- EFTPOS & Point of Sale Solutions

What is surcharging? Is it right for your business?

Passing on an EFTPOS transaction fee to your customer is increasingly becoming a favoured cost-saving measure for businesses navigating a tough economy.

With every card payment comes a fee, and whose side of the fence that should fall on – that of the customer or the merchant – is still very much up for debate. While it is the customer who decides what card they pull out, it’s the merchant who makes the call on the payment processor, the rates of which ultimately determine the fee. However, as businesses continue to be squeezed by rising costs, many are opting to pass on this fee to the customer, through what is known as surcharging.

While it is entirely legal to surcharge your customers, there are stringent rules set by the ACCC in Australia to ensure that businesses don’t charge more than their cost of acceptance (the amount you incur to process card transactions).

What’s more, customer sentiment varies greatly across industries and geographies, and while you might get away with it at a metropolitan café, the same might not be said for a regional clothing store. In this article, we break down the practice of surcharging to help you make an informed decision for your business.

Read on to find out what surcharging is, where and among what business types it’s most popular, what rules you need to abide by, and how you can enable surcharging on your Zeller Terminal.

Minimum card spend shifts to surcharging

The idea of making your customers pay for the convenience of using a debit or credit card is not new. We’ve all been in the situation where we’ve ended up buying something we didn’t need, purely to reach a business’s minimum EFTPOS requirement. The minimum card spend was introduced as a way for businesses to discourage customers from paying on card, so that they could avoid paying the transaction fee. At a time when people also held cash in their wallets, this practice made sense, but it’s fast becoming outdated, and frankly very frustrating. According to a 2023 report by the Reserve Bank of Australia, 76% of all payments in 2022 were made using debit or credit card. It’s becoming increasingly difficult – and counterproductive – for businesses to ask customers to pay with cash, and yet, someone still has to foot the bill for EFTPOS payments. This is where surcharging comes in.

“My costs for five terminals across three locations were in excess of $5500 a month… So I said enough is enough. I'm done spending this sort of money on bank fees.”

Kirsten Pitman

Restaurant owner in Victor Harbor, South Australia

Kirsten Pitman, who owns several restaurants in Victor Harbor switched to Zeller, which charges one low flat fee of 1.4% per transaction, and began passing the cost onto her customers through surcharging. “Because we’ve saved so much money with our EFTPOS process, we haven't had to increase our prices and I feel like that's actually played into our favour in this current environment.”

Three in five transactions now incur an EFTPOS surcharge

According to Zeller data, nearly 60% of all transactions now include a surcharge. Since June 2021, the percentage of transactions with a surcharge applied has increased eightfold. Now, nearly three in every five payments that your customers make, include a card payment surcharge.

Surcharging more prevalent in hospitality, transport, and beauty sectors

Surcharging is most prevalent in the food and drink industry, with nearly 60% of hospitality businesses choosing to enable surcharging. This is followed by the transportation and beauty sectors where approximately 40% of businesses are choosing to pass on their transaction costs to the customer.

Surcharging is least prevalent in travel, education, and charities or member-based businesses, with less than 20% of them choosing to enable surcharging.

The propensity to surcharge increases with business size

Zeller data shows a direct correlation between annual turnover and the decision to surcharge. Businesses in their nascent stages — when the focus is on building a strong brand and establishing relationships with customers — are less likely to impose a surcharge. Whereas more than half of merchants with an annual turnover of $500,000 or more, choose to adopt the practice. It would seem that the surcharging strategy evolves over time, as businesses become more established, they become more confident that their customers will accept a card payment surcharge.

Businesses in Victoria and New South Wales surcharge more

While 54% and 64% of businesses operating in New South Wales and Victoria, respectively, are surcharging, the rest of the country is yet to adopt the practice with the same enthusiasm. With the exception of Queensland where 43% of businesses are surcharging, in every other state it is still relatively uncommon, with less than 30% of businesses choosing to pass on their EFTPOS fees.

Surcharging is also much more commonplace in metropolitan cities than it is in regional areas, with nearly 60% of metro-based Zeller businesses choosing to surcharge compared to just 33% of regional businesses.

The importance of understanding your cost of acceptance

Before we get into the legalities of surcharging, it’s important to understand how EFTPOS transactions work. When a customer uses a credit or debit card to make a purchase, a number of fees are charged between your bank (or payment provider), your customer's bank and the payment card network (eg. Visa, Mastercard, or American Express).

The fee that you are charged to process the payment is entirely dependent on the type of card your customer uses, and it could be anywhere between 0.2% and 3.5%. Additionally, your bank may charge you terminal rental fees, account-keeping fees, or monthly service fees (learn more about The True Cost of EFTPOS Transaction Fees here). Together, these fees make up what is known as the ‘cost of acceptance’, that is, the expense incurred to accept a card payment.

Unless you are using a service such as Zeller, which keeps things simple with one low, flat fee of 1.4% per in-person card payment, it can be extremely difficult to calculate your cost of acceptance. Why this is important, is because, should you choose to pass on the cost to your customer, you legally cannot pass on a charge greater than the one you incur. In order to curb excessive surcharging, the Reserve Bank of Australia introduced the following legal obligations:

Your surcharge cannot exceed your cost of acceptance

You must review your cost of acceptance at least once every year

As a merchant, you have a responsibility to check your annual statement, to ensure your surcharge remains less than — or equal to — your cost of acceptance, and set your surcharge for the following year based on what you discover.

For Matt Bisaro, who runs Floral Craftsman in Sydney’s affluent suburb of Mosman, having one low, flat rate meant that he didn’t have to turn away customers wanting to use American Express, which traditionally incurs a much higher transaction fee.

“My favourite thing with Zeller was that I got the same [fee] for AMEX. I used to have to refuse AMEX payments, and I lost people over it… Now you can add on that surcharge and no one thinks about it.”

Matt Bisaro

Owner of Floral Craftsman, Mosman, Sydney

Customer perception and experience

Even though public perception around surcharging is changing, it’s always important to tread with caution so as not to get your customers offside. When weighing up whether surcharging is right for you, consider the following:

Gauge whether surcharging is commonplace in your local area and within your industry. If so, it’s likely customers won’t even bat an eyelid at having to pay the extra few cents.

Ensure you are providing a smooth payment experience. If you’re charging customers for using a card, the payment process must be quick and effortless. Adding a surcharge on top of things like connectivity issues and processing delays will undoubtedly lead to frustration.

Make sure you display appropriate signage. Your surcharge signage must be clear and in public view, and where relevant should display the percentage or amount of the surcharge. Zeller Terminal keeps things transparent by displaying the surcharge on-screen during the payment process.

The alternative to surcharging? Lowering your EFTPOS transaction fees

After taking into consideration your industry, your location, and your customers, you might decide that surcharging is not for you, which is completely reasonable. However, avoiding EFTPOS transaction fees altogether is becoming increasingly difficult as customers move away from cash. It’s therefore more important than ever to reassess your EFTPOS solution to ensure you are getting the best deal. With Zeller Terminal, you can own your EFTPOS machine outright, and will only be charged one low flat fee of 1.4% per in-person card payment. No hidden costs, no lock-in contracts. You can also speak to the Zeller Sales team about an even lower custom transaction fee, if your business is processing over $250K annually in card payments.

“I’m very anti-surcharging… I understand that there might be a day when I have to start… but I think it’s more important to negotiate with the payment provider. With Zeller, we negotiated a great rate. I think it's on me to provide good service and that’s one way that I do it.”

Adele Arkell

Owner of Radio Mexico, St Kilda, Melbourne

How do I start surcharging?

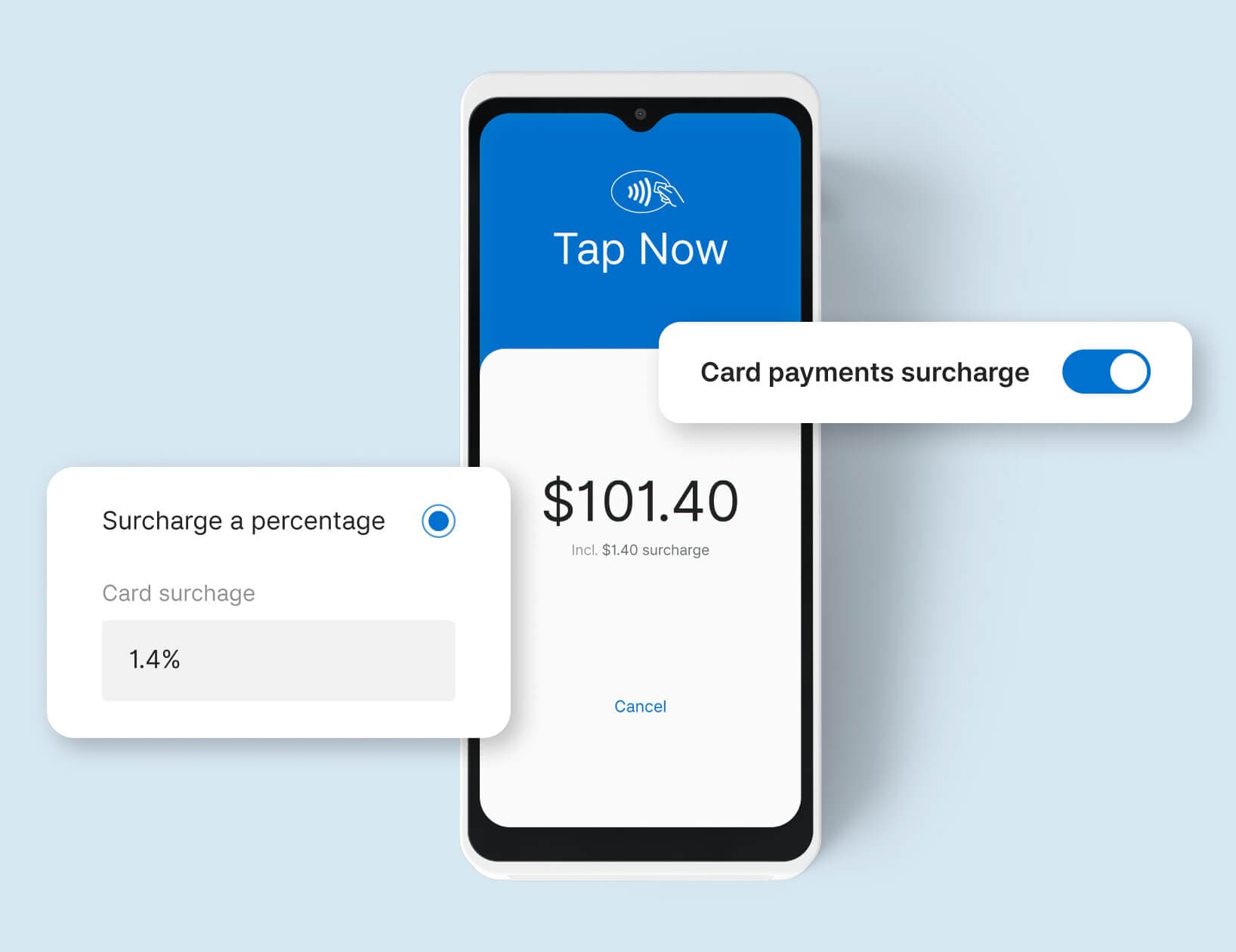

If you’re already using Zeller, surcharging can be enabled simply by toggling on the feature on Zeller Terminal or on your Dashboard.

If you are not using Zeller, you will need to check with your bank or payment provider. Bear in mind, some merchant services will only allow you to enable surcharging if you can meet minimum turnover thresholds every month, or will require you to sign a contract that locks you into using the functionality.

At Zeller, we believe in giving merchants the flexibility to run their business in the way that suits them best. That means having the ability to pass on your EFTPOS transaction fees in full or in part, and to turn the functionality on or off whenever you want to. There’s no contract to sign, or hoops to jump through.

To learn how to enable surcharging and recover your EFTPOS transaction fee in full click here.

Download the ACCC's guide to ensure your business is compliant with surcharging regulation.

Switch to fee-free EFTPOS with Zeller

Pass on your transaction costs with automated surcharging, so you'll never pay a card processing fee — no matter the card type.