- Banking

More Ways to Get your Invoices Paid with Zeller and Xero

Connecting Zeller online payments with Xero Invoices helps to get your invoices paid faster.

No business owner enjoys waiting for invoices to be paid. On top of that, many online payment processors have slow settlement speeds, confusing pricing, and a lack of local support — making it harder to get your money when you need it. It’s not easy to see a consolidated view of your cash inflows when you’re using multiple, disparate providers for in-store and online business payments, too.

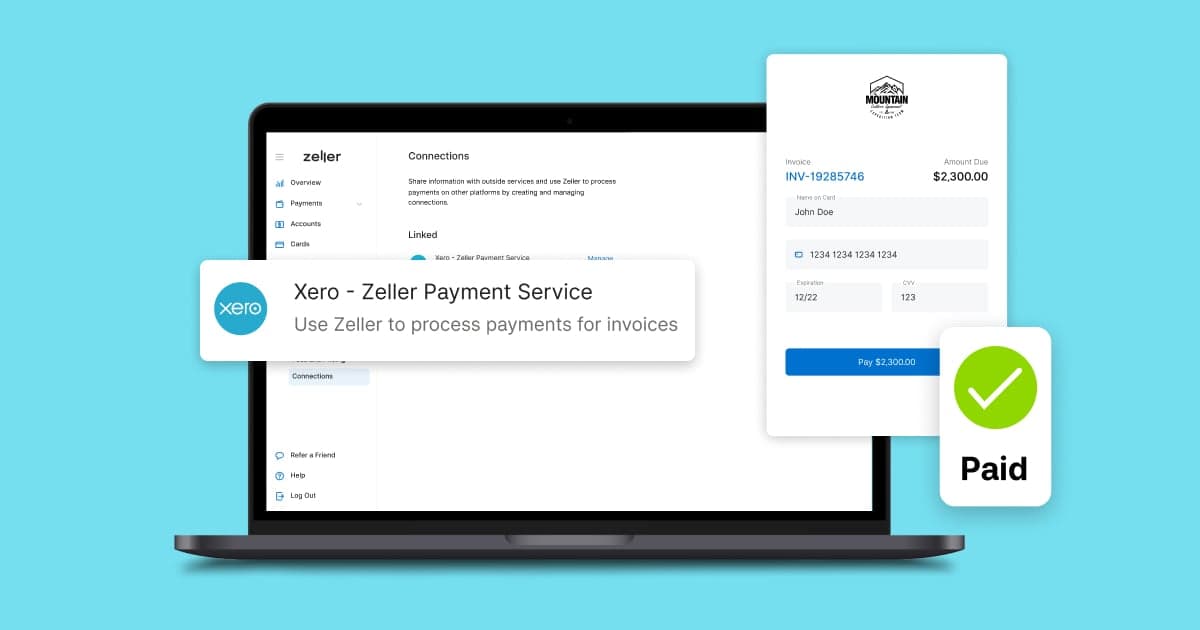

This is why Zeller has partnered with Xero. We’re excited to announce our newest integration with Xero, enabling you to accept and settle Xero invoice payments in a click with Zeller. When using Xero Invoices, you can now select Zeller as your online payment processor. With Zeller's fast, secure online payment processing, combined with free settlement of your funds to your Zeller Transaction Account, you'll not only enjoy the lowest processing fees — you'll also be able to access your funds nightly, 365 days a year, with faster settlement.

You’re likely to know Xero as one of the world’s leading small business accounting platforms. Our new integration makes it even easier to connect Xero to Zeller, whether for Bank Feeds or Xero invoice payment processing. There are multiple benefits to connecting Zeller and Xero.

Save time chasing late payments by providing a quick and easy way to pay.

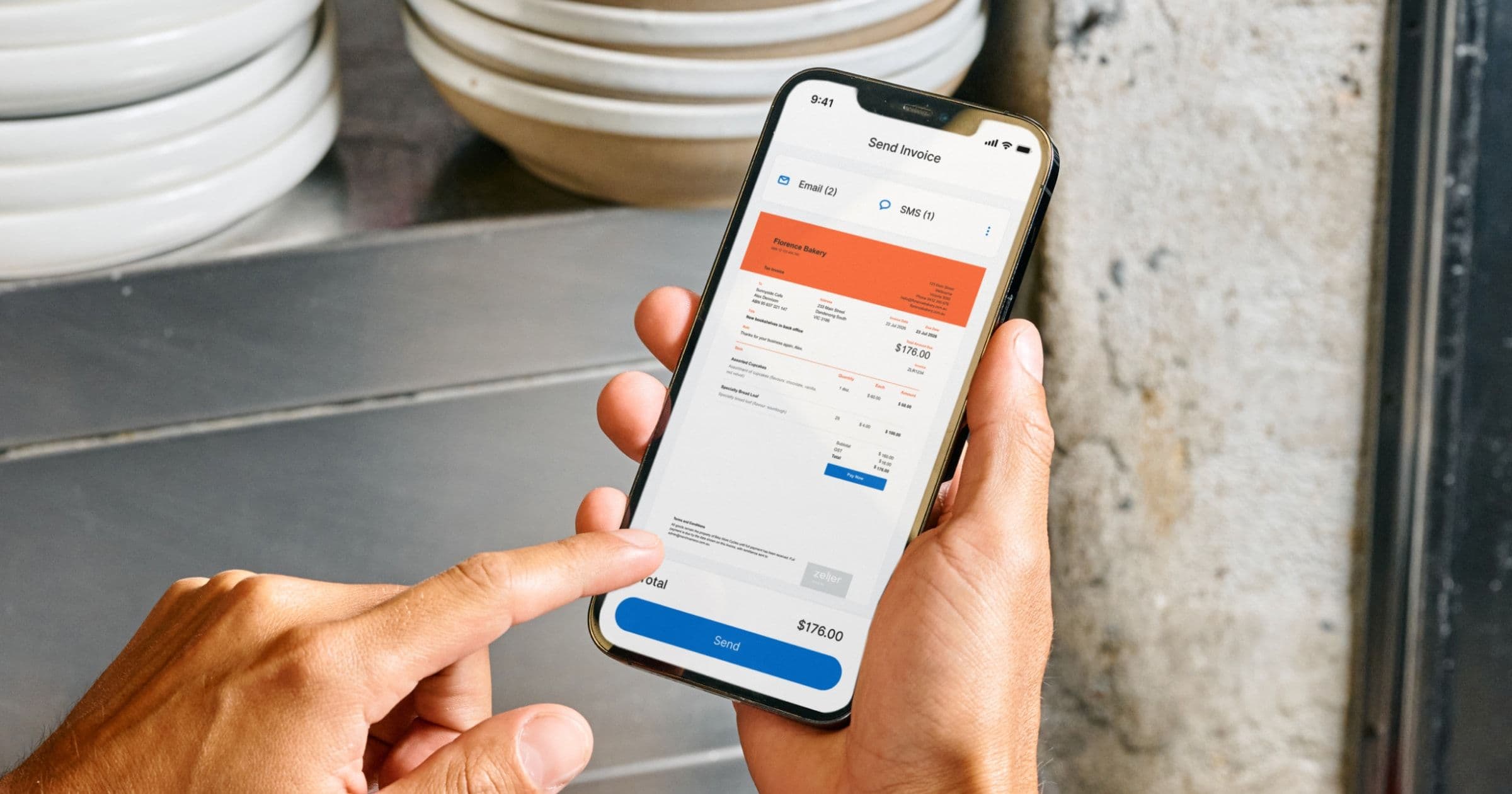

When you add Zeller as a payment processor for your Xero invoices, your customers can pay with a click using the ‘Pay Now’ button. By removing any friction at the point of payment by not requiring customers to remember their bank account details, you’re increasing the likelihood of a faster invoice payment.

One-click payment reconciliation in your Xero account.

Integrating Zeller and Xero provides you with an accurate picture of your cash balance and assists in identifying any errors in the process. Zeller works with Xero bank feeds to automatically import transactions from your Zeller account directly into your Xero organisation.

More affordable transaction pricing.

Improving your business bottom-line is more important than ever. Xero invoice payments processed with Zeller are charged at a low, flat rate of 1.75% + $0.30 on domestic transactions, or 2.9% + $0.30 on international transactions, for all cards including American Express. There are no monthly subscription fees or lock-in contracts to use Zeller, either.

Faster settlement of your funds.

Other online payment processors can take up to three days to settle you your hard-earned money. With Zeller, there’s no waiting. Your funds are settled to your free Zeller Transaction Account nightly, 365 days a year. You can then spend your funds immediately with any linked Zeller Debit Card. Alternatively, you can also choose to settle funds to any 3rd-party business bank account, which will be available to you the following business day.

A complete view of your business finances.

Using the Zeller Dashboard or the new Zeller App, you can view all your in-person and Xero invoice payments, and more, in one convenient location..

Find out how to connect your Zeller Account to Xero in just a few clicks.

What are Zeller online payments?

When you select Zeller as your online payment processor for Xero invoices, your customer has the option to pay their invoices you send to them using Zeller’s secure online payment gateway. All online payments are processed quickly and securely online, with funds settled to your Zeller Transaction Account nightly, or next business day to any third-party bank account.

Ready to get started with Zeller? Sign up free.

How to connect Zeller with Xero.

It’s simple to connect your Zeller and Xero Accounts. To get started with the integration, you’ll need an active Xero subscription and Zeller Account.

To set up the connection between Zeller and Xero:

Log in to your Zeller Account.

Navigate to the Zeller Payment Service unlinked connection by clicking to expand Settings, and then clicking Connections.

Click the plus button, review the disclaimer, and click the checkbox to agree.

Click the Connect button and you’ll be taken to Xero’s authentication page to sign in to your Xero Account.

Select your branding theme, and you’ll be prompted to enter the business details which will appear on your Xero Invoices.

Click Save to complete the integration setup.

If you need support connecting your Zeller and Xero Accounts, you can also speak with the Zeller Support team.

Streamlining your invoice reconciliation.

After your customer pays their Xero Invoice online with Zeller, Xero will automatically mark the invoice as paid and separate the invoice and fee amounts in a newly-created clearing account in Xero. From here, you can simply press Reconcile and Xero will take care of the rest.

In your Zeller Account, you can view every transaction record for payments processed via the Xero Invoices integration. You’ll see both the total amount paid, as well as the transaction processing fee. There’s also a link included to the matched invoice within your Xero Account, to make reconciliation simple.

Accept Xero Invoice payments more affordably with Zeller.

Adding Zeller payment services to your Xero Invoices will boost your business cash flow, streamline your bookkeeping, and improve your bottom line. Your customers can pay you quickly and securely, through Zeller’s online payment gateway, and you’ll be able to reconcile transactions in a few simple steps with our seamless Xero Bank Feeds integration.

Not already a Zeller customer? Get started today by signing up for your free Zeller Account, and learning more about our Xero integrations, here.