- Banking

Best Invoicing Software for Australian Businesses in 2025

For many Australian businesses, invoicing is still a time-consuming, manual task – even in 2025.

Whether it’s creating Word or Excel templates, chasing late payments, or staying on top of GST and BAS obligations, invoicing can quickly turn into a mess of paperwork and frustration.

But the right invoicing software doesn’t just make it easier to send professional invoices. It helps you get paid faster, improves your cash flow, reduces errors, and saves you hours each week. It also gives your customers more convenient ways to pay and makes your business look more polished and trustworthy.

Use the table below to see how Zeller Invoices stacks up against other popular invoicing tools for Australian small businesses, freelancers, sole traders and tradies

Top invoicing software options for Australian small businesses.

Why your business needs invoicing software.

Whether you’re a plumber, graphic designer, or running a café, invoicing is at the heart of your business operations. Invoicing isn’t just a box to tick, it's one of the most important touchpoints between you and your customers.

Here’s why switching to proper invoicing software is a smart move:

Get paid faster: Offer an instant, secure payment option and reduce the back-and-forth

Easier for your customers: Save your customers from having to manually transfer funds

Look more professional: Send polished, branded invoices in a few clicks

Save time: Automate invoice payment reminders, recurring invoices, and more

Stay compliant: Automatically handle GST to help you prepare for BAS

Track everything: See who’s paid, who hasn’t, and what’s overdue

Work on the go: Create and send invoices from your phone or tablet

By choosing the right invoicing tool, you'll be giving your cash flow a boost and freeing yourself to focus on growing your business.

How to choose the best invoicing software for your business.

Not all invoicing tools are made the same. Some are built into broader accounting platforms while others are standalone tools. If you’re shopping around, here are the key features and criteria to consider:

Ease of use and interface

A clean, intuitive interface on your invoice app is essential, especially if you’re not naturally a numbers person. Look for software that’s genuinely easy to use, whether you’re sending invoices from your desktop, or directly from your smartphone when you’re on the go.

Invoicing features

Naturally, you want flexibility and control. Does the software let you invoice on the go? Can you add your logo and colours to your invoices? Apply discounts or GST line items? Track invoice status? Set up recurring or scheduled invoices? Zeller Invoices does all that and more.

Payment acceptance and speed

Getting paid quickly matters. Does the software support secure credit card payments? Can customers pay instantly via a secure link? Just as importantly, how quickly do those funds land in your account – within a few business days, or by the next day? With Zeller Invoices, funds settle nightly into your Zeller Business Transaction account. So when your customers pay, you’ll have your funds by the next morning.

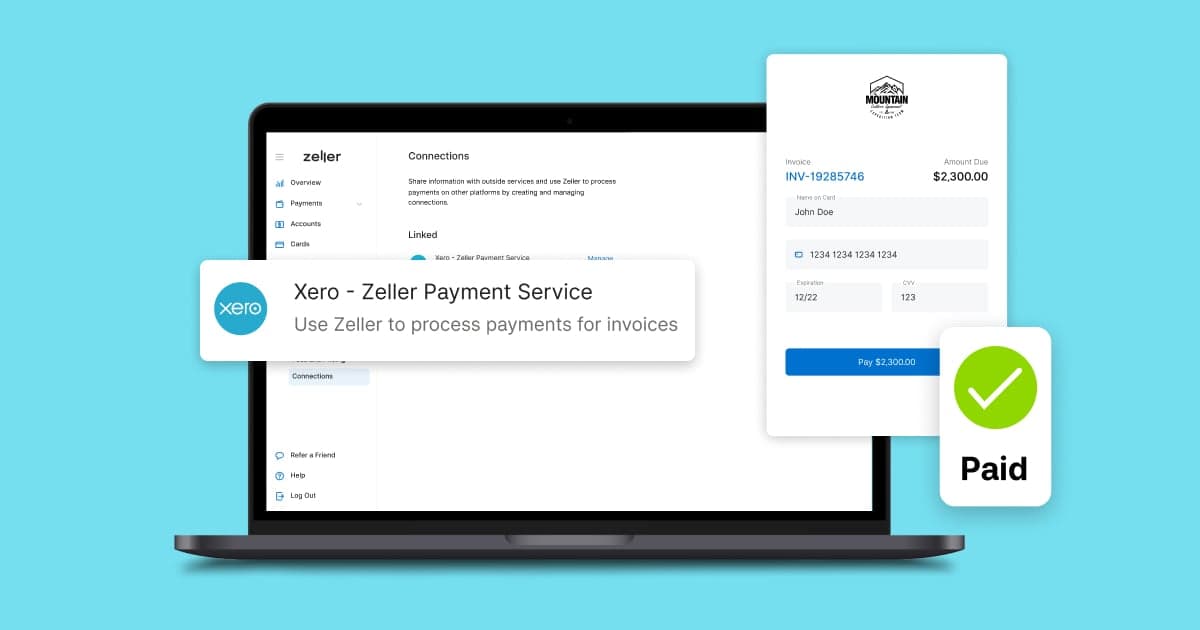

Integration and ecosystem

Good invoicing software should integrate with your other tools, especially accounting software like Xero. But beyond that, some solutions (like Zeller Invoices) are part of a bigger ecosystem of financial tools that include EFTPOS terminals, transaction accounts, debit cards, reporting, and more. This integrated ecosystem approach can save you time and reduce complexity.

Pricing model and value

Many platforms advertise a free plan, but keep their features locked behind a paywall. Consider how pricing scales as your business grows, and make sure you’re not paying monthly fees for features you don’t need. Zeller Invoices has no monthly fees, and it’s free to create and send an unlimited number of invoices at no cost to your business.

AU tax compliance

Running a business in Australia with an annual turnover above $75,000 means GST obligations and BAS reporting. Your invoicing software should make that easier, not harder. Choose a tool (like Zeller) that lets you toggle GST and export records for BAS.

Support and local relevance

Does the provider offer local support in Australian time zones? Are help documents written with Australian businesses in mind? Are fees listed in AUD? Local understanding can make a big difference. Zeller’s support team is here to support you 24/7 via phone, email, or SMS.

The ability to add pre-populated items to Zeller Invoices makes it a lot faster to create and send, and triggering reminders to customers to prompt them for payment has streamlined my entire invoicing process. I’m no longer wasting hours issuing and chasing late payments – it’s literally saving me hours every week.

Paul Doody

Panda Dry Cleaning & Laundry Services, Victoria.

Why Zeller Invoices really stands out.

Zeller Invoices is built for the way modern Australian businesses actually work. Mobile-first, tax-compliant, and designed to help you get paid fast. Here’s what sets it apart.

It’s free to create and send invoices

There are no monthly fees, no invoice send limits, and no hidden costs. You only pay a small fee of 1.7% +25¢ for domestic cards (separate pricing for international cards) when a customer pays using their card. That’s it. No surprises.

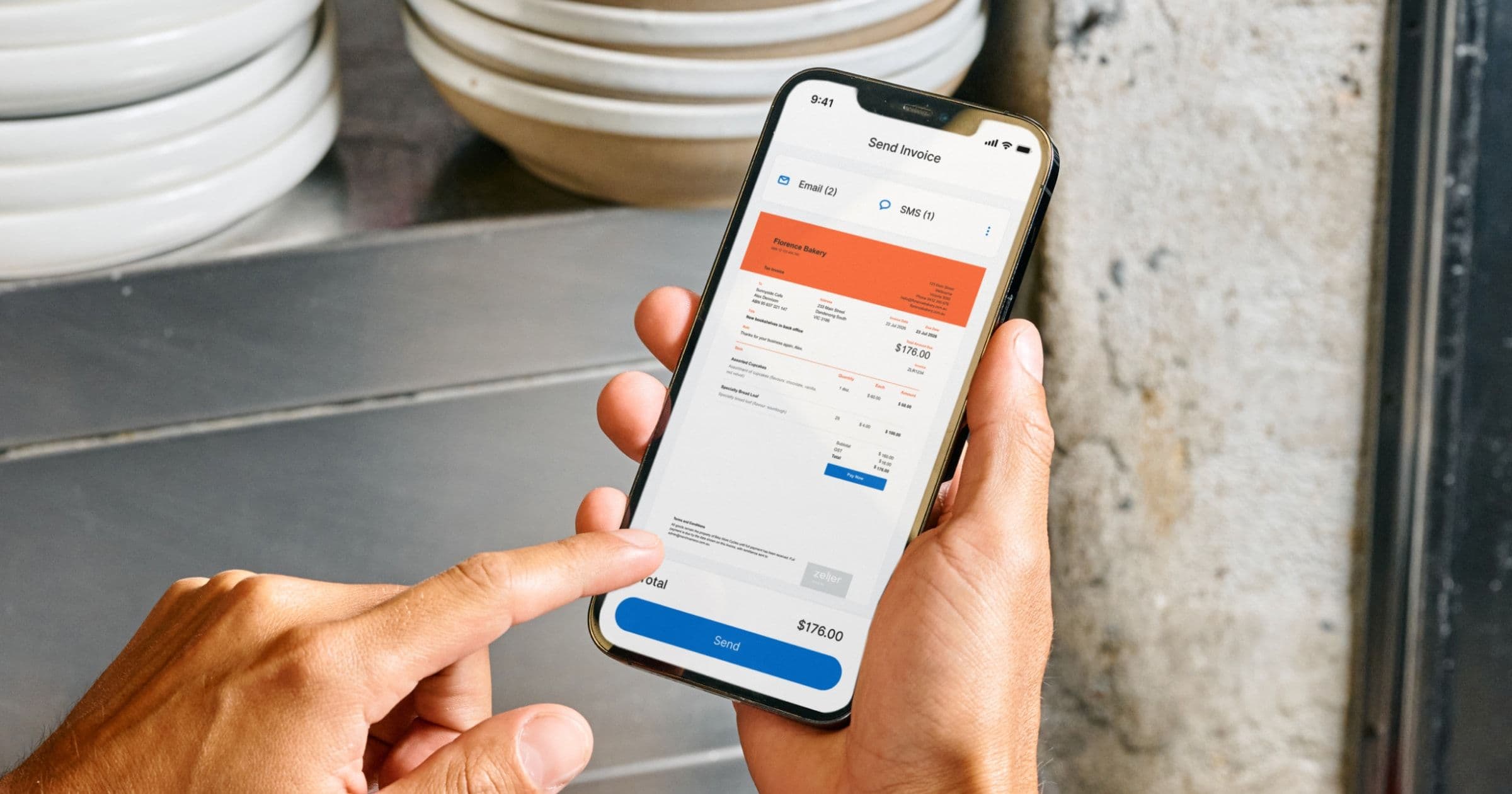

It’s made for mobile

With Zeller App, you can create, send and manage invoices on the go, in under 30 seconds – perfect for tradies, freelancers, or mobile service providers who work on the go. Send invoices by email or SMS, track them in real time, and manage everything from your phone. You don’t need to be in the office to run your business.

Fast payments = better cash flow

Payments made online via Zeller Invoices are processed fast, with funds settling nightly into your Zeller Transaction Account. That’s money you can use sooner, whether you’re paying suppliers or investing back into the business.

Built for Australian businesses

From GST toggling to BAS-friendly reporting and local support, Zeller Invoices is designed for Aussie businesses from the ground up. You won’t waste time trying to adapt US-centric software to suit local needs.

Easy for your customers

Your customers can pay securely online via card or mobile wallet, straight from the invoice. No app or login required. In fact, over 75% of Zeller Invoices are paid in under 24 hours.

Integrated with the full Zeller ecosystem

Zeller Invoices connects to your Zeller Transaction Account, which can easily also be connected to your Zeller EFTPOS terminal and Zeller Debit Card. Having everything in one place means less admin, fewer systems to juggle, lower costs, and better visibility of your cash flow.

Over 75% of Zeller Invoices are paid in under 24 hours.

In stark contrast, when only a bank transfer payment option is offered to customers, only 28% of invoices are paid the same day in under 24 hours.

Ready to level up your invoicing?

It’s easy to start doing all your invoicing with Zeller.

1. Download Zeller App

Get the free Zeller App from the App Store or Google Play. Sign in with your Zeller Account, or create one online in minutes.

2. Set up your invoice template

Head to Invoices in the main menu of Zeller App, then tap Settings. From there you can upload your business logo, add details for your receipts, customise colours, and more.

3. Create and send your first invoice

Once you’re ready, click the ‘+ Invoice’ button and follow the steps to create and send your first invoice. You'll receive an email and push notification as soon as the invoice is paid.

If you're ready to take the hassle out of invoicing and start getting paid faster, it's time to try the best free mobile invoicing app in Australia.