- Product Updates

What's New at Zeller

From analysing settlement reports to managing budgets and simplifying expense reconciliation: you’ve now got even more visibility and control over your finances.

This month, we’ve enhanced the Zeller Dashboard to give you more granular details about when and how your funds are being settled, and we’ve given you more flexibility over how your budgets and expenses are managed with big feature updates for Zeller Corporate Cards. And that’s not all. Read on to discover all the latest updates from Zeller, and how they can benefit your business.

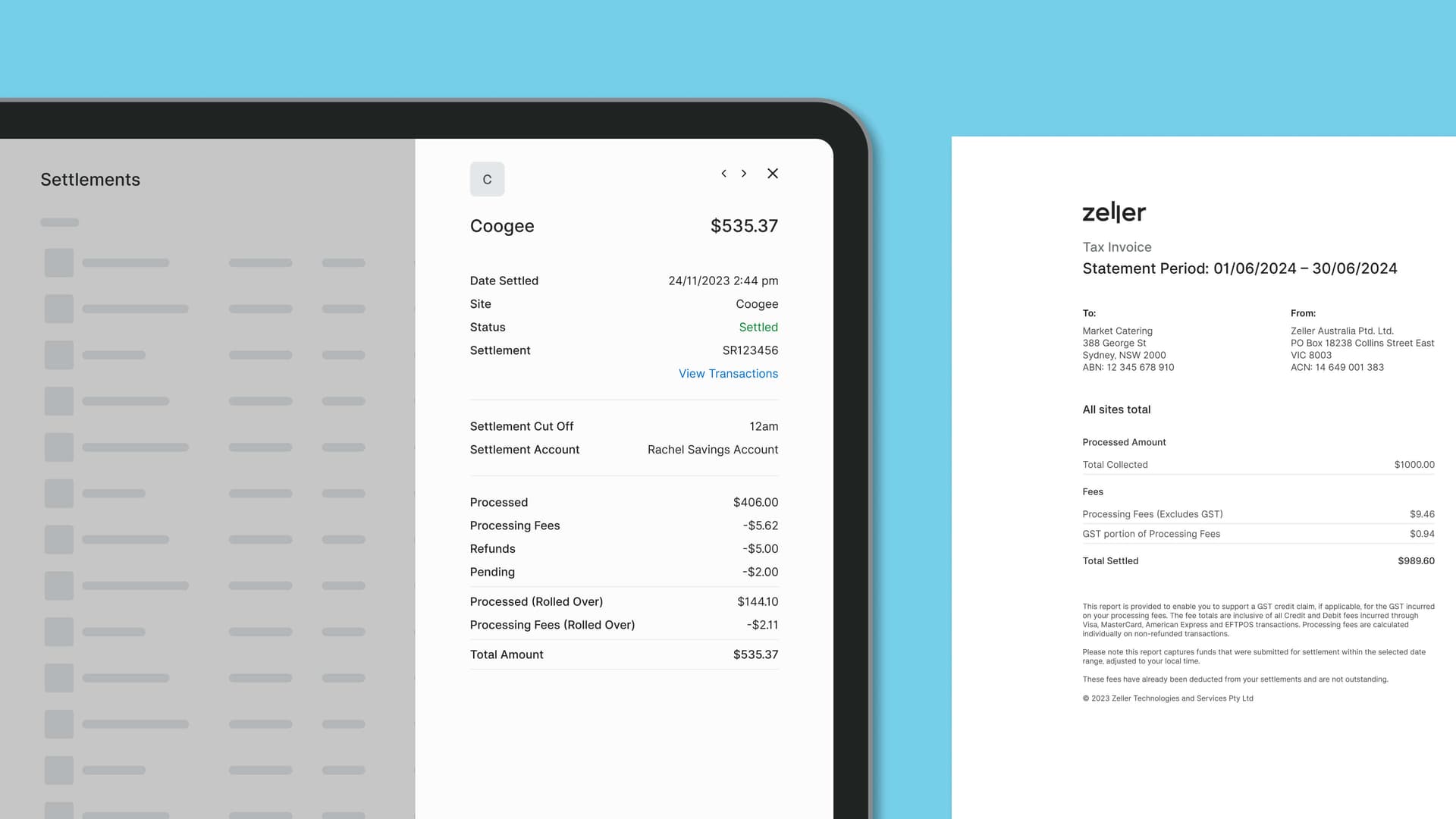

Track business performance with detailed settlement reporting.

‘Settlement’ is the final and crucial step of the payment process for your business. It involves settling funds from transactions accepted into your nominated account. When you settle into a Zeller Transaction Account, your funds are deposited into your account nightly, 7 days a week, (settlements to third party bank accounts are available the next business day) and a settlement report is made available on your Zeller Dashboard. This month, we’ve added more details to our settlement reports so that you can do a deeper analysis of your business performance.

Now, when you open your settlement reports, you’ll see some new fields to help you understand the breakdown of your settlements, and reconcile settlements across multiple locations:

Click here to learn more about settlements and how you receive your funds from Zeller.

We’ve also improved your settlement report exports. Now, when you export settlement details as an Excel file, you will see a new column: ‘GST portion of processing fees’. This details how much GST you paid (or collected, if you are surcharging) as a portion of each processing fee. This information is also available on your settlement statement, which will help when it comes to making a GST credit claim at tax time.

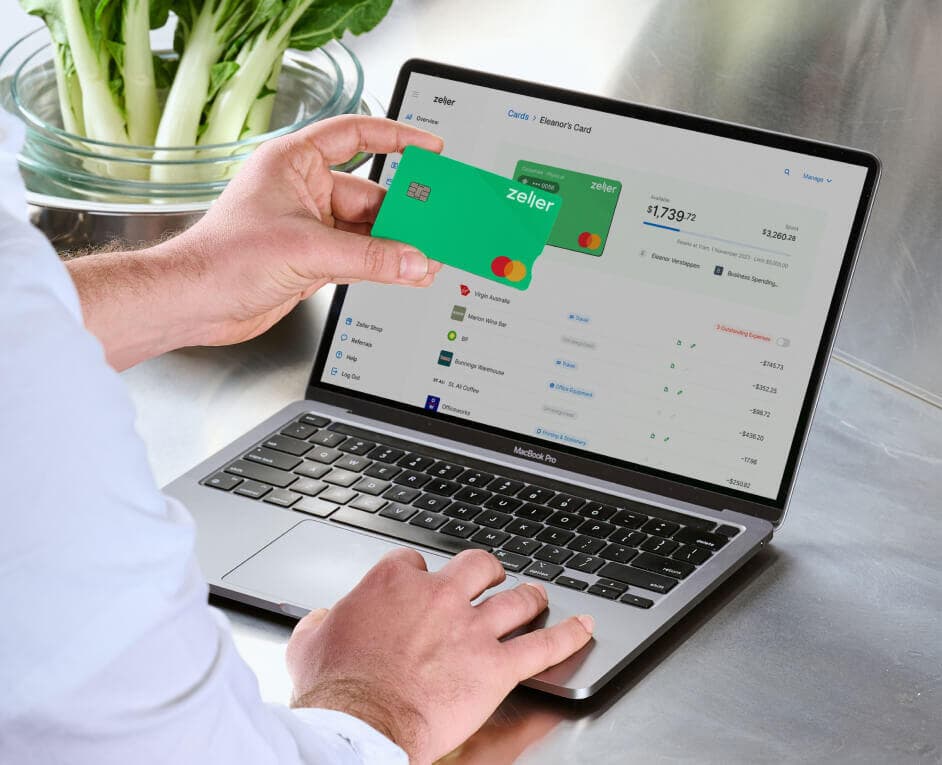

Get more control over team budgets with Zeller Corporate Cards.

When managing a project with unforeseen costs it’s not uncommon to use up the set budget while your project is still progressing. With Zeller Corporate Cards, we’ve now made it easier for you to change your budget reset period (daily, weekly, fortnightly, monthly, or quarterly) and to see when your allocated budget is nearly exhausted.

When cardholders log in to their Zeller Dashboard or Zeller App, a message will now appear on the ‘Cards’ screen alerting them when less than 10% of the allocated budget is remaining on their Zeller Corporate Card. Similarly for users with ‘Admin’ access, an alert message will appear next to all the cards whose budget is nearing their limit, prompting admins to either add more funds or speak with their team about capping their spending.

Additionally, you can now adjust the reset period for a budget even after you’ve created a Zeller Corporate Card. For example, if you set up a Zeller Corporate Card to be predominantly used as a fuel card with a monthly budget reset, but now you need to use it for a week-long business trip, you can simply adjust the budget reset period from Zeller Dashboard or Zeller App. Navigate to ‘Cards’, click ’Corporate Cards', then under ‘Manage’ select ‘Edit spend control’ and select your new reset frequency and click ‘Save’. You can change this frequency as often as you like!

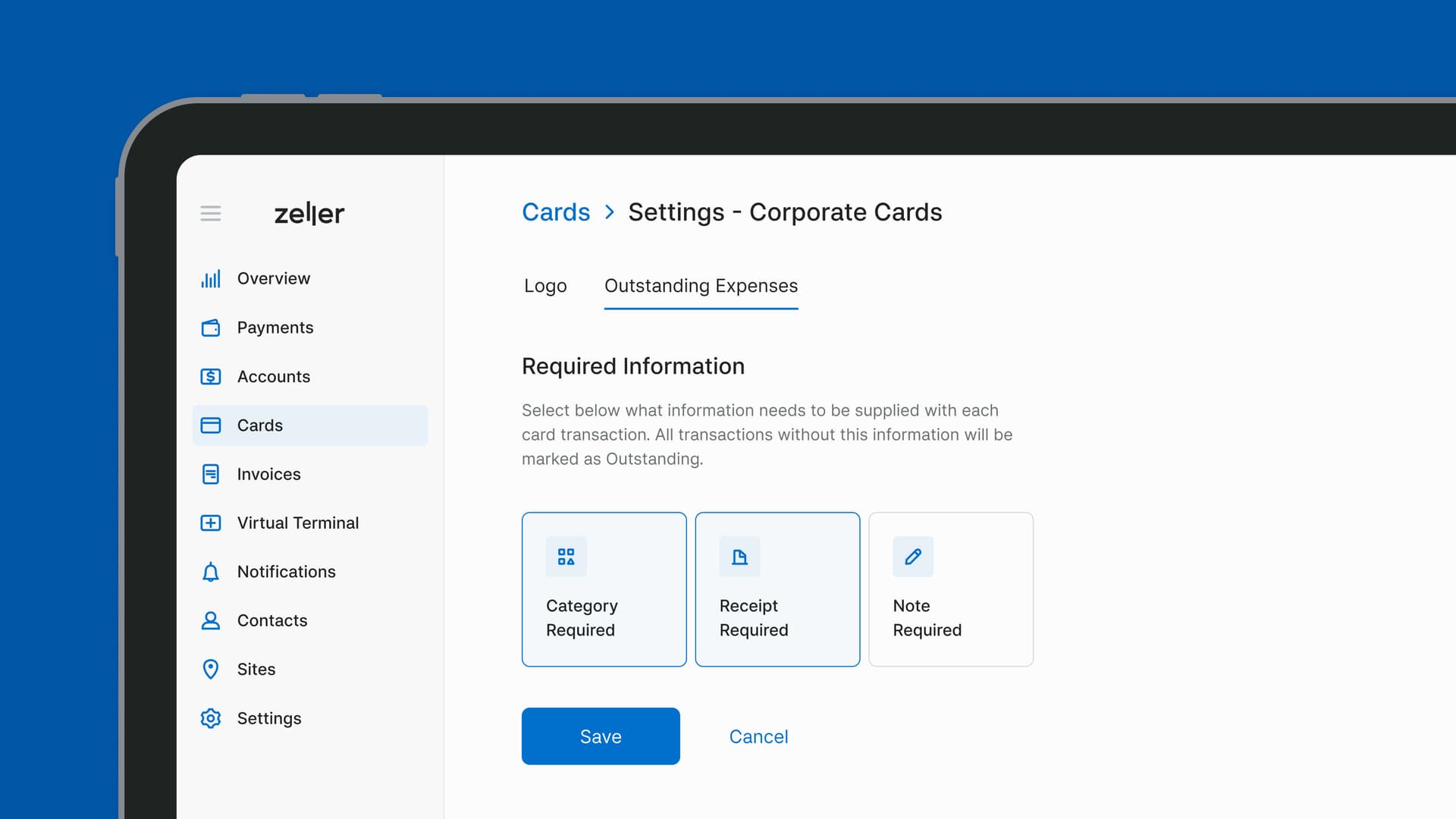

Customise expense reconciliation requirements for your business.

We understand that every business is different, which is why flexibility is central to all of our services. This month, we’ve updated Zeller Corporate Cards to allow you to choose what information you require your employees to provide when they are logging expenses. You now have the option of mandating any or all of the following properties:

Expense category - such as ‘travel’ or ‘entertainment’

Receipt - acts as proof of purchase to approve the expense

Note - staff can reason for the purchase and add any additional information

To select your business' reconciliation requirements, navigate to ‘Cards’ within Zeller Dashboard, click ‘Settings’, then ‘Outstanding Expenses’, then select the relevant transaction information you require from your team, then click ‘Save’. For any future or past transactions, admins will now be able to easily identify those that do not have all the relevant information. Simply navigate to any card, apply the ‘Outstanding Expenses’ toggle filter, and the icons in red will help you identify what information still needs to be provided to complete the expense.

Send proof of transfer directly to your recipient.

Last month, we enhanced our transfer feature by displaying a summary of transfer details after funds are deposited into another bank account. This month, we’ve gone one step further — by enabling you to send remittance receipts, too. Now, you can send proof of transfer directly to the recipient once the transfer is finalised, via SMS, email, or PDF.

Keen to see a feature that’s not currently available?

We take feedback very seriously at Zeller. Every piece of feedback we receive from you is reviewed by our product team and incorporated into their roadmap to ensure that your most-requested features are built quickly. If there’s something you’d like to see, we want to know about it. Help shape the Zeller experience by sending your ideas or requests to feedback@myzeller.com and a member of our team will be in touch with you soon.

For all the latest features, special offers and small business tips sent right to your inbox, sign up to our newsletter today and be a part of the Zeller merchant community.