- Banking

The Best Expense Management Software for Australian Businesses in 2025

What is expense management?

Expense management refers to any solution that helps your business track and reconcile business-related expenses. Traditionally, this might have been achieved through petty cash or per diems, but today’s technology affords businesses much more advanced and efficient ways of managing spending including corporate cards and expense management software. These new solutions are designed to simplify the process of paying for and managing business related expenses by reducing employee reimbursements, speeding up the approval process, digitising receipts, and ultimately giving your employees the freedom to pay for what they need, according to pre-approved limits and budgets.

Who offers expense management?

Once upon a time, traditional banks were the main institutions that businesses would turn to to help manage their expenses, primarily through corporate credit card schemes. These solutions, however, are designed for businesses to cover work-related expenses with funds borrowed from the issuing bank and therefore are only available to much larger companies with an established credit history and large annual revenues. To cater to businesses of all sizes wishing to manage their expenses with debit (not credit) a number of new web-based technology or software providers (Zeller, Airwallex, and Volopay to name but a few) have emerged in recent years. These platforms allow businesses to organise and control their spending without the reliance on a bank. While some banks such as Commbank and Westpac have attempted to offer their own equivalent expense management solutions, none of them have been able to compete with these newer tech platforms on pricing or functionality (and it is for this reason that we have not included them in the comparison above).

Use the interactive table below to compare the functionality and pricing of seven of the most popular expense management tools for Australian businesses.

Not sure what features you need? We explain them all below.

Why is expense management important?

There are five main reasons why we recommend incorporating an expense management system into your business:

1. It saves you time.

Time spent chasing up receipts, reimbursing employees, and manually entering your business’s expenses into spreadsheets is time you can get back simply by adopting an expense management system.

2. It saves you money and keeps projects within budget.

Being able to clearly see what your business is spending in realtime is a surefire way to identify cost-saving opportunities. With expense management tools, you can establish approval processes and set restrictions on spending to ensure that all your expenses remain within budget and align with company policy. What’s more, by eliminating the need to share the company card or give your employees cash, the risk of misuse or theft is greatly reduced.

3. It helps with tax compliance.

Being able to keep accurate and detailed records of all expenses, including receipts, invoices, and any other relevant details or documents makes it much easier to substantiate deductions and comply with tax regulations. What’s more, most expense management tools integrate with accounting software such as Xero or MYOB, which simplifies the process of transferring financial data, and ensuring that the information needed for tax reporting is accurate and up-to-date.

4. It helps manage cash flow.

Unlike traditional processes, which either rely on end-of-month reconciliation or monthly credit card repayments, expense management software allows businesses to track expenses in real-time. This means that as soon as an expense is incurred, it is recorded in the system, providing an up-to-date view of the company's financial situation, eliminating any surprises that could negatively impact your cash flow. What’s more, by creating and monitoring budgets, you can avoid overspending, instead, ensuring that there are always sufficient funds available.

5. It helps manage employee expectations.

By establishing a clear and standardised process for managing and reporting expenses, employees are able to better understand the expectations and limits around business spending, leading to reduced instances of unauthorised expenses, and improved financial responsibility within a business or organisation.

What services do expense management providers offer?

Expense management platforms vary greatly in functionality with some providing the most basic features and others supporting an all-inclusive suite of expense management within their accounting or financial services offering. Below, we outline the most common features:

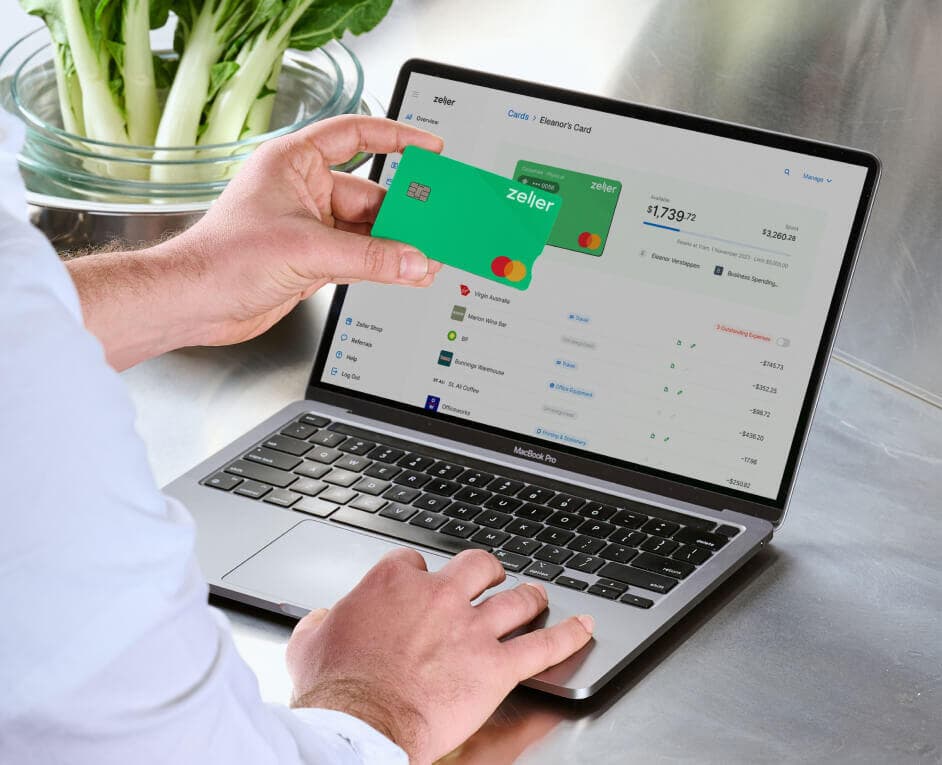

Payment cards

Corporate Cards, as they are most commonly known, (not to be confused with Corporate Credit Cards or Corporate Debit Cards) are cards that employees can use to pay for business-related expenses. They draw funds either from your external bank account, or in the case of Zeller, from your Zeller Transaction Account. Different providers will offer a combination of physical and/or virtual cards.

Budgets & spending limits

The beauty of the payment cards (above) is the ability to tailor each one with spending controls. Expense management providers allow you to set maximum transaction limits, budgets that reset automatically (for example, daily, weekly or monthly), and other controls that will ensure that employees can only use the cards for transactions that are in line with your business’s budget and policy.

Automated expense categorisation

By analysing receipts and extracting data, expenses can be automatically categorised by type. This saves you from having to examine each expense and then enter its category manually.

Real-time expense tracking

Rather than waiting until the end of the month to reconcile expense reports or pay off a corporate credit card (which can often reveal some unpleasant surprises), expense management software allows you to track business spending as it happens. A huge advantage when it comes to managing your business’s cash flow.

Mobile receipt upload

Gone are the days of pouring over paper receipts. Expense management mobile applications allow employees to capture photos of their receipts and upload them directly onto the platform where they are saved against the transaction itself.

Integration with accounting software

Most expense management software will integrate with one (if not more) types of accounting software, such as Xero or MYOB. Having data flow seamlessly to your company’s accounting system, not only speeds up the reconciliation process, but also reduces the risk of manual error.

Expense analytics

Rather than having to plug expense data into a spreadsheet to examine your business spending patterns, expense management software can pull analysis and reports at the click of a button. This data can offer important insights into opportunities for cost savings or improved budgeting.

Try expense management for free with Zeller.

If you’re not sure whether expense management is right for you, why not try it for free? For you first 60 days following card activation, you will enjoy full access to Zeller Corporate Cards, and it won’t cost you a cent. The best part is you can sign up online in a matter of minutes, open a free Zeller Transaction Account, create a virtual card, and start managing your business expenses today.