- EFTPOS & Point of Sale Solutions

Smarter Surcharging: Apply a Custom Surcharge

Discover how to pass on your cost of acceptance with Zeller.

In Australia, businesses are legally entitled to charge customers a fee for processing an electronic transaction. This fee is called a surcharge.

The purpose of this fee is to cover the costs associated with accepting the customer’s chosen payment method — yet some merchants choose to absorb this cost themselves. Zeller Terminal makes it simple to pass on your entire transaction fee, or a percentage of your transaction fee, with the toggle of a switch. When you surcharge the transaction fee in full, your business is getting zero cost EFTPOS.

Keep reading to discover more about credit card surcharges, the legalities around passing on your cost of acceptance, and how to set your EFTPOS surcharge on Zeller Terminal.

What is a surcharge?

Different payment methods have varying costs and benefits to both businesses and their customers.

A surcharge is an extra charge you can pass onto your customers who choose to pay with a credit or debit card, or smart device. Every time your business processes a cashless transaction with an EFTPOS terminal, you are charged a small fee to cover the checks and balances that must occur in order to safely move funds from a customer’s bank account into your own.

Zeller makes it easy for you to pass that cost — either in its entirety or in part — onto your customers as a surcharge. Having the ability to set a custom surcharge means you can choose what suits your business, and your customers.

Why businesses surcharge their customers

The prices that merchants set for their goods and services incorporate the general costs of running the business — such as rent and electricity, among other things. Yet an important distinction between other business costs and the costs associated with transactions is that it is the customer that chooses the method of payment, which then determines the cost of the transaction.

Cards are the most frequently used method of payment in Australia. As cash use continues to decline, the more electronic transactions your business processes. You will need to make fewer trips to the bank to deposit your takings, spend less time counting cash drawers, and benefit from the increased security that solutions such as Zeller Terminal offers. For more information about the shift away from cash and how this impacts your business, read our blog: Why Accepting Credit Cards is Critical for Business.

It typically costs just a few cents to process an electronic transaction. However, many merchants look for ways to grow their business. For some businesses, passing on transaction fees via surcharging is a way to achieve this.

The downside of surcharging

Surcharging is relatively common in Australia — you’ve undoubtedly paid a surcharge as a consumer, whether at your local coffee shop, hairdresser, or high street store. Businesses of all shapes and sizes choose to pass on their cost of acceptance this way. Yet, for some customers, surcharging can be a turn-off that impacts their likelihood to return to your business and purchase again. It may even impact their perception of your business.

Research from Finder shows the majority of Australians don’t believe they should be charged for choosing to pay with a card or smart device. Now that cash payments are becoming less and less common, the practice of charging an additional fee for card payments has even been called “redundant”.

Should your business surcharge customers?

In determining whether or not to utilise the Zeller surcharging functionality to recoup your cost of acceptance from customers, consider:

the customer perception of surcharging.

how common (or uncommon) surcharging is in your specific industry.

whether your nearby competitors impose a surcharge.

Surcharging is more commonly accepted in some industries than others. For example, 23% of Zeller merchants who run retail stores surcharge their customers, compared to just 2% of those who operate a beauty salon — which indicates that consumers are likely accustomed to paying a surcharge when tapping their card to pay for a new shirt, but less accustomed to paying a surcharge for a manicure. On the other hand, 12.7% of Zeller merchants who run a bar, restaurant, cafe, or other hospitality business surcharge customers.

It’s also important to pay attention to what your competitors are doing — especially if you run a business that is reliant on a steady stream of local customers, such as a coffee shop. If locals know they can purchase their daily cup of coffee from a competitor across the street without paying a surcharge, you may risk losing their business.

Ultimately, the decision of whether or not to surcharge is yours alone; no one knows your customers better than you. If you decide not to toggle on surcharging, either in full or in part, you could look for other ways to reduce your business expenses — such as by increasing the price of your products or services.

Zeller Terminal makes it as simple as possible for those who wish to surcharge their customers to recoup their cost of acceptance, either in full or in part. Keep reading to discover how much you can surcharge, and how to set up your Zeller Terminal for surcharging.

Surcharging rules in Australia

The Competition and Consumer Amendment (Payment Surcharges) Act 2016 prohibits businesses from charging customers an “excessive” surcharge. However, there is no set rule regarding what is deemed an excessive charge.

Legally, businesses are entitled to recoup the cost of accepting a customer’s method of payment — no more. The Reserve Bank of Australia outlines the costs that can be covered in a surcharge, including:

Merchant service fees

Terminal rental fees

Costs to maintain a credit card terminal

Other fees including switching fees, fraud-related chargeback fees, and more.

How much can Zeller merchants surcharge?

In setting your surcharge, it’s important to remember that Zeller Terminal is yours to own outright. That means businesses that use Zeller do not incur terminal rental fees.

Transactions processed through Zeller Terminal, where the customer and their card are both present, typically cost 1.4% of the total transaction amount. Card-not-present transactions (whether over the phone or via post) typically cost 1.7%, to reflect the increased security measures required to verify the transaction.

The maximum surcharge you can set is equal to your transaction fee.

How to set your surcharge with Zeller

Setting your custom surcharge takes just a few moments, and can be done via Zeller Dashboard or Zeller Terminal. Simply follow the steps below, and every transaction processed through Zeller Terminal will have a surcharge applied automatically.

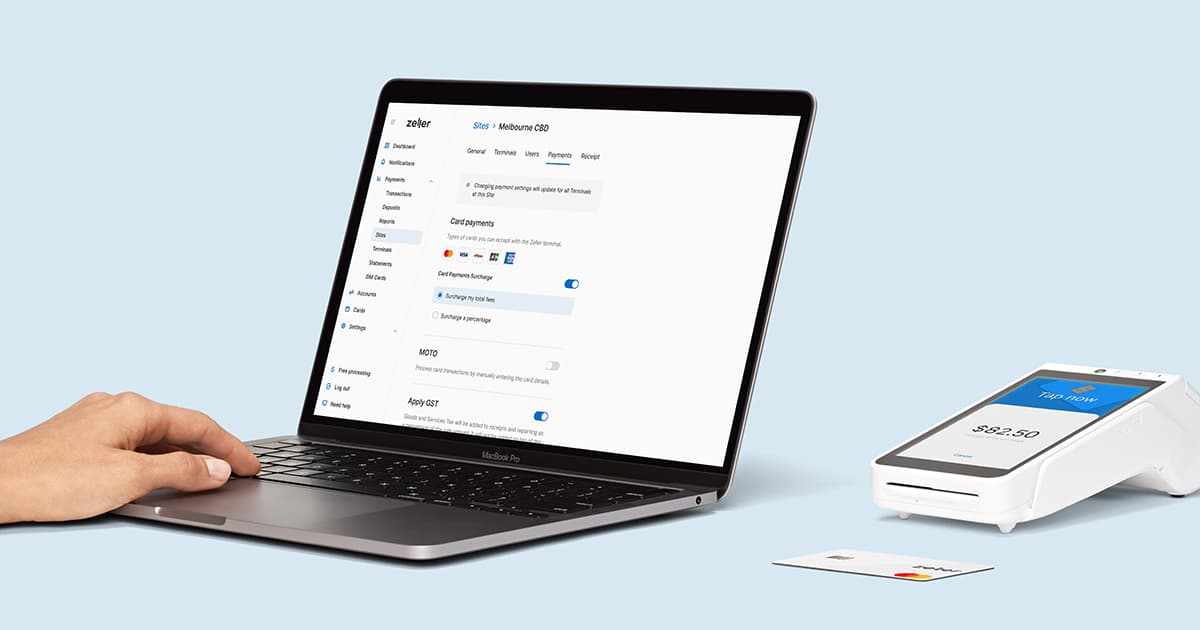

Setting your surcharge on Zeller Dashboard

Surcharging functionality can be accessed via the Payments settings for each individual Zeller Terminal.

Follow the below steps to set your surcharge on Zeller Dashboard for in-person payments.

Expand the Payments menu and then click Sites.

Select the Site you would like to manage.

Click the Payments tab at the top of the screen.

From here, you can either:

Toggle on Surcharge my total fees, or Surcharge a percentage and enter a custom card surcharge that is no more than 1.4%, or

Click Save to confirm your changes.

Electing to pass on your total fees means you will recoup your costs for the full transaction amount, including any tips, every time.

As MOTO transactions incur a higher fee, you need to toggle on surcharging for card-not-present payments separately. The maximum surcharge you can set for MOTO transactions is 1.7%.

Setting your surcharge on Zeller Terminal

Setting and updating your surcharge on Zeller Terminal is just as simple — however, you must be logged in as an Account Administrator. This is to protect your business from staff accidentally toggling surcharging on or off.

For more information about surcharging with Zeller Terminal, visit the Support Centre.

Providing Zeller merchants with the ability to pass on transaction fees in full or in part is just one way Zeller supports merchants to run their business the way that suits them.