- Business Growth & Optimisation

Managing Tax on Tips and Gratuities in Australia

Here's what you need to know about accepting tips from customers.

There is no hard and fast rule about tipping in Australia. Some customers do, some never will, yet most are on the fence. Zeller data shows more customers could be prompted to leave a few dollars to reward great service, if the payment flow made it simple.

As a business owner, there are tax considerations you need to be aware of. Keep reading to find out more about managing tips in Australia.

What is a tip?

Also referred to as a gratuity, a tip is a voluntary payment gifted to a business in recognition of exceptional customer service. In Australia, a tip between between 5 and 10 percent is customary for a restaurant meal, while smaller cafes and other service-based businesses may find that tips are smaller, but more frequent.

Now that customers no longer carry cash, there’s even less change to leave with a server. Businesses — especially those in hospitality — need a way of collecting cashless tips. The good news is that prompting for a tip via an EFTPOS terminal makes customers more likely to leave one.

How are tips collected?

Some businesses place a tip jar on the front counter, while others train wait staff to verbally invite a customer to leave a tip, should they wish. However, a subtle on-screen prompt is the simplest way of collecting tips — while also increasing the likelihood that a customer will leave one.

A tip jar was once an effective tactic to collect loose change after a cash transaction, however because this method usually captures spare change (rarely carried these days) it is unlikely to amount to much once divided amongst the staff.

In more formal settings, such as fine dining restaurants or salons, tips have traditionally been collected as part of the point of sale transaction. It used to be that happy customers would leave a cash tip in the leather receipt folder, after signing the docket. These days, the process is far more convenient.

Your staff can process the sales total, then invite a customer to tap, dip or swipe their card or digital device to your mobile EFTPOS terminal from the comfort of their seat. Zeller Terminal can prompt the customer to leave a percentage-based or custom tip — a tactic that 57% of diners say would make them more likely to tip.

Zeller Terminal. The perfect EFTPOS for restaurants.

With Zeller, customisable tipping and surcharging can be switched on or off in a few clicks.

Are tips taxable?

Unlike in the United States, where tips represent a substantial portion of a worker’s expected compensation, workers who receive tips in Australia typically consider it a fortunate bonus on top of their usual wage. However, tips are not tax free.

According to the Australian Taxation Office, tips are income — regardless of how they are paid. Assuming that tips are dispersed to employees, all tips (whether paid via cash, card or otherwise) must be declared on a worker’s tax return. The duty falls on employees to declare their tips as income, and meet their personal income tax obligations.

If you choose to collect tips, and distribute them to your employees as part of your regular payroll process, tips should be recorded on their payslip as an allowance for tax purposes.

Some businesses prefer to keep tips completely separate from their payroll activities. In this case, if tips are not recorded on a payslip, the onus is on workers to keep accurate records of any gratuities they receive from their employer or directly from the customer. This can be a pain for smaller payments, but is strongly advised in order to avoid any nasty tax surprises.

Are tips subject to GST?

Any tips that are collected and distributed on behalf of employees are not subject to GST, as they are not technically classified as income for the business. However, if the business keeps any gratuities, that money becomes income and is subject to GST.

What are your responsibilities as an employer?

When it comes to managing tips in your workplace, it pays to have a clear policy on how to handle collecting, distributing and reporting all amounts.

Collecting tips is very much determined by the payment method chosen by the customer. A tip jar is the simplest method, but not necessarily the most effective for maximising gratuities. Some customers may be less inclined to place a larger tip in a jar, preferring to hand the cash directly to an employee. In this scenario, you should have clear guidelines on how that cash is handled once received.

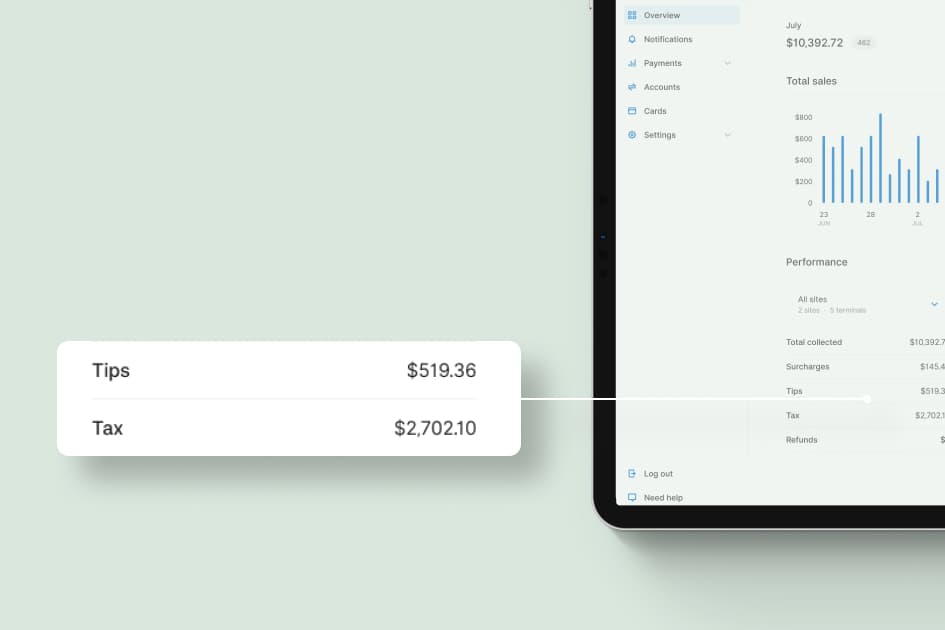

Electronic tip payments will be processed by your Zeller Terminal and reported on Zeller Dashboard, minimising the potential for human error.

How tips are distributed differs between workplaces, but it is customary for tips to be pooled and distributed equally amongst workers, rather than go to the business. If the business does hold onto tips, aside from having disgruntled employees, you may find that there are tax implications.

Tipping can be a pleasant, and profitable incentive for your workers to provide an exemplary customer service experience to your customers. If you’re in an industry where tipping is common practice, having a clear and consistent approach to managing and distributing gratuities is recommended.

Remember, tips are usually a reflection of a great customer experience — something you definitely want to encourage in your business — so you should aim to make it as simple and easy as possible for your customers to show their appreciation. When comparing EFTPOS terminal providers, look for functionality that enables you to set up automatic tipping prompts. The fewer hurdles to tip, the more likely your customer is to leave a few extra dollars.