- EFTPOS & Point of Sale Solutions

Zero Cost EFTPOS: How Does It Work and What’s the Catch?

You might have heard about ‘zero-cost’, ‘fee-free’, and ‘no-pay’ EFTPOS: as their names suggest, they offer business owners a way to accept payments without the regular transaction fees. Before you sign up, it’s important to understand how these schemes work and whether or not they’re right for your business.

Fee-free EFTPOS explained.

When someone makes a cashless transaction – by tapping their card or mobile device to your EFTPOS terminal – there is a cost for using the technology that moves the money from their account to your business bank account. This cost is known as a ‘transaction fee’ or ‘merchant fee’.

A way for businesses to avoid having to pay this fee is to pass it on to the customer as a small surcharge that is added to the sales total. So, instead of your business incurring the cost of the transaction, your customer covers it at the time of payment. This is referred to as ‘surcharging’.

Fee-free EFTPOS means the processing fee is passed on to your customer as a surcharge.

Zero-cost EFTPOS means the cost to your business is zero, because it is passed on to your customer as a surcharge.

This process is sometimes also referred to as an “automatic surcharge”, which means the cost of accepting a transaction is automatically passed on to your customer.

Is surcharging legal?

Yes. In Australia, it is legal to pass on the transaction fee, however, the Reserve Bank of Australia (RBA) mandates that the surcharge rate can’t be higher than the amount you incur to process card transactions (your ‘cost of acceptance’). Read our blog article to learn more about how surcharging works in Australia and in what states and industries it is most popular. It is important to note that if you do choose to pass on the fee to your customers, you are legally obliged to display appropriate surcharge signage at the point of sale.

Zeller Surcharge Trend Report

Find out what states and industries surcharge the most in Australia and understand if surcharging is right for your business.

When ‘fee-free’ isn’t actually free.

While the promise of ‘free’ EFTPOS processing is enticing, it’s important to make sure you fully understand the terms of your contract with your payment provider before proceeding. Many fee-free or zero-cost EFTPOS plans do indeed have additional costs and obligations, which we’ve listed below:

Machine rental – Most payment providers will charge a monthly fee for the EFTPOS hardware required to take payments. If your business requires multiple machines, this cost can quickly add up.

Upfront establishment fee – When you get started with EFTPOS, you may be charged a one-off establishment fee that covers the setting up of your payment terminal. It is usually charged per facility, so if you have more than one EFTPOS machine, you will be charged for each.

Lock-in contracts – This means you cannot remove the surcharge without help from your financial services provider, which will likely involve lodging a formal request and then waiting for it to be actioned.

Minimum monthly transaction volume – Many payment providers will only honour their ‘fee-free’ promise when you meet a minimum transaction volume, which can be upwards of $10,000 processed through your EFTPOS terminal per month.

Variable fees per card type – As a merchant, you have a responsibility to ensure your surcharge remains less than – or equal to – your cost of acceptance. However, some payment providers will charge a variable transaction fee, (one that changes depending on the card type) which makes it very difficult to predict what an appropriate surcharge will be. In order to stay within the law, you will have to surcharge an amount that, in some instances, won’t entirely cover the cost of the fee.

When signing up for a zero-cost EFTPOS provider, make sure you’re asking questions to uncover the hidden charges and obligations — to ensure you’re getting the best deal for your business, and for your customers, too.

To learn more about the true cost of EFTPOS, read our article on deciphering transaction fees.

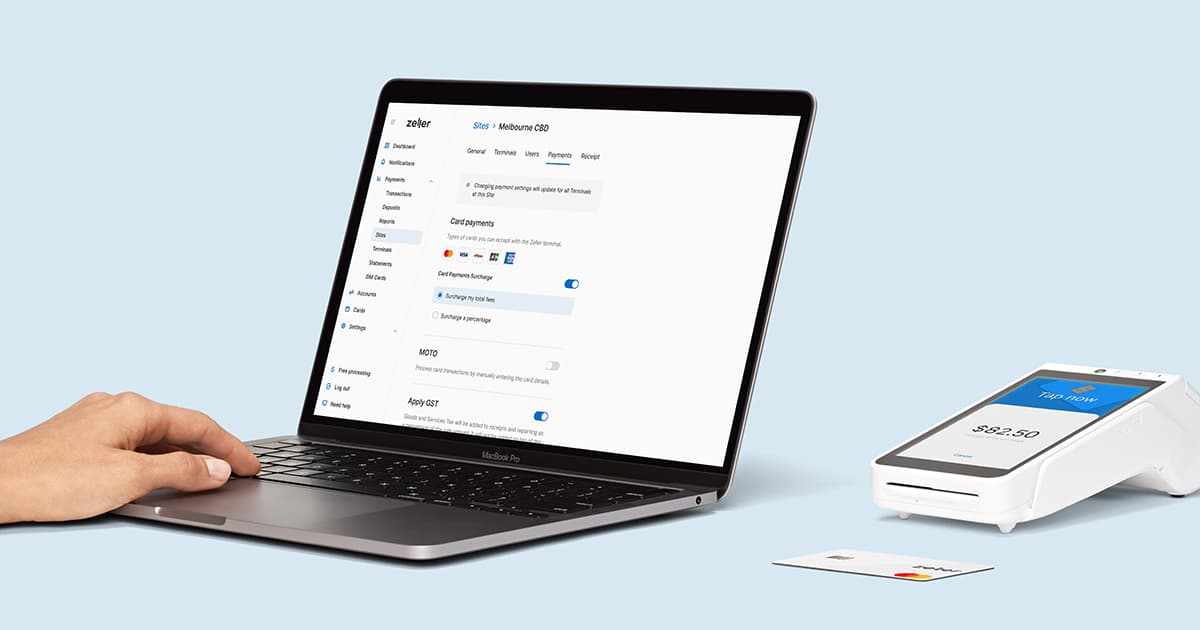

Zero-cost EFTPOS made simple with Zeller.

At Zeller, we pride ourselves on keeping our fees simple and transparent. When you use Zero-Cost EFTPOS with Zeller Terminal, you know exactly how much (and how little) you’re paying.

Purchase your EFTPOS machine outright – Zeller Terminal 1 is yours to own for just $99, and Zeller Terminal 2 is just $199 outright. Having no monthly rental fees makes Zeller Terminal the most affordable EFTPOS machine on the market. Order one online from the Zeller Shop and enjoy free express shipping.

Turn surcharging on and off at any time – We understand that surcharging doesn’t always sit well with the customers who have to foot the bill, which is why we have built flexible surcharging into our technology. With Zeller Terminal, you can toggle surcharging on or off with ease. What’s more, you can also customise the surcharge if you would prefer to only pass on a portion of the transaction fee.

One low, flat fee – No matter what card your customer chooses to pay with, Zeller will only ever charge one low, flat transaction fee of 1.4% to every in-person transaction — taking the guesswork out of calculating surcharges.

No monthly minimum requirements – At Zeller, we do not discriminate: our offer remains the same for all businesses. Whether you process $5 or $50,000 in a month, you will always have access to zero-cost EFTPOS.

No hidden fees and no lock-in contracts – With Zeller, what you see is what you get. Purchase Zeller Terminal outright and pay (or surcharge) 1.4% per in-person transaction. There are no additional fees, and we’ll never lock you into a contract.

Switch to fee-free EFTPOS with Zeller

Pass on your transaction costs with automated surcharging, so you'll never pay a card processing fee — no matter the card type.