- Product Updates

What's New at Zeller

This month we’ve been busy building enhancements that will give you even more flexibility when it comes to managing your business finances.

Whether you need a fully mobile payment solution or a hardwired connection: our latest updates have you covered. Android users can now join the thousands of businesses taking payments on their smartphones, meanwhile our new Ethernet dock allows you to connect Zeller Terminal to your local network, ensuring non-stop, fast and reliable connectivity in the event your Wi-Fi is unstable. We’ve also made it even easier to gain the full picture of what’s happening in your Zeller Account – from the fees you're paying to important security notifications and updates. Plus, we’ve added two more features to enable you to manage user permissions on mobile and chase up unpaid balances with Zeller Virtual Terminal. Read on to learn how you can get the most out of Zeller for your business.

1. Take payments on your Android phone.

Since the release of Tap to Pay on iPhone in October last year, thousands of businesses have adopted this new, mobile payment solution. This month, we were thrilled to launch Tap to Pay on Android. Compatible with Android 10 devices (or later versions using NFC technology), this exciting solution gives even more businesses an affordable, convenient alternative for accepting contactless payments, with no other hardware required.

Powered by Zeller’s industry-leading smartphone app, Tap to Pay turns your phone into an EFTPOS machine and incorporates many of the features available on Zeller Terminal, including tipping, surcharging, transaction notes, digital receipts, sales tracking and more. If you already have a Zeller Account, the set-up process is straightforward – simply download Zeller App, log in, and configure Tap to Pay on your mobile device. Once set up, customers can tap their credit or debit card, Apple Pay, or digital wallet to your phone, and/or enter their card PIN number. Tap to Pay incurs a 1.4% flat fee per transaction, for all card types – including American Express, and includes the option to pass on the fee through surcharging. Whether you are looking for a back-up option, run a mobile operation, are just starting your business, or simply don’t want to buy an EFTPOS machine – Tap to Pay can have you taking payments in a matter of minutes.

2. Connect Zeller Terminal to your local area network with Ethernet.

For larger venues or those using integrated EFTPOS, sometimes their Wi-Fi just isn’t adequate for maintaining fast, reliable connectivity. In these instances, a hardwired connection is required. To ensure you never miss a sale, we have designed a dock to support Ethernet connectivity with Zeller Terminal. The dock is simple to set up: sit Zeller Terminal inside the dock, plug your ethernet cable into the dock, and the terminal will automatically connect via Ethernet.

To request an Ethernet dock for your business, please contact Zeller Support.

3. Manage users and view notifications on Zeller App.

This month we’ve uplifted Zeller App to give you more ways to manage your business on the go. Now, additional users on your Zeller Account can be added, managed or deleted via the Zeller App. Whether you need to add users to different sites, remove a user altogether, or adjust their roles (which determines their level of access to your Zeller Account) – everything can be done simply, and quickly from your mobile device.

Additionally, we’ve added your Notification centre to Zeller App. Now, you can view a list of all your Zeller Account notifications – from security alerts such as new device logins, modifications to user permissions, password or contact detail changes, and more. We’ll also be sending you a notification every time we publish a What’s New article to the Zeller Business Blog – so you’ll never miss a feature update!

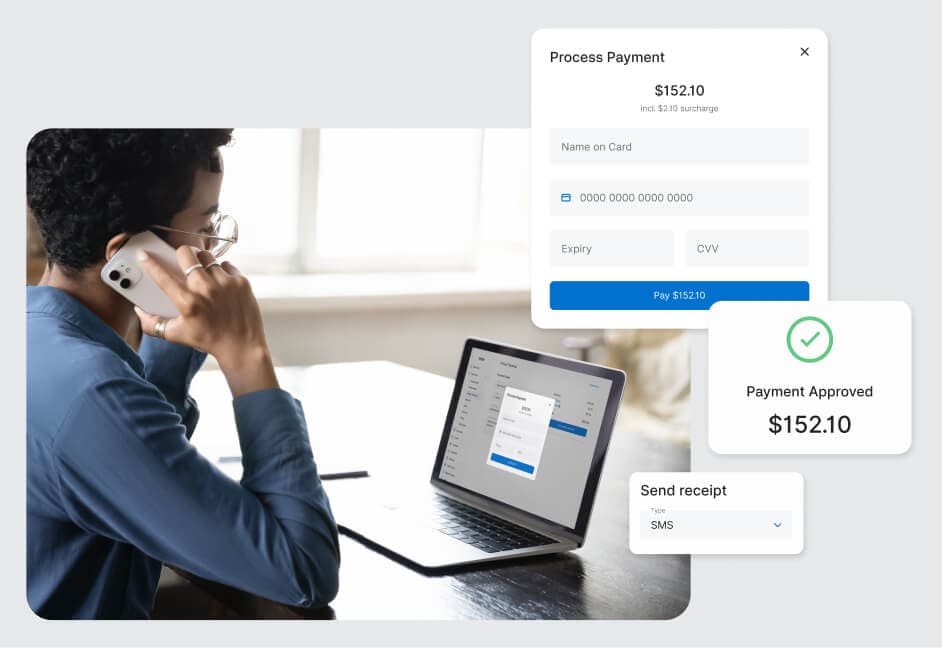

4. Follow up unsettled payments faster on Virtual Terminal.

To help you chase up unpaid balances sent through Zeller Virtual Terminal, we’ve added a quick link to copy the payment URL to your clipboard so that you can re-share it with your customer via their preferred channel. Simply navigate to the transaction you’d like to follow up on from the ‘History’ list within the Virtual Terminal tab on Zeller Dashboard, click on ‘Copy Link’ from the bottom of the right-hand side panel, and share it in whatever platform you are communicating on – be it email, WhatsApp, Instagram or Messenger.

5. Get the full picture of your finances – fees included.

At Zeller, we don’t endorse hidden fees: it’s why we make all our pricing clear and simple. In this vein, we have made it even easier to understand how much you are paying in fees for a total period in the Reports & Overview page of your Zeller Dashboard. Now, when you log in, you will be able to view what you have paid in fees in relation to your total sales, tips and surcharges. This allows you to get a clearer picture of your net sales total, after your Zeller fees have been taken out. Not only is this helpful to ensure your cash flow reporting is accurate, but it may also help inform your decision to pass on your transaction fees or not through surcharging. Simply sign into your Zeller Dashboard to access your performance report in the Overview tab.

Keen to see a feature that’s not currently available?

At Zeller, we take feedback very seriously. Each piece of feedback we receive from you is reviewed by our product team and incorporated into their roadmap to ensure the most-requested features are built quickly. If there’s something you want to see in your Zeller Account, we want to know about it. Help shape the Zeller experience by sending your ideas or requests to feedback@myzeller.com and a member of our team will be in touch with you soon.

For all the latest features, special offers and small business tips sent right to your inbox, sign up to our newsletter today and be a part of the Zeller merchant community.