- Banking

Xero vs. MYOB: How to Choose the Right Accounting Software for Your Business

Xero is cloud‑native and generally easier for beginners to navigate.

MYOB offers advanced payroll and inventory tracking for complex business needs.

Xero has a larger third‑party integration ecosystem, including Zeller integration.

Bank feeds simplify reconciliation, available on both but broader in MYOB.

Choose based on business size, feature needs, and preferred user experience.

Whether you’re scaling up and looking to streamline your payroll and inventory, or need a bit of support managing your business cash flow and tax compliance, Xero and MYOB are two names that have probably crossed your desk.

Within the accounting software landscape, these are the two biggest players in Australia. Both offer an all-encompassing suite of accounting features that are equally as suitable to sole traders as they are to midsize companies. Navigating the features and functionality of each is no small task though, and ultimately comes down to what’s right for your business. To assist you in your decision, we’ve summarised the key points of comparison.

What is accounting software?

Accounting software is used for managing financial transactions and records within an organisation. It allows businesses to automate accounting tasks and helps them keep track of their financial information efficiently and accurately. By streamlining processes in invoicing and billing, managing accounts payable and receivable, and generating financial reports, the software can provide valuable insights into the financial health of the business. Accounting software also provides a centralised platform for managing financial data, saving time and increasing accuracy, which will not only be a huge advantage at tax time, but can also make it easier to apply for loans and financing should you ever need it.

Key differences between Xero and MYOB

Usability

Anyone can use either Xero or MYOB. Both cater to small business owners, sole traders, and freelancers as much as they do seasoned bookkeepers and accountants. However, if you are just starting out, Xero’s user-friendly interface is generally regarded as an easier point of entry for people with limited to no accounting experience. If you are a skilled bookkeeper or accountant, you may prefer MYOB for its more advanced features with regard to payroll and inventory tracking. Both Xero and MYOB offer a 30-day trial, so the best way to get a feel for the user experience is to try them out for yourself.

Cloud vs. desktop

When MYOB launched in the early 1980s, it was a computer-based software designed for users to install and use locally. When Xero entered the scene in 2006, it had the advantage of building internet capability directly into the software and, as such, has always relied on cloud accounting (software that is accessible from an internet browser). To keep up with demand, MYOB has now transformed all its packages to cloud-based plans but still gives users the option to choose online or desktop versions for the MYOB AccountRight subscriptions. The beauty of having data stored in the cloud rather than on your desktop is that it allows you to access your account from wherever you have an internet connection. What’s more, it also offers enhanced security with access control, user authentication, data encryption, and network protection.

Mobile apps

Managing your admin and bookkeeping on the go is now also made possible with Xero and MYOB’s mobile applications. Xero offers an all-in-one mobile business app that lets you view insights, manage invoices and quotes, track your cash flow, reconcile bank transactions, and upload photos of physical receipts. MYOB on the other hand has three separate applications: MYOB Capture for uploading receipts, MYOB Invoice for creating and sending online invoices and quotes and MYOB Team for creating rosters, approving timesheets, and tracking worksite locations. So, while Xero’s all-in-one app wins on convenience, MYOB does offer additional functionality for business owners who need to manage rostering on the go.

Third-party integrations

From point-of-sale systems to payment gateways, rostering and payroll, there are thousands of third-party providers that help small businesses from every industry streamline their processes. By integrating your accounting platform to other business apps and software you use on a day-to-day basis, you’re able to streamline bookkeeping and simplify reconciliation.

How Xero and MYOB integrate with these applications is a vital consideration when choosing one over the other. Whether you use Shopify for your e-commerce, Deputy for your staff scheduling or Zeller for your invoicing payment gateway, you’ll need to choose an accounting software that will integrate with the programs your business uses. Xero’s App Store is by far the largest, boasting over a thousand third-party integrations — including Zeller App. MYOB’s integration library is less robust, and currently only offers several hundred integrations.

Bank feeds

The available bank feeds will be an important factor in informing your decision to choose Xero or MYOB. Rather than reconciling transactions manually, bank feeds offer a much easier and quicker solution. This process allows data to flow directly into your accounting software where it can be coded and matched off with sales, invoices, purchases and payroll entries, saving you hours of data entry and reducing human error.

Bank feeds are available for bank accounts, loan accounts and credit cards, but the list of available connections will differ between accounting software. MYOB currently offers a longer list of supported bank connections than Xero, but Xero is more up to date with next-generation financial service providers including Zeller.

For a full list of compatible bank feeds for Australian-based businesses, see Xero’s list here and MYOB’s here. Note that if you are planning on setting up more than two bank connections, the MYOB Lite package will not support this (it is limited to two), however every other plan from both Xero and MYOB offer unlimited connections.

Accounting features

Most importantly, choosing between Xero and MYOB will come down to the features that each one offers and how best they suit your needs. For most small business purposes, both platforms offer everything you’ll need. For that reason, we won’t exhaustively cover the features of each, but we will mention what sets them apart.

Inventory management

MYOB has a comprehensive inventory system integrated into the software that lets you manage orders and suppliers and run stocktake. Which subscription you choose will depend on how many items and locations your business has. Xero, on the other hand, offers limited features suitable for small inventory needs, but its customisation capabilities with third-party apps ensure it stays competitive in this area.

Automation and AI

Xero has advanced its AI capabilities with JAX (Just Ask Xero) – a financial superagent that automates routine accounting tasks and delivers business insights. JAX uses multiple AI agents to learn how a business operates, adapting to handle workflows like bank reconciliation, invoicing, data entry, and payment tracking. It also understands natural language, allowing users to ask questions and instantly access financial data or generate documents. MYOB, by contrast, offers more basic automation focused on improving efficiency and accuracy through workflow automation, predictive analytics, and smarter resource planning for complex businesses.

Payroll

Both MYOB and Xero allow you to process superannuation payments automatically, support Single Touch Payroll and offer advanced reporting. However, for large companies, MYOB has the advantage of supporting unlimited employees with its BusinessPro and AccountRight plans. The cost of Xero increases once your business grows to over 50 employees, and caps out at 200.

Online and phone support

Xero offers extensive online resources and benefits from a wide community of online users, so help is never far away, however they do not offer phone support. MYOB on the other hand do offer business-day phone support, which can be very helpful if you get stuck.

Sign-up and implementation

Integrating or replacing your existing processes is easy with Xero and MYOB’s cloud-based subscriptions, however, if you are planning on installing MYOB AccountRight to your local desktop, it is important to note that this is only available for Windows.

Cost

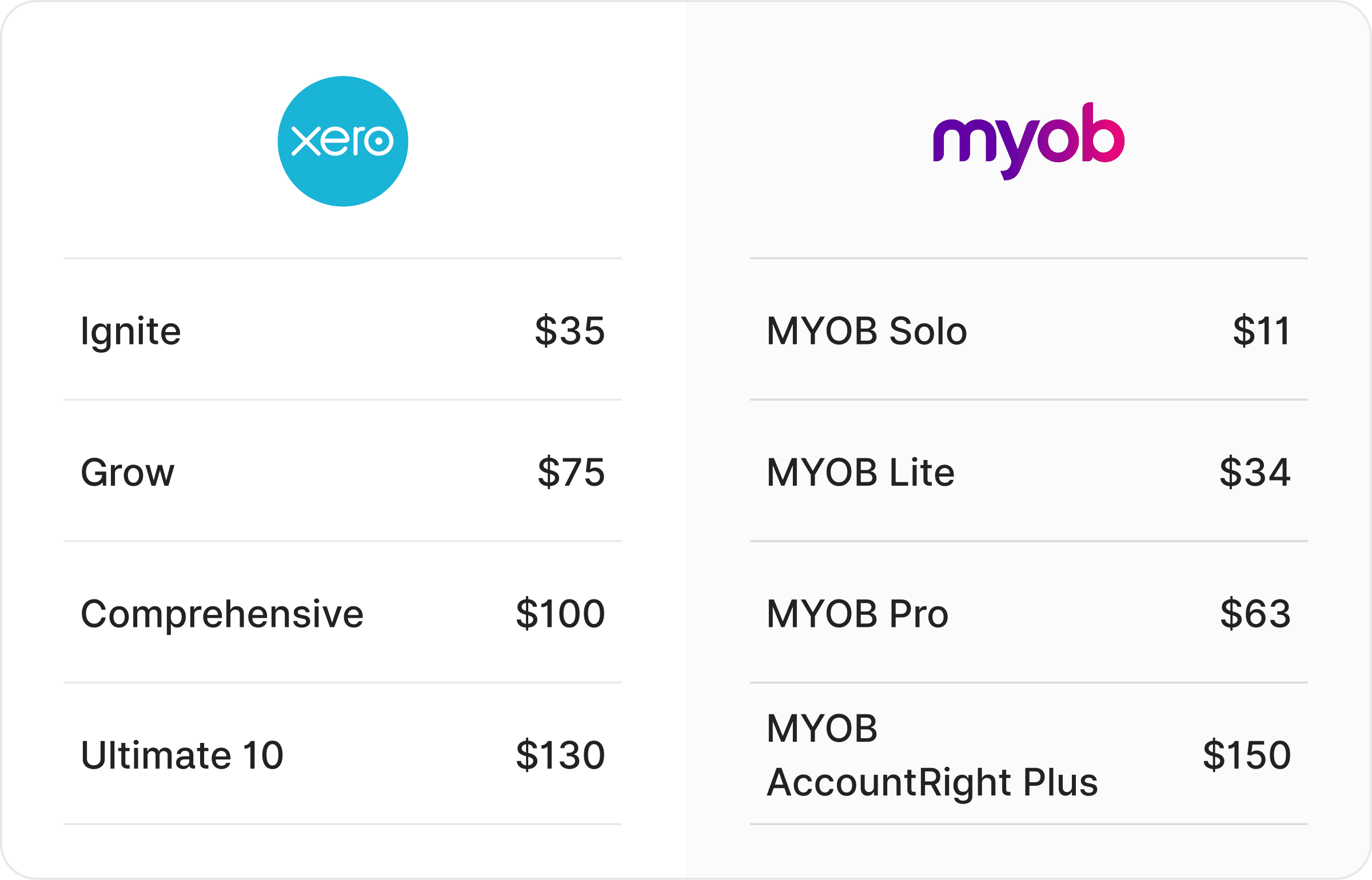

Both Xero and MYOB offer four tiers of monthly-based subscription pricing. The more you pay, the more functionality you get. When choosing a subscription, it is important to select one whose inclusions will not only serve your purposes today, but also as your business scales in the future. The cost differences between the two platforms are outlined in the table below.

Xero and MYOB monthly subscription pricing as of November 2025

Xero vs. MYOB: which is right for your business?

What accounting software you choose is ultimately going to depend on the needs of your business, and your personal preference. Before making your decision, you need to weigh up who will be using the software (you or your accountant), where you'll be using it (desktop or cloud), whether having a mobile app is going to be vital in your day-to-day accounting, and what integrations and bank connections you require. Of course, most important is, will it integrate with your Zeller Account.