a significant quantity of your product, your ability to take on this new customer is entirely tied up in whether or not you can afford it.

Even though it might be tempting to take on larger clients or jobs, if you do not have the cash on hand to deliver the product or service, it could put your business in a perilous situation. Having positive cash flow is the key that unlocks future growth opportunities. Don’t try breaking down the door without the key.

2. You have a reliable team.

Your business is only as strong as the people in it. If you plan on expanding your operation, it's paramount that you have a trustworthy team who will support you in the process. Ask yourself: are they reliable? Are they passionate? Are they knowledgeable? Are they driven? If you have more than one employee, do they work well together?

Additionally, it’s important that you have a healthy work culture within your business. Ensure your employees feel supported and respected, talk to them about your expectations, their ambitions, and most importantly, ensure you are paying them correctly (if you’re not sure, read our guide to the minimum wage in 2024. Think about how the growth of your business might offer them opportunities to up-skill, gain responsibility or earn more. It’s essential you have buy-in from them before you start executing the growth plan.

However you intend to grow your business, there will likely be a heavier workload – whether it’s answering more customer queries, handling higher production volumes, or managing additional sales channels. A team that already has experience and knowledge will be much better equipped to absorb this increased load.

3. You have business savings.

Whether you plan on taking out a loan to finance the next stage of your growth, or whether you intend on funding it yourself, you’re going to need some savings to back you up. Adding funds to an interest-bearing savings account is a simple way to earn some passive income that can be invested back into your business. Additionally, having some business savings also improves your position to borrow. In ascertaining your credit rating, a lender might assess your cash flow and your cash on hand, so having a savings account can assist in providing this context.

Importantly, having a cash reserve will also act as a safety net in the event that your growth strategy doesn’t go quite according to plan. If COVID-19 taught us anything, it’s that you never know what’s around the corner. As you take on more risk in this next phase of growth, it’s important to have a cash buffer that your business can use through unforeseen expenses.

Earn 3% p.a.* with a Zeller Savings Account.

4. You have a loyal customer base.

Before you go looking for more customers, you need to nurture those that you have. Remember, it’s much easier to re-engage an existing customer than it is to find and convert a new one. Your existing clientele is already convinced of the quality of your services or products, and you already know and understand their purchasing behaviours. As you execute your growth strategy, ensure your customer service is not compromised in any way, you cannot risk losing your loyal customers. They are, after all, the driver of your cash flow as well as your best sales representatives.

Before you roll out your growth strategy, seek your customers’ feedback. Positive testimonials will help give your business legitimacy and will help convert new leads as you expand your operations, while negative reviews can help you identify shortcomings that need to be ironed out before you expand.

5. You have an opportunity.

One of the biggest indicators that it’s time to scale your business is the presence of an opportunity. This may take the form of a partnership proposition, a new high-volume client, entry into a fresh market, or a gap in an existing market, for example. If you own a clothing store, you may decide to stock additional sizes. If you run a restaurant, you might explore the opportunity to rent a market stall outside of your local area and increase awareness of your brand. If you own a beauty salon, you might employ a technician who can offer an additional service.

Whatever shape or size your opportunity takes, it must align with your business goals, resources, and capacity for growth. When evaluating the opportunity, conduct thorough market research, analyse potential risks, and project the impact on your operations. The goal is to be able to effectively capitalise on the opportunity while maintaining business as usual for your existing clients or customers.

6. Your operations are efficient.

Before you expand, you need to know that your resources are being used efficiently. If your business is leaking money, it’s very important to find the cracks before you take on more work or more employees. When operations are optimised, unnecessary time and money are saved. Conversely, if your business expands before it has streamlined its processes, the growth can further exacerbate inefficiencies, leading to increased costs and reduced profitability.

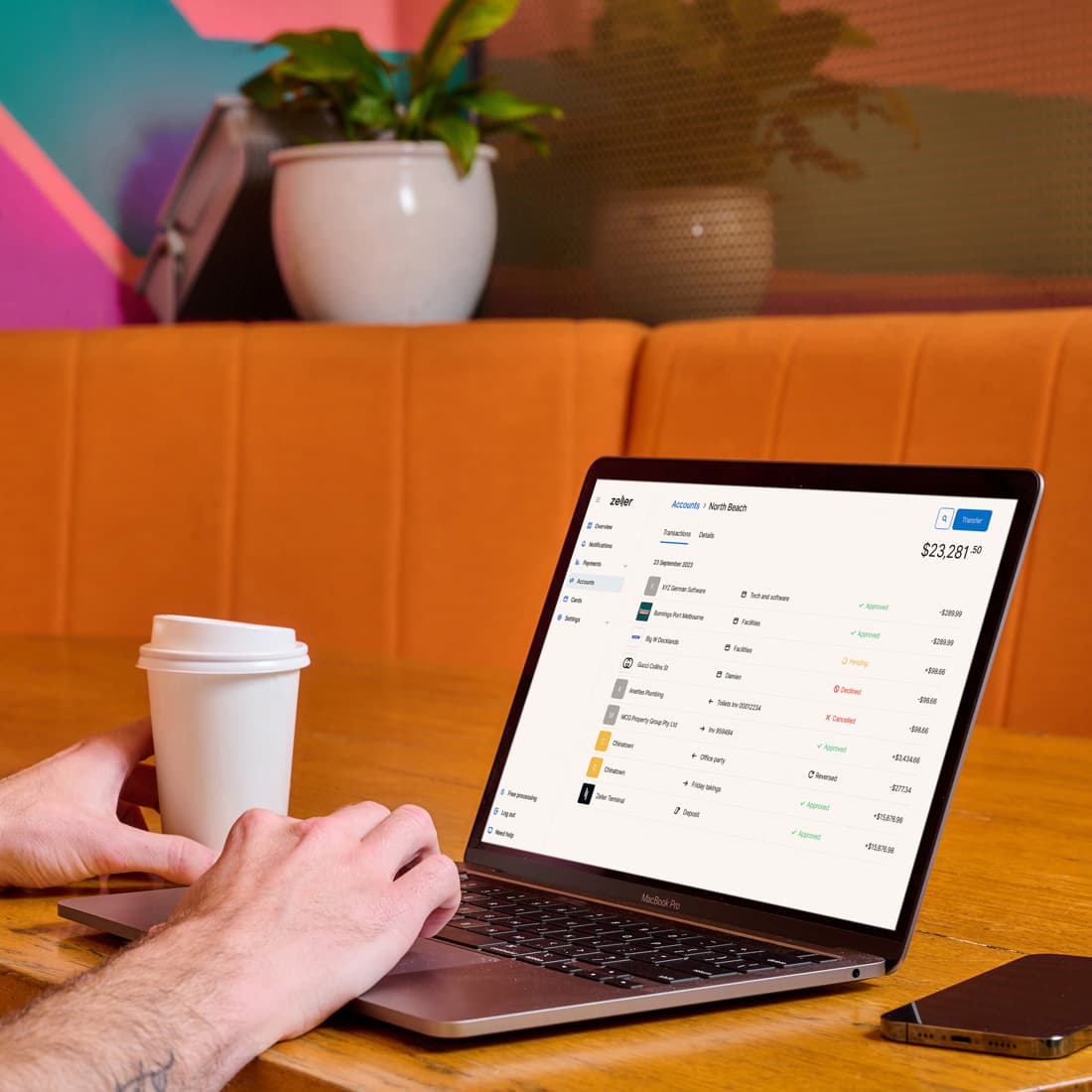

The best way to assess efficiency in your business is to follow the money. Every expense needs to be traced. If you find you’re spending too much on staff, ask yourself what new processes you could put in place to help your employees do their work faster, and in turn, reduce your labour costs. Analysing sales data can help you recognise patterns that can inform when you need more or less staff on the floor. If you’re spending too much money on bank fees, it might be time to consider an alternative EFTPOS provider or whether surcharging is right for your business. If you can’t keep up with what your team is spending, an expense management system will help ensure budgets aren’t exceeded and that money isn’t being wasted on unnecessary purchases.

Zeller can help.

From accounting tools to POS software, and content management systems, there is plenty of technology available to automate or simplify processes and make your operations more efficient. Zeller is one such service that helps business owners manage their money. An alternative to your traditional business bank, Zeller helps you monitor every cent that flows in and out of your business – from accepting payments to storing funds and paying for expenses. Everything can be tracked in real-time via an online dashboard or Zeller’s mobile app – an important feature that will prove essential when tracking the success of your growth strategy.