- Business Growth & Optimisation

2024 Guide to the Australian Minimum Wage for Employers

If you’re hiring staff, promoting staff, or giving employees different responsibilities this year, you’ll need to know exactly how much you should be remunerating them for their work.

In this guide, we outline how the minimum wage works in Australia and explain the difference between awards, registered agreements, and the National Minimum Wage, and how to find the wage rates for your employees.

What is minimum wage in Australia?

Minimum wage refers to the minimum amount you can pay an employee for the work they are doing. The wage of every Australian worker is regulated by the Fair Work Commission to ensure employees are not exploited. In Australia, there are three potential frameworks that can stipulate what wage rate your employee is covered for. These are awards, registered agreements, or the National Minimum Wage. Each of these frameworks will outline exactly how much an employee should be paid in accordance with their age, skill level, and when they work (full time, part time, casual, shift work, weekends, public holidays etc.). Note that when we talk about minimum wage in Australia, we are referring to the amount of pay before tax is taken out (gross pay).

When figuring out how much you need to pay your employees, the first step is to understand which of the following three frameworks they may be covered by.

Award

A legal document that stipulates the minimum wage and employment conditions for a particular industry or occupation, set by the Fair Work Commission.

Registered Agreement

A negotiated arrangement between employers and employees, specifying the minimum wage and employment conditions, and formally approved by the Fair Work Commission.

National Minimum Wage

The lowest wage rate that must be paid to employees who are not covered by an award or a registered agreement, as determined by the Fair Work Commission.

Awards

For most employees, the minimum wage is set by the award that covers their industry or occupation. There are more than 100 different awards in Australia covering everything from retail to hospitality and beauty, and the full A-Z list is available on the Fair Work Commission website here. Awards stipulate weekly and hourly pay rates, penalty rates, rates for shift work and overtime as well as other entitlements. Each award will also have a tiered classification system, where each level reflects different skills, experience and responsibilities. The higher the level, the higher the minimum wage. It’s essential that you understand these minimum wage rates and when they apply, because failing to do so could put your business in breach of the Fair Work Act 2009. If you already know the award of the industry you are working in and the age and experience level of your employee, an easy way to find their pay grade is to use the Fair Work Commission’s Pay Calculator.

You can view the awards and download the pay guides for some of the most common awards covering small businesses below:

Registered agreements

In certain businesses, interpreting the appropriate award can be complex and administratively difficult, which is why there is another option available to employers: an enterprise or registered agreement. A registered agreement is formed when employees and employers in a specific business or company unanimously (or at least majoritarily) agree on their working conditions, and formalise them in a document that is approved by the Fair Work Commission. As with an award, a registered agreement covers all kinds of working conditions, including minimum wage, but also working hours, overtime, penalty rates, annual leave, and sick leave, for example.

The purpose of a registered agreement is to benefit both the employer and employees, so the minimum wage outlined in such an agreement can never be lower than the applicable award. If a registered agreement is in force, it will apply to the business until it is terminated or replaced by the Fair Work Commission. This means that even if a new employee joins the business after the document has been approved, they will still be covered by the registered agreement.

An employer and 2 or more employees can create an agreement that meets the needs of the business. Find more information about the process of forming a registered agreement here.

National Minimum Wage

If your employee is neither covered by an award nor a registered agreement, they will be covered by the National Minimum Wage. As of 1 July 2024 the National Minimum Wage is $24.10 per hour or $915.90 per week. This is the base rate for adult employees and it is used to calculate different rates (called 'special national minimum wages') for certain types of employees, depending on:

the type of employment (for apprentices or trainees)

the employee’s age if they are under 21 years ('junior')

the employee’s work capacity (if they have a disability).

For example, for junior employees, their pay rate is calculated as a percentage of the National Minimum Wage as follows:

The National Minimum Wage is reviewed every year by an expert panel at the Fair Work Commission. Should they decide to make any changes, these usually come into effect on the first day of the following financial year, so it’s important to stay up to date in the lead up to the 1st of July.

How do I find the minimum wage for my employees?

In order to figure out the minimum wage rate for an employee, follow these steps:

1. Find your award.

You can find this either by searching the A-Z list, or by using the Fair Work ‘Find my award’ tool. If you work in the hospitality, retail, restaurant or beauty industry, you can view the awards at the links at the top of this page.

2. Use the Fair Work Pay Calculator.

This tool will ask you a series of questions about your employee, such as whether they are a trainee/apprentice, how old they are, what their classification (skill level) is and what type of work they are doing (part time, full time or casual). It will then present you with the hourly and weekly minimum wage for that profile including weekend, public holiday and early morning or night shift rates.

Lost in labour costs and team expenses? Here are three ways Zeller can help.

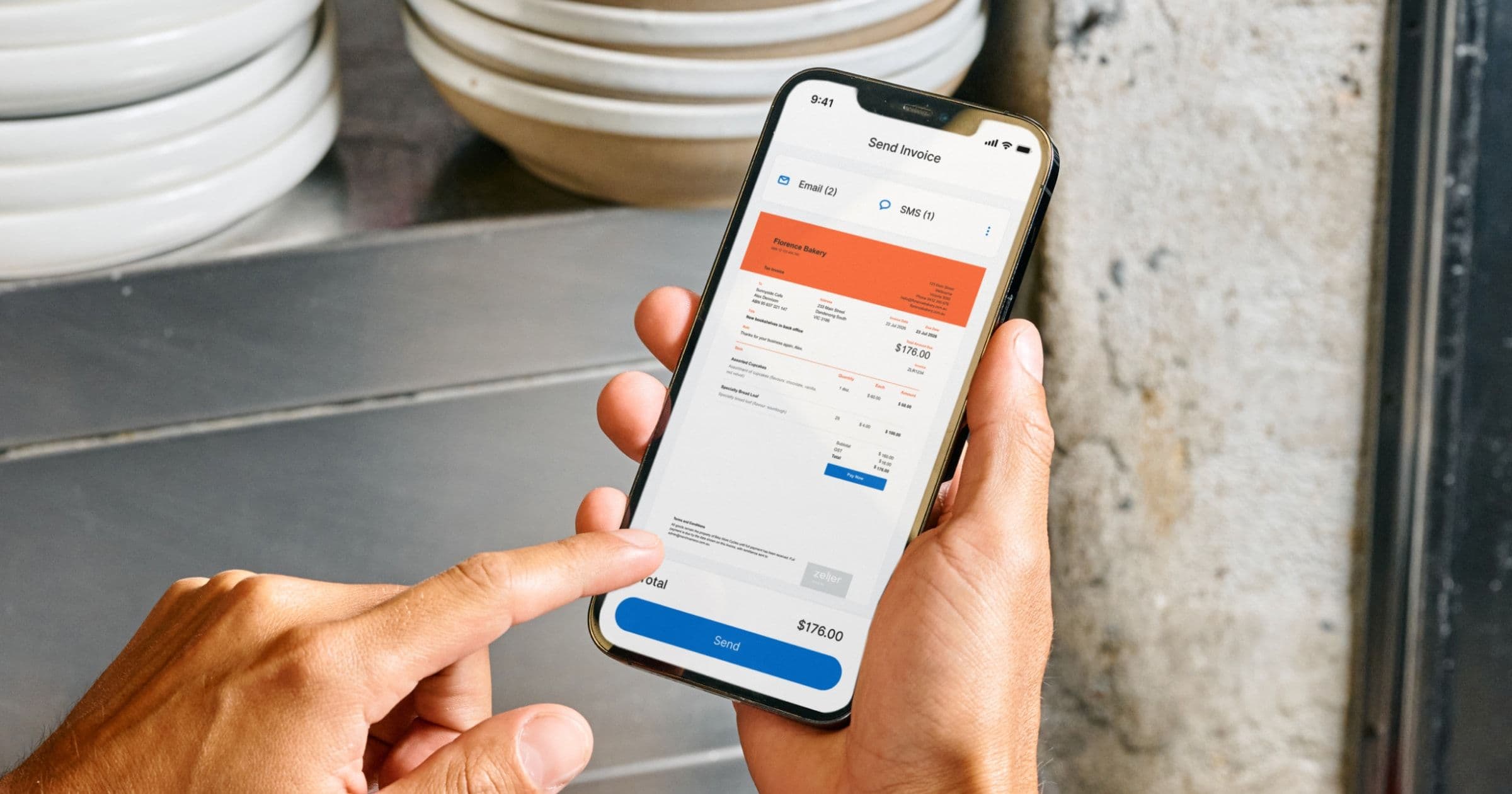

1. Tracking sales to optimise rostering

When you take payments with Zeller Terminal, every single sale is tracked in the Zeller Dashboard, or the Zeller App, for you to see. By monitoring your sales over time, you can identify trends in transaction volume, which can help you to manage your roster strategically, adding more staff in busy periods, and less staff when things are quiet.

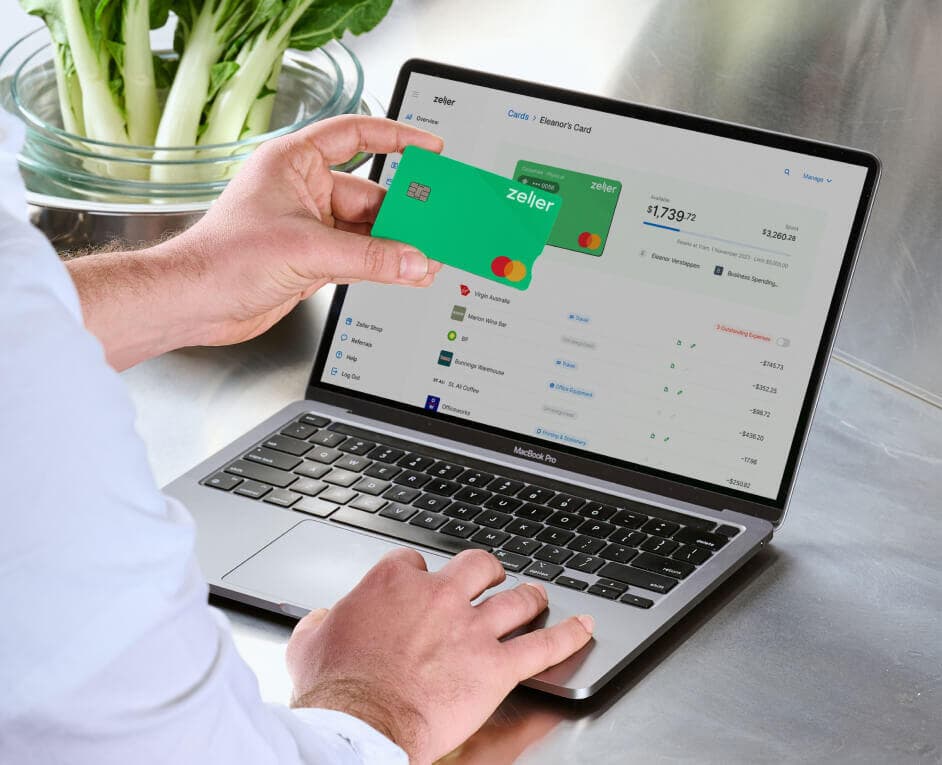

2. Managing team expenses with Corporate Cards

From coffees for clients to taxi rides, toilet paper, maintenance calls, or interstate travel, team expenses are part and parcel of running a business. With Zeller Corporate Cards, you can give your employees the freedom to pay for expenses, while individually controlling how much they can spend through transaction limits and budgets. It saves you the administrative hassle of chasing up receipts and processing reimbursements, while also ensuring expenses remain within budget and align with company policy.

3. Monitoring labour costs against revenue

Cash flow can be the make or break of any business, and with labour costs accounting for a significant portion of your expenses, it’s important to monitor these closely. When you settle payments into and pay your wages from Zeller Transaction Account, you will be able to gain a clear visualisation of your cash position over time from Zeller Dashboard and Zeller App. This will help you make informed business decisions to keep your cash flow healthy.