- EFTPOS & Point of Sale Solutions

How EFTPOS Transactions Work: Pulling Back the Curtain on Cashless Payments

Discover how this everyday technology functions and why it’s important to choose the right hardware.

You’ve tapped. You’ve swiped. You’ve been approved and declined. Your interactions with EFTPOS have been countless, and yet you may not know what’s behind this ubiquitous technology. While most people can remain happily, cashlessly oblivious, for business owners, it’s very important to know what EFTPOS transactions are, how they work, and how to select the right hardware. Read on for a breakdown of everything you need to know about EFTPOS and some handy advice for choosing a terminal.

What is EFTPOS?

The name EFTPOS is an acronym for Electronic Funds Transfer at Point Of Sale. Put technically, it is an electronic payment system that allows customers to make transactions by electronically transferring funds from their bank account to a merchant's business bank account. Put simply, it is any machine that accepts debit and credit card payments. In today’s age, having an EFTPOS terminal is a boon for business. It is a convenient and efficient way to accept digital transfers, with the added benefit of quick payment processing, automatic record-keeping, and reduced cash handling.

The Rise of EFTPOS.

Introduced to the Australian market in 1984, the EFTPOS transaction system took a while to grow in popularity as business owners and consumers got used to the idea of digital payments. For context, Australians were still using cash for 90% of all transactions in 1985. It wasn’t until 2002 that the EFTPOS industry saw significant growth. At the time, EFTPOS terminals were all produced by the big 4 Australian banks and had cumbersome designs, made for function, not form. These days, the landscape has changed on both sides of the counter. For customers, the shift towards electronic payments has seen a massive adoption of debit and credit cards, as well as more recently, mobile wallets. For merchants, there has been a dramatic improvement in EFTPOS hardware which now not only comes in a plethora of sleek styles to match the aesthetic of your business, but also offers up new functionality to help businesses manage their bottom line and enhance the customer experience, such as surcharging, tipping, and Pay at Table technology.

And if embracing the cashless society wasn’t already tracking steadily, the COVID-19 pandemic massively accelerated the trend. Business owners and customers all over Australia have precipitously sought to reduce cash handling since early 2020 due to health concerns around the physical exchange of money. In 2021, the Reserve Bank of Australia reported that just 27% of in-person payments were made using cash.

EFTPOS VS. eftpos.

To confuse matters, eftpos (lowercase) also refers to a privately-run Australian debit card platform. So, while EFTPOS is the globally accepted term referring to the conduit between a customer’s bank account and your business bank account (or Zeller Transaction Account), eftpos is also the brand name of such a payment system. The important difference with eftpos is that it only serves debit cards — not credit cards — and works in Australia only.

It’s unlikely that you’ve ever noticed this subtle difference because 90% of all debit cards in Australia are co-branded with Visa or Mastercard. This means they can process transactions through Australia’s local debit card network (eftpos) as well as international schemes. When a customer taps, dips or swipes their eftpos card and selects either Cheque or Savings, the transaction goes through the eftpos network. If a customer decides to pay via Credit, the transaction is processed via Visa or Mastercard because a credit payment cannot be processed through eftpos. Without getting into the weeds, it’s just important to be aware of the difference between EFTPOS and eftpos so that you understand what you are looking for when shopping for a card-processing terminal.

How do EFTPOS transactions work?

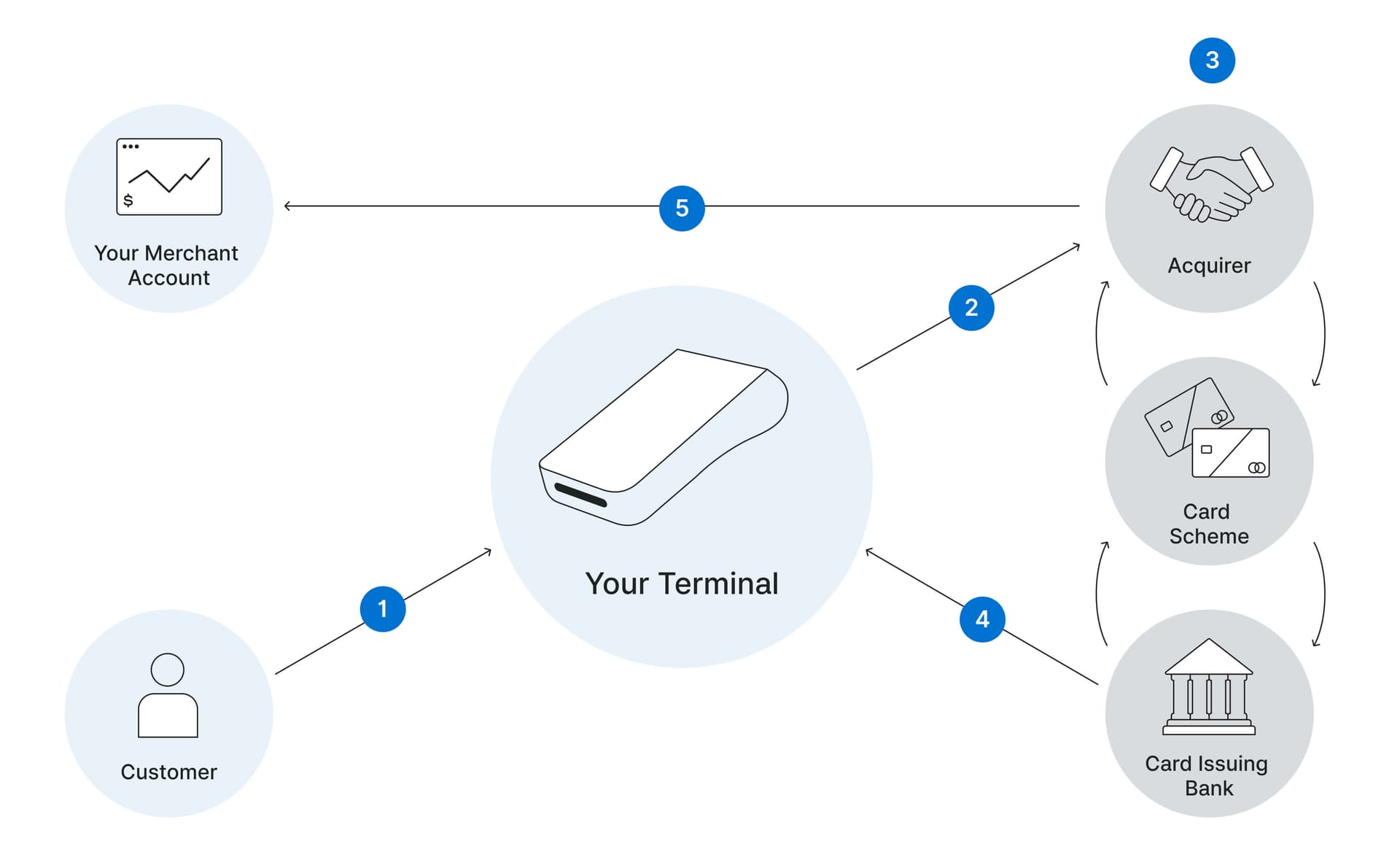

EFTPOS transactions start with an EFTPOS machine. These machines are the conduits that allow the relevant networks to connect and exchange information in order to complete a payment. The networks involved include the bank where the buyer has an account, your own business bank account, the company providing the EFTPOS machine, and more recently, your point-of-sale technology. The back-and-forth talk between the terminal sitting on your counter and the larger networks ensures the card being used has the necessary funds in its associated account and confirms the identity of the cardholder as well as the bank tied to the card. If the machine is integrated with your POS software, the machine will also communicate with the system to bring up the relevant transaction amount on the terminal. The image below outlines how this system works, and in what order.

The Acquirer refers to the financial institution that processes the payment on behalf of the merchant. Zeller for example.

The Card Scheme, also known as a payment network or payment scheme, is the organisation that establishes and maintains the rules and infrastructure for the use of credit and debit cards. Visa, Mastercard, American Express are all examples of card schemes.

The Card Issuing Bank is the financial institution that provides a credit or debit card to the customer.

How long do EFTPOS transactions take?

While the transaction is instantaneous, the multi-step process of authentication, verification, and funds transfer detailed above can require some time to fully process. How quickly your money will “settle” (that is, show up in your bank account) will also vary from one EFTPOS terminal provider to another. This is a very important consideration when choosing your payments platform, because the time it takes to access your funds will greatly affect your business cash flow. For example, Zeller customers who settle to their Zeller Transaction Account will receive their funds nightly. Many other platforms can take up to 72 hours.

What to look for in an EFTPOS machine.

When choosing an EFTPOS terminal for your business there are nine questions you need to be asking. Your selection process will involve a consideration of initial output costs, such as terminal fees and setup fees, functionality, and mobility but to make sure you’re getting the best bang for your buck, your terminal also needs to tick the following boxes:

It needs to accept all card types

As a business owner in Australia, your best bet is to ensure your terminal can accept eftpos debit cards as well as common international standards, like Visa, Mastercard, and American Express.

It needs to accept contactless payments

Thanks to the expansion of NFC technology, the “tap-and-go” payment method has gained enormous traction in Australia both with cards and mobile wallets in recent years (four in five customers now pay contactlessly at least once a week). It’s an extremely quick and convenient way for your customers to pay, and will no doubt become the norm over the next few years.

Merchant fees need to be low and flat

Typically, the EFTPOS transaction fee (charged by the machine provider) will depend on the customer’s choice of payment method — making it very hard for businesses to estimate what their transaction fees will amount to for any given period. Having one low, flat fee for all card types means that you can forecast how much you are likely to pay in processing fees. At Zeller, you will only ever pay 1.4% per transaction.

It needs to offer the option of surcharging

Also more commonly referred to as zero-cost EFTPOS, surcharging gives you the ability to pass on the aforementioned fee to the customer. Surcharging is becoming more and more common in Australia, and is an important cost-cutting measure for businesses. Read our article on whether surcharging is right for your business.

It needs to offer multiple options for connectivity

If your WiFi connectivity dips out, it’s integral that you can keep processing payments until it is back up and running. Having a SIM card in your EFTPOS machine means you’ll never have to worry the next time your main connection fails, you’ll simply need to switch to SIM usage and business can continue as usual.

For more detail on how terminals work, read our step-by-step guide on how to use an EFTPOS machine.

Faster. Smarter. Zeller.

At Zeller, we’ve built a smarter EFTPOS payments solution.

Zeller Terminal is a dependable, secure EFTPOS terminal boasting mobility, customer convenience, a sleek design and low, transparent fees. With Zeller Terminal, you pay just 1.4% per transaction — no matter whether the customer has tapped, dipped or swiped their payment method of choice. With one low rate for all in-person payments, as well as faster settlements, forecasting your cash flow is simple.

With Zeller, you can accept payments, access the money you’ve earned, oversee and manage your cash flow, and much more. And as more payment methods emerge, we are committed to supporting your business to keep pace with change.