Should You Accept Card-Not-Present Payments?

In the service industry, taking payment hasn’t always been as straightforward as tapping a card. Now it is, thanks to Pay by Link, a handy new feature available with Zeller Virtual Terminal. ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

As service providers, you deal with instalments, deposits, prepayments, higher transaction values, and ultimately, customers who aren’t present when it comes time to pay. Traditionally, this has meant chasing up invoices or making repeated phone calls to accept a payment. Nowadays, technology is affording a much smoother payment experience for these types of transactions. With Zeller Virtual Terminal, businesses can accept card payments by sending their customers a secure payment link, which lets them enter their card details in their own time. It’s simple, secure, and fast, and businesses from all industries are adopting it. Below, we explain three of the most common uses for Pay by Link and why it’s a handy solution to have in your back pocket to help keep your cash flow healthy, and your customers happy.

What is Pay by Link?

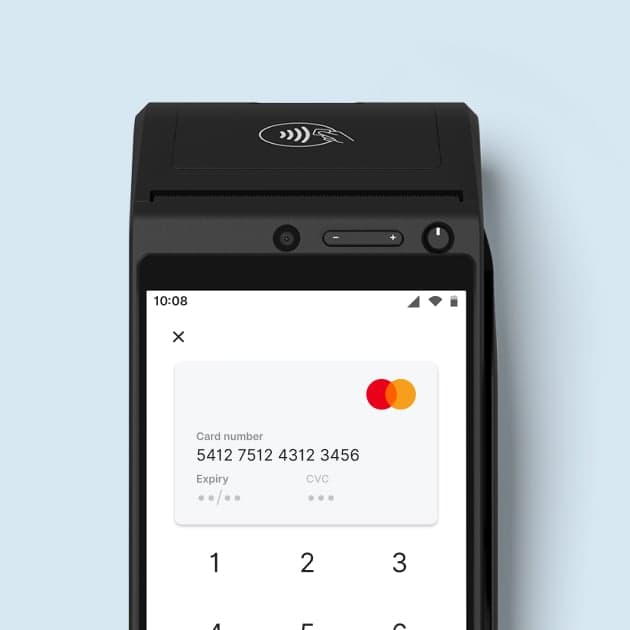

Pay by Link is a payment solution available on Zeller Virtual Terminal – a web-based tool that allows you to process payments without the need for a physical EFTPOS machine. It enables businesses to generate a secure payment link from their browser and to send it to their customer, who can then enter their card details in their own time. Pay by Link is accessed via Zeller Dashboard, simply by navigating to Virtual Terminal and selecting one of three options: ‘Send Payment Link via Email’, ‘Send Payment Link via SMS’ or ‘Copy Link’. Choosing the latter means you can share the link on whatever platform is most convenient for your customer, be it WhatsApp, iMessage or Facebook Messenger. The link is secure and will direct customers to a page where they can enter their card details and proceed with the payment. Once the payment has been processed, customers will have the option to download a copy of the receipt.

What are the most common uses of Pay by Link?

For high-value transactions.

Whether you’re selling kitchens, cars or wedding dresses: you’ll know how important customer experience is in the transaction process. When a customer is about to hand over a large sum of money, they need to be given the white-glove treatment. Additionally, when your business relies on fewer but higher value transactions, these payments need to be made promptly and securely in order to ensure your cash flow is healthy. For these two reasons, Zeller’s Pay by Link is a great solution.

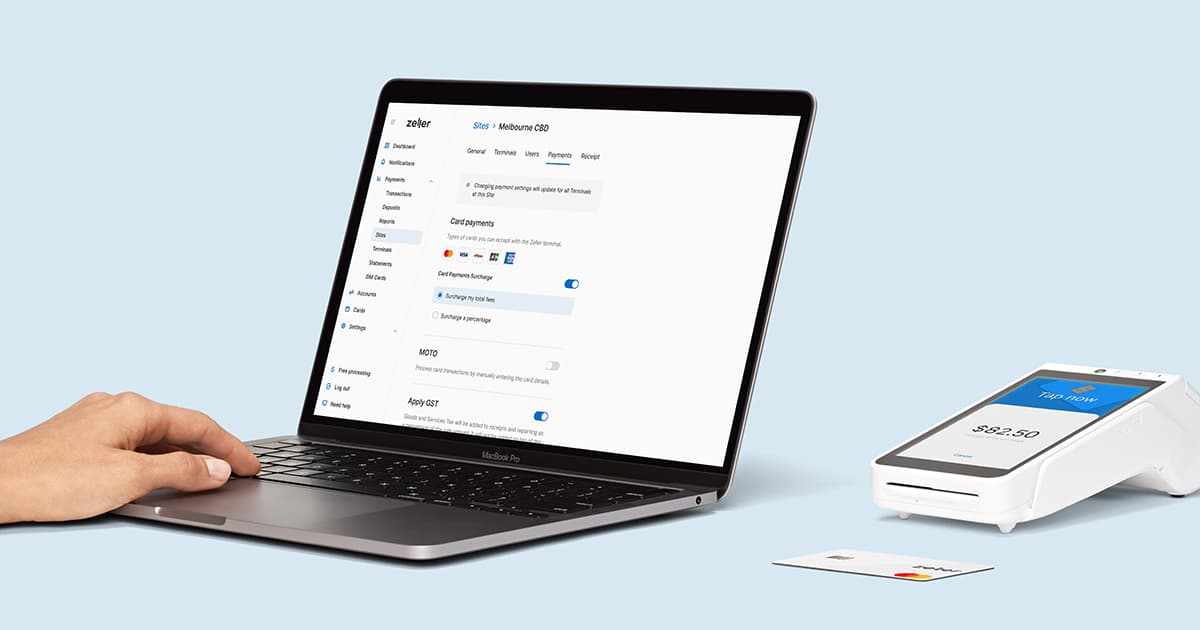

On the customer side, it offers them convenience and peace of mind knowing that their card details are securely and privately shared, as well as the added benefit of being able to pay with American Express, which, for high-value transactions, is particularly advantageous. While for you as a business owner, it keeps fees low and your business protected. With Zeller Virtual Terminal, the transaction fee (1.75% +25c) can be passed on to the customer through surcharging and your business will also benefit from a dedicated anti-fraud team and 24/7 transaction monitoring. When dealing with high-value transactions where you can’t always verify that the customer is who they say they are, this is especially important to avoid falling victim to credit card fraud.

For deposits, pre-orders, and pre-bookings.

No matter what kind of business you run, there’s likely to come a time where you’ll need to take a deposit or secure a service or item for your customer with a pre-order or pre-payment. Restaurants do it for large group bookings, hotels do it to reserve event spaces or to accommodate special catering requests, and retailers do it to guarantee the sale of high-value or custom-made items. In these situations, not only does Pay by Link help get the payment made fast, but it greatly facilitates the reconciliation process.

When you create your unique payment link with Zeller Virtual Terminal, you can enter all the relevant details about the transaction in the notes section, such as the date of pick up, the job number, whether it’s one instalment of many, or the name of the person in charge of the sale. Additionally, if your business has a number of different departments – a hotel might have the office, the pool bar, the corporate space, the rooftop, and the massage room, for example – you can create a different ‘site’ for each, and quickly assign each Pay by Link transaction to the relevant site. When it comes time to reconcile your sales at the end of the month, payments can easily be filtered in Zeller Dashboard by site, date, status (approved, declined or refunded), transaction value, and reference number.

For gift vouchers.

Many businesses won’t have a formalised process for selling gift vouchers, and yet it’s important not to deny customers this opportunity if they specifically ask for one. Having the option of generating a payment link is an ultra-simple, quick, and professional way to accept gift voucher payments. Simply generate a payment link with Zeller Virtual Terminal, send it to your customer, and ask them to download a receipt once their payment has been processed. This receipt will contain a unique reference number (RNN). Write the RNN down on a gift certificate or ask your customer to send it to the gift receiver. When the recipient comes to redeem their voucher, your staff will simply have to search the RNN in Zeller to bring up the associated transaction and add a transaction note to indicate that the voucher has been redeemed.