- Banking

5 Reasons a Savings Account Might Be Good for Your Business

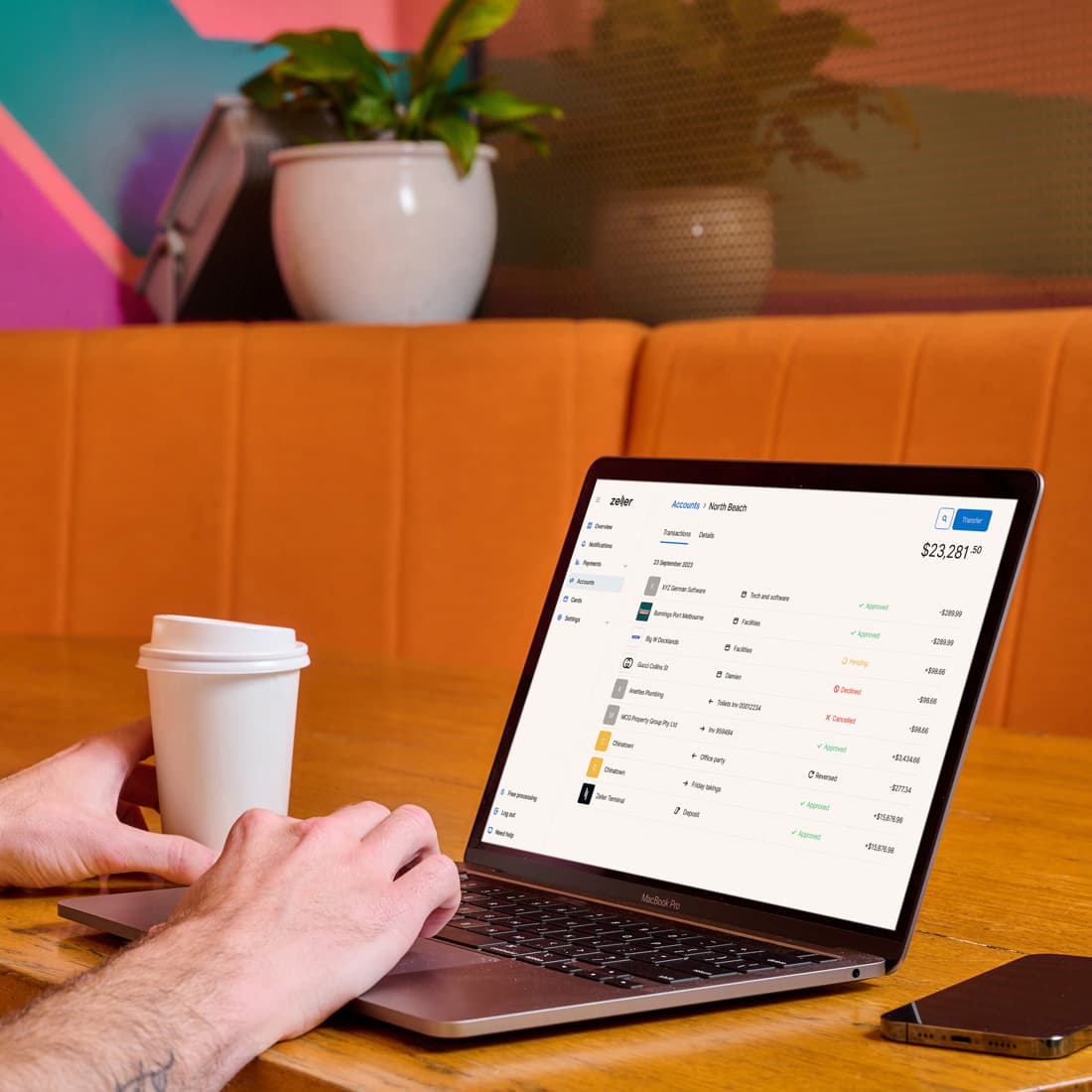

Zeller already helped you grow your business, now we’re helping you grow your account balance.

Whether you’re an established business owner or are just about to launch your new venture, there’s never a bad time to reassess how your business finances are organised. By now you will most likely have opened a business transaction account but have you considered a business savings account? With a better interest rate than the big-4 banks, a Zeller Savings Account can help you grow your business savings faster.

You'll earn up to an amazing 4% p.a. interest rate with a Zeller Savings Account.

Whether you’re looking to upgrade your coffee machine, give your shop a new fit out, or purchase a new delivery vehicle, a savings account will help get you there. Read on to discover five ways a business savings account can help bolster your business.

1. It can serve as an emergency fund

If COVID-19 taught us anything, it’s that you never know what’s around the corner. If you want your business to be able to better survive unexpected events, it’s very important that your business has a cash reserve. By adding funds regularly to a savings account that earns interest, you are building a buffer that your business can use through unforeseen expenses, such as an important piece of equipment breaking down, a legal battle, a sudden increase in operational costs or an economic downturn, for example.

2. It can help manage poor cash flow

According to The Invoice Market’s research, cash flow is the number one issue affecting small to medium businesses across Australia, with more than a third of them having to dip into their own personal savings to keep their business afloat. By moving funds into a savings account, you can contribute to building your businesses' resilience. Late payments, rising overheads, overstocked inventory or seasonal fluctuations are all common causes of poor cash flow; having some extra funds to see you through these leaner times will help give your business more stability.

3. It can help you avoid tax stress

As a business owner, it is your responsibility to manage your tax obligations. If you do not have an organised approach to earmarking tax funds and declaring your turnover, you may end up with an unforecasted tax bill that could cripple your business. One great way of managing funds for not yet paid tax obligations is to put them into an interest-earning account before you need to pay the tax office. Not only will you have set aside cash to meet your tax obligations, but you will also have earned interest on it.

4. It can improve your position to borrow

Even if you’re not currently planning on taking out a business loan, it might be something you choose to do in the future – so it’s important to consider your credit rating. When a lender is assessing whether or not to lend you money, they look at how much risk they are taking on. This ‘risk’ is what is known as your credit rating. In ascertaining your credit rating, they might assess your cash flow and your cash on hand. A savings account can therefore assist in providing this context to a lender.

5. It can help finance future investments

Interest rates on savings accounts may not be very high, but they still offer a way to earn some passive income on idle funds. The extra cash that you earn from interest can be invested back into your business: whether you use it for purchasing new equipment, upgrading your technology, or helping to fund an advertising campaign, over time, these purchases can make a considerable difference to your business. While the day-to-day running of your business can be all consuming, making a contribution each week to a savings account can set you up for future expansion by earning you money in the background.

How does a Zeller Savings Account compare to the big-4 banks?

*Interest rates current at 1 December 2025. Terms apply.

Don’t let your business savings stagnate in a big-4 bank account. With Zeller’s competitive interest business savings account, not only will you earn a better return on your savings without a minimum balance requirement, but you will also benefit from a whole ecosystem of financial services and business products. From securely holding your money to accepting payments, managing expenses and tracking your cash flow, Zeller’s suite of financial tools lets you tailor your solution to your business needs. With everything consolidated into one reliable platform, you can accept, settle, spend, and track your funds faster, leaving you more time to run your business.

Disclaimer: The information provided on this site is for general informational purposes only and should not be considered as advice that takes into account your business needs and objectives. If you are unsure, seek the advice of a qualified accountant or financial service advisor before deciding whether a savings account is right for your business.