- Business Growth & Optimisation

Small Business Growing Pains and How to Overcome Them

Discover five ways Zeller helps keep business on track during the transition.

Thinking about scaling up your business? Having the opportunity to expand to new locations, upsize to a bigger premises, hire more staff, or build out your operations is a sign you’re doing something right. Whatever step you’re preparing to take next, you should be proud and excited.

There are some common mistakes merchants make during this transitional time, and the consequences that flow from taking on too much too soon can stifle – rather than encourage – growth. Fortunately, there are ways and means of scaling up sustainably. It all comes down to engaging the right tools.

Here are five ways Zeller can minimise the potential for growing pains as you scale your operations.

Ready to get started with Zeller?

Sign up now1. Get a clear overview of all stores

The more business locations you have, the harder it becomes to understand how each is performing. This is especially true if you’re juggling independent sales channels, staff and technology.

Before you open a second location, take the time to gain a real-time oversight of your finances — something that will play a priceless role in future business decisions. Unifying your data in the one dashboard is a simple way to retain visibility over multiple locations, enabling you to quickly access key sales information from anywhere with an internet connection.

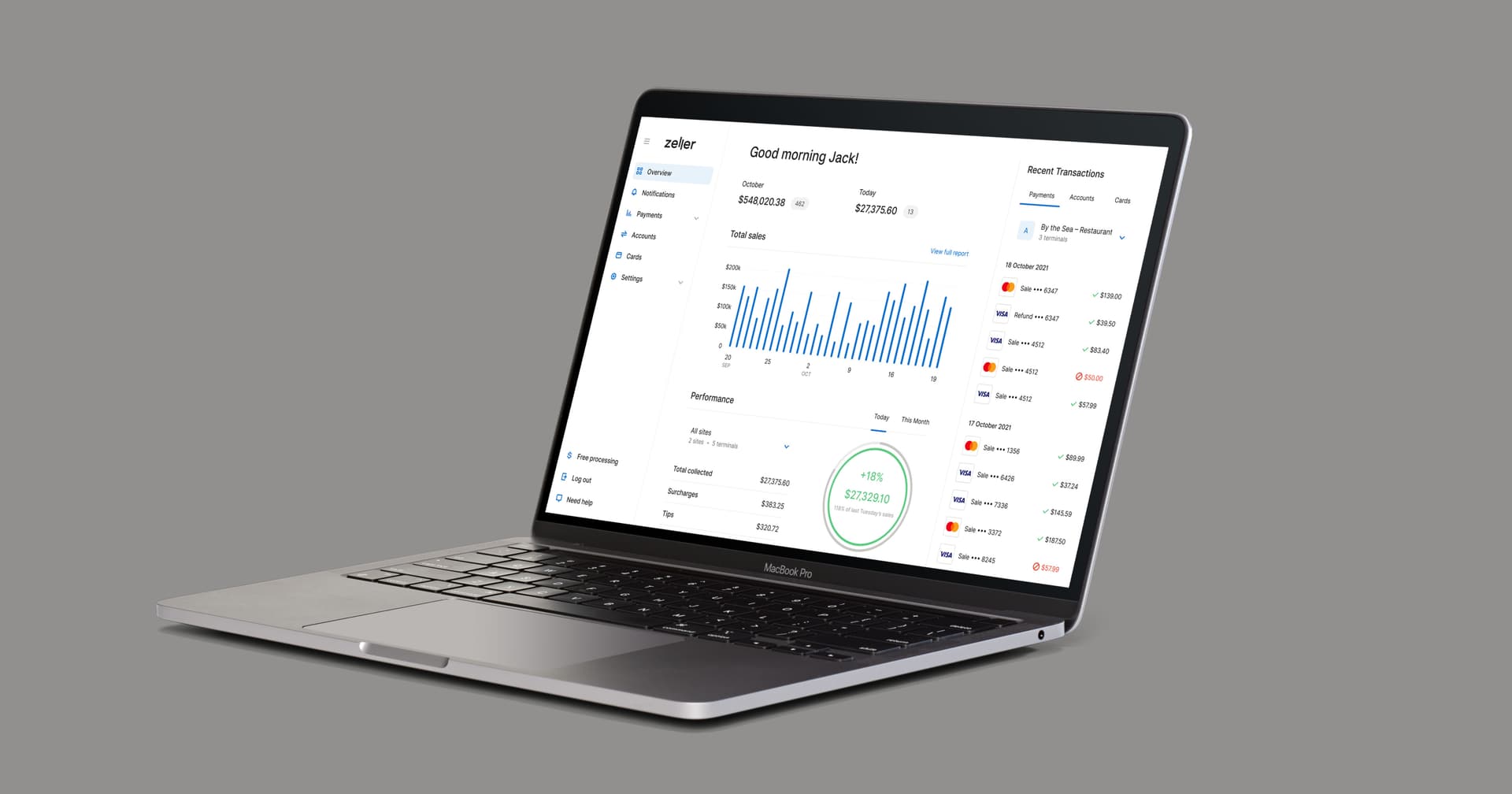

Zeller Dashboard gives you real-time visibility over the financial health of your business, and each of the locations within it. When you accept payment via Zeller Terminal and make business purchases using Zeller Mastercard, you can see all of your incomings and outgoings at a glance.

2. Keep track of your customers

When you run a single-location business, it’s relatively simple and straightforward to retain complete control over your customers’ store experience. You can take the time to get to know your regulars, give staff hands-on training, and provide attentive, personalised customer service.

As your business grows, that positive customer experience can be compromised in favour of more sales. When you’re operating out of multiple locations, you lose some of that control. It’s impossible to be in two places at once, after all.

One thing you do have control over is the technology you rely upon to grow your business. There are many customer relationship management tools on the market that can help you make your customers feel seen and looked after, such as the Zeller Contact Directory.

Storing business and personal details in the one place will give you a clear oversight of every customer — what they buy, how they buy it, and where and when they bought it. This insight can be used to build clever marketing programs that offer rewards, discounts and communications that create a positive customer experience even when they’re not in-store.

3. Iron out inventory management

Streamlined, accurate inventory management becomes more critical with every new business location you open. Issues such as displaced, miscounted and lost stock are a bigger threat to your business when you operate multiple shop fronts. With the right retail POS system installed, you can minimise the management required to keep on top of all your stock.

Having one centralised platform makes it easier to transfer stock, track shipments and manage inventory levels. Many POS systems will also give you the ability to remotely order stock for any store, from any store, as well as identify and forecast product sales trends to facilitate smarter ordering.

Make sure your payment system can seamlessly integrate with your POS system, adding an extra layer of data and control to your inventory processes while minimising the admin overload of keeping on top of stock.

4. Simplify your finances

It can be difficult to keep track of the money going in and out of your business when you’re not the only one accepting payments from customers, or making business purchases. This is a common problem owners come up against when they expand their business. Plus, having more money to manage can be a hurdle in itself.

One way to avoid the repercussions of mishandling your income and expenses is to employ a professional bookkeeper, but there are many tasks you can do yourself to keep administrative costs as low as possible.

For day-to-day expense management, accounting software will help you keep track of invoices and get paid on time. For real-time information about the incomings and outgoings at each business location, Zeller Dashboard provides at-a-glance insights to ensure you know whether you’ll reach your sales targets.

5. Better coordinate your staff

Expanding your store means expanding your staff and, while it sounds straightforward, the financial and time investment can be substantial. Hiring new staff will likely require a sizeable investment of your own time — you’ll need to bring them up to speed with products, systems and customer experience standards.

Having intuitive tools can significantly streamline this process, especially if you use a fully-integrated system like Zeller Terminal. When your tools speak to each other, it reduces the need for staff to juggle multiple platforms.

Keep in mind that, when it comes to hiring junior staff, there are some parts of your business you will likely want to keep secure. You may not want new junior staff to be able to process refunds, or change the settings on your EFTPOS terminals. With Zeller, you can secure these features with a PIN code.

Taking the first steps towards growing your business can be daunting. Fortunately, there are a number of things you can do to streamline the process and minimise any growing pains you may experience along the way. The trick is strategising for growth and ensuring you’re properly equipped to scale up. Having the right tools on hand will make all the difference.

Now that you know how to smooth the path to expansion, keep up with the latest Zeller updates and announcements by subscribing to the Zeller Business Blog newsletter below.

Let us help your business grow.

Zeller Sales is here to help you succeed.

Leave your contact details and we’ll be in touch soon.

By sharing your details with us, we may contact you from time to time. We promise we won’t bug you — and you can unsubscribe from communications at any time.