- Banking

Banks vs Zeller: Which is the Best Business Savings Account For You?

Make your spare cash work as hard as you do by putting it in a smart business savings account with a high interest rate. Read on to discover and compare the best business savings accounts in Australia.

When you’re choosing a business savings account, the ideal one should:

Help your funds grow with a strong interest rate

Be easy to open with no lengthy application processes or forms

Have zero fees eating up your savings account balances

Have no minimum balance requirement to earn the best interest rate

Allow for easy access to your funds when you need

That’s why we created Zeller Savings Account – to offer Australian businesses flexibility, transparency and a fantastic interest rate.

How Zeller Savings Account stacks up against the big-4.

Customers are eligible to earn up to 4% p.a. interest on funds saved in an active Zeller Savings Account from 1 October 2025. Terms apply. Interest rates accurate as at 17 September 2025.

As you can see from the table above, the big-4 banks’ business savings rates are quite low, and that's before you consider the balance requirements to qualify for their maximum savings rates.

For example, to qualify for just 0.65% p.a. from Commonwealth Bank, a business must deposit at least $1 million dollars into the account. Needless to say, most Aussie businesses do not have that kind of spare cash.

For balances under $50k, with Commonwealth Bank, you’d earn an interest rate of just 0.01% p.a. Zeller, on the other hand, offers all businesses – no matter how much they deposit – up to 4% p.a., with full access to their funds whenever they need them.

How much extra could you be earning?

Use the tool below to see how much extra cash your business could save every year with a Zeller Savings Account.

Calculate what you could earn.

See how your savings could grow over 12 months with our high-interest savings account.

Want to start earning more?

Learn more about how a Zeller Savings Account can help your business grow.

Why should you have a business savings account?

Whether you’re just starting out or have already amassed a large savings balance, a business savings account is an excellent financial tool. Here’s why:

1. Clear separation of funds

Mixing your savings with your operating account can make financial management messy. A dedicated savings account keeps your reserve cash separate, ensuring that funds meant for growth, emergencies, or future expenses remain untouched until needed.

2. Earn more on your business savings

In business, every dollar counts. With an interest rate of up to 4% p.a., Zeller Savings Account makes your money hard for your business instead of sitting idly in an account that pays next to nothing.

3. Financial stability and preparedness

Unexpected expenses are part of running a business. Whether it’s replacing essential equipment, handling a cash flow shortfall, or taking advantage of an unexpected growth opportunity, having funds readily available ensures your business remains financially resilient.

4. Building a habit of saving

Even depositing a small amount regularly can help create a healthy financial habit for your business. With a Zeller Savings Account, there’s no minimum balance required to earn maximum interest, so you’ll watch your business savings grow with daily interest calculations, paid monthly to your Zeller Savings Account, while earning our highest interest-rate from the first dollar you deposit.

Why open a Zeller Business Savings Account?

In addition to offering a much higher interest rate than the big-4, a Zeller Savings Account provides instant access to your funds, ensuring your money is both secure and easily available when needed.

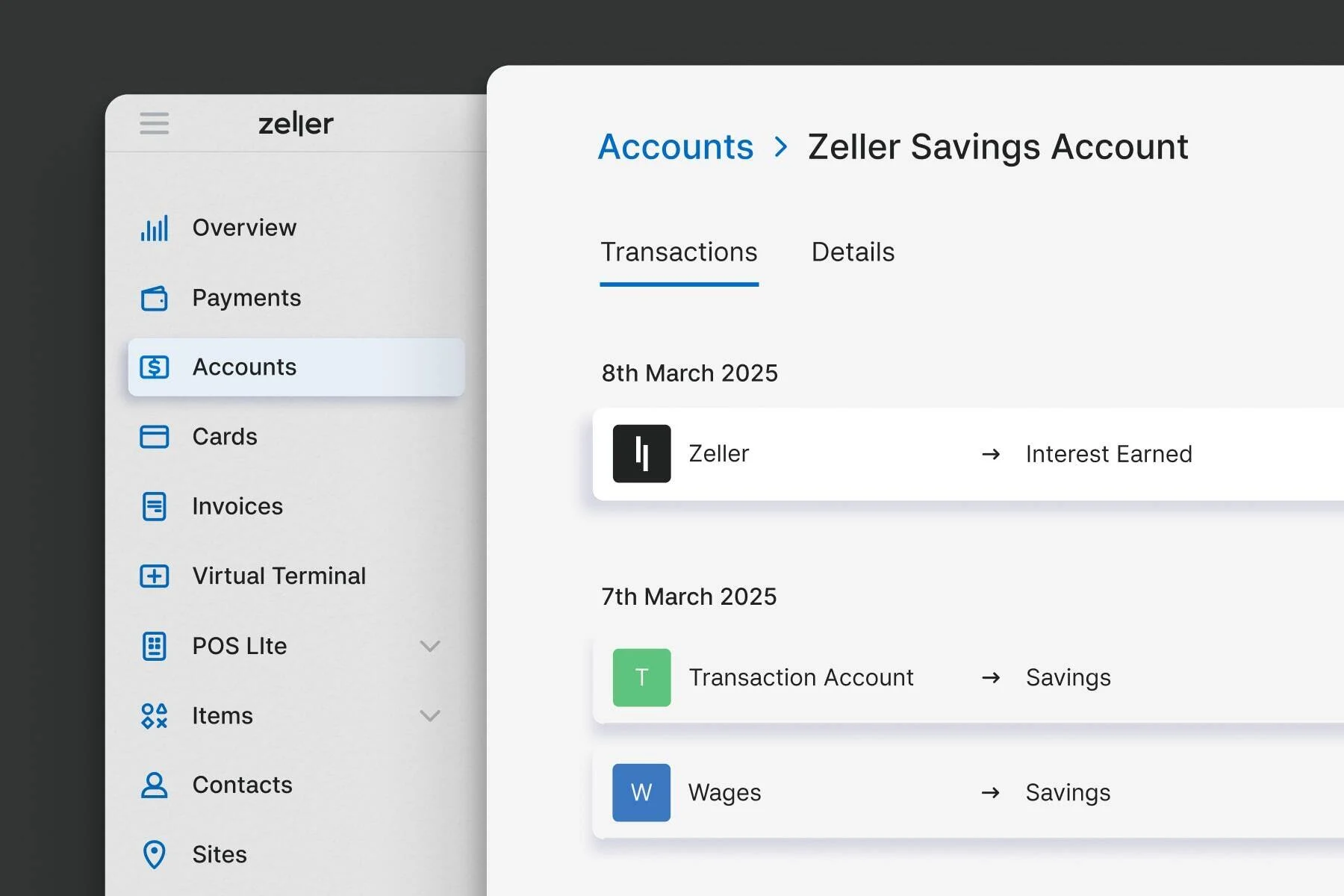

But there’s another big benefit that isn’t immediately obvious – having a Zeller Savings Account means you’ll also have access to a Zeller Business Transaction Account.

With both accounts working together, you’ll get:

High-interest savings · Earn up to 4% p.a. on your business savings.

No monthly account fees · Or any other fees, for that matter.

Unlimited free debit cards · Issue as many physical or virtual debit cards as you like.

Xero integration · Automatically reconcile settlements with your accounting system.

Clear statements · Easily see all deposits and withdrawals, plus when interest is paid into your account.

Real-time visibility · Track all transactions, expenses, and income with live cash flow reporting.

Instant access · Withdraw your funds anytime with no penalties or hassles.

Excellent security · All funds are held with a fully licensed, APRA-regulated Australian bank, and two-factor authentication is enabled on all Zeller Accounts.

These features go beyond just savings, they make managing your business finances easier and more efficient.

Stop letting the big-4 banks hold you back.

The days of being forced to use an outdated business bank are over. Thankfully, Australian businesses no longer need to settle for subpar savings accounts with low interest rates and strict conditions.

If you’re currently banking with one of the big-4, ask yourself:

Are you earning the best return on your business savings?

Does your bank offer instant access to your funds with no restrictions?

Are you happy with the limited reporting functions of your current business account?

If the answer to any of these is "no", then it’s time to make the switch to Zeller.

Save more with a Zeller Savings Account.

With an interest rate of up to 4% p.a. and full access to your funds, Zeller Savings Account offers the perfect blend of features and flexibility to help your business grow.