- Business Growth & Optimisation

8 Black Friday Strategies to Maximise Your Sales in 2025

Love it or hate it, Black Friday is here to stay and if your business is taking part, you’ll be tapping into the $6.7 billion that is set to be splashed over the Black Friday–Cyber Monday weekend this year—a 4% increase on last year’s figures.

Black Friday—falling on Friday 28 November, 2025—has become the unofficial start of Australia’s Christmas shopping season. In recent years, it has evolved from a single day into a full sales period, with many retailers launching promotions as early as 18 November. With Australians spending at record levels, now is the time for retailers to make sure they’re set up to capture as much of that demand as possible. To help you prepare, we’ve put together 8 Black Friday strategies to maximise your success during the year’s busiest sales weekend.

1. Give your customers FOMO

Black Friday shoppers expect to see limited-time deals. By giving them a sense of FOMO (fear of missing out), they’re much more likely to buy immediately instead of waiting or shopping around. Similarly, if customers think stock is limited or the deal is exclusive, the perceived value increases, even if they weren’t planning on buying right away. FOMO reduces the time a customer spends comparing or overthinking. They’re less likely to abandon their cart if they feel they might lose the deal.

Ensure your website and/or your store clearly communicate urgency. Use messaging like: “Ends at midnight”, “Only 24 hours left”, “Only 12 left at this price”, “Selling fast—over 500 sold today.” You could also use countdown timers on your website or on your social media. Learn how to add a countdown timer to your Instagram story here. Just be aware that if you advertise a limited-time offer, you are legally obligated to honour it under Australian Consumer Law (see point 7 for more on this).

2. Create deals without discounts

Get creative with your Black Friday offers. If your margins are tight, you don’t have to rely on blanket discounts to drive sales, you could try bundles, tiered deals like “Buy More, Save More,” hourly flash sales, mystery boxes, or limited-edition drops that create excitement without reducing prices.

Focus on your best-sellers or high-intent products to maximise conversions, and don’t be afraid to test different formats throughout the weekend to see what resonates with your audience. Pair every offer with clear urgency (see above) to encourage shoppers to act quickly.

3. Offer Buy Now Pay Later options

3. Offer Buy Now Pay Later options

Many customers use Black Friday and Cyber Monday sales as an opportunity to tick off their entire Christmas shopping list. While it’s a big outlay for just one weekend, Buy Now Pay Later (BNPL) programs like Afterpay, Zip, and Klarna make it more manageable by allowing customers to spread payments over weeks or months. This flexibility encourages shoppers to buy more than they might with a single upfront payment, helping businesses increase basket sizes, and sell higher-ticket items.

Ahead of Black Friday weekend, speak to your payment provider about integrating a BNPL option to your online or in-store sales. With Zeller Terminal, setting up Afterpay is straightforward. Simply follow the steps to offer Afterpay card payments with Zeller Terminal here.

4. Offer early access to subscribers

If you already have an email database, make the most of it in the lead-up to Black Friday by giving subscribers early access to your offers. Exclusive previews not only drive anticipation but also reward loyal customers. If you run a loyalty program, consider offering bigger discounts to your VIP members or inviting them to an after-hours, invite-only shopping event. These personalised perks create a sense of novelty and recognition—and the more valued your customers feel, the more likely they are to make a purchase.

5. Ensure your checkout is optimised

If you run an online-only store, your website will make or break your Black Friday performance. With higher traffic expected, speak to your web developer ahead of time to ensure your site can handle the surge. Even a few seconds of slow loading—or friction in the checkout process—can quickly translate into abandoned carts and lost revenue.

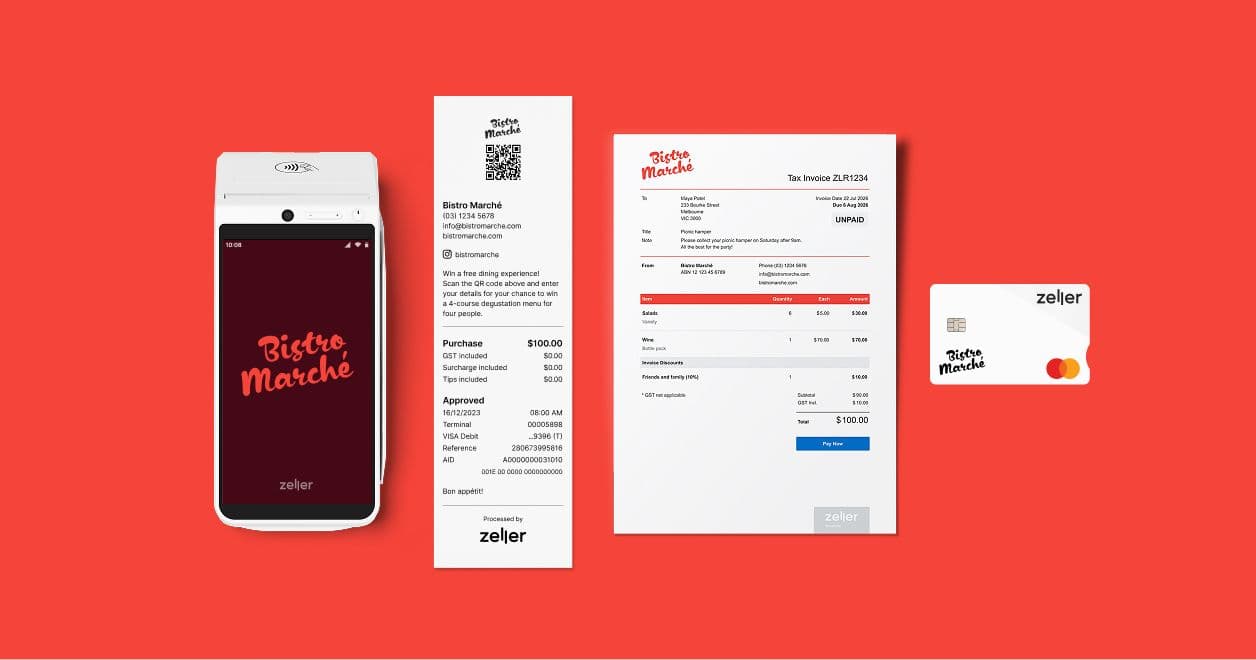

The same principle applies in-store: your payment experience must be fast, reliable, and friction-free. Slow EFTPOS machines, limited card acceptance, or high transaction fees can lead to frustrated customers and reduced profits. Zeller Terminal accepts all cards—including American Express and China UnionPay—for one low flat fee of 1.4%, and you can enable surcharging for a fee-free solution.

Zeller also gives you built-in backup. If you realise you need extra terminals to keep up with demand, you can turn your phone into an EFTPOS machine. Simply download Zeller App and enable Tap to Pay. It takes minutes to set up and could save you thousands in missed sales if queues start forming.

6. Boost your customer support

More customers mean more customer service — so it pays to be prepared. Whether that’s rostering on additional staff, updating and expanding the FAQ section of your website, or integrating a chatbot to handle common queries, planning ahead helps you stay ahead of the rush. The smoother and more responsive your support experience is, the easier it is to keep customers happy throughout the Black Friday weekend, reduce pressure on your team, and prevent small issues from turning into lost sales.

7. Avoid false advertising

Although you might be tempted to extend a limited-time offer if you’re flooded with sales, this would constitute false advertising under Australian Consumer Law. It pays to understand what your legal obligations are ahead of time, so that you can steer clear of unlawful advertising.

Businesses cannot falsely claim “site-wide” or “store-wide” sales, if not everything is on sale. You also cannot state “up to X% off” promotions if only a handful of products reach that discount, and you cannot use “was/now” strikethrough pricing that isn’t supported by a genuine previous selling price. Retailers also shouldn’t create a false sense of urgency through misleading limited-time offers or hide important exclusions and conditions in fine print. The ACCC actively monitors Black Friday promotions and can issue infringement notices and significant penalties for breaches.

While consumers are entitled to refunds for faulty products, retailers may set conditions on change-of-mind returns during sales periods provided these policies are clearly communicated. Ahead of Black Friday weekend, ensure you have updated the returns policy on your receipts.

With Zeller, you can quickly change the information that appears on receipts from either your Zeller Dashboard or directly on Zeller Terminal. Learn how to customise your Zeller receipt setting here.

8. Follow up after purchase

Black Friday shouldn’t just be seen as a one-off sales event—it’s also an opportunity to capture new customer data and turn one-time shoppers into repeat buyers. For online stores, this is straightforward, as customer information is automatically collected and stored in your CMS. For bricks-and-mortar retailers, it requires a bit more creativity. Encourage customers to join your mailing list or follow your social accounts by offering a small gift or extra discount, run a competition requiring an email entry, or use QR codes at the point of sale to collect contact details.

With Zeller, you can add a custom image to your receipts or terminal screensaver featuring a QR code that links to your newsletter signup or Instagram account. By making it easy for customers to engage at checkout—when they already have their phones out to pay—you create a frictionless way to build a valuable database of engaged customers. This enables you to follow up with targeted offers and promotions long after Black Friday has ended.