- Product Updates

What's New at Zeller

This month, we’ve made end-of-day reconciliation easier, added an extra layer of security to online payments, and given even more power to the Zeller App so you can do more on the go. And that’s not all.

Reconcile your point-of-sale and Zeller Terminal with a clearer end-of-day breakdown.

At the end of a day of trading, sometimes your point-of-sale (POS) and Zeller Terminal will present slightly different totals. This is because, when a payment is processed through the EFTPOS machine, it may be subject to surcharges and tips that are added onto the sale after the POS has recorded the transaction.

What’s new?

We’ve added a clearer breakdown of your end-of-day surcharges, tips, and fees, to the on-screen report. This gives you an accurate reflection of the amount value that will be settled into your account for the day, and helps to streamline your reconciliation process.

Where can I find it?

To view your report on Zeller Dashboard, navigate to the sidebar menu, click ‘Payments’, then click ‘Reports’. To print your report on Zeller Terminal, select ‘Reports’ from the navigation menu. Specify the date range, select ‘Site’ or ‘Terminal’, then tap ‘Print’ on the top right corner of the screen.

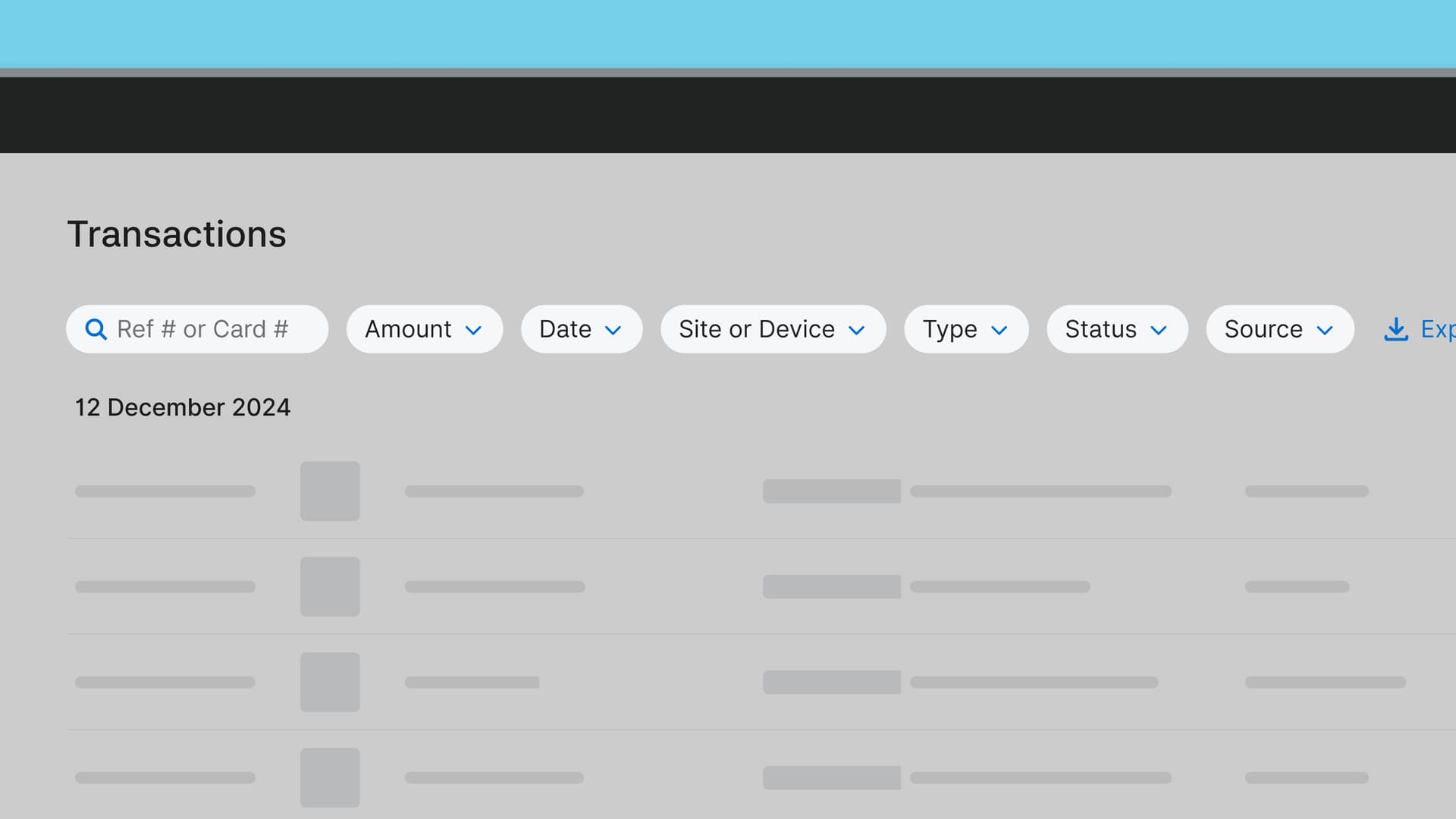

Pick up where you left off when filtering transactions.

Applying filters to your transaction records is a great way of finding refunds or declined sales as well as identifying transactions processed in certain sites, on particular devices.

What’s new?

We’ve uplifted the filtering experience on your transaction reports to help you find what you’re looking for faster especially when you use the same filters regularly.

Where can I find it?

When you apply filters to your transaction reports in Zeller Dashboard and navigate away from the page, the same filters will still be applied when you return.

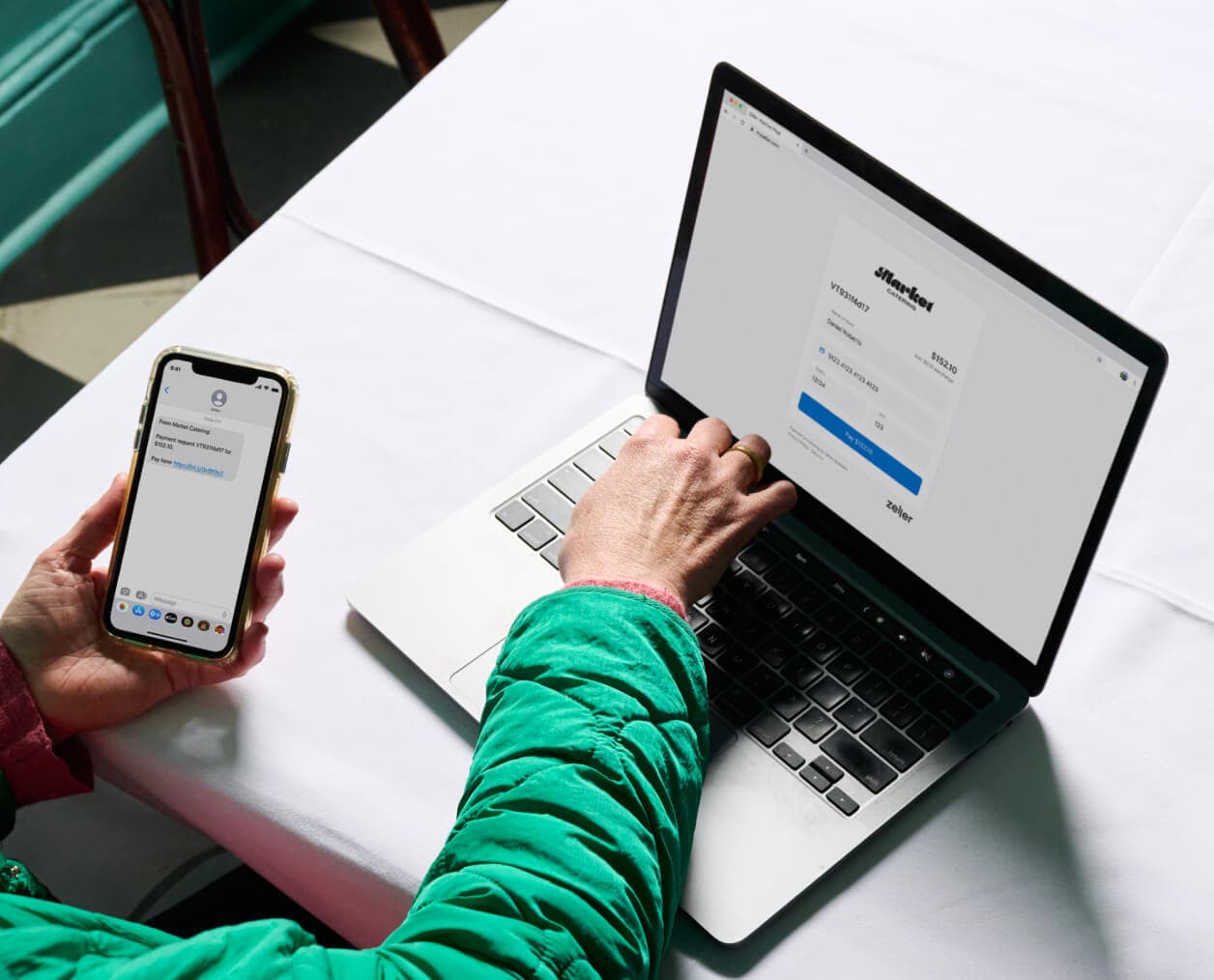

Safeguard your online payments with a new layer of security.

When you accept payments with Zeller, your business benefits from a dedicated anti-fraud team and 24/7 transaction monitoring. However, there's now even more you can do to safeguard your business against scammers.

What’s new?

We have introduced an extra layer of protection, known as 3D Secure, to online payments with Zeller Invoices, Pay by Link, or Xero Invoices (when using Zeller’s online payment gateway).

How does it work?

Your customer may be prompted to enter a passcode or go through a similar authentication step on their banking app to proceed with the payment. Once your customer has entered the correct passcode and been authenticated successfully, the payment will be processed.

Update your security notifications from Zeller App.

Security notifications help you stay abreast of any potential changes to your account in order to safeguard your business against potential fraud. Managing these is especially important if you have multiple people who are admins of your Zeller Account.

What’s new?

We’ve further enhanced the notification centre on Zeller App to allow you to have even more control over what updates you’d like to receive as an email and/or push notification.

Where can I find it?

Customise how you’d like to be notified under ‘Settings’ within the ‘App’ tab on Zeller App.

Manage your contacts on the go.

Zeller Contact Directory lets you manage business relationships with contact and customer management tools and is included free with your Zeller Account.

What’s new?

Zeller Contact Directory is now available on Zeller App! Manage customer and supplier details, automatically attach supplier and vendor information to transactions, and track customer purchases on the go.

Where can I find it?

To add a new contact on Zeller App, navigate to the menu on the top left-hand side and click ‘Contacts’ and follow the prompts.

Keen to see a feature that’s not currently available?

Help shape the Zeller experience by sending your ideas or requests to feedback@myzeller.com and a member of our team will be in touch with you soon. For all the latest features, special offers and small business tips sent right to your inbox, sign up to our newsletter today and be a part of the Zeller merchant community.