- Banking

Best High Interest Business Savings Accounts in Australia (2026)

Business savings accounts help earn interest on surplus funds.

Compare interest rates, fees, and withdrawal conditions before choosing.

Some accounts require minimum balances to unlock higher interest rates.

Flexible access options ensure funds remain available when needed.

Selecting the right account supports stronger long-term cash flow management.

If you’re looking for a high interest account to hold funds that you don’t need day-to-day, we’ve got you covered with this guide to Australia’s best business savings accounts.

In this article, we provide a side-by-side comparison of the big-four banks and Zeller. We break down base rates, maximum rates, and explain what to look for in a business savings account to help you find the best account for your needs.

Compare the best business savings accounts in Australia

Customers are eligible to earn up to 4% p.a. interest on funds saved in an active Zeller Savings Account from 1 February 2026. Terms apply. Interest rates accurate as at 5 February 2026.

What is a business savings account?

A business savings account is designed to hold surplus business funds while earning interest. Unlike a business transaction account, which is built for everyday payments and expenses, a savings account is best suited to money you don’t need to access regularly.

If you have idle funds sitting in your transaction account – whether these are set aside for tax, future investments, or a financial buffer, it could be a good idea to put these into a savings account where they will gradually accrue interest. If you’re not sure whether it’s the right move, discover Five Reasons a Savings Account Might Be Good for Your Business.

How to choose the best business savings account

There are a number of factors that you need to consider when deciding on the best business savings account for your requirements. Below is a 9-step checklist of features to look for when weighing up your options:

1. Interest rate

Interest rates can vary widely — from as little as 0.01% to around 4% p.a. When comparing accounts, look for a competitive base rate (around 2.5% or higher) and a bonus rate with conditions you can realistically meet.

2. Bonus rate conditions

Many providers advertise a maximum or bonus interest rate. This higher rate may only apply if you meet certain conditions, such as making regular deposits or limiting withdrawals. If those conditions aren’t met, a lower base rate applies. Be sure to know exactly what those conditions are before signing up.

3. Linked account requirements

Most business savings accounts must be linked to a business transaction account with the same provider, so the ease of setting one up matters. Traditional banks may require a branch visit, while digital banks and fintechs typically offer fast, online-only applications.

4. Access and flexibility

Consider how easily you can access your funds when you need them. Some business savings accounts allow instant transfers, while others limit withdrawals or require notice. If your cash flow fluctuates or you need funds for tax, payroll, or emergencies, access can be just as important as the interest rate.

5. Account conditions

Some accounts impose conditions like regular deposits, minimum balances or restricted withdrawals. Make sure these requirements align with your business’s cash flow requirements before signing up.

6. Fees and charges

Monthly account fees, transaction fees, or minimum balance requirements can quickly offset interest earned. When comparing accounts, it’s essential to look at returns net of fees, not just the headline rate.

7. Mobile app access

Managing your savings on the go can make a big difference, particularly for business owners who don’t sit at a desk all day. A well-designed mobile app can make it easier to check balances, transfer funds, track interest earned and stay on top of cash flow in real time.

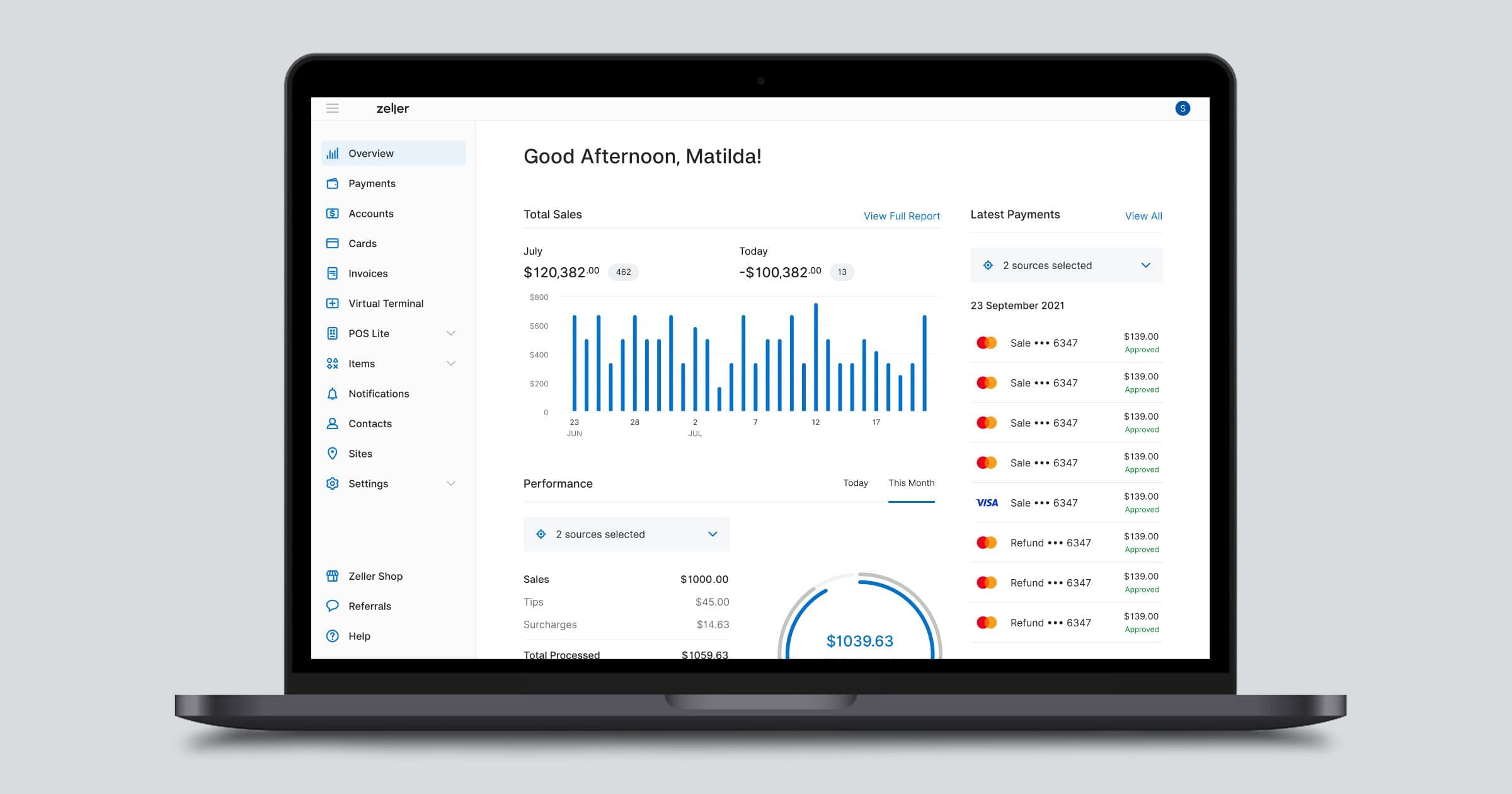

8. Online dashboard

Look for providers that offer a clear, intuitive business cash flow dashboard that lets you view savings account balances, track interest earned, monitor deposits and withdrawals, and generate reports in real time.

9. Account support

When something goes wrong, responsive customer support matters. Look at how quickly you can reach a real person, what support channels are available, and whether assistance is offered outside standard business hours.

What is the best business savings account?

Taking into consideration the nine factors listed above, the option that stands out most within the Australian market is a Zeller Savings Account. Here’s why:

It offers the highest maximum interest rate (4% p.a.)

You can create a Zeller Account online in minutes

You can access your funds anytime you need them

There is no minimum balance or restriction on withdrawals

There are no fees or lock-in contracts

Zeller Savings Account is held with a fully licensed, APRA-regulated Australian bank

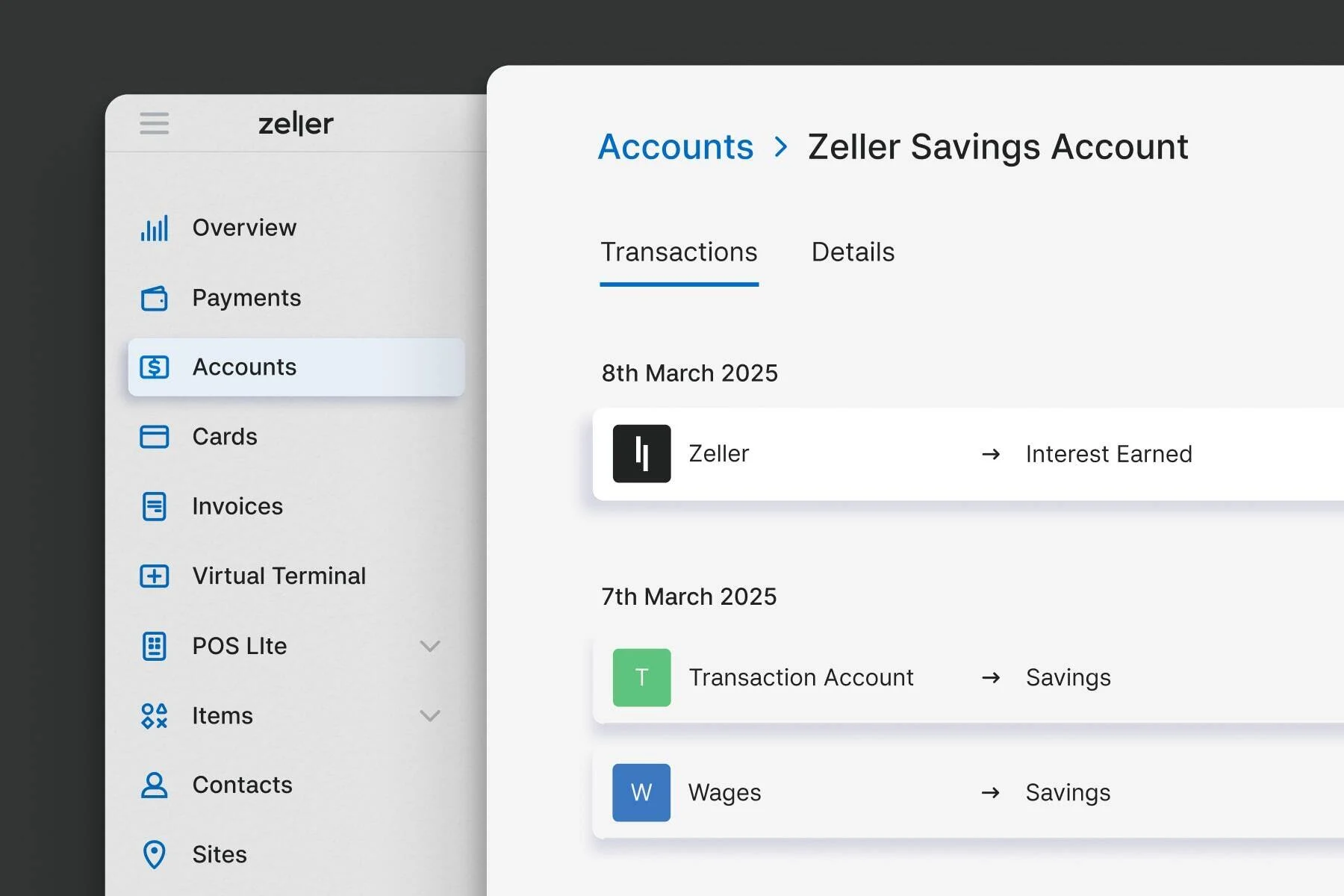

You can organise, save, and track funds, simply with Zeller Dashboard and Zeller App

Customer support is available 24/7 over the phone, via email or SMS

Calculate what you could earn.

See how your savings could grow over 12 months with our high-interest savings account.

Want to start earning more?

Learn more about how a Zeller Savings Account can help your business grow.

Save more with a Zeller Savings Account.

With an interest rate of up to 4% p.a. and full access to your funds, Zeller Savings Account offers the perfect blend of features and flexibility to help your business grow.

FAQs

How does a business savings account differ from a transaction account?

Unlike a transaction account, which is used for everyday payments, a business savings account earns interest and may limit withdrawals.

Can I use a personal savings account for my business?

Technically, sole traders can use a personal account, but keeping business funds separate is recommended for accounting, tax, and liability purposes.

Why should I have a business savings account?

A business savings account helps you separate surplus funds from day-to-day expenses, making it easier to manage cash flow and plan for future costs. It also lets your money earn interest while remaining accessible for emergencies, tax obligations, or planned investments.

How do I open a business savings account?

To open a business savings account you’ll typically need to open a transaction account with the chosen provider first. Banks will often ask that you visit a branch to open an account, whereas online providers, like Zeller, allow you to apply online. You will typically need to provide your ABN, Tax File Number, proof of identity, and business details. Once approved, you can link a transaction account and start saving.

Which business savings accounts have the highest interest rates in Australia in 2026?

Rates change often, but as of February 2026, Zeller Savings Account, Macquarie Business Savings Account, Great Southern Bank Business+ Saver, and AMP Bank GO Business Save offer the highest maximum interest rates of 4% p.a or more.

What fee-free business savings accounts offer the highest interest rates?

As of February 2026, Zeller Savings Account, Macquarie Business Savings Account, Great Southern Bank Business+ Saver, and AMP Bank GO Business Save accounts offer the highest maximum interest rates with no account fees.

How often is interest paid on business savings accounts?

Interest is typically calculated daily and paid monthly, though exact timing may vary by provider.

What are bonus interest rates, and how do I qualify for them?

Bonus rates are higher interest offers that usually require conditions such as regular deposits, maintaining minimum balances, or limited withdrawals.

Can I set up automatic transfers to my business savings account?

Yes — many modern accounts, like Zeller Savings Account, let you schedule recurring transfers from your transaction account so your savings grow automatically.

What happens if I withdraw money before meeting bonus conditions?

Withdrawing funds early may reduce or forfeit bonus interest, leaving you with only the base rate.

Is interest earned on a business savings account taxable?

Yes — interest earned is generally treated as business income and must be reported for tax purposes.