- Product Updates

What’s New at Zeller this December

This month, we’ve bolstered the Zeller toolkit with functionality that will allow you to customise your EFTPOS terminal, manage team expenses, keep your account even more secure, and grow your savings faster.

To finish out the year, the Zeller team has been hard at work sharpening some of the tools you know and love, as well as adding two new features to your kit. For those taking payments on Zeller Terminal, you can now give your machine a branded glow up, with the custom screensaver functionality. On Zeller Dashboard you’ll notice a new notifications centre where security and activity alerts will help you stay across everything that’s happening in your account. And if managing expenses is giving your finance team a headache, consider Zeller Corporate Cards an early Christmas gift from us. Finally, it’s time to let go of your outdated business bank once and for all, thanks to the all new Zeller Savings Account, where you’ll grow your funds faster than with a big-4. Read on to discover how your business can harness the latest enhancements from Zeller.

Boost your brand with a custom screensaver on Zeller Terminal.

Even when Zeller Terminal goes to sleep, it keeps working for your business. Thanks to this new update, you can now set a custom screensaver that will appear on your terminal screen when it’s not in use. The large digital screen is the perfect place to engage customers with your brand while they wait for you to scan their items or pull up their order on your point-of-sale. The screen is a blank canvas, so you can be as creative as you want: add a QR code to send people to your newsletter, promote a new product or upcoming event, or simply reiterate your brand identity with a bold logo.

To upload a custom screensaver:

Open the Zeller Dashboard and navigate to Sites

Locate and click the site to see its settings

Click the Appearance tab

Upload your logo

Select a background colour (Zeller will automatically recommend some colours based on your logo)

Click Save

All Zeller Terminals within the site will display the image when in sleep mode

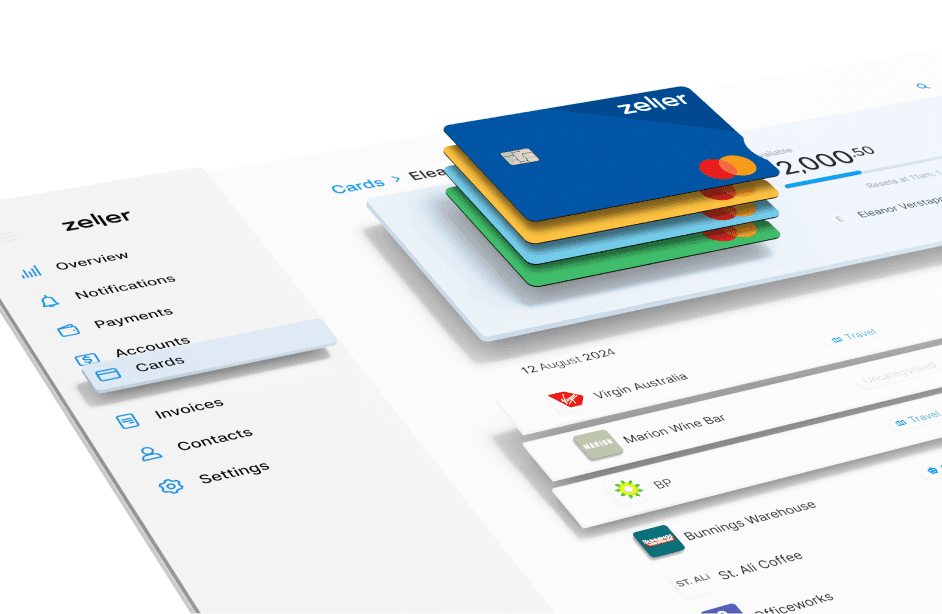

Stay in control of employee and project-related expenses with Zeller Corporate Cards.

A round of coffees for clients, a flight to check out a potential new business location, a grocery order for the office, a software subscription… business expenses add up quickly, and if you’re not staying on top of them, they can hurt your bottom line. That’s why we’ve introduced Zeller Corporate Cards. These payment cards are specifically designed for employees or teams to be able to pay for business expenses, within predetermined transaction limits and budgets that automatically reset daily, weekly, fortnightly, monthly, or quarterly. Doing away with manual, time-consuming reimbursements, Zeller Corporate Cards instead allow employees to upload receipts against their transactions, saving business owners, CFOs or finance teams hours of work (and headaches) when it comes time to reconcile expenses.

Zeller Corporate Cards can be created instantly via the Zeller Dashboard. Simply follow the prompts to create a new Corporate Card, assign the card to an employee, set the spend limits and choose your card colour. Your card can then be added to your employee’s mobile wallet or a physical card can be ordered.

Grow your account balance with a 2% p.a variable interest rate with Zeller Savings Account.

In today's challenging economy, every dollar saved counts. But despite the multiple interest rate hikes we’ve experienced in Australia, many of the big-4 banks have kept the interest rates on savings accounts on hold — or in many cases, even reduced them. Our all-new Zeller Savings Account is just another way we’re challenging the status quo, and offering small businesses the support they’re not getting elsewhere. The Zeller Savings Account offers a special 2% p.a. introductory rate for the first 60 days, then a competitive 1.4% p.a. standard variable rate thereafter. With no paperwork or need to visit a bank branch, you can create your savings account within a matter of minutes. Plus, there is no minimum balance requirement, making Zeller Savings Account accessible for businesses of all sizes. Whether you’re looking to upgrade your coffee machine, give your shop a new fit out, or purchase a new delivery vehicle, a savings account will help get you there, faster than with a big-4 bank.

Reduce your risk of fraud with security alerts.

At Zeller, we understand that ensuring your account security is critical. Our platform already exceeds the strictest industry standards, but we are constantly making improvements to reduce the risk of unauthorised activity within your account. This month, we’ve introduced a notifications centre into the dashboard where you will receive security alerts in real time when the following activities take place:

An email address is changed

A phone number is changed

A password is changed

A new user is created as an Admin

An existing manager is upgraded to an Admin

An Admin user is removed

A Manager is removed

An unauthorised login has occurred

A login has occurred on a new device

A transaction is approved on a Zeller Debit Card or Zeller Corporate Card

Being alerted to the above activities gives you complete transparency over your Zeller account, and will allow you to react promptly in the event that account changes or Zeller Debit Card or Zeller Corporate Card transactions were not initiated by you or a trusted administrator. When any of the above activities take place, you will be notified via email and the Zeller Dashboard, as well as via a push notification if you have the Zeller App installed on your phone. You can choose which notifications you receive and how you receive them through Notifications preferences on your Zeller Dashboard.

Keen to see a feature that’s not currently available?

Help shape the Zeller experience by sending your ideas or requests to feedback@myzeller.com and a member of our team will be in touch with you soon. For all the latest features, special offers and small business tips sent right to your inbox, sign up to our newsletter today and be a part of the Zeller merchant community.