- Payments & Point of Sale Solutions

How to Securely Transact Over the Phone

Phone transactions require secure processes to protect sensitive card data.

Never record or store full card details unless PCI compliant.

Use secure payment systems designed for card-not-present transactions.

Train staff on fraud warning signs and identity verification steps.

Clear policies reduce chargebacks and protect your business reputation.

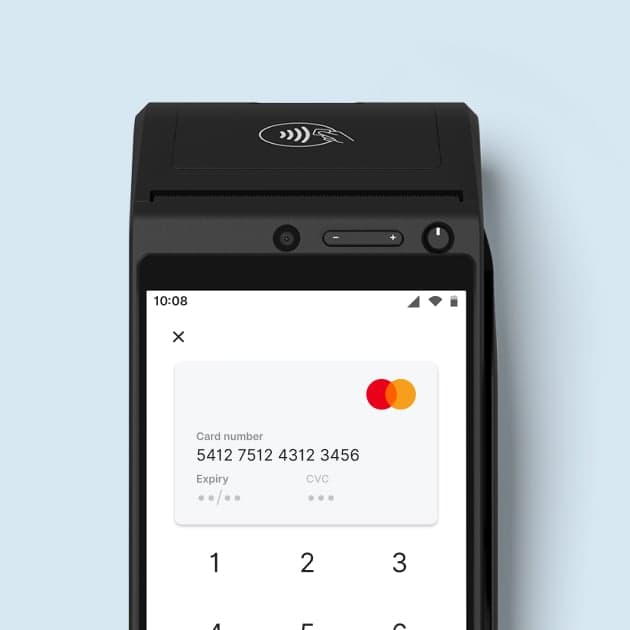

Learn how to accept manually entered card payments.

When it comes to tapping into new markets, businesses that accept over-the-phone payments have a significant advantage over those that don't. MOTO payments open your business up to a more broad audience, allowing you to attract and serve a greater number of customers.

For customers, having the ability to pay over the phone is an added level of convenience — one that requires minimal effort, and causes far less disruption to their busy day than making a trip to a brick-and-mortar store.

With Zeller, it's as simple as toggling the MOTO switch on.

Before you start accepting payments from customers over the phone, familiarise yourself with the below guidelines and make sure your employees know what to do to safely accept manually entered card payments.

Know what to look out for

Naturally, with these types of transactions, the risk of fraud increases. A fraudster may attempt to make a phone or mail order purchase using someone else’s compromised card information, taking advantage of the fact that it’s difficult for a merchant to verify the identity of a cardholder without meeting them face-to-face.

When processing MOTO transactions, there are a few things to look out for:

large orders with unusual quantities, placed by new customers.

orders where the card is initially declined, and the customer continues provides different card details in an effort to complete the transaction.

customers who request payment be made by a third party (e.g. freight or delivery companies).

In all of the above circumstances, it pays to take a few extra steps to verify the customer is indeed the cardholder.

Although it's unlikely your business will be the unfortunate target of fraud, it's important to mitigate the risks. The vast majority of disputes can be halted before they even happen.

Verify the customer’s identity

The most important thing you should always do when processing a transaction is to verify that the customer is who they say they are.

When processing a manually entered card payment, there is an obvious hurdle to consider: your customer is not standing in front of you. Instead, they are placing the order via phone (or perhaps email mail). Because neither the card nor the cardholder is present, it can be difficult to verify the customer’s identity.

If you’re not able to verify a customer’s identity, you can:

request a copy of their government-issued ID, and check to see whether the details match those of the payment card.

ask the customer to sign an invoice or, if you’re providing a service, proof of service. Then, check the signature matches the payment card signature.

check that the billing and shipping details match, if you’re shipping a product.

If any of the details are inconsistent, let the customer know and request clarification. Any customer that is not willing to provide this information should not be served.

Obtain a signature

It’s always a good idea to obtain signed documentation for the goods or services you provide. Doing so allows you to establish a clear set of payment conditions with your customers, whilst also capturing signatures for your records.

Plus, requiring a signature may put off any potential fraudsters. If a customer refuses to sign a document you require, you may decide to refuse them business.

Email a receipt

An email receipt is easier to keep on hand and track than a paper receipt. It’s a good idea to email your customer a receipt after the transaction is processed, so that they have the details in front of them.

Additional measures for higher-value transactions

Of course, if you typically accept transactions of a higher amount, the risks are greater so you should implement more stringent security measures.

Depending on the type of business your run, there are additional security measures you could consider. There are three documents you should consider.

Clear and binding service terms that explain customer liability.

A clear, easily accessible refund policy.

Signed contracts or customer agreements.

Whenever money is involved, there is always a potential risk of fraud. Whether you’re accepting cash, card, or MOTO payments, vigilance is required; it's part and parcel of running a business.

Need more information? Our Support team can help with any questions about accepting manual card entry payments. Read more about how Zeller keeps your business safe here.