- Banking

Best Business Bank Accounts in Australia for 2026

For Australian businesses, choosing the right business bank account isn’t as straightforward as it used to be.

Between traditional banks, online-only challengers, and modern fintech alternatives like Zeller, the options are broader than ever — and more confusing.

This guide compares some of the top options in Australia, from the Big Four to rising digital banking platforms, so you can choose the right account for your needs, whether you're a sole trader, freelancer, small business or scaling company.

Compare top Australian business accounts to see why Zeller Transaction Account stands out.

As you can see from the table above, Zeller either matches or beats the big-4 banks in almost every area. Traditional banks like CommBank, NAB, Westpac and ANZ each offer business accounts with in-branch service, cash handling and international payment features. While these can suit businesses that still rely on physical banking, they often come with higher monthly fees and less flexible digital tools.

The two limitations to a Zeller Business Transaction Account are depositing cash and multi-currency accounts. Zeller merchants typically overcome this by:

– keeping a separate bank account with a traditional bank for the sole purpose of depositing cash, then sending the money directly to their Zeller Business Transaction Account

– keeping international currencies with another provider (like Wise or Airwallex).

Note: Zeller is working towards offering multi-currency accounts, so watch this space!

Understanding business bank accounts: what they are and why they're essential.

A business bank account isn’t just a nice-to-have, it’s a key part of running a compliant, professional and scalable operation. Here’s why you need one:

Legal and tax compliance: If you're registered for GST or operate as a company, you’ll need a dedicated account for your business transactions.

Simplified admin: Separating personal and business finances makes reconciling income, preparing for BAS, and managing deductions far easier.

Professionalism: Customers take you more seriously, and are more likely to trust your business, when invoices and payments come from a business bank account.

Cash flow control: Monitor your business incomings and outgoings more clearly to make faster decisions.

Access to finance: It’s typically a requirement for business loans, overdrafts, business credit cards, and trade accounts.

Types of business bank accounts in Australia.

In Australia, there are a few core types of business accounts on offer, such as:

Transaction accounts: Your day-to-day account for receiving payments, making purchases, paying suppliers.

Savings accounts: For earning interest on unused business funds.

Term deposits: Lock away funds for a set time to earn higher interest.

Offset accounts: Linked to a business loan, helping reduce interest payments.

Key factors to consider when choosing a business bank account.

Fees

Monthly fees, overdraft fees, dishonour fees, and FX costs can vary widely amongst business banks. For example:

– Traditional banks may charge $10-$25/month just to keep the account open

– Overdraft fees can be surprisingly high and feel unnecessarily punitive

– International payments might include conversion fees or transfer costs

– Staff-assisted transactions and even electronic transactions can also incur more fees

This last point is worth illustrating with two examples:

1. CommBank charges $5 per staff-assisted transaction on business accounts

2. Bendigo Bank charges $0.40 per electronic transaction on their Business Basic Account

In contrast, Zeller Business Transaction Account has no fees whatsoever. For small businesses, especially those just starting out, these savings can quickly add up.

Access and convenience

In business, time is money. You’ll want an account that’s easy to use and built for purpose. Consider things like:

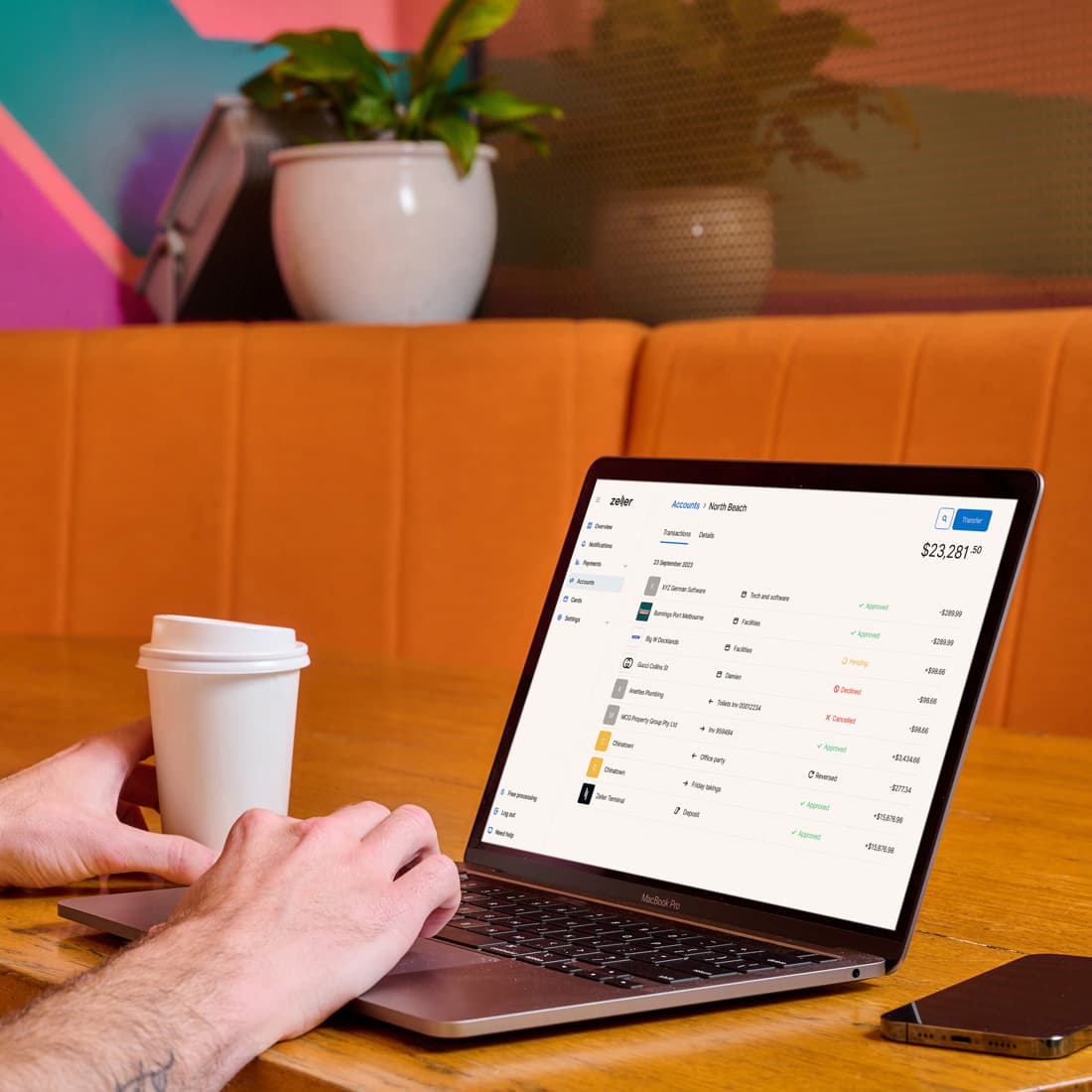

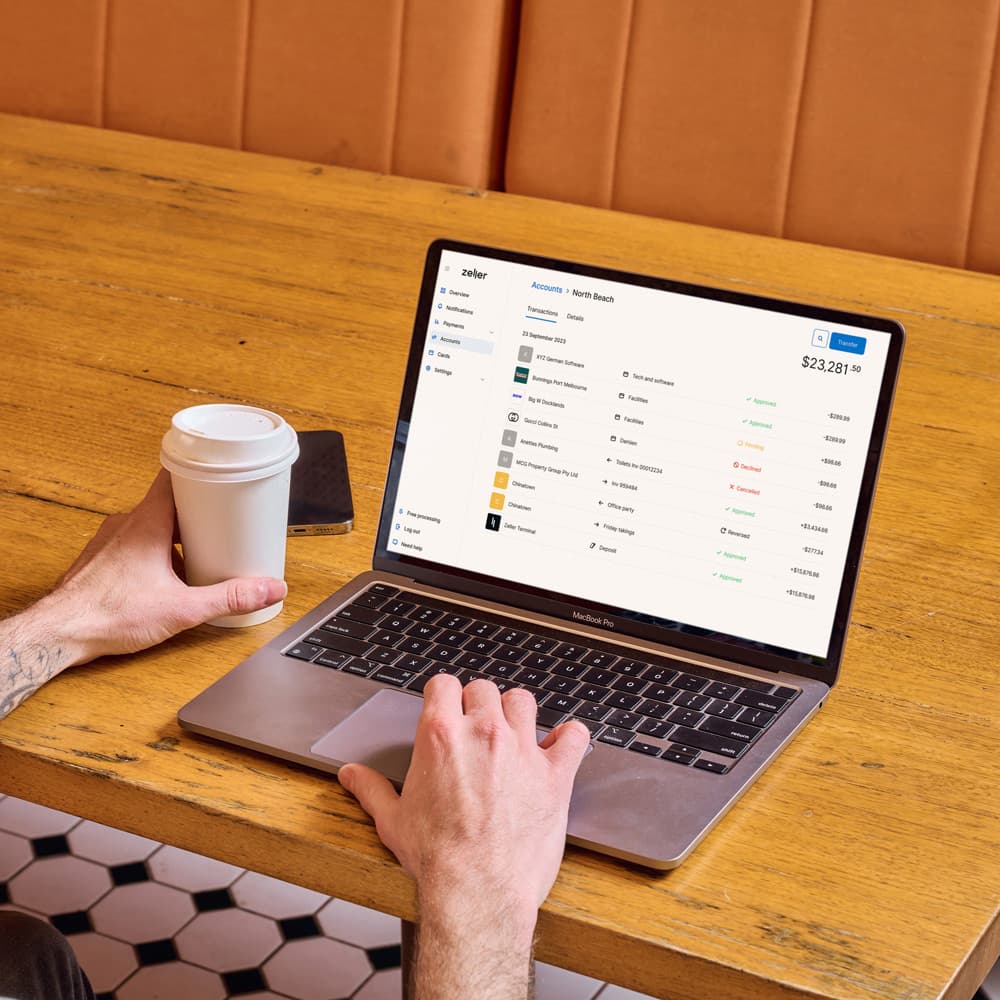

– Does the online banking interface have a clean, modern design?

– Does it have powerful transaction filtering and searching?

– Is the mobile app easy to use on the go? (Zeller App is rated 4.2 on the App Store)

– Can you access help when you need it? (Zeller offers 24/7 online access and support)

More businesses are moving away from needing face-to-face banking and instead placing higher value on mobile-first platforms that work wherever they are.

Account features

Choosing a business account isn’t just about the basics. The right features can save you time, reduce admin, and give you more control over how your business operates. For example, a Zeller Business Transaction Account offers you:

Cards: Zeller lets you issue unlimited free physical and virtual debit cards with custom spending limits. You can also generate single-use virtual cards for added security when shopping online.

Multi-user access: Give team members custom access, so they can view balances, send invoices or manage cards, without full account control.

Integrations: You can easily connect your Zeller Business Transaction Account to tools like Xero for easy bookkeeping.

Reporting: Built-in analytics, spending breakdowns, and receipt capture with Zeller.

Access to interest: A Zeller Savings Account allows you to earn significantly more interest than with a traditional big-4 bank.

Transaction categorisation: Automatically sort and label incoming and outgoing payments, helping you track spending by type, supplier or category.

Multiple accounts: Spin up extra accounts for different projects, teams or business locations – no paperwork or branch visit required.

Real-time fund transfers: Move money instantly via Australia's New Payment Platform (NPP).

BPAY: Quickly and easily pay suppliers directly from your dashboard using BPAY.

Security and regulation

Traditional banks are Authorised Deposit-taking Institutions (ADIs), so deposits are protected by the Financial Claims Scheme (FCS), a government guarantee of up to $250,000 if the bank was to fail.

With Zeller, customer funds are held in a segregated account at a fully-regulated, authorised Australian bank. Zeller also maintains strict compliance protocols, and uses advanced encryption, fraud monitoring and multi-factor authentication to keep your business finances secure.

For many modern businesses, the benefits of speed, flexibility and innovation make this a smart, secure, and trusted alternative to traditional banking.

Customer support

Zeller offers 24/7 customer support via phone, email and SMS – so whether you need help setting up your account, have a question about a transaction, or are sorting something urgent during tax time, you can speak to someone when it matters most. Unlike many traditional providers, support isn't limited to business hours or ticket-based systems, you’ll speak to a real human with experience in supporting Aussie businesses.

Suitability for your business type

Every business is different. The right account for your business should suit your operating model, whether you're client-facing, retail-based, or remote. For example:

Sole traders/freelancers often prioritise ease of use and low fees

Growing businesses typically look for multi-user access, cards, and integrations

Retailers/tradies frequently find POS and EFTPOS integration can make a huge difference

International traders need strong FX capabilities and multi-currency accounts.

Real-world examples: who should choose what?

Not every business needs the same thing from their transaction account. Here are a few common scenarios to help you match features to your business type.

Tradie on the road

Zeller’s mobile-first setup, SMS invoicing and no-branch model means you can quote, invoice and track payments without ever setting foot in a bank.

Freelancer with local clients

Zeller gives you all the essentials with no monthly cost, plus faster access to funds to keep your cash flow healthy.

Import/export business

Wise and Airwallex make more sense here, with multi-currency accounts and competitive FX. Zeller does not currently offer multi-currency accounts yet, but has plans to do so in the future.

Brick and mortar retailer

Zeller integrates with EFTPOS and provides detailed sales tracking across channels.

How to open a business account in Australia.

Opening a business account in Australia is fairly straightforward, but exact requirements can vary slightly between providers. Here’s what to expect.

In most cases, you’ll need:

– A business name

– An ABN or ACN

– An industry type

– Personal ID (driver licence or passport)

– Business contact details

– In some cases, business structure documentation (e.g. partnership agreement)

With Zeller, the process is 100% online and takes just a few minutes. No paperwork. No queues. Just fast onboarding and instant access to your transaction account and cards.

Managing your business account effectively.

Once you’ve opened your account, here are a few tips to help you get the most out of it:

Separate personal and business spending so your bookkeeping is cleaner and reconciling transactions is easier come tax time.

Use categories and tags to track expenses by type – this helps you understand where your money’s going and identify areas to reduce spend.

Review reports monthly to spot trends, catch anomalies, and stay on top of cash flow.

Set up automatic payments to ensure bills, wages and subscriptions are always paid on time.

Stay on top of GST and BAS by regularly exporting your records, so you’re never scrambling at lodgement time.

Zeller makes all this easy, with built-in notes, digital receipts, auto-categorisation and integrations that connect your financial activity directly to your accounting software.

So, which account is right for your business?

The best business account depends on your priorities, but if you're an Australian business looking for a modern, mobile-first, all-in-one platform that’s free to use, integrates with your tools, and helps you manage everything from invoicing to spending, Zeller offers a strong alternative to the big-4 Australian banks.

A Zeller Business Transaction Account is fast to set up, simple to use, and purpose-built for how Aussie businesses operate.

Sign up for a free Zeller Business Transaction Account.

Your fee-free account will be ready to use in minutes – no branch visit or lengthy paperwork required.